State Regulators Bet on a Legal Difference Between Prediction Markets, Sports Gambling

Connecticut claims Kalshi, Robinhood and Crypto.com don’t have the proper licenses to handle sports wagers in the state.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

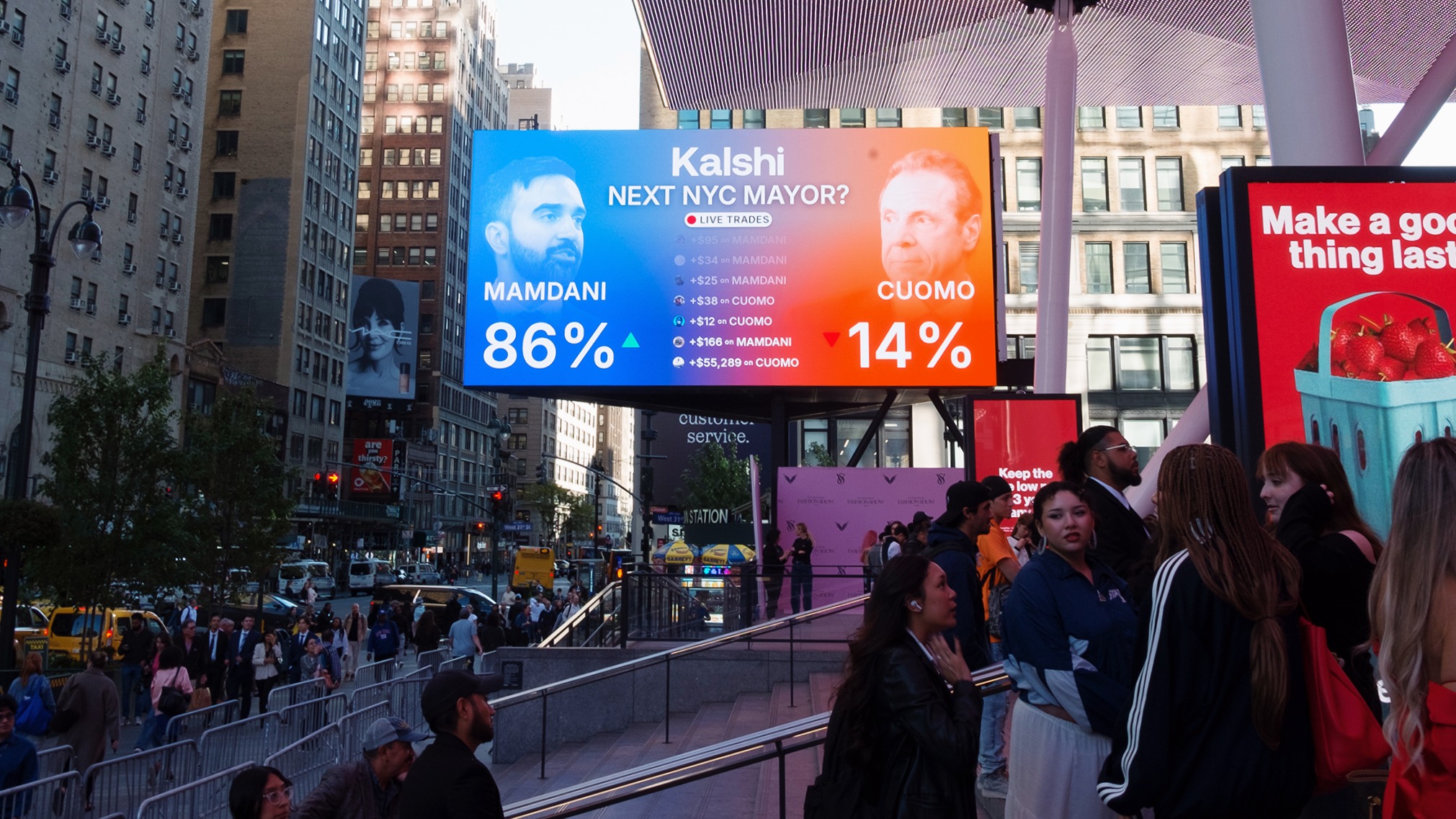

Are prediction markets just gambling rebranded? Connecticut seems to think so: The state’s Department of Consumer Protection sent cease-and-desist orders to Kalshi, Robinhood and Crypto.com, alleging the platforms facilitated unlicensed online sports gambling.

The challenge comes the same week that Kalshi rival Polymarket reopened to US users, starting with sports events contracts, after being barred from operating here in early 2022. Adding to the competition, on Wednesday, Fanatics launched prediction markets in 24 states.

Same Difference or Different Difference

Prediction-markets platforms offer events contracts that allow users to put money on anything from how much it’ll rain in LA this month to how many rate cuts there’ll be this year, but sports-related contracts are where their offerings have gotten legally sticky. While companies like Kalshi argue that events contracts and sports wagers are like apples and oranges, a growing contingent of regulators says they’re more like Gala apples and Fuji apples.

Connecticut claims Kalshi, Robinhood and Crypto.com don’t have the proper licenses to handle sports wagers in the state and aren’t following state rules, like restricting betting to people over the age of 21. “These platforms are deceptively advertising that their services are legal, but our laws are clear,” added Department of Consumer Protection Gaming Director Kris Gilman, “A prediction market wager is not an investment.” If the companies don’t comply with the shutdown order, they could face penalties and charges.

Robinhood and Kalshi said their platforms are allowed under federal law. But Connecticut’s not the only state that’s challenging prediction-markets platforms as the lucrative business model faces nationwide side-eye:

- Kalshi has said that its business is regulated by the Commodity Futures Trading Commission as a derivatives platform that facilitates commodity futures and swaps. In May, the CFTC under President Trump moved to dismiss a case that would’ve prevented Kalshi from letting users bet on US elections.

- But a growing number of states disagree with Kalshi’s stance and think prediction markets should be regulated under the same state rules as sportsbooks like DraftKings and FanDuel. Eight states have sent Kalshi cease-and-desist letters, and several Native American tribes have sued Kalshi and its partner, Robinhood. (FYI: Robinhood made up more than half of Kalshi’s trading volume as of mid-November, Bloomberg Intelligence found.)

Seeing Dollar Signs: Kalshi completed a $1 billion funding round on Tuesday, led by Paradigm, valuing the platform at $11 billion. After the raise, co-founder Luana Lopes Lara became the youngest self-made female billionaire at 29. The youngest self-made billionaire is Polymarket founder Shayne Coplan, 27, who secured his spot among the prediction-market nouveau riche after Polymarket raised $2 billion in October from NYSE-owner Intercontinental Exchange. And there’s more money to be made, as long as the platforms continue to resist legal challenges: Prediction-market trading amounted to more than $3 billion in the third quarter alone, five times as much as the same time last year.