Good morning and happy Sunday.

The 10 most valuable US companies had a market capitalization of nearly $24.4 trillion as of October, accounting for roughly 40% of the entire S&P 500. It may be time to the consider the (relatively) little stocks.

But first, a word from our sponsor, Invesco.

A handful of companies account for an outsized portion of S&P 500 returns.1 When concentration is at such heights, portfolios become vulnerable to sharp reversals in those names.

Invesco offers ways to help reduce this concentration risk.

- Equal-weight strategies spread risk evenly across all S&P 500 large-caps.

- Mid-cap strategies mine a segment most portfolios neglect.

- Factor-based ETFs targeting momentum, low volatility, and quality give advisors precise tools for managing risk and return.

These strategies use straightforward, rules-based approaches that advisors can explain easily and clearly. They seek to offer tax efficiency and work across different market environments without the need for constant rebalancing.

But the most significant advantage to Invesco’s approach is flexibility. Advisors can adjust portfolio positioning when concentration becomes uncomfortable or when market conditions shift. Clients can access tactical options that respond to current risks while looking to uphold their long-term investment discipline.

Worried About Record Stock Market Concentration? Us, Too

The big are getting bigger, and the small are growing much more slowly.

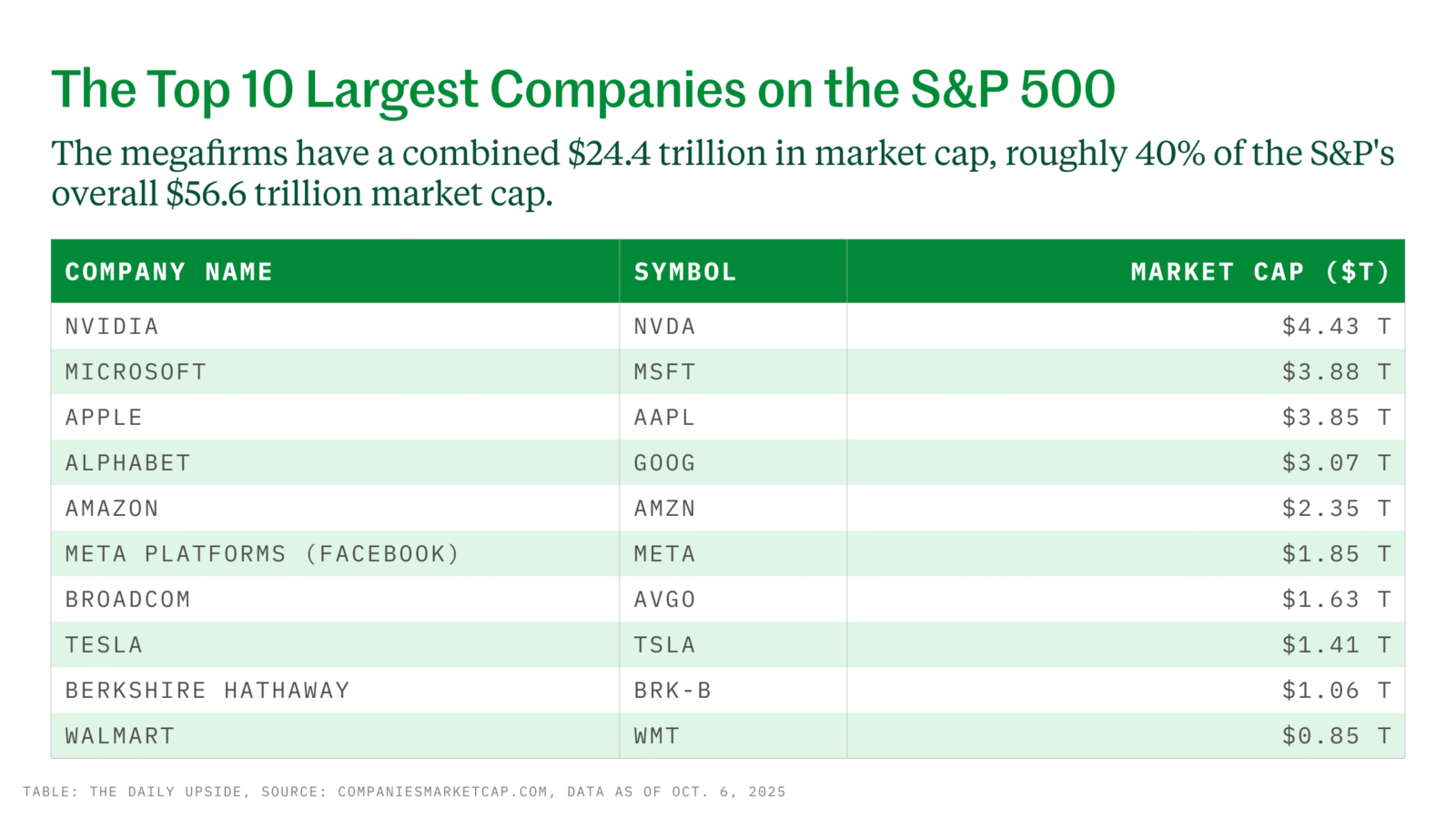

That’s according to Bryan Taylor, the chief economist at the financial data firm Finaeon, who has over 200 years of financial data upon which to base this statement. The stock market has simply never been this concentrated. In fact, the 10 most valuable US companies had a market capitalization of nearly $24.4 trillion as of October 23, according to CompaniesMarketCap.com. The heavy concentration is in large-cap growth tech stocks.

To put this in perspective, these 10 companies represent just over 43% of the S&P 500. Nvidia alone represents nearly 8% of the S&P 500. That’s roughly the same value as the entire 2,000 small-cap companies in the Russell 2000 index. As of June 30, 2024, the top 10 companies accounted for 34.8% of the S&P 500; so, in just over 15 months, concentration increased by 8.2 percentage points. To put it another way, large-cap growth has trounced small-cap value over the past decade. Small-cap value was the rage back then, often touted as greater return with less risk.

Here’s What Not to Do

One response is that the market is overvalued, and it’s time to get out. Taylor noted: “Based upon our analysis of the past 150 years, there seems no reason to believe that the increased concentration of the past 10 years is the harbinger of a major bear market. Increased concentration is the sign of a bull market, and bear markets reduce concentration.” Of course, that strategy would have backfired over the past couple of years. According to Goldman Sachs, “while investors usually think of elevated concentration as a sign of downside risk, the S&P 500 rallied more often than it declined during the 12 months following past episodes of peak concentration.”

Another often-used strategy to avoid exiting the market is to buy an equal weight S&P 500 index fund. This would have these 10 most valuable companies represent only 2% of the fund, rather than 43% for the cap-weighted S&P 500. That strategy failed miserably in the past few years with some equal weight funds underperforming. Taylor agreed that this strategy is trying to outsmart the market by underweighting the largest of the companies and overweighting the rest.

Finally, don’t overweight these companies. Now that large-cap growth companies are doing so well, there are more and more portfolios with large-cap growth funds, or owning the likes of Nvidia and Microsoft directly. Many are now avoiding small-cap altogether, claiming that the best small-cap companies can grow to become large-cap, while staying private and avoiding the costs, and extra regulation, of being a public company. Open AI is one example. The argument is that this only leaves the bad companies in the public markets. (While I’ve never been in favor of tilting to any factor, such as small-cap, I’ve never believed in excluding them either.)

Let’s Diversify the Right Way

Many believe that this high market concentration is a sign of an upcoming market plunge. The historical data doesn’t support this view. Of course, the market will plunge, as it always does, at some point. The question is when it will plunge or how much it will gain in the meantime.

That’s why we use rules. By committing to stick to an asset allocation target, the bull market since 2023 requires rebalancing by reducing equity exposure. This is very different from selling because we think we know the market is overvalued. It’s merely managing how much risk to take and counting on so many investors being predictably irrational (buying after stocks have surged and selling after a plunge). Buying high-quality fixed income with the proceeds from trimming stocks reduces risk.

Next, diversifying beyond the S&P 500 also reduces risk. A cap-weighted total stock index fund owns over 3,500 companies rather than 500 and reduces this exposure from 43.0% to 35.4%. Diversifying beyond the US reduces the exposure to about 18.3% by owning about 12,000 companies. International stocks had badly lagged the US in large part due to having far less domination of tech stocks. So far this year, international markets have significantly outpaced the US so, ironically, it has been easier to convince people to invest globally.

It’s OK to be Scared. Admittedly, this record stock market concentration is nerve-racking. But one investing rule to embrace (and which I have lived by since my early days of investing) is that we’re not smarter than the market. Instead, own everything, according to market capitalization. This harnesses all available information from millions of investors. While the prospect of a market plunge is worrisome, so-called experts claiming they know the future is even more so. No one knows when markets will plunge, or what parts of the stock market will outperform.

Own the world at the lowest costs and rebalance with an allocation to high-quality fixed income. Then, when you get that irresistible urge to change your strategy, let it pass and stick to your plan.

Tactical Strategies For Today’s Concentrated Market

Invesco helps advisors do something positive about portfolio concentration. Equal-weight strategies provide balanced S&P 500 exposure, mid-cap strategies capture opportunities in an underweighted segment, and factor strategies add precision.

This combination of ETFs variously characterized by momentum, low volatility, and quality helps advisors try to create stability or capture performance depending on the environment. And each tactic uses rules-based methods that clients readily understand.

As a result, advisors get better control without adding operational complexity. They can respond to concentration risk and market shifts while maintaining their core investment frameworks.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

1 Morningstar, “6 Key Takeaways From Examining 10 Years of Stock Performance by Sector”, August 27, 2025.

Prospectus Offer: Before investing, investors should carefully read the prospectus/summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the Fund call 800-983-0903 or visit invesco.com for the prospectus/summary prospectus.

Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes.

Momentum: momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole or returns on securities that have previously exhibited price momentum are less than returns on other styles of investing.

Low Volatility: there is no assurance that such ETFs will provide low volatility.

Quality: companies that issue quality stocks may experience lower than expected returns or may experience negative growth, as well as increased leverage, resulting in lower than expected or negative returns to Fund shareholders.

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Fund.