Finance

-

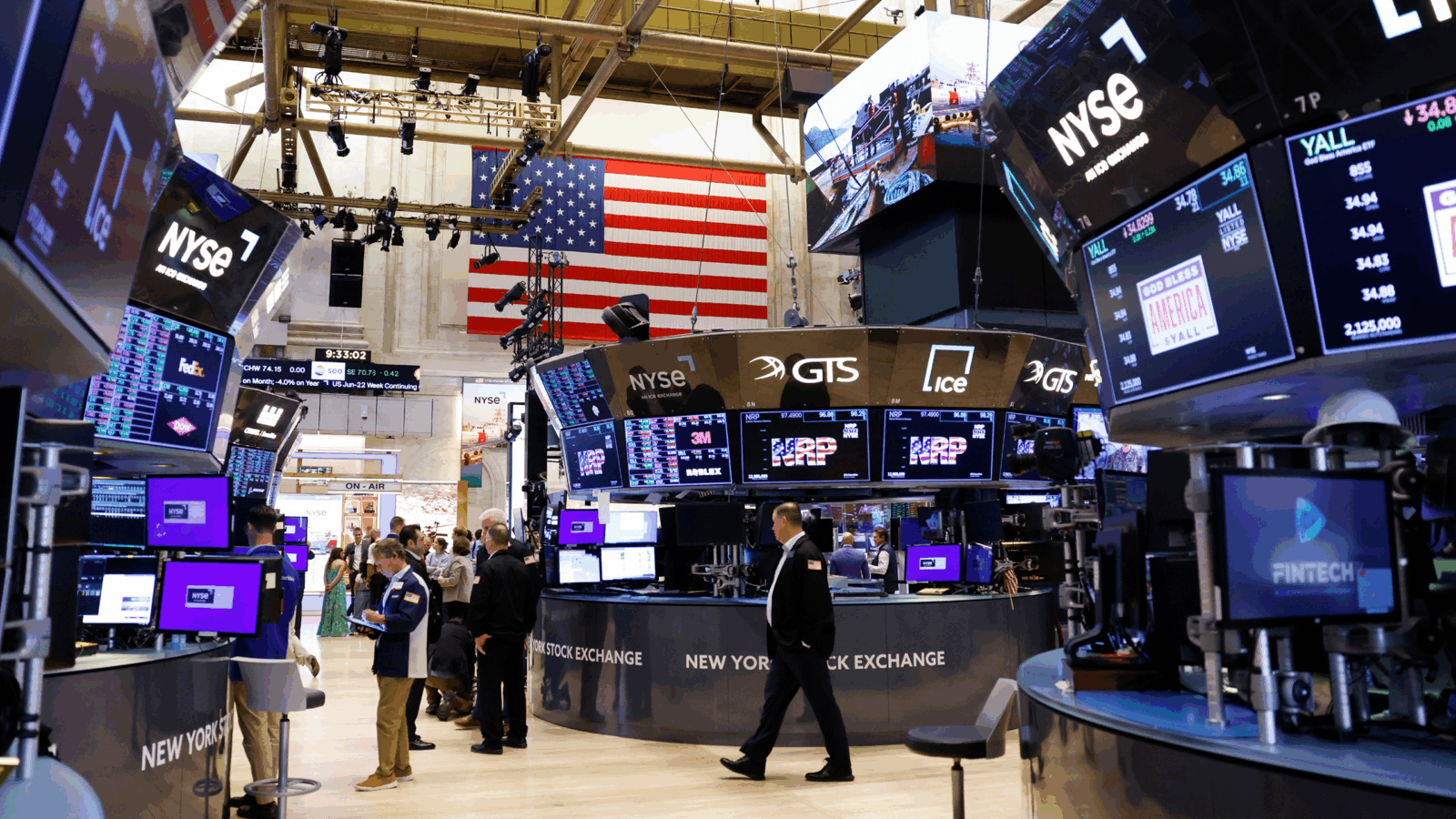

Dwindling IPOs Reward Investors With Return Bonanza

Photo via John Angelillo/UPI/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Retail Investors Risk Ominous Opportunity Cost With Private Investments, Moody’s Warns

Photo via Richard B. Levine/Newscom

-

Thoma Bravo’s $34B Win Leaves PE Rivals Choking on Exhaust Fumes

Orlando Bravo, founder and managing partner of Thoma Bravo. Photo by Joe Budd via CC BY-SA 4.0