DoorDash Delivers Fresh Profits with a Soggy Forecast

The delivery giant’s revenue in the winter quarter climbed 38% compared to the same time last year, for a total near $4 billion.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

DoorDash delivered piping hot earnings this week, accompanied by a side of lukewarm expectations for the first quarter.

The delivery giant’s revenue in the winter quarter climbed 38% from the same time last year for a total that’s flirting with $4 billion. The app notched about 903 million orders, a 32% jump, as coffee-table diners double-dashed breakfast burritos and ramen. Orders were boosted by DoorDash’s October acquisition of British delivery app Deliveroo—without the new app, DoorDash orders still climbed about 20%.

But feast could turn to famine this year. DoorDash, whose shares have dropped nearly 20% this year, lowered its first-quarter forecast. The company expects supersized investments into its technology, along with an international push and winter storms, to bite into its earnings.

Spending Money to Make Money

DoorDash shares had their biggest one-day drop ever in November, when the company announced plans to spend hundreds of millions of dollars improving its platform and business. Investors at the time had already grown skittish about large investments into unguaranteed futures as tech companies poured hundreds of billions into AI.

Now, investors know more about the details of DoorDash’s self-improvement plan, and yes, it does include AI:

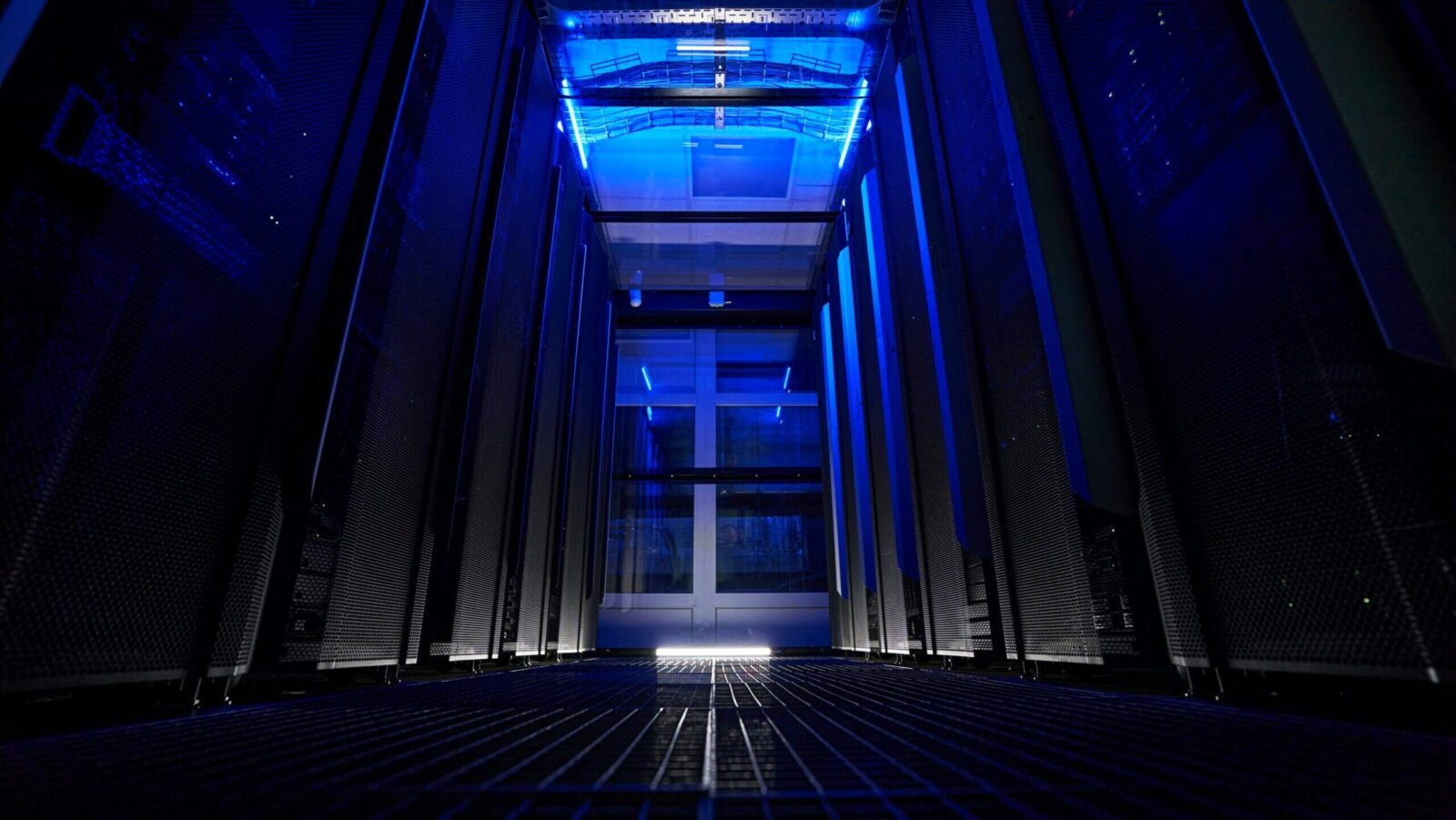

- DoorDash is working to integrate its three delivery businesses — DoorDash, Deliveroo and EU-favorite Wolt — into a single platform that it says will be more efficient. The company’s spending push also focuses on both agentic and physical AI. The AI agents could facilitate more orders for the delivery company, while AI-powered autonomous vehicles could cut costs. DoorDash said its research and development expenses had already surged 41% last year.

- DoorDash is also investing in the last mile of delivery with robots and drones (some of the bots have heart eyes). These last-mile solutions could give DoorDash an edge in grocery delivery compared with rivals like Amazon.

Global Ambitions: DoorDash is looking to make its plan pay off in the second half of the year, which could catapult it higher up the list of apps people order fried rice on. In the US, DoorDash dominates the delivery industry with more than double the order volume of its closest competitor, Uber Eats, according to Consumer Edge and Fortune. Deliveroo and Wolt, meanwhile, have strong presences abroad but still face stiff competition from rivals like Just Eat.