Good morning.

Won’t somebody please think of the children?

House Republicans unveiled a $4 trillion tax bill as part of President Trump’s broader economic package this week, and within it is a unique proposal: accounts seeded with $1,000 for each American baby born in the coming years. The funds can go toward school, training programs, small business loans, or first-time home purchases, and families can contribute up to $5,000 per year. And yes, of course, they’re called “MAGA” accounts, only this time it stands for “Money Account for Growth and Advancement.”

Also known as “baby bonds,” the idea has been around for a few years and some Democratic politicians, including New Jersey Senator Cory Booker, have endorsed them, according to Bloomberg. Sen. Ted Cruz described it as “essentially a 401(k) for every newborn in America.”

We’d say they’re also like 529s, but these funds would actually use letters in their name.

LPL Soars on First Earnings Beat After Commonwealth Deal

A little stock market uncertainty isn’t going to rattle LPL.

The country’s largest independent broker-dealer saw its stock price soar 13% over the past week, driven by a better-than-expected earnings report and optimistic remarks from the company’s CEO about the purchase of Commonwealth Financial Network. In fact, shares have climbed some 23% over the past month after the deal was announced at the end of March. But maintaining the San Diego-based brokerage’s recent success will hinge on a successful campaign to bring on the almost 3,000 Commonwealth advisors in what will become the largest acquisition by assets in LPL’s history.

“Let’s kind of hit this thing head-on,” CEO Richard Steinmeier said on an earnings call with analysts last week. “There’s been ample chatter in the marketplace around the deal, but that really speaks to the importance of the Commonwealth franchise, and quite honestly, the quality of their advisors. It’s exactly what we expected to see with a franchise of this quality.”

Which One’s the Pinot?

Some Commonwealth advisors are wary about joining LPL, and rivals — like Raymond James, Cetera, Wells Fargo, Morgan Stanley and Ameriprise — have all reportedly floated lucrative compensation packages to lure those advisors onto competing platforms. Steinmeier reassured investors that LPL is on track to meet its retention target, which would transition 90% of Commonwealth advisors.

“Commonwealth is a very tight-knit community that oftentimes feels far more like a family,” Steinmeier said. He told analysts he has talked with dozens of Commonwealth advisors, some on a “rain-soaked” bike ride in Scottsdale, Arizona, others at a Sunday lunch in Sacramento, and still more at a blind wine-tasting (location undisclosed). “We are deeply committed to keeping that community intact, safeguarding their experience, their cultures, their capabilities,” he said.

Put That in Your Pipe. LPL increased its advisory and brokerage assets by 25% year over year, thanks to higher revenue on commission-based products. Advisor headcount also ticked up 2% to 29,493 over the same period. But it’s not just a stellar earning report and the monumental Commonwealth deal causing all the commotion:

- LPL acquired institutional clients in recent months, including WinTrust and Prudential Advisors, adding over $80 billion in M&A assets.

- New-York based Atria Wealth Solutions will add an additional 2,400 advisors to the platform over the next few months.

“Look at what we have in front of us, specifically right now, on beginning the Atria conversions, and specifically getting ready for Commonwealth,” LPL CFO Matthew Audette said on the call. “The recruiting pipeline continues to be quite large.”

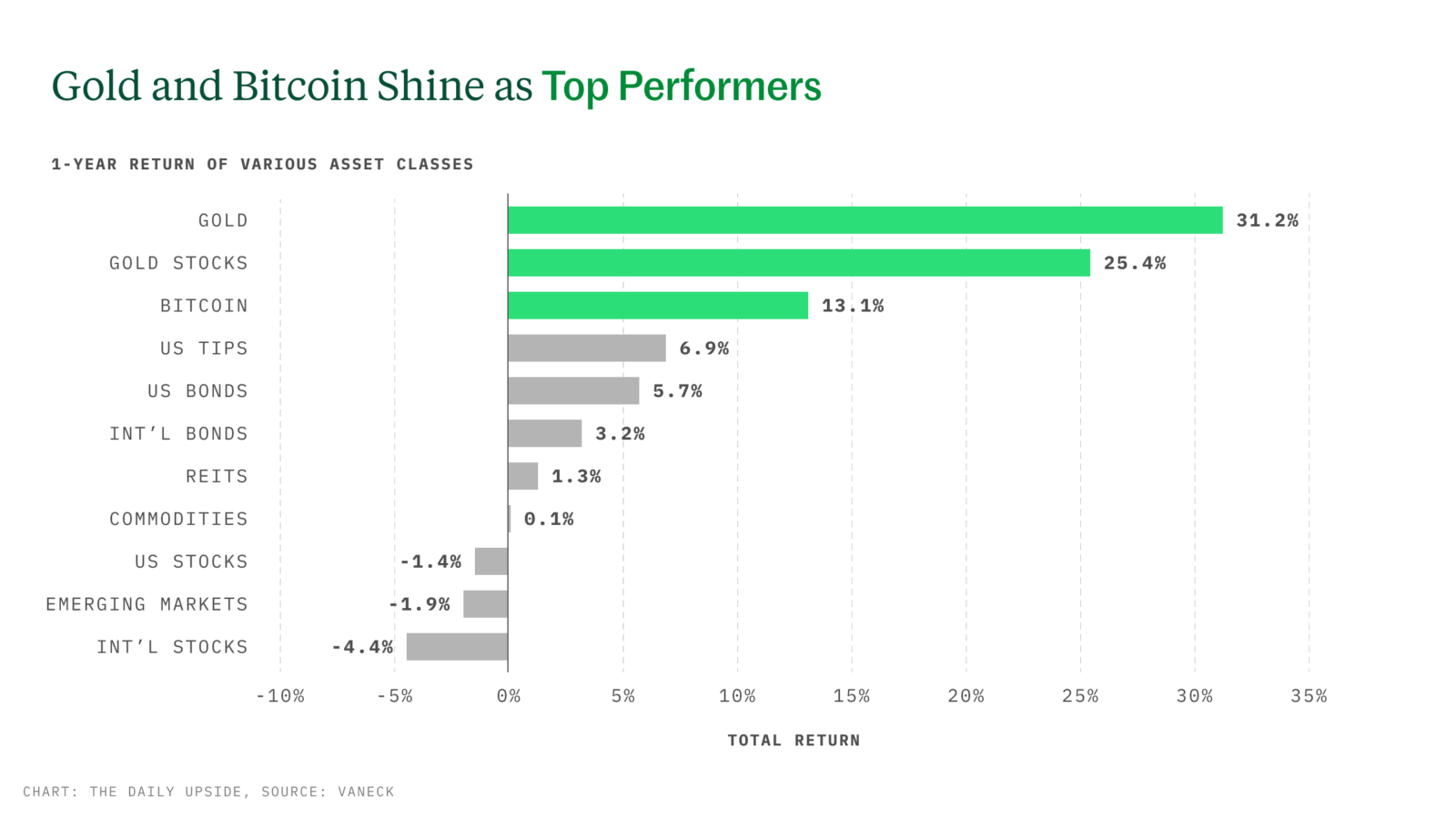

Why More Financial Advisors Are Embracing Gold

Gold has punched through $3,000 an ounce — a signal of its strength amid broader market stress. But, for advisors and clients alike, the bigger story is gold’s ongoing strategic role in client portfolios.

VanEck sees gold not just as a hedge against volatility, but as a core holding in today’s uncertain economic environment. With inflation still elevated and global risks on the rise, VanEck’s Merk Gold Trust (OUNZ) offers cost-efficient access to physical gold — and the ability to take delivery, all without triggering a taxable event.

In the face of what VanEck calls a “fiscal reckoning” — with US spending cuts totaling 3% of GDP — the rationale for holding gold is more compelling now than ever.

Who Wants to Live to 100? Not Most Americans

Naomi Whitehead is the oldest living American at 114 years old, and we’d like to take a peek at her retirement plan.

Reaching 100 is a remarkable feat, but it’s not one most Americans are eager to achieve. More than 70% of Americans say they don’t want to hit the century mark, fearing they won’t be able to afford the cost of longevity, according to a new report from the Nationwide Retirement Institute. However, living longer is becoming increasingly common thanks to medical advances, and for financial advisors, that means preparing clients not just for 15–20 years of retirement — but potentially 35 years or more.

“Most clients tell me, ‘There is no way I will live that long,’” said Jessica McNamee, an advisor with Sirius Wealth Strategies. “I find their certainty fascinating.”

Are We in a Blue Zone?

The number of American centenarians is expected to quadruple over the next 30 years, per the US Census Bureau. That reality is unsettling for many who fear their bank accounts will run out before they do:

- Some 40% of non-retired individuals plan to delay retirement due to inflation, per the NRI report.

- Even for those who reach 100 with savings, one in five healthy couples will outlive their nest egg unless they adjust their money-management strategy.

The NRI highlighted annuities, long-term care insurance plans, and lifetime income solutions within employer-sponsored retirement plans as enablers of confidence, independence, and dignity for clients.

Financial Caregiving. Even with money in place, managing it is another challenge. Increasingly, that responsibility falls to younger family members acting as financial caregivers. Over 40% of clients at Wells Fargo, Morgan Stanley, and Ameriprise fit this role, according to market researcher Hearts & Wallets. “It starts off with paying bills, then quickly flows into managing income flows, and segues into handling taxes and insurance,” said Laura Varas, Hearts & Wallets CEO.

More than half of financial caregivers are open to paying for professional help managing an aging loved one’s finances. “It could be a good way for advisors to build business,” Varas told Advisor Upside, “but it’s also a massive and growing need for US households.”

Private Assets Get the In With Long-Sought-After 401(k)s

The barbarians are at the gate to a $12 trillion industry.

Empower, one of the country’s largest retirement plan providers, is offering private market investments from the likes of Apollo, Franklin Templeton, and Goldman Sachs. The private equity, credit, and real estate allocations would sit inside collective investment trusts used in managed accounts for plans working with advisors, according to the firm. It’s the latest sign of private markets extending their reach well beyond their traditional clientele of wealthy families and institutions. On the retail front, similar strategies have already been worked into ETFs and interval funds.

Empower’s “profound move” will diversify 401(k) portfolios, Empower CEO Edmund Murphy III said in the company’s announcement Wednesday. But demand is a question. “If you ask participants or plan sponsors, they’re not demanding this,” said Fred Barstein, founder of The Retirement Advisor University. “But then again, they didn’t ask for target date funds.”

Extra Upside

- Movin’ On Up. Advisor market sentiment ticked up in April after a 12-month low in March.

- Hand-Me-Downs. Some 75% of women say they are not prepared to handle their inheritance without difficulty, per UBS.

- Access To Gold With Distinct Advantages. OUNZ offers the efficiency of an ETF and the security of gold ownership — plus the ability to take delivery without triggering a taxable event. Explore the gold ETF that delivers.**

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

*Investing in the VanEck Merk Gold ETF (“OUNZ,” or the “Trust”) involves significant risk and may not be suitable for all investors. OUNZ is not registered under the Investment Company Act of 1940 (the “1940 Act”) and lacks the protections mutual funds or ETFs have under the 1940 Act.

Not intended as a recommendation to buy or sell any names referenced herein. Digital assets are subject to significant risk and are not suitable for all investors. Past performance is no guarantee of future results.

The Sponsor for the Trust is Merk Investments, LLC. The Marketing Agent for the Trust is Van Eck Securities Corporation.

© Merk Investments LLC

© Van Eck Associates Corporation

Source: VanEck, FactSet. Data as of April 7, 2025. Digital assets involve significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Index performance is not representative of fund performance and cannot be invested in directly. This is not an offer to buy or sell any security, strategy, or index referenced. For definitions and index/asset class descriptions, visit: https://www.vaneck.com/us/en/vaneck-advisor-upside-disclosures