Electric Vehicles

-

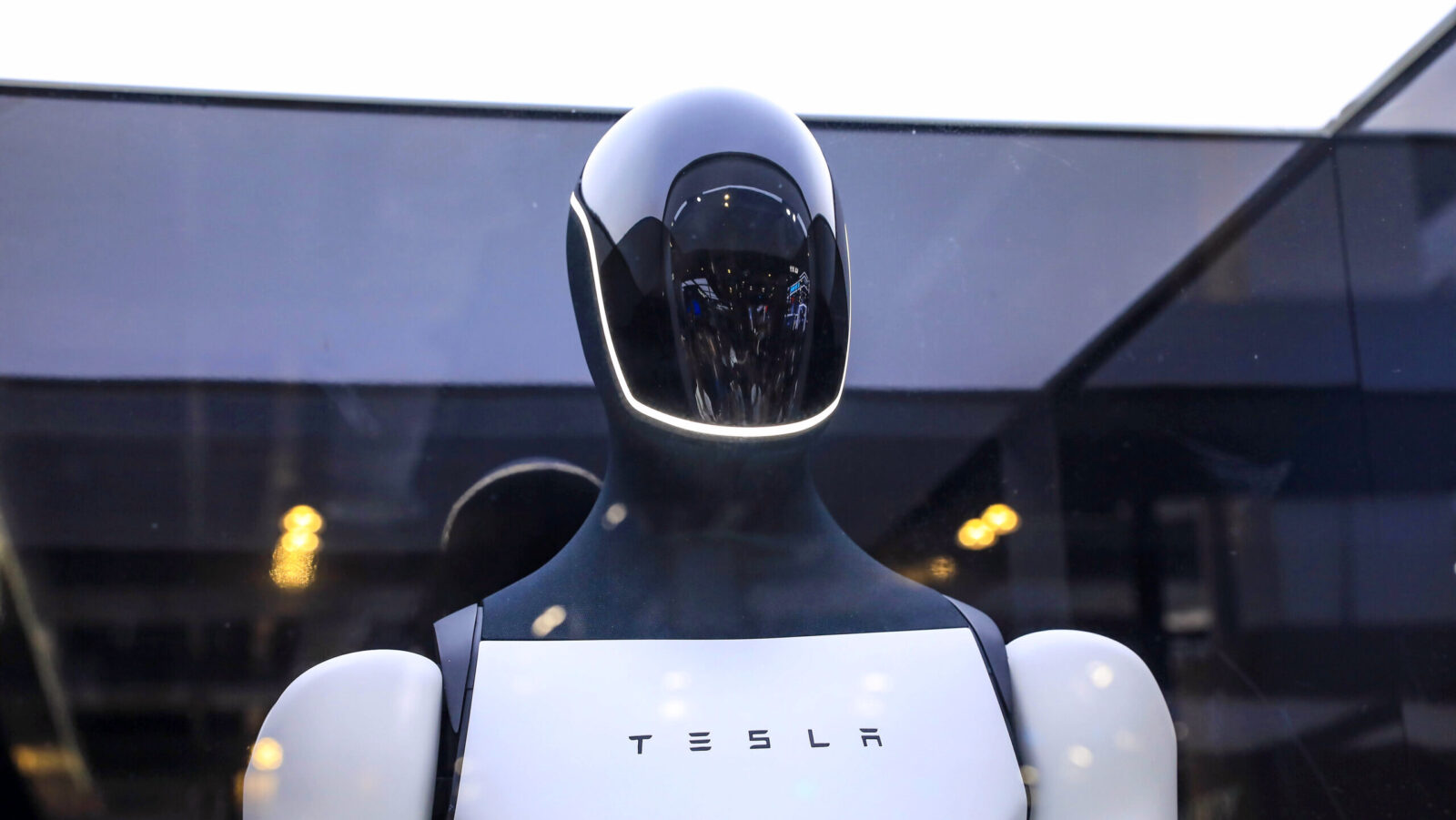

Tesla Needs its Robo-Tech to Recharge Revenue

Photo via Javier Rojas/ZUMAPRESS/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Can Tesla and Samsung Find Salvation in Each Other?

Photo via IMAGO/VCG/Newscom