Investments

-

Defiance to Launch 3 Volatility ETFs

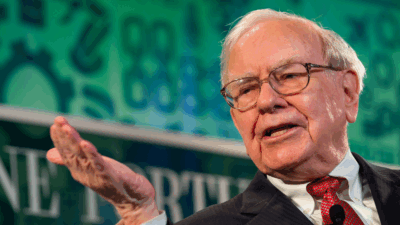

Photo via Connor Lin / The Daily Upside

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

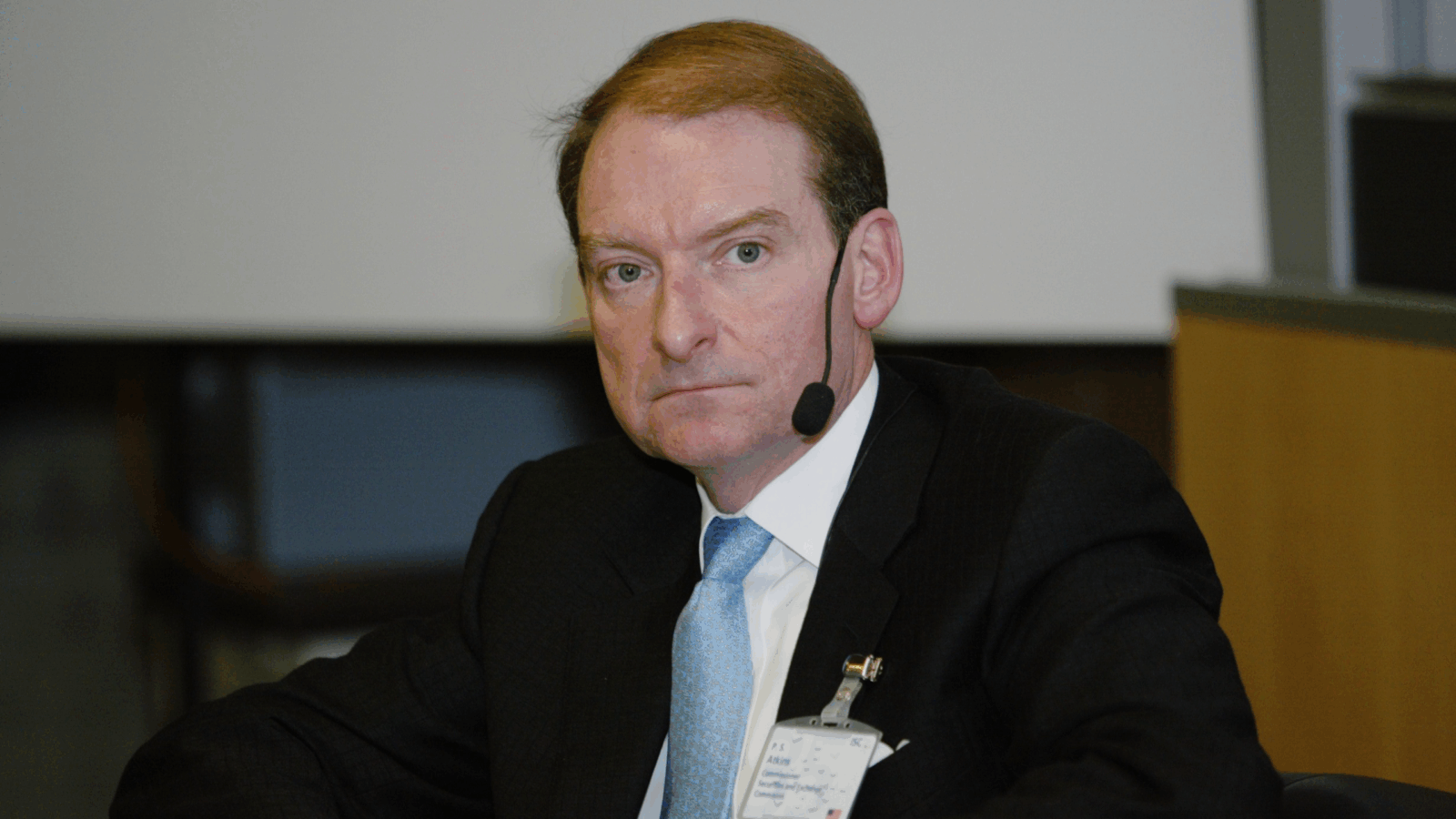

Amplify ETFs CEO Christian Magoon on the Past 2 Decades of ETFs

Photo via Skylar Ogren