Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

This story brings new meaning to the term: swimming in money.

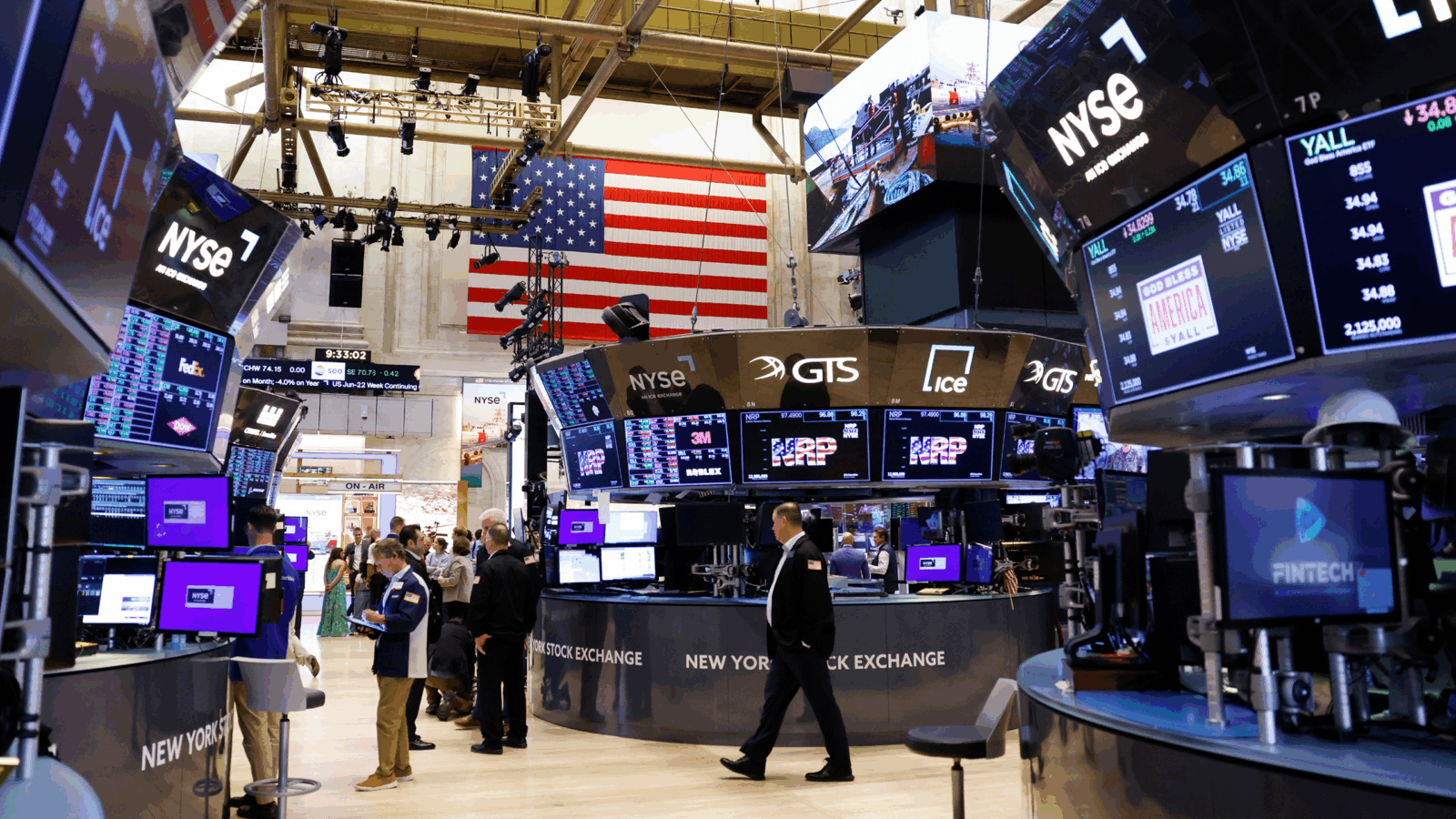

Wall Street, tapping into its ability to put a price tag on anything, has launched a way to bet on the price of water.

Water World

Yesterday the Chicago-based CME Group launched a futures contract tied to the Nasdaq Veles California Water Index.

For those whose knowledge of the water market ends with Poland Spring and Dasani, the Nasdaq Veles Index was established in 2018 to set the benchmark price of water in California. The index measures the volume-weighted average of water transaction prices in the state’s five largest water markets.

Why California? With high-volume activities like almond and pistachio farming and celebrities watering their lawns during a drought, California is the largest water market in the U.S. by a multiple of four.

The futures contracts will be financially settled, meaning buyers won’t need a second pool to take delivery. The contracts began trading yesterday under the ticker NQH20.

Why It Matters

Until now, farmers had no way of hedging their exposure to the price of water. Should prices soar during the wrong season, they could be financially drained. According to CME, the futures will help water users manage risk and better align supply and demand.

The futures market will also serve as a scarcity gauge for investors and other interested parties.

- Two billion people live in nations with water shortages, and nearly two-thirds of the world could face a shortage in the next half decade.

- An analyst at RBC Capital Markets told Bloomberg, “Climate change, droughts, population growth, and pollution are likely to make water scarcity issues and pricing a hot topic for years to come.”

The Takeaway: If anyone has seen James Bond’s Quantum Of Solace, you can imagine how this goes wrong.