Good morning and happy Monday.

ETF flows are ticking northward, in more than one sense, eh?

Funds focused on Canadian equities drew in $2.5 billion the week of April 7, the highest level seen in four years, according to Bloomberg. It’s possible that the spike in sales is partly due to the US tariffs and aggressive foreign policy, and it’s been widely reported that attitudes toward the US have taken a nosedive. While investors also poured money into US stock ETFs, it was only the third best week of the year.

It’s also unclear whether Canadians are divorcing their portfolios from the US, given that residents to the north invested a record of nearly $30 billion in US stocks in February. Nonetheless, if US companies want to repair relations with our closest ally, they seriously need to give’r.

New BlackRock ETF Takes Bite Out of S&P 500 Weightings

Mega-cap stocks are getting bigger than a shark in a Jason Statham movie — and that trend is chomping away at diversification within S&P 500 ETFs. That may not be a problem for many investors, but the likes of Apple, Microsoft, Nvidia, Amazon, Meta, and other big names account for an increasingly disproportionate share of assets within index-tracking funds. That of course means the performance of an index fund is affected more by larger names than smaller ones.

BlackRock has a sort of answer to that. The firm last week launched the iShares S&P 500 3% Capped ETF (TOPC), which as the name implies limits the exposure to any individual stock at 3%. The index is packed to the gills with stocks, and the new strategy gives the biggest fish smaller bites. “The timing of Blackrock’s launch of TOPC could be good, since investors who have been concerned about the top-heavy nature of the S&P 500 can use it to tilt away from mega caps, while retaining US equity exposure,” said Aniket Ullal, head of ETF research and analytics at CFRA Research.

Not the Only Fish in the Sea

BlackRock is floating the ETF as the first of its kind, at least as far as using a 3% cap on individual stocks. But there are others that adjust market-cap weightings. The biggest potential competitor for the new iShares ETF, for example, is Invesco’s S&P 500 Equal Weight ETF (RSP), Ullal said. “In practice, TOPC is effectively an equal weight S&P 500 ETF and will compete directly with RSP,” he said. “RSP is a very established ETF with $68 billion in assets, so Blackrock will need to market its lower expense ratio (0.09% vs RSP’s 0.2%) and also rely on its strong brand and distribution capabilities to compete.”

Here’s how a few S&P 500 ETFs compare:

- The biggest S&P 500 ETF, Vanguard’s $590 billion VOO, has about 7% of its assets in Apple, 6% in Microsoft, 6% in Nvidia, and 4% in Amazon.

- The new iShares ETF has about 3% in each of those stocks.

- Invesco’s RSP has just 0.2% or less in those — and the single biggest holding, Northrup Grumman, accounts for just 0.24% of its portfolio.

Against the Current: There’s yet another new take on S&P 500 investing. Last week, Global X debuted two new products: The S&P 500 US Revenue Leaders ETF (EGLE), and the Global X S&P 500 US Market Leaders Top 50 ETF (FLAG). Both funds seek out US companies that have 50% or more of their revenue coming from within the country. “These strategies take a more targeted approach to focus on those US companies strategically positioned for an environment that includes onshoring, rising tariffs, and shifting economic dynamics,” said Scott Helfstein, the firm’s head of investment strategy. Fin.

Are Your Clients Looking For Bitcoin Exposure?

Grayscale Bitcoin Mini Trust ETF (fund ticker: BTC) is the most cost-effective way to gain exposure to Bitcoin directly through existing brokerage or retirement accounts — it has the lowest fee* of all spot Bitcoin funds in the market. Learn more.

*Grayscale Bitcoin Mini Trust ETF (“BTC”), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Investing involves significant risk, including possible loss of principal. An investment in BTC is subject to a high degree of risk and heightened volatility. BTC is not suitable for an investor that cannot afford the loss of the entire investment. An investment in BTC is not an investment in Bitcoin.

*Based on gross expense ratio at 0.15%. Brokerage fees and other expenses may still apply.

Where Do You Turn When Stocks and Bonds are Hurting?

“Nowhere to run to, baby, nowhere to hide,” Martha Reeves & The Vandellas famously sang. The ‘60s Motown group was talking about a no-good man, but investors are feeling the same angst when it comes to their portfolios.

Financial markets have seen better days. Since the US enacted aggressive tariffs earlier this month, the S&P 500, Nasdaq, and Dow have all sunk into the red year-to-date. Traditionally safe assets are also in flux as 10-year Treasury yields have jumped to 4.37% following a major bond sell-off. With volatility rising, advisors are scrambling to find both protection and returns for their clients, but clear answers are scarce.

“Where do you hide?” said James St. Aubin, chief investment officer at Ocean Park Asset Management. “It feels like what happened in 2022 is happening again in 2025.”

Duck and Cover

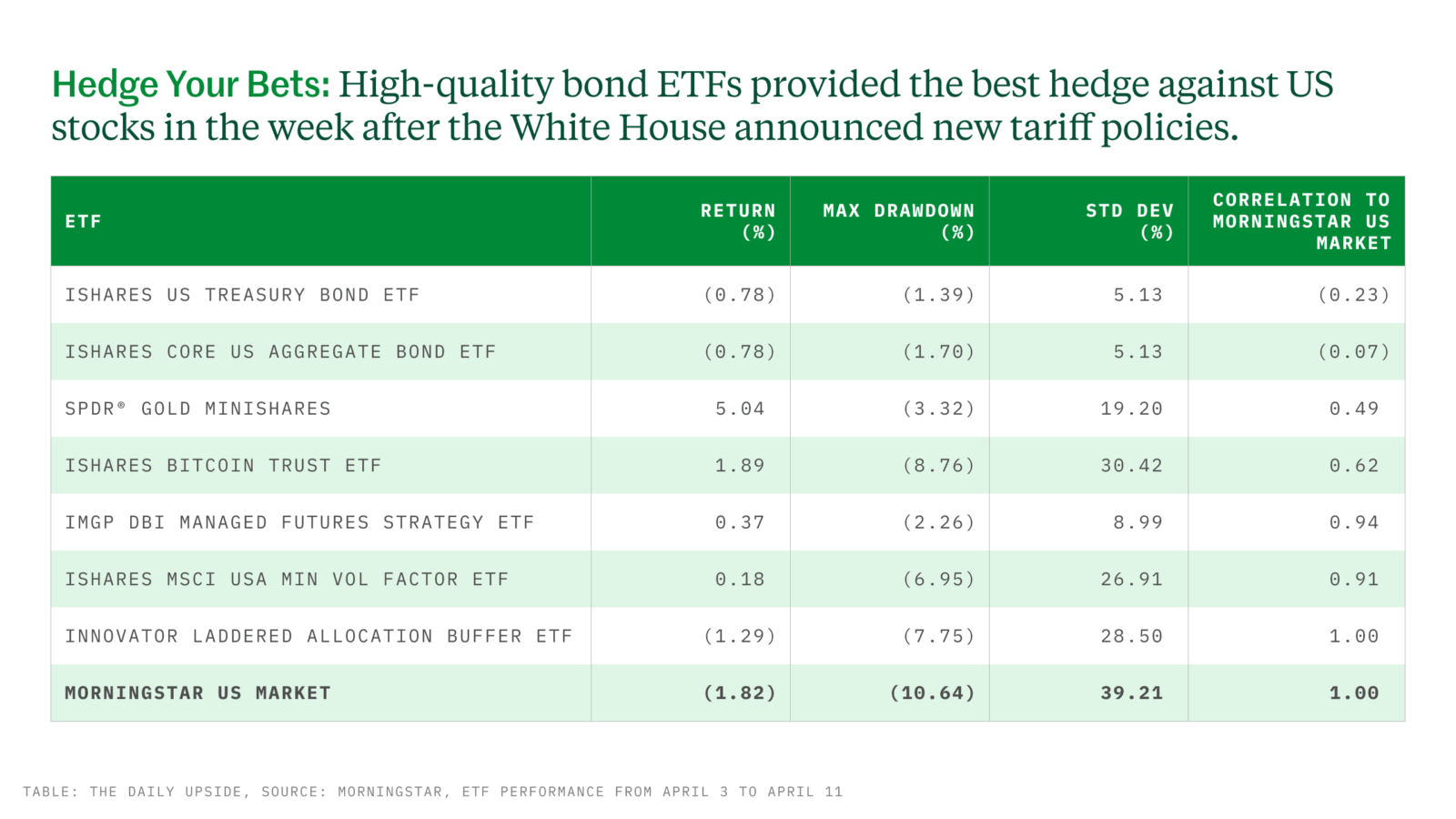

For most, diversification remains key. Morningstar tested a range of ETFs tracking different assets to see which hedged US stocks best in the week following the tariff news, which sparked concerns that inflation would spike and the US economy might slump into a recession. While all the tested ETFs outperformed the Morningstar US Market index between April 3 and 11, high-quality bond funds — in this case the iShares US Treasury Bond ETF and iShares Core US Aggregate Bond ETF — had the lowest correlation with broadly declining equities.

While it would have been ideal to be diversified before the tariffs, it’s never too late to start allocating to different assets, especially since equity markets could remain in a slump, said Bryan Armour, director of passive strategies research at Morningstar. “With assets like bonds or managed futures, you’re certainly not buying on the highs right now,” he told ETF Upside, adding that even gold, currently trading at more than $3,300 per ounce, still offers a long-term store of value.

For others, protection goes beyond diversification, and Ocean Park takes a more tactical approach. The firm has four active ETFs — two for stocks and two for bonds — that contain “DUK” in their tickers. The funds have parameters in place that trigger buy or sell signals when markets show signs of rising or falling. Lately, the ETFs have gone almost entirely to cash equivalents. “What do you do if someone throws a fastball at your head? You duck,” St. Aubin told ETF Upside. “When we see danger in the market, we duck and get into cash.”

Bitfall. And what about bitcoin, which got its first spot ETFs last year? In theory, the world’s top cryptocurrency could act as a hedge, but that’s rarely the case, and it’s extremely volatile. Bitcoin has tumbled more than 6.5% year-to-date. “In 2022, when equities were in freefall, bitcoin collapsed even further,” said Davis Richardson, managing partner at tech consultancy R3 Insights. “People keep saying this could be the moment when bitcoin decouples from stocks, but I’m remaining cautious.”

Capital Group, Dimensional Top Active ETF Inflows Amid Volatility

When the market goes down, the value in active management goes up — or so fund managers like to say.

That was certainly true from a demand standpoint amid the volatility in the first two weeks of April, when investors funneled $2.4 billion into US large cap active ETFs. The big winner was a name that’s all but synonymous with active management, Capital Group, whose Dividend Value ETF raked in about $648 million, according to Morningstar. The haul was about two and a half times that of the next-closest fund, also a Capital Group product, the Group Growth ETF, which saw more than $235 million in net sales.

“Fund companies are not shy about selling clients on the benefits of active management in volatile periods,” Morningstar principal for equity strategies Jack Shannon wrote.

“They say that their managers are best able to find the babies the market often throws out with the bathwater.”

Extra Upside

- Green Light: The SEC approved an application for the first sustainability-focused stock exchange.

- Low flow: New money suddenly stopped going into State Street’s and Apollo Global Management’s private-credit ETF.

- Are Your Clients Asking About Crypto? Grayscale is a crypto-focused asset manager and they offer resources created specifically for financial advisors — like their Bitcoin Book and Crypto Connect event series. Bookmark for when you need it.**

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.

Disclaimer

*Please read the prospectus carefully before investing in the Fund. Foreside Fund Services, LLC is the Marketing Agent for the Fund.

The Fund holds Bitcoin; however, an investment in the Fund is not a direct investment in Bitcoin. As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and exposure to digital asset exchanges may impact the value of Bitcoin and, consequently, the value of the Fund. The value of the Fund relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.