Good morning.

Baby, you’re a rich man, too.

Elon Musk, Warren Buffett and Jensen Huang are among the wealthiest people in the world. And now, there are two more names we can add to the list. Robinhood co-founders Vlad Tenev and Baiju Bhatt cracked the Bloomberg Billionaires Index of the world’s 500 wealthiest people this week, with fortunes of $7.5 billion and $8.8 billion, respectively. Thanks to deregulation, sky-high stock prices, and growing enthusiasm for crypto, Robinhood’s stock is up more than 285% this year. It’s the best-performing company on the S&P 500 index. Bhatt stepped down from his executive role at Robinhood last year, but is still on its board of directors. He’s almost 100 spots higher on the billionaires list than Tenev.

Looks like someone’s advisor has been working overtime.

Private Markets: Too Big to Ignore, But…

…for an advisor, the devil is in the details.

That’s because, while the allure of private markets is clear, each individual asset class (private equity, infrastructure, credit, timberland, etc.) comes with its own investment case.

And then there are the diligence items:

- Liquidity considerations for clients (not something you want to be caught flat-footed on).

- Valuation and investing mechanics.

- Risk and volatility (not unique to private markets, but can function in different ways).

We are going straight to the source: Capital Group and KKR, two of the most prominent names in financial services.

Join John Queen, fixed income portfolio manager at Capital Group, and Paula Campbell Roberts, Chief Investment Strategist of KKR’s Global Wealth business, for an in-depth discussion on the future of public and private markets.

Attend live, and bring your toughest questions for what is sure to be a lively Q&A.

This Week’s Highlights

Crypto Stocks and Currencies Earn Their Own S&P Index

The blue bloods in the S&P 500 and Dow Jones Industrial Average will soon welcome their nouveau riche crypto-stock cousins into the family.

They’ll arrive via the new S&P Digital Markets 50 Index, which S&P Global announced Tuesday. In a fitting twist, fintech Dinari is collaborating with S&P to release an investable token that tracks the benchmark.

A Hybrid Approach

Rather than just 50 companies, the S&P Digital Markets 50 will include 15 cryptocurrencies alongside 35 companies from the broader crypto sector. While S&P has launched indices with multiple asset classes before, mixing stocks and cryptocurrencies is a new frontier. Equities listed on the index will be required to have a minimum market cap of $100 million, and cryptocurrencies will be required to have a minimum cap of $300 million. Single assets will be restricted to 5% of the index.

Crypto markets remain somewhat volatile, so indexing adds the appeal of smoothing out exposure. Institutional investors have grown increasingly interested in the crypto sector, especially as federal regulators have adopted a friendlier approach under the Trump administration. An EY survey of institutional investors earlier this year found that 85% reported increasing their allocations to digital assets in 2024, and a similar proportion plan to invest more. And 60% said they preferred to gain exposure through registered vehicles, such as diversified index funds and ETFs. The S&P index makes crypto practically mainstream:

- “Cryptocurrencies and the broader digital asset industry have moved from the margins into a more established role in global markets,” Cameron Drinkwater, chief product officer at S&P Dow Jones Indices, said in a statement. “S&P DJI’s expanded index suite offers market participants consistent, rules-based tools to evaluate and gain exposure to this segment.”

- The companies and cryptocurrencies on the S&P Digital Markets 50 have yet to be named, and the index is still weeks from launch, but it’s not hard to see the appeal of the hybrid format. Bitcoin, which is up roughly 30% this year, hit a new all-time high of $126,080 on Monday, and crypto industry stocks like Coinbase (up 51% YTD), Circle (up 115%) and Strategy (up 13%) have been a hit among investors this year.

Check Your Wallet: If you have personal crypto holdings, a security check may be in order. Researchers at Elliptic said Tuesday that North Korean hackers have stolen more than $2 billion in crypto assets this year and warned that they are increasingly targeting crypto-wealthy individuals because they typically have less sophisticated safeguards than businesses.

Gold ETFs Shine as Price Hits $4,000

It’s not just a flash in the pan. Gold is having a moment, and ETF sales have gone technically… well, bonkers, as its price crushed records, reaching $4,000 per ounce on Tuesday.

Despite this year’s strong stock market performance, uncertainty is a major concern for investors, with the latest contributor being the US government shutdown. That has people leaning into decentralized stores of assets like gold and cryptocurrencies, said David Schassler, VanEck’s head of multiasset solutions. The current government shutdown feels more severe than prior ones, given that the Trump administration has proposed making permanent workforce cuts. Further, jobs data for September is being delayed by the shutdown, compounding concerns over the Federal Reserve’s independence, inflation and other issues, Schassler said in a statement.

“Shutdowns used to be sideshows,” he said. “Each week brings another hit to institutional trust: political violence, weaponized agencies, fraying alliances and now the shutdown. Investors are beginning to connect the dots.”

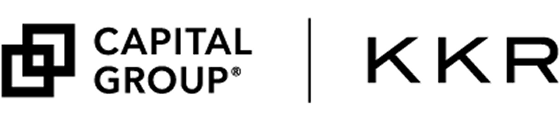

Gold ETF Prospectors

More than $9 billion flowed into US gold ETFs in September, the highest-ever figure for a single month. The big winner from that was State Street’s $124 billion SPDR Gold Shares (GLD), which raked in $3.5 billion, according to data from Morningstar Direct. Despite that fund being the biggest seller among gold ETFs last month, it took in even more in August, at $4.1 billion in net sales.

What advisors are saying:

- “I started recommending my clients take an allocation in gold in early 2023 and have not stopped recommending it,” said John Bell, owner of Free State Financial Planning. “While gold has been called an inflation hedge, I think that is a little overdone. In my opinion, gold does best in times of crisis.”

- “We have increased exposure, not as a performance driver, but to protect against market surprises,” said Assunta McLane, senior wealth advisor at Summit Place Financial Advisors.

Golden Eye: Historically, gold has performed well, with annualized returns over 20 years being 11%, compared with 9% for equities and 2% for global bonds, according to a recent report by Pictet Asset Management. Meanwhile, Goldman Sachs analysts are predicting a near $5,000-per-ounce spot price by the end of 2026, The Wall Street Journal reported. However, Citadel CEO Ken Griffin told Bloomberg that he is concerned about the moves investors have made to gold and away from the US dollar.

At least people aren’t just burying gold in their backyards anymore (hopefully).

- Discover how Alternative ETFs are reshaping portfolios — Download the report.

- Steve Lockshin’s Estate Planning Playbook — Transform estate planning into competitive advantage.

Tax Planning Is Table Stakes for Advisors

There are 196 days until taxes are due, but clients want help now.

Americans paid more than $206 billion in capital gains taxes last year, according to the Tax Foundation, a Washington think tank. By our calculations, that is … a lot of money. For good reason, along with portfolio management and estate planning, tax planning is quickly becoming one of the most in-demand advisory services. Nearly 70% of high-net-worth clients say reducing taxes is important, yet fewer than half of advisors provide this service, according to a new report from Cerulli and Parametric. As clients shift focus from investment returns to services, tax planning is giving advisors a leg up.

“Ten years from now, this will need to be the standard, and if you’re not doing it, you can be at a distinct disadvantage,” said Scott Smith, senior director of advice relationships at Cerulli.

1 for You, 19 for Me

Traditionally, many firms limited tax planning to end-of-year tax-loss harvesting. Now, more offices are adopting systems that handle it monthly, weekly or even daily. Despite recognizing their shortcomings, many firms hesitate to invest in the expertise needed, viewing it as costly. Smith warned that without strong tax planning, performance gains can be quickly eroded by taxes.

Transition management is another area of growing emphasis. For example, when clients bring 401(k)s in-house, advisors often restructure portfolios. “They end up trading a bunch of things to get the recipe they want,” Scott said. “But it’s created a lot of capital gains tax along the way.” He recommended treating this process as a multi-year transition, rather than an immediate overhaul to minimize tax impact.

The Cerulli report found:

- Some 53% of advisors working with clients holding $5 million or more in assets offer tax planning.

- Only 38% of advisors working with clients under $100,000 provide the service.

“Tax planning used to be a value-add; now it’s table stakes,” said Adam Wojtkowski, founder of Copper Beech Wealth Management. “They want integrated wealth management where tax strategy is central to every decision.

Declare the Pennies on Your Eyes. Client questions are also evolving. While many still ask, “How do I lower my taxes?” others are becoming more sophisticated, said Patrick Huey, principal advisor at Victory Independent Planning. Since the passage of the One Big Beautiful Bill Act, clients are asking how new rules affect income, Social Security, Roth conversions and legacy planning.

“Clients now recognize that taxes aren’t a once-a-year headache,” Huey told Advisor Upside. “They’re a crucial piece of every wealth and retirement strategy, especially in the face of sweeping tax law changes that create moving targets and new phase-outs.”

Upcoming Events

Advisor Upside is edited by Sean Allocca. You can find him on LinkedIn.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.