Ferrero Puts Snap, Crackle and Pop into Its Earnings With WK Kellogg Acquisition

Ferrero previously bought Nestlé’s US candy biz for $2.8 billion, as well as chocolate-maker Fannie May and RedHots owner Ferrara.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

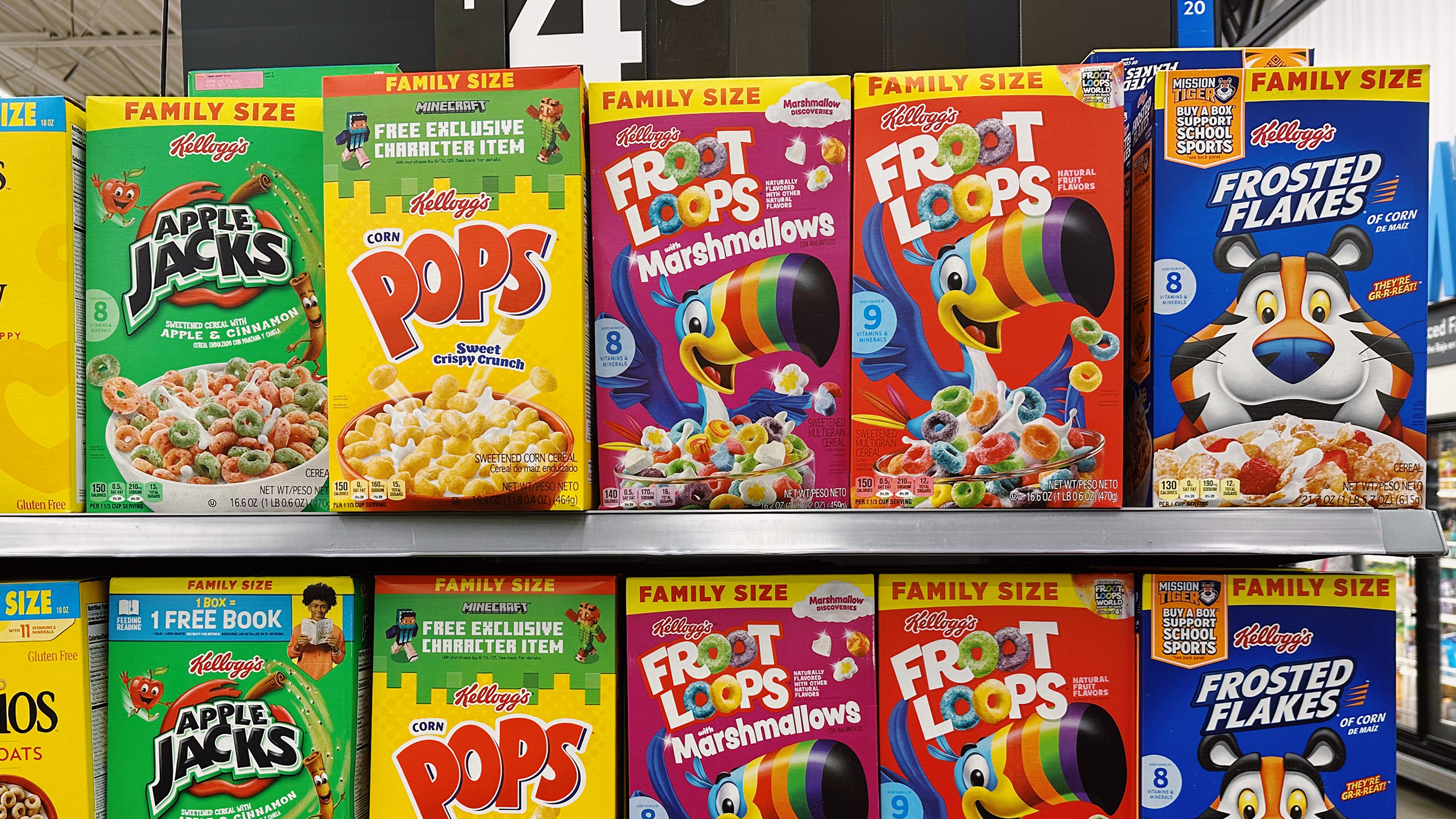

Nutella-covered Froot Loops could become a thing now that Ferrero’s buying WK Kellogg for $3.1 billion. The Rice Krispies-maker’s shares did “Gr-r-r-eat” yesterday, popping 30% as investors backed the Italy-founded company’s takeover of American breakfasts.

Ferrero previously bought Nestlé’s US candy biz for $2.8 billion, as well as chocolate-maker Fannie May and RedHots owner Ferrara — considering the name, it was inevitable. The Italian company is now the US’s third-largest candy seller, behind Hershey and Mars, according to Evercore ISI.

Ferrero has also brought over brands that Americans used to visit the EU to buy (Kinder Bueno, Joy Eggs) and Americanized a couple of its products: Dr Pepper Tic Tacs and Nutella Peanut.

Part of an Incomplete Breakfast

Sugary cereals never left the ’90s as shoppers switched to healthier and higher-protein breakfast options with fewer artificial food dyes. And in recent years, inflation has pushed cereal buyers to opt for more affordable private-label brands (Shredded Wheat instead of Mini-Wheats). WK Kellogg reported that its sales fell 6% in the first quarter and cut its annual guidance, citing “weaker than expected consumption trends.”

The company has been going soggy for a while:

- In 2023, Kellogg spun off its struggling cereal biz as WK Kellogg and renamed itself Kellanova to focus on its snack portfolio (Pringles, Cheez-Its). Though both companies have struggled with scrimping shoppers, Kellanova’s sales weren’t hit as hard as WK Kellogg’s last quarter.

- Ferrero’s competitor Mars is betting on snacks over cereal. Mars announced in August that it’ll buy Kellanova for $36 billion, and the deal was approved by the FTC last month — it’s still facing antitrust scrutiny in the EU.

Experts don’t think regulators will challenge Ferrero’s deal since it’s significantly smaller, and Ferrero isn’t a major player in the cereal aisle.

Milking It: The campaign to get Americans to eat more cereal is underway. WK Kellogg CEO Gary Pilnick encouraged Americans to eat cereal for dinner last year (the comment caused some PR drama), citing company data showing a quarter of consumers already eat cereal outside of breakfast time. WK Kellogg’s has also tried turning its cereals into snacks, launching grab-and-go bags of brands like Froot Loops and Apple Jacks as well as cereal bars.