Good morning.

It could have been a scene out of the next Aquaman movie …

Fraudulent advisor Matthew Piercey tried and failed to evade authorities via an underwater scooter in California’s Lake Shasta in 2020, and pleaded guilty to running a $35 million Ponzi scheme last week. He conned investors into pouring millions of dollars, and in some cases their life savings, into fake companies, according to a statement from the FBI. While in jail, he also used coded language to tell associates to clear out a storage locker he rented under a fake name that contained a wig and ₣31,000 in Swiss francs, the agency said. He faces a max sentence of 540 years.

Safe to say, he won’t be uniting the lost kingdom of Atlantis any time soon.

Jamie Dimon Clears Bitcoin for JPMorgan Clients: ‘I Defend Your Right to Smoke’

What do Ponzi schemes and smoking have in common? Apparently, they’re just as dangerous as investing in Bitcoin, according to JPMorgan CEO Jamie Dimon.

Still, the notoriously blunt crypto skeptic made a stunning reversal at the company’s investor day this week, saying clients of the Wall Street bank will be able to purchase digital assets. JPMorgan was one of the last major financial firms holding out, and the move puts it on par with rivals like Morgan Stanley, which allowed wealth managers to pitch Bitcoin ETFs to clients in August. Goldman Sachs invested some $400 million in similar funds that same month.

“When I look at the bitcoin universe, the leverage in the system, the misuse of the system … the sex trafficking, the terrorism, I am not a fan of it,” he said, adding the firm won’t custody the assets, but will put them in statements for clients.

Don’t Take Pet Rocks for Granite

The about-face is a milestone for the bitcoin industry, which Dimon has largely lampooned. He dismissed bitcoin as “worthless” in 2021 when valuations were hitting record highs, per CNBC. The Queens, New York, native has expressed similar sentiments on some of the world’s largest stages:

- “The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance,” he told lawmakers during a Senate hearing in 2023. “If I was the government, I’d close it down.”

- “Bitcoin does nothing. I call it the pet rock,” Dimon said at the 2024 World Economic Forum in Davos. “This is the last time I’m talking about this with CNBC, so help me God.”

All of that criticism has made the bank’s announcements that much more surprising, said Damon Polistina, director of research at Eaglebrook. “Jamie Dimon has been a vocal bitcoin detractor. This move serves as a reminder that the institutional adoption of bitcoin is further along than most people realize.”

Who’s Got a Light? JPMorgan isn’t the only big brokerage caving on crypto. Charles Schwab is expected to open up bitcoin trading within the year, according to CEO Rick Wurster. He cited a “changing regulatory environment” in an update with analysts in April, but the company still listed stark warnings about the asset class on its website.

Advisors, and their clients, are certainly interested. More than half of advisors are planning to increase crypto investments this year, according to a January survey from Bitwise. Some 22% of advisors allocated to crypto in client accounts last year, which nearly doubled the rate from 2023 and marked an all-time high.

“I don’t think you should smoke,” Dimon told the crowd. “I defend your right to smoke. I defend your right to buy Bitcoin.”

Why More Financial Advisors Are Embracing Gold

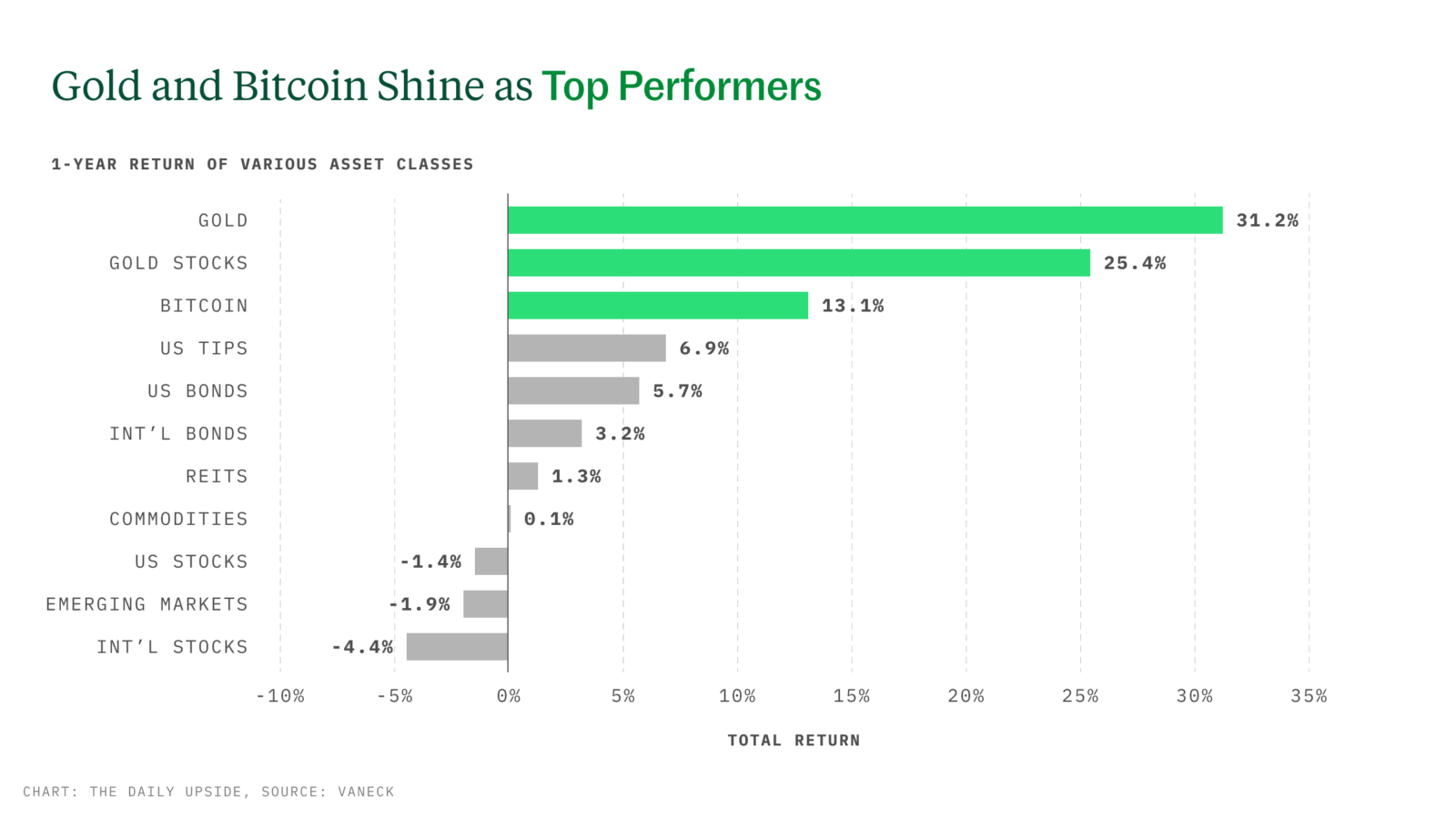

Gold has punched through $3,000 an ounce — a signal of its strength amid broader market stress. But, for advisors and clients alike, the bigger story is gold’s ongoing strategic role in client portfolios.

VanEck sees gold not just as a hedge against volatility, but as a core holding in today’s uncertain economic environment. With inflation still elevated and global risks on the rise, VanEck’s Merk Gold Trust (OUNZ) offers cost-efficient access to physical gold — and the ability to take delivery, all without triggering a taxable event.

In the face of what VanEck calls a “fiscal reckoning” — with US spending cuts totaling 3% of GDP — the rationale for holding gold is more compelling now than ever.

Schwab Dangles a Consulting Service for Indy Advisors

The 4th of July is a ways off, but Charles Schwab wants RIAs to be thinking about independence.

The financial services giant will also help breakaways get there, for a fee. And more importantly, it hopes newly independent RIAs will custody at Schwab. The firm this week announced a membership-based consulting program, Schwab Advisor ProDirect, aimed at helping small independent RIAs build up their businesses. Coincidentally, the forthcoming program launches in — you guessed it — July. And there may be some fireworks.

A problem the company says advisors face is one common in the age of Amazon: Too many choices. “The program begins with a one-year membership. During this crucial early time, the member’s consulting, service, and relationship teams are working hands-on to help implement our guiding principles for advisory firm success,” a company spokesperson said. “Importantly, participation includes access to an exclusive membership network, offering the peer-to-peer relationships that so many advisors tell us they value, but have trouble establishing on their own.”

Head to Head

With a membership-based consulting program, Schwab is competing, to an extent, with XY Planning Network, Dynasty Financial Partners, and other RIA support services. It’s aimed at advisors who manage $50 million to $300 million and is separate from the onboarding and custody programs at Schwab Advisor Services.

Here’s how it compares at a glance:

- Schwab Advisor ProDirect charges $21,000 for the first year, billed at $5,250 quarterly and renews quarterly after a year.

- XY Planning’s Emerald membership, which is separate from its turnkey RIA affiliate model, charges $520 per month, and additional services such as bookkeeping and registration support are extra.

Schwab’s model appears more focused on established advisors who break away from broker-dealers, said Michael Kitces, co-founder of XY Planning Network. “Advisors who just want to start ‘new’ with an RIA can join networks like XYPN for barely one-third of the cost of Schwab to get compliance support, tech, practice management training, community, etc.,” he said. Schwab may be going up against other independent advisor support networks, recruiters, consultants, and corporate RIA models that help with breakaways, he said. “It really begs the question of why Schwab felt the need to compete with the organizations that already bring advisors to them, rather than support the ecosystem that’s already grown to drive breakaways (which already plays to Schwab’s favor) and/or make strategic investments into the organizations that are already growing with them (as Schwab did a few years ago with Dynasty, for instance).”

Filling a Need. “It’s absolutely a needed service,” said Jodie Papike, partner at advisor placement services firm Cross-Search. “A lot of advisors that are considering setting up their own RIA have a hesitancy to being completely on their own.” Following Schwab’s somewhat recent integration of TD Ameritrade, “there has been a transition period, where a lot of advisors have felt a squeeze at Schwab on service,” she said. “In order for this to be successful … they will have to staff really well to provide a high level of service to justify the cost of it.”

Jason Hsu’s Fundamentals Avoid ‘Sex and Sizzle’ of Value Investing

Jason Hsu, a quantitative expert by trade, likes when companies and leaders have proven, successful track records. He utilized that same thinking when forming his own business.

In the early 2000s, Hsu served as a visiting professor alongside industry veteran Rob Arnott, a well-known name in the investment world who had previously worked at Salomon Brothers, The Boston Company, and First Quadrant, LP. However, Arnott “got bored of teaching after two classes,” Hsu said, and in 2002, the pair formed investment strategies firm Research Affiliates, renowned for its focus on fundamental investing. “It was just two guys in a living room with the Bloomberg terminal,” Hsu told Advisor Upside.

Today, Hsu is the founder and CIO of Rayliant, a firm that applies his fundamental- and value-investing principles to markets all around the world. “It’s a basic idea,” Hsu told Advisor Upside at a New York cafe where he showed up sporting one of his signature graphic T-shirts, this one emblazoned with a Batman logo. “You want to buy companies that have already demonstrated a proven track record of success and value, as opposed to buying an amazing person with a great PowerPoint. It isn’t just about investing in something that’s cheap and exciting. ”

Extra Upside

- Come Fly with Me. Hightower purchases airline-focused RIA for $2 billion.

- Welcome Aboard. Not-for-profit financial services group Thrivent plans to hire about 600 advisors this year.

- Access To Gold With Distinct Advantages. OUNZ offers the efficiency of an ETF and the security of gold ownership — plus the ability to take delivery without triggering a taxable event. Explore the gold ETF that delivers.**

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

*Investing in the VanEck Merk Gold ETF (“OUNZ,” or the “Trust”) involves significant risk and may not be suitable for all investors. OUNZ is not registered under the Investment Company Act of 1940 (the “1940 Act”) and lacks the protections mutual funds or ETFs have under the 1940 Act.

Not intended as a recommendation to buy or sell any names referenced herein. Digital assets are subject to significant risk and are not suitable for all investors. Past performance is no guarantee of future results.

The Sponsor for the Trust is Merk Investments, LLC. The Marketing Agent for the Trust is Van Eck Securities Corporation.

© Merk Investments LLC

© Van Eck Associates Corporation

Source: VanEck, FactSet. Data as of April 7, 2025. Digital assets involve significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Index performance is not representative of fund performance and cannot be invested in directly. This is not an offer to buy or sell any security, strategy, or index referenced. For definitions and index/asset class descriptions, visit: https://www.vaneck.com/us/en/vaneck-advisor-upside-disclosures