Good morning.

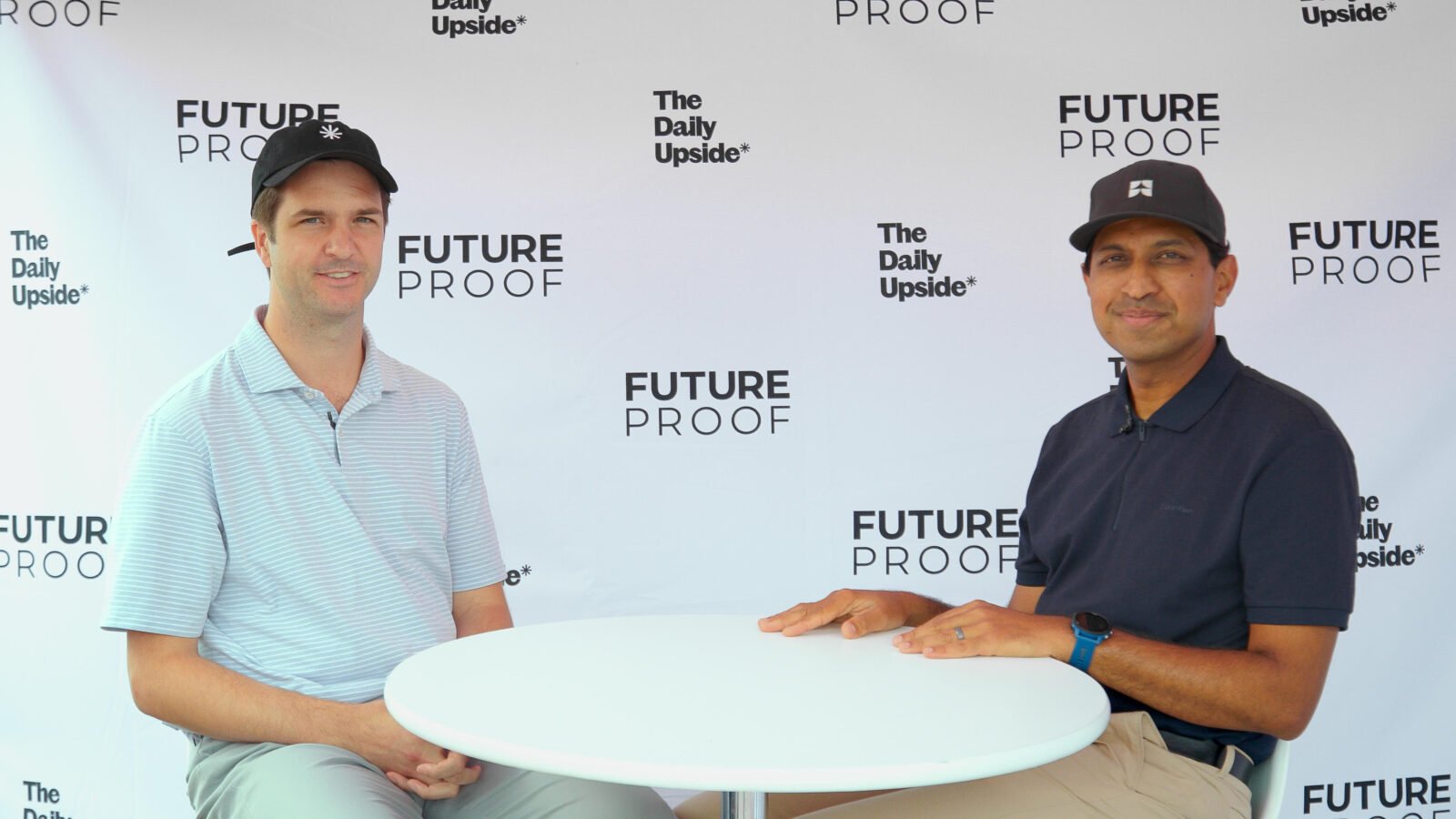

Today we have a special edition of Advisor Upside. Earlier this week our team, along with 5,000 other professionals from the wealth management space, descended upon Huntington Beach, California for the Future Proof conference. There we had the chance to sit down with Manju Boraiah, the Head of Systematic Fixed Income and SMAs at Allspring Global Investments.

In this special Q&A edition of Advisor Upside, we unpack Manju’s approach to markets and investing, and how Allspring is approaching the wealth management industry. Let’s dive in.

Navigating Fixed Income and SMAs: A Q&A with Allspring’s Manju Boraiah

The Daily Upside: I understand as you were growing up you had a knack for both art and math. How did those two passions shape your path into finance and how do you use them day to day at Allspring?

Manju Boraiah: I’ve always been very curious. I was fortunate to be surrounded by different languages growing up, and simultaneously I fostered a genuine love across multiple disciplines in school. Ultimately whether it’s the analytical side of my brain or the more artistic side, I love applying them in a problem solving capacity. And that’s really the way I think about it, those skills are a means to an end to understand and contextualize the complexity of the world, to frame problems, and ultimately finding ways to creatively work through them.

I ended up in finance, but I actually started out in computer science and computer graphics. I have now been in the wealth ecosystem for some time, and I love that I can apply these same skills to navigate solutions for clients.

The Daily Upside: What are a few examples of problems you most enjoy?

Manju Boraiah: Something that involves not just the analytical piece, but also human interaction. Ultimately most problems boil down to some type of human element, and wealth management is inherently a human-centric business. So every day I am focused on how we can make life easier for advisors as they are delivering investment solutions for their end clients. Whether that’s managing risk, optimizing tax loss harvesting in a systematic fashion, or finding value in fixed income, we are focused on creating systems for advisors to accomplish their goals.

The Daily Upside: I’d love to talk about Allspring as a firm. The firm has a storied history and is obviously a behemoth, but the brand itself is newer. Tell me a bit about the firm’s DNA and approach to investing.

Manju Boraiah: We’ve been on a fascinating journey. We became an independent private entity about three years ago. But the firm dates back to the 1930s when we began managing money. Right now we are focused on creating a best-of-breed asset manager with an investment approach that marries both fundamental analysis and systematic models. We have a large and capable team of analysts who are working on the individual security level to identify value, and we want to couple that with a top-down approach to building portfolios. SMAs and active ETFs are the fastest-growing segments out there, and we have been growing that book of business. But we know it’s about more than investing, we are laser focused on building best-in-class technology and operational platforms that are intuitive and frictionless for advisors.

The Daily Upside: Let’s dive into a few more market-focused questions. You are a fixed income expert – what are you seeing in the market? Are there any pockets of value that advisors should be thinking about?

Manju Boraiah: We are at an interesting point in time, to say the least, right? So if you think about the macro risks that we currently face, the biggest one I see is stagflation. Growth is definitely slowing, and labor markets are slowing at the same time based on the numbers that we’ve seen over the last three months. At the same time inflation is still persisting and is proving to be very sticky. Markets are pricing in three rate cuts this year, now it all boils down to how the Federal Reserve is going to balance the inflation issue vs. slowing growth.

We are approaching markets with three core principles. The first is diversified duration, so if you’re looking at the curve, we think the duration range of 5 to 15 years is a good horizon to look at in terms of risk / reward. The second thing we are focused on is maximizing real income, that’s table stakes. Lastly, how can we create a risk framework that protects against exogenous shock, like a higher than expected inflation reading.

The Daily Upside: As I was prepping for this interview I read that there are over a million bond issues out there. How do you navigate that sheer size and scale of that market?

Manju Boraiah: The muni market is fascinating. There are close to 60,000 issuers and a million plus muni bonds outstanding. The broadest benchmark captures only a fraction of those issuers. Our approach is to build a blended portfolio that is anchored in fundamental ratings built at an individual muni level. Our fundamental research team rates each bond on a scale of 1 to 5, and then we meet that bottom-up work with a systematic framework that picks about 20 to 50 bonds that can be combined to build a diversified portfolio for clients.

The Daily Upside: Can we talk about SMAs, and the ways in which advisors should think about utilizing them?

Manju Boraiah: Definitely. The core premise here is that you can get more personalized for clients with an SMA to solve for unique risk tolerance, diversification, income targets, or perhaps most importantly maximizing after-tax returns. What the SMA structure allows you to do is when an individual securities is experiencing a loss or a drawdown, you can sell out of that name, and then shift to another security commensurate in risk where you have locked in losses but the portfolio remains intact.

It’s very powerful, and a core benefit of the SMA structure than you can’t really do in a mutual fund or an ETF in the same fashion. If you’re an advisor dealing with a legacy position or a concentrated portfolio, and you want to push them toward diversification, SMAs can play a big role.

The Daily Upside: I’d love to hear a little bit about Remi and how it makes SMAs easy for advisors.

Manju Boraiah: So we built Remi in-house and launched a few years ago and have been expanding the offering ever since. Remi is a multi-asset class platform, so you can build SMAs across both fixed income and equities, active and passive, so it’s pretty unique from that perspective. If you’re looking to build a tax efficient asset allocation model, Remi is a great option where you can add sleeves, muni ladders, direct indexing, it’s all possible on the platform as a one-stop-shop.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

THIS CONTENT AND THE INFORMATION WITHIN DO NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO AND SHOULD NOT BE CONSIDERED INVESTMENT ADVICE, AN INVESTMENT RECOMMENDATION, OR INVESTMENT RESEARCH IN ANY JURISDICTION.

INVESTMENT RISKS: All investments contain risk. Your capital may be at risk. The value, price, or income of investments or financial instruments can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Past performance is not a guarantee or reliable indicator of future results.

Unless otherwise stated, Allspring Global Investments (Allspring) is the source of all data (which is current or as of the date stated). Content is provided for informational purposes only. Views, opinions, assumptions, or estimates are not necessarily those of Allspring or their affiliates, and there is no representation regarding their adequacy, accuracy, or completeness. They should not be relied upon and may be subject to change without notice.

Allspring Managed Account Services is a unit within Allspring that is responsible for the management and administration of the Allspring Funds Management, LLC, retail separately managed account (SMA) portfolios. Allspring Funds Management acts as a discretionary manager for SMAs and as a non-discretionary model provider in a variety of managed account or wrap-fee programs (MA programs) sponsored by third-party investment advisers, broker-dealers, or other financial services firms (collectively, sponsors). When acting as a non-discretionary model provider, Allspring Funds Management’s responsibility is limited to providing non-discretionary investment recommendations (in the form of model portfolios) to the sponsor. The sponsor may use these recommendations in connection with its management of MA program accounts. In these model-based programs, the sponsor serves as the investment manager and maintains trade implementation responsibility.

Allspring Global Investments does not provide accounting, legal, or tax advice or investment recommendations. Any tax or legal information in this document is merely a summary of our understanding and interpretations of some of the current income tax regulations and is not exhaustive. Investors should consult their tax advisor or legal counsel for advice and information concerning their particular situation.

Tax-loss harvesting is the selling of investments at a loss so that losses can be used to offset gains on the sale of other investments—thereby reducing capital gains tax owed. Proceeds from the sale may be used to purchase similar securities to maintain the general composition of the investment portfolio.

Diversification does not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

Duration is a measurement of the sensitivity of a bond’s price to changes in Treasury yields. A fund’s duration is the weighted average of duration of the bonds in the portfolio. Duration should be interpreted as the approximate change in a bond’s (or fund’s) price for a 100-basis-point change in Treasury yields. Duration is based on historical performance and does not represent future results.

Remi is a solution for personalizing separately managed account portfolios, powered by technology, research, and human insights. Remi’s portfolio construction engine is backed by our fundamental research team, simplified transitions, and tax management. Remi is a service of Allspring Funds Management, LLC, offered indirectly to investors through financial intermediaries. Investors should contact their financial advisor for more information.

Allspring ETFs are not available for distribution outside the United States.

Allspring Global InvestmentsTM is the trade name for the asset management firms of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P. These firms include but are not limited to Allspring Global Investments, LLC, and Allspring Funds Management, LLC. Certain products managed by Allspring entities are distributed by Allspring Funds Distributor, LLC (a broker-dealer and Member FINRA/SIPC).

ALL-09112025-61pklhfu