Mastercard Sees Double

Mastercard wants to take the exchange out of the crypto-to-fiat equation.

Sign up to uncover the latest in emerging technology.

Mastercard wants to make it easier to turn crypto into cash (and vice versa).

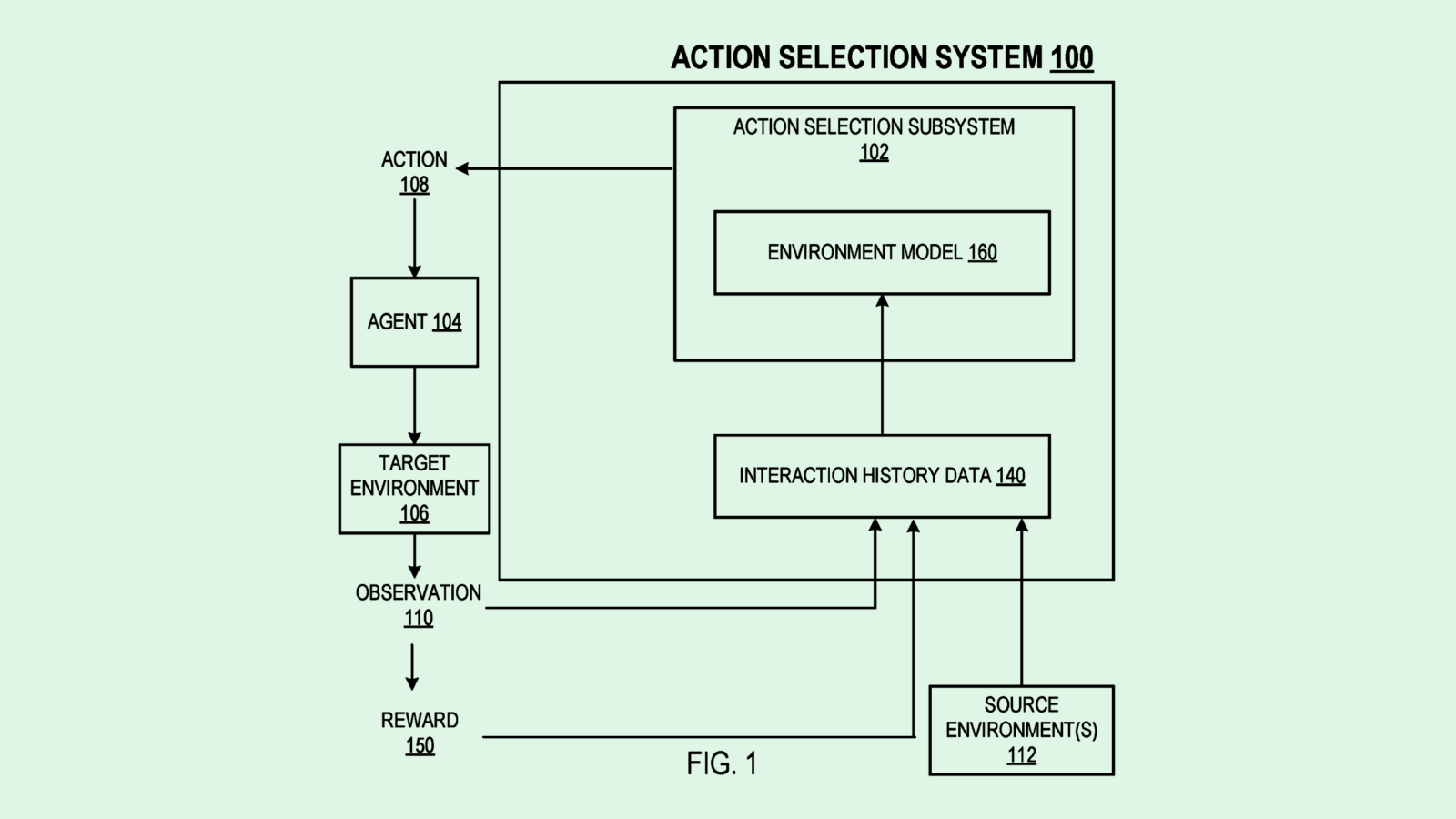

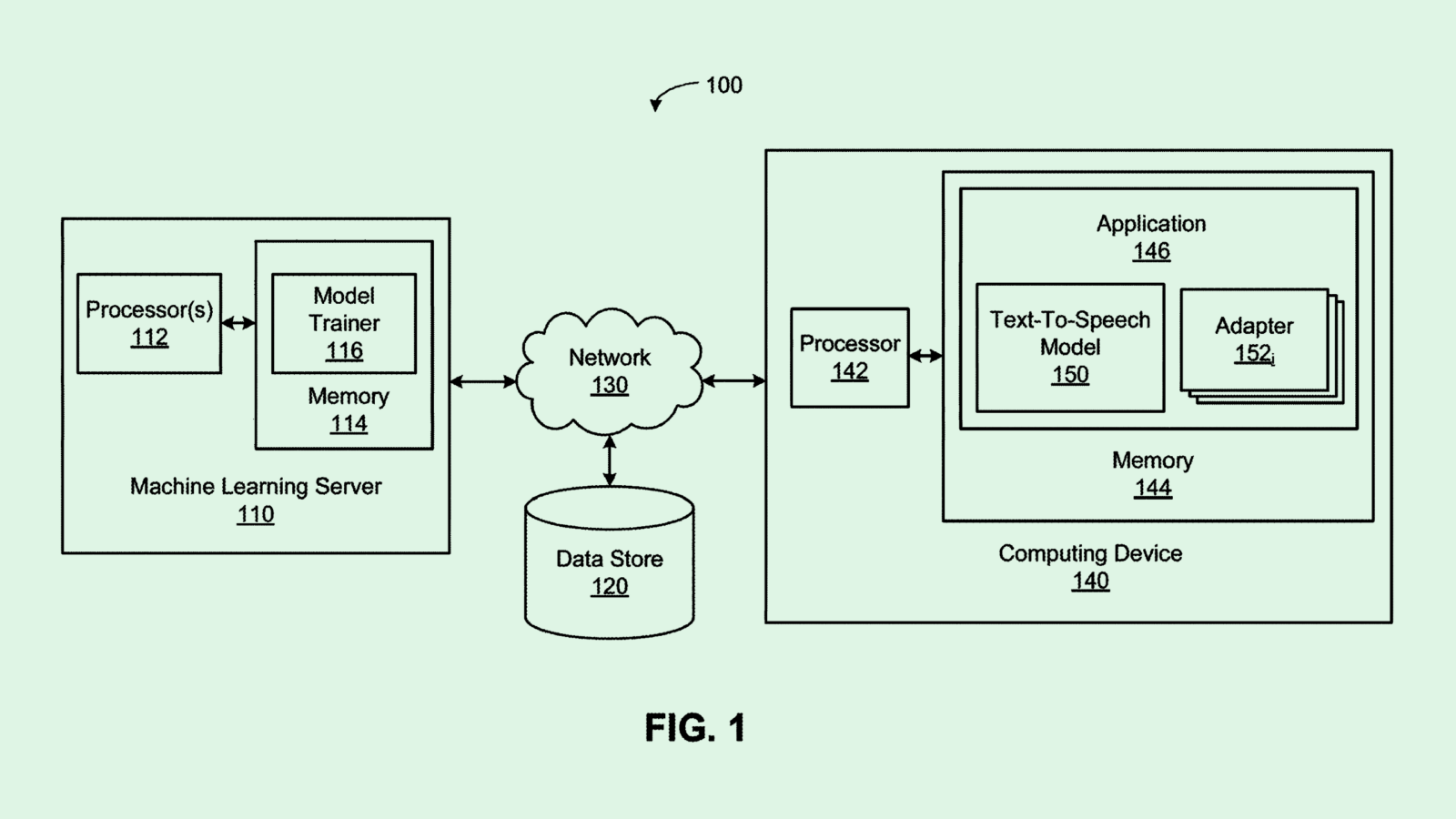

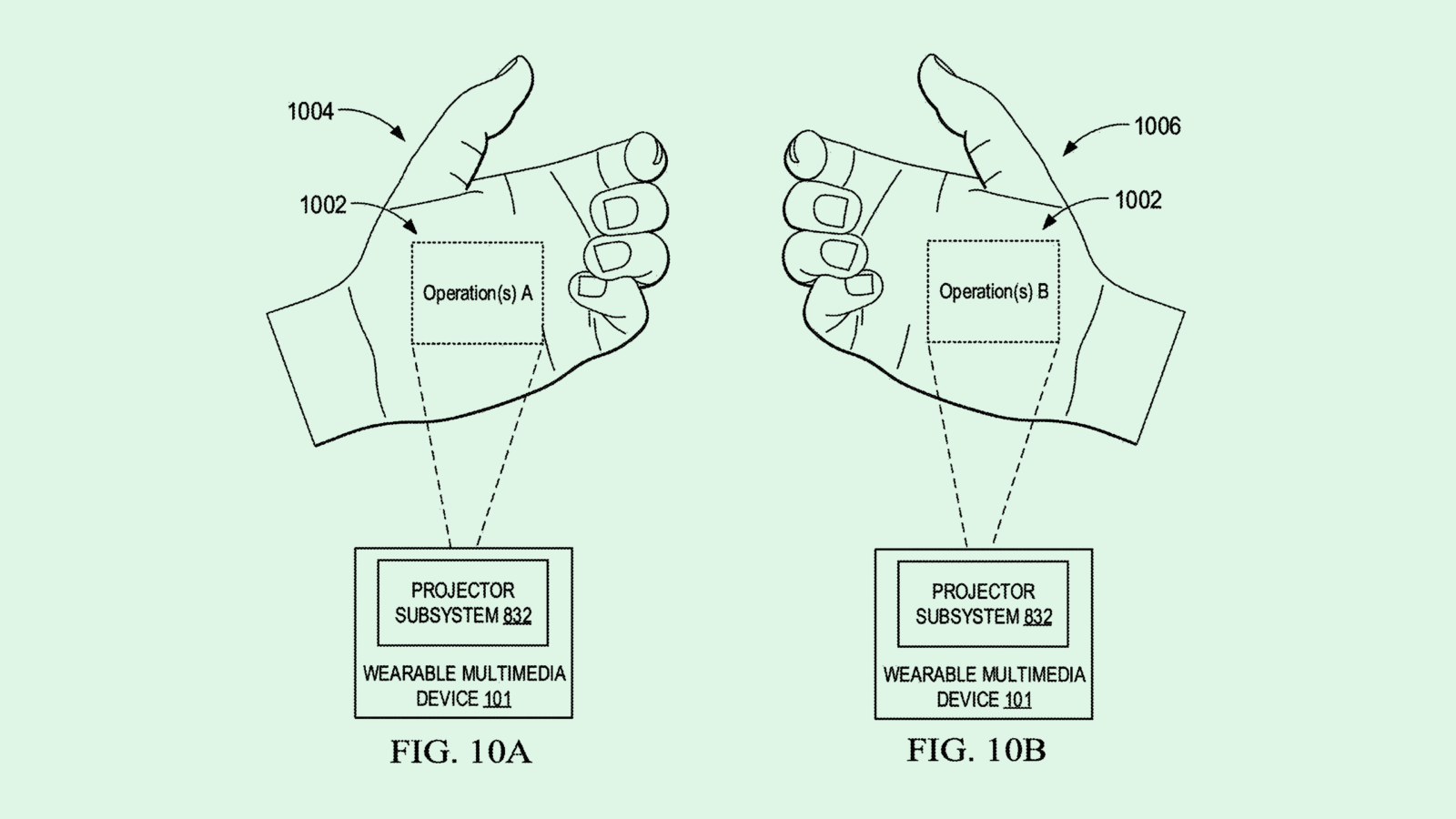

The credit card giant is seeking to patent a system for the “conversion of digital assets to fiat currency.” The foundation of this tech is a process that Mastercard calls “mirrored accounting,” or mirroring a transaction onto a second record to ensure a “reliable and auditable conversion” by essentially creating an immutable receipt of it.

To break it down, this system first receives transaction data consisting of a payer identifier, recipient identifier, and blockchain currency amount, and validates that the entities involved are authorized to make these transactions. The system then determines the payout (a.k.a., how much your crypto is worth).

Then, an identical transaction is generated on a second blockchain, and the validation process happens again. Once that transaction is confirmed, the recipient gets their payout, “without the need for an exchange and in a manner that is more trustworthy and efficient.”

Mastercard said this system bypasses the need for conversions to go through a conventional crypto exchange, which it said are “not regulated institutions and do not have to provide any transparency or accountability, which can result in merchants being taken advantage of or being apprehensive to accept digital asset payments due to the difficulties and dangers in converting their assets to fiat currency.”

To put it lightly, cryptocurrency companies had a really bad year last year. Some of the most notable to collapse include FTX, which faced a liquidity crisis in November and soon after filed for bankruptcy, Voyager Digital, which filed for bankruptcy in July, and Genesis Global, which filed for bankruptcy in January after reporting stark losses in 2022.

The crypto market overall has yet to recover from last year’s crash. But traditional financial institutions like Mastercard taking an interest in the tech could be the credibility that the industry needs to get back on its feet, said Aaron Rafferty, co-founder at StandardDAO.

“The crypto market in general lost a lot of credibility with the FTX collapse,” said Rafferty. “But there is going to be a move toward the space … MasterCard clearly has a vision on that. I think you had to really snuff out some of the bad players before that could really happen.”

Along with restoring crypto’s credibility, this patent’s tech could revitalize crypto adoption by specifically helping merchants, Jordan Gutt, head of Web 3.0 tech at The Glimpse Group, told me. By removing crypto exchanges from the equation, Gutt said, this patent could allow merchants to accept digital assets and seamlessly convert them into another currency.

“This would be most advantageous to the merchants on the MasterCard network,” Gutt said. “It cuts out that middleman of the exchange, which could be complicated, or a system they don’t necessarily trust, or just risky in general.”

MasterCard has been interested in blockchain for a while now. In February, the company debuted plans to allow its merchants to receive and settle digital asset transactions by the end of the year. And last week, the company announced that it’s in talks with a host of different banks and fintechs on a digital asset credit card with a way to convert crypto to traditional fiat currency. This patent could offer a deeper look into it’s blockchain ambitions.

While spending resources on blockchain isn’t the hottest take in the tech world at the moment, MasterCard is taking advantage of a bad situation. By investing in new tech when the market is down, Gutt said, the company is seemingly “positioning themselves to make the most out of the next bull run.”

“It’s a signal that more reputable entities are getting involved because they don’t want to be left behind,” Gutt added.

Have any comments, tips or suggestions? Drop us a line! Email at admin@patentdrop.xyz or shoot us a DM on Twitter @patentdrop. If you want to get Patent Drop in your inbox, click here to subscribe.