Good morning.

What could scream retirement savings more than buying a bar of gold and a 40-pack of Kirkland brand toilet paper in the same trip.

Costco, the membership-based megastore that has everything from groceries to electronics to tires, is pumping the brakes on how much gold customers can buy. Yes, you can even buy gold at Costco, and demand for the precious metal has skyrocketed, hitting an all-time high of $3,500 per ounce last month. Unfortunately, members can now make only one transaction of up to two 1-ounce gold bars per 24 hours, down from five units in January, USA Today reported. Just make sure to leave room for the $1.50 hotdogs.

Why Big Brokerages Like UBS, Goldman and JPMorgan Are Ditching Their Robo-Advisors

Oh, how the mighty robo-advisors are falling.

UBS became the latest major brokerage to unplug its robo-advice strategy last week, joining a venerable who’s who of top brokerages, including Goldman Sachs and JPMorgan, that have abandoned their automated services in recent months. While the low-cost investing options exploded in popularity over the past decade, the costs of running robo-advisors — coupled with extremely low fees and minimums — have proven too steep. UBS declined to comment, but its platform listed a fee of just 75 basis points and a minimum of $10,000 on its website.

“The big banks are finding it’s harder than they realized to drive meaningful profits with low fees and margins,” said industry analyst Vijay Raghavan. “The appeal just isn’t there at firms who are known for serving wealthy and ultra-wealthy clients.”

Domo Arigato, Mr. Roboto

A fundamental challenge for robos, at big brokerages and independent shops alike, has been the razor-thin margins. Onboarding new clients can cost hundreds or thousands of dollars, meaning it takes years in some cases for those firms to recoup expenses. The accounts are also almost by definition “low engagement,” which makes it more difficult for firms to cross-sell clients into more lucrative products, Raghavan said. It’s become a major problem for Wall Street banks and asset managers:

- JPMorgan Chase shut down its automated investing platform called Automated Investing last year; while Goldman offloaded digital accounts from its Marcus Invest to Betterment.

- Betterment also purchased digital accounts from Ellevest in February, following the departure of Wall Street veteran and founder Sallie Krawcheck.

- BlackRock sold FutureAdvisor to Ritholtz Wealth in 2023.

“Robo-advisors generally appeal to younger, digitally savvy customers who are more likely to seek out digital-first platforms, like Betterment or Robinhood, over an incumbent bank like UBS,” Raghavan said.

Machine or Mannequin? Automated advice’s future, at least at the big banks, may lie in striking the right balance between cost-saving tech and sentient human beings, said Will Trout, Datos Insights’ director of securities and investments. Technology can certainly help with accessibility and improve efficiency, but human expertise will remain necessary for complex decision-making and to help build lasting relationships with clients.

“This industry-wide retreat points to a sobering reality: The robo revolution failed to deliver on its promise,” Trout told Advisor Upside. “It’s an acknowledgement that financial wellbeing ultimately requires both human and digital-advice elements.”

It’s Not Too Late to Add Gold To Your Portfolio

Gold’s surge above $3,000 has left many investors wondering if they’ve missed their window. But according to VanEck CEO Jan van Eck, it’s not too late to consider gold as a portfolio anchor.

In his latest investment outlook, van Eck emphasizes that gold and bitcoin remain long-term bull market assets, especially as the US is in the middle of a “3% fiscal reckoning” driven by spending cuts and tariff pressures. Inflation may cool, but recession risks remain elevated.

Gold has historically served as a reliable store of value. Since 1969, when US inflation has topped 5%, it has outpaced both equities and bonds. With inflation still above target and central banks accelerating gold accumulation, the case for gold is only strengthening. Here’s why:

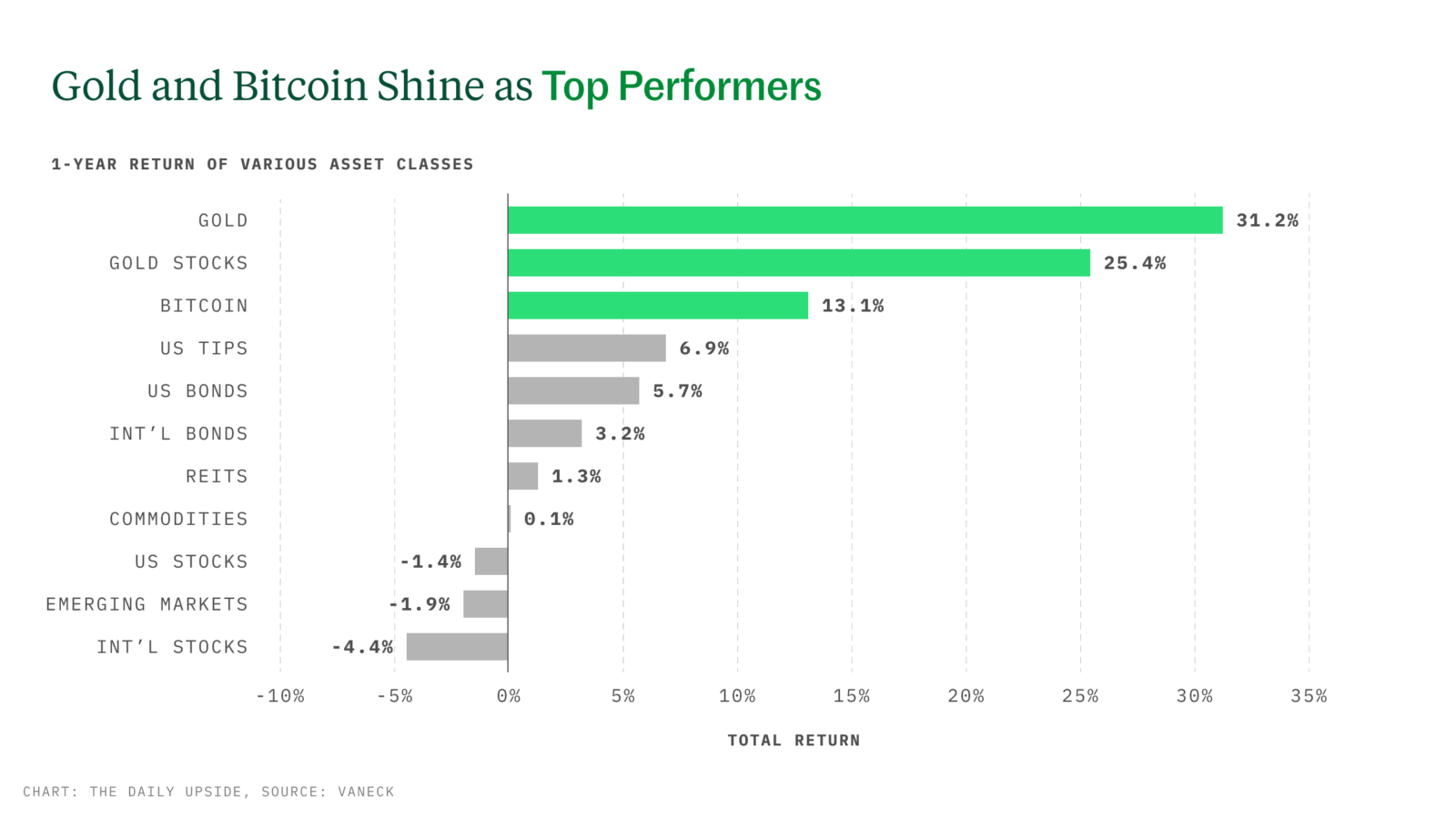

- Gold has outperformed major assets over the past year. Shining in periods of market turmoil and heavy inflation.

- Gold demand continues to rise as gold performance strengthens.

- Gold can enhance resilience in a time of de-dollarization, geopolitical tension and tightening fiscal policy.

Gain cost-efficient access to gold through the VanEck Merk Gold ETF (OUNZ), which provides investors the unique option to take physical delivery of gold. Explore OUNZ ETF.*

LPL Taps Anna Kendrick in Latest Ad Campaign

LPL Financial is rolling out the red carpet.

The nation’s largest independent broker-dealer is looking to expand its reach even further and has kicked off a new advertising campaign called “What if you could?” featuring actor Anna Kendrick that will include video, social media, billboard, digital, and print spots. The move comes on the heels of LPL’s $2.7 billion acquisition of Commonwealth Financial Network, part of a broader expansion push. While LPL traditionally marketed to advisors, the new effort aims to make its name more recognizable to everyday investors.

“If an advisor starts their own business and goes through LPL, their clients can say, ‘Oh yeah, they’re the ones with Anna Kendrick,’” said Frank LaRosa, CEO of Elite Consulting Partners.

Woman of the Hour

You may recognize Kendrick for her role as Beca Mitchell, the cup-tapping lead in all three Pitch Perfect movies. Last Thursday, LPL debuted a commercial that features Kendrick dragging an absurdly large swath of grass through city streets, essentially saying “the grass is greener on your side when you choose LPL.” An IBD going the Hollywood route has been done before, with one of the most notable examples being a collection of Ameriprise TV spots from the early 2010s that featured the always stone-faced Tommy Lee Jones.

What’s new for LPL is advertising directly to consumers. The firm has been “quietly delivering” on its goals since its 1989 founding, company CEO Rich Steinmeier said in a statement. Despite being the largest IBD with almost 30,000 advisors, LPL is not really a household name to average Americans. “You’d be surprised how few people have heard of LPL,” LaRosa told Advisor Upside. “Their pitch to advisors has always been, ‘If you come to our firm, it’s all about your brand.’”

Lights, Camera, Action. The second part of the campaign still targets wealth managers. LPL released a series of short testimonial videos in which advisors share how LPL helps them do more with their time and resources. “If I could, I would enable my advisors to use financial planning software as the driver and the engine to their practice instead of just being an option or an add-on,” Premier America Credit Union advisor Ye Su said in one of the ads.

New Startup Offers Lending to the 401(k) for the 401(k)

A startup backed by hedge fund manager Bill Ackman and private equity billionaire Henry Kravis is banking on a new idea for retirement savings: The 401(k) should be treated like a mortgage.

Basic Capital offers 401(k) participants and IRA owners an option to use leverage, just not through options or futures on equity securities. Rather, the firm provides financing for four times what someone contributes to their account, “amplifying your market exposure and supercharging the compounding effect,” CEO Abdul Al-Asaad said last week in a LinkedIn post. It’s aimed at everyday folks who are starting to build wealth. One of the first clients, for example, is a family-owned plumber and electrician company. Another client, a warehousing provider, has also signed up. Its employees allocate 60% of contributions on average to the financing option.

“These workers are our chief focus, which is why we’re building partnerships with businesses whose employees typically don’t earn high salaries,” Al-Asaad said.

Extra Upside

- Send Backup. Family offices of the ultra-wealthy are facing a talent crunch.

- Ease Up a Little. Republican House Member reintroduces bill to limit regulatory burden on smaller RIAs.

- Gold Remains A Prime Strategic Asset In Uncertain Times. Jan van Eck calls gold a long-term bull market. The OUNZ ETF offers cost-efficient access and physical delivery. Learn more about adding gold to your portfolio.**

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

*Investing in the VanEck Merk Gold ETF (“OUNZ,” or the “Trust”) involves significant risk and may not be suitable for all investors. OUNZ is not registered under the Investment Company Act of 1940 (the “1940 Act”) and lacks the protections mutual funds or ETFs have under the 1940 Act.

Not intended as a recommendation to buy or sell any names referenced herein. Digital assets are subject to significant risk and are not suitable for all investors. Past performance is no guarantee of future results.

The Sponsor for the Trust is Merk Investments, LLC. The Marketing Agent for the Trust is Van Eck Securities Corporation.

© Merk Investments LLC

© Van Eck Associates Corporation

Source: VanEck, FactSet. Data as of April 7, 2025. Digital assets involve significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Index performance is not representative of fund performance and cannot be invested in directly. This is not an offer to buy or sell any security, strategy, or index referenced. For definitions and index/asset class descriptions, visit: https://www.vaneck.com/us/en/vaneck-advisor-upside-disclosures