Finance

-

Wells Fargo Gets Called Out for Lax Crime Prevention

(Photo by Griffin Wooldridge on Unsplash)

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

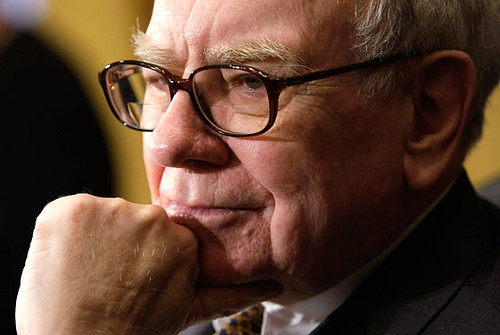

Berkshire Hathaway Has Built a Massive Mountain of Cash

(Photo Credit: Serba Sembilan/Unsplash)

-

Homebuilders Feel the Squeeze of Tight Housing Market

Photo by Zac Gudakov via Unsplash

-

UK Abolishes Cap on Bankers’ Bonuses

(Photo by Christopher Bill on Unsplash)