Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

At least Big Oil is making the Sage of Omaha look smart.

Despite falling well short of start-of-year production goals, oil and gas companies are posting financial results far beyond any reasonable expectations this year. The massive profits were enough to help Warren Buffett’s Berkshire Hathaway, which owns a major stake in Occidental Petroleum, weather an otherwise ugly quarter.

Cry and Demand

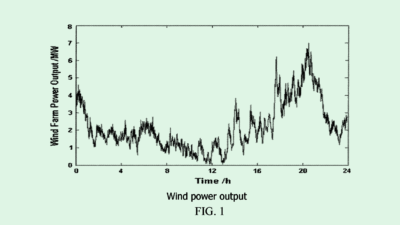

Oil companies may have finally learned how to refrain from overkill. After years and years of a drill, baby, drill mentality, firms are opting now to chill, baby, chill… and collect massive profits from raised prices amid high demand for oil and gas. Despite the increased demand for fossil fuels, US frackers and shale companies have kept oil production roughly flat this year.

The unsurprising result? Rollicking profits for energy companies in the latest quarter:

- Last week, Exxon reported a record $20 billion in quarterly profit, nearly matching Apple’s numbers, while Chevron posted over $11 billion, good for its second-highest quarter ever. ConocoPhillips reported $4.5 billion in profits in the latest quarter — nearly doubling its results from the same period last year.

- Berkshire reported a nearly $2.7 billion net loss in its Saturday earnings call, down from a profit of over $10 billion last year, thanks to this year’s volatile market conditions. But its massive stake in Occidental and Chevron buoyed the company from sinking any further, with the former seeing its share price double this year even as the rest of the S&P 500 has plummeted over 20%.

All told, oil production in the US has increased only around 3% from December through August this year, according to the Energy Information Administration — even as benchmark Brent crude oil prices have increased nearly 30% year-to-date. That’s good news for Big Oil, but a gut punch for commuters everywhere.