Good morning and happy Monday.

“It’s not easy being green,” Kermit the Frog famously sang. As much as that applies to the venerable Muppet, it also has meaning for something entirely different: sustainable funds. Investors worldwide pulled an estimated $8.6 billion from mutual funds and ETFs in that category during the first quarter, per Morningstar. Those record outflows contrast with over $18 billion that went into sustainable funds in the fourth quarter of 2024. While US investors have been withdrawing from sustainable funds for 10 quarters in a row, it was the first on record for European investors.

It wasn’t all bad, though, as sustainable funds saw net inflows in both New Zealand and Canada. Kia ora, eh?

SEC’s Going on the Atkins Diet

A blast from the past at the SEC is hinting at the future direction of the agency.

Paul Atkins, who was a commissioner during George W. Bush’s administration, was sworn in last week as SEC chairman. He takes the place of Commissioner Mark Uyeda, who has led the Securities and Exchange Commission as acting chairman in the early days of the second Trump administration. So far, the securities and crypto industries are happy with what they see as a much more business-friendly regulator than the previous one led by Gary Gensler.

“I don’t expect to see a lot of ‘big picture’ regulatory initiatives against Wall Street’s powerful brokerage firms, banks, and hedge funds. It’s going to be small ball rather than swinging for the fences,” said Bill Singer, a veteran Wall Street regulatory lawyer, pointing to a focus on protecting individual investors. “Frankly, I welcome that, because in recent decades the SEC has devolved into a regulator more interested in generating press releases and marketing the illusion of hands-on oversight.”

Making Privates Public

A few things are evident from what Atkins has stated: He wants the SEC to allow for more innovation, increase retail investors’ access to products typically reserved for the wealthy, and reduce regulatory obstacles, such as those for companies to go public, said Jamie Peterson, managing director at Iron Road Partners. For ETFs, that likely means dual share-class approval and exemptive relief around private market investments, he said. “It could come up in other areas as well, with that theme of innovation. Products that were caught up in a review process for a long time in the prior administration could be viewed more favorably,” Peterson said. And of course, a framework for crypto assets will be front and center, he said.

Even before Atkins was confirmed by the Senate, the new Trump-era SEC has rapidly shifted its direction.Already this year the SEC has:

- Instituted a crypto task force led by Commissioner Hester Pierce, and dropped multiple lawsuits against crypto firms.

- Approved private credit funds and indicated being open to access for retail investors.

Cop on the Beat: A glaring challenge for the SEC is watching out for small investors amid staff reductions pushed through by the Trump administration. Add in the volatile market conditions, and consumer protection becomes a big question, Peterson said. “The loss of institutional knowledge does present a challenge for Atkins and the SEC staff,” he said. “Anytime you have more volatility, you do have the potential for more issues to bubble up in the industry, and historically speaking that has meant more enforcement, not less.”

Atkins, who most recently was chief executive of Patomak Global Partners, may have a style akin to that of former Chairman Jay Clayton, who led the SEC during the first Trump administration, Singer said. “The best that I think those of us in the Wall Street reform movement can and should expect from Atkins is that he takes many pages out of Jay Clayton’s book — the latter who managed to navigate politically fraught waters with incredible grace and wisdom, while finding a way for the SEC to still bring meaningful cases.”

The Not-So-Transparent Fees Hiding in the ETF Market

Exchange-traded funds are known for being pretty transparent, but there’s one cost that’s largely undisclosed.

Licensing fees are paid by issuers to the index provider for the right to use their benchmarks, and they can make up more than a quarter of the total expense ratio of the products, according to a Morningstar analysis. The fees aren’t required to be disclosed, but even when asset managers do include them, the costs can be difficult to find, said Lan Anh Tran, manager research analyst for Morningstar. While the fees are generally small, they create a layer of fog over the otherwise transparently priced products.

“It’s not something that we’re happy about,” Tran told ETF Upside.

How Do License Fees Work?

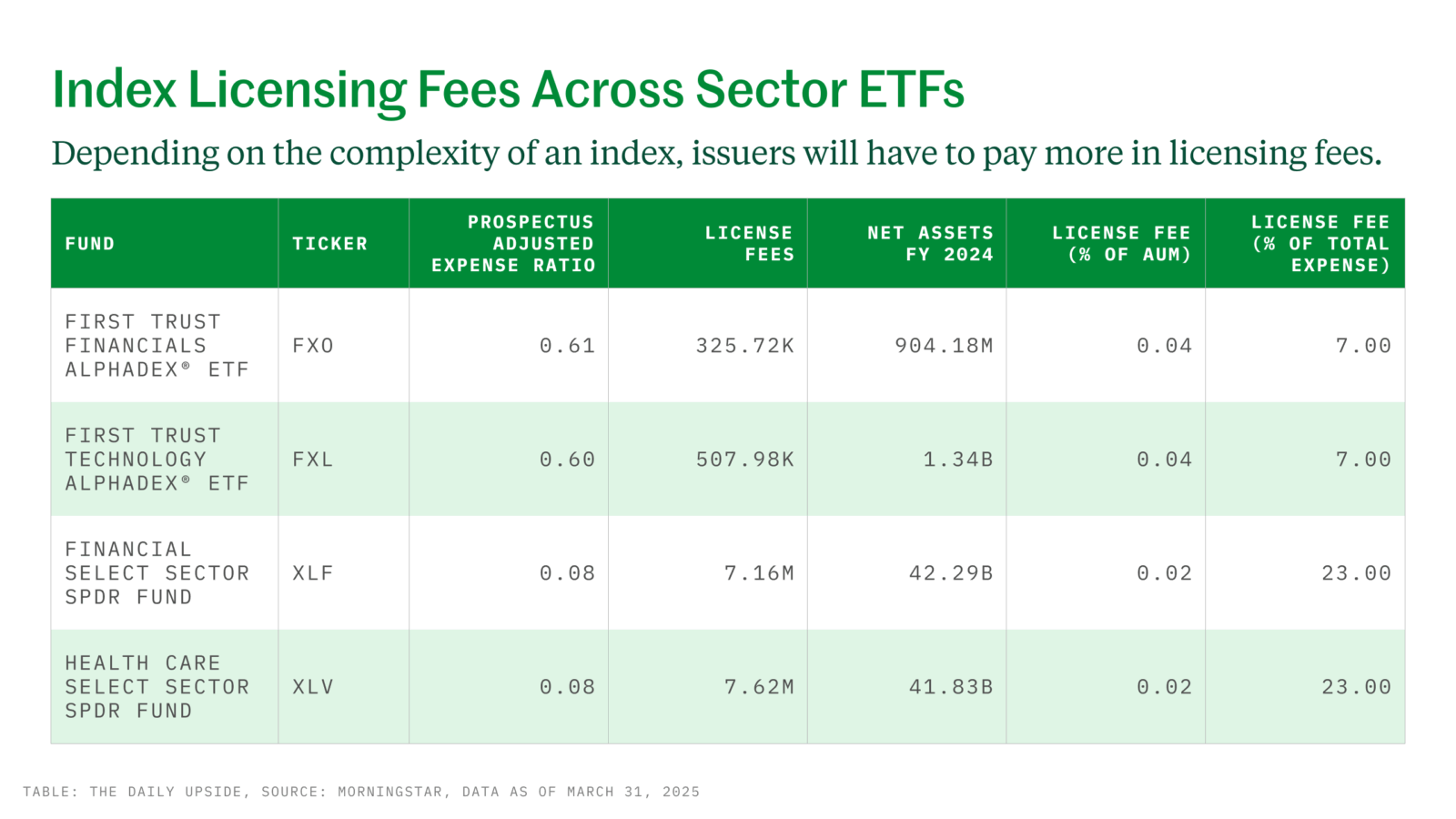

Licensing fees vary depending on the index a fund tracks, with some funds paying more for more complex indexes. For example, as a percentage of assets, First Trust’s AlphaDEX ETFs pay roughly double the licensing fees of State Street’s SPDR funds, Morningstar highlighted. That’s because AlphaDEX tracks ICE Data Indices designed to outperform sectors through growth and value factors, while SPDR ETFs simply mimic traditional S&P sector indexes. However, because the First Trust ETFs have higher expense ratios, their licensing fees make up only 7% of total cost to investors, compared with about 25% for the SPDR funds.

How Low Can You Go? Tran noted that many new ETFs aim for niche or strategic beta exposures, rather than tracking traditional indexes. “With the complexity that comes with those strategies, I doubt there’s going to be a trend toward cheaper costs for index providers,” she said.

One way some issuers have reduced costs, though, is by switching indexes. Morningstar highlighted Vanguard’s 2013 move from MSCI to CRSP indexes, which lowered expense ratios by 1–2 basis points per fund. But switching isn’t easy. “Changing an index is a very complicated, costly, and disruptive process,” Tran said, adding that a lower licensing fee is often a benefit — but not the primary motivation. “Asset managers aren’t just looking for the cheapest option, jumping from index to index,” she said.

ETF Launches Reach Record Quantity. Quality? Not So Much

More isn’t always better.

A total of 233 new ETFs hit the market during the first quarter of 2025 — a record number fueled by options-based and leveraged funds. ETF sponsors may be taking a spray-and-pray approach with new products in a portion of cases, since some won’t attract enough assets to remain viable and may liquidate in a couple of years or less. What’s more, many of the new class of ETFs simply aren’t in buyers’ best interests, since leveraged or complex strategies don’t add much value, said Bryan Armour, director of ETF and passive strategies at Morningstar.

And not insignificantly, they are expensive. The average fee among ETFs launched in the first three quarters of the year was 79 basis points, he noted. The proliferation of active ETFs has notched fees up since 2023, but average fees over the past decade for new ETFs have been about 50 basis points. “The new launches this year have been about enriching the issuers, not the investors,” he said.

Extra Upside

- Call it a Comeback: Investors banking on a market with positions in leveraged equity ETFs.

- Decoupling? Bitcoin and Bitcoin ETFs see gains as stocks fall and dollar weakens.

- On the Move. Active ETFs are weathering the volatility storm, says T. Rowe Price exec.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.