Good morning and happy Wednesday.

Happy early birthday to Vanguard, which is celebrating its 50th anniversary tomorrow. The company, which was founded in 1975 by the famous Jack Bogle, has made its mark on investing with low-cost index funds. Or, in Bogle’s own words on diversified, passive portfolios: “Don’t look for the needle. Buy the haystack.”

The nautically themed company, based in Malvern, Pennsylvania, has grown to serve 50 million investors with a total of $10 trillion in assets. It’s worth pondering whether Vanguard is like the Ship of Theseus — a thought experiment in which every part of a boat is replaced over time, and the question is whether it’s still the same ship. In an announcement of the anniversary, CEO Salim Ramji said Bogle “founded Vanguard as a different kind of investment firm — one owned by its investors, ensuring a focus on making money for them, not from them. Everything we do is grounded in the belief that investing should be lower cost and more accessible.”

Why Flows Into State Street’s Public-Private ETF Are Drying Up

Not exactly the “watershed moment” the industry was expecting.

The heavily anticipated launch of State Street’s PRIV, the first ETF to package public and private investments into a single product, made waves after its launch in late February. Fast-forward two months, and that enthusiasm is drying up. The SSGA IG Public & Private Credit ETF pulled in just $55 million in assets since Feb. 29 — less than notable for a new product by a storied issuer. Just $5 million in assets was secured in its first two weeks, and inflows have been nonexistent in recent weeks, per Bloomberg.

“I am not surprised about the flows — or lack thereof,” said Paul Schatz, president of Heritage Capital. The fund is so new that many firms are simply waiting until it matures, and without a sizable chunk of assets already invested, advisors are having trouble trusting it. “PRIV has no flows because there is no sex appeal, very little marketing and no education that I know of,” he told ETF Upside.

Public Displays of Investment

One underlying issue may be that it’s not really holding all that much private credit. While the fund claimed it could hold more than the SEC’s 15% limit on illiquid investments, PRIV’s private credit exposure clocked in at about 5% as of March 3, per a CFRA analysis. Public corporate debt, treasurys, and agency pass-throughs accounted for 76% of its exposure. In fact, PRIV’s current holdings are actually widely owned by many other mutual funds and ETFs.

To be fair, other newly launched private credit ETFs have also had relatively slow starts, not surprising in the current market environment. In fact, PRIV’s $55 million in assets are on par with competitors:

- The BondBloxx Private Credit ETF (PCMM) had $108M in assets.

- The Virtus Private Credit ETF (VPC) had $55 million.

“Given the uncertainty with tariffs and the macroeconomic environment, investors are in a ‘risk-off’ mindset,” said Aniket Ullal, head of ETF research at CFRA.

What a Performance. Advisors will likely come around once the private-market products start beating major indices: The S&P 500 gained more than 23% last year. Schatz said he approaches it like Bitcoin: small allocations of 5% to 10%, but PRIV is going to need a longer track record. Once the returns start to trickle in, advisors will start to test the waters.

“The asset does warrant attention and a position in a well-diversified portfolio,” Schatz said. “It’s just going to take time.”

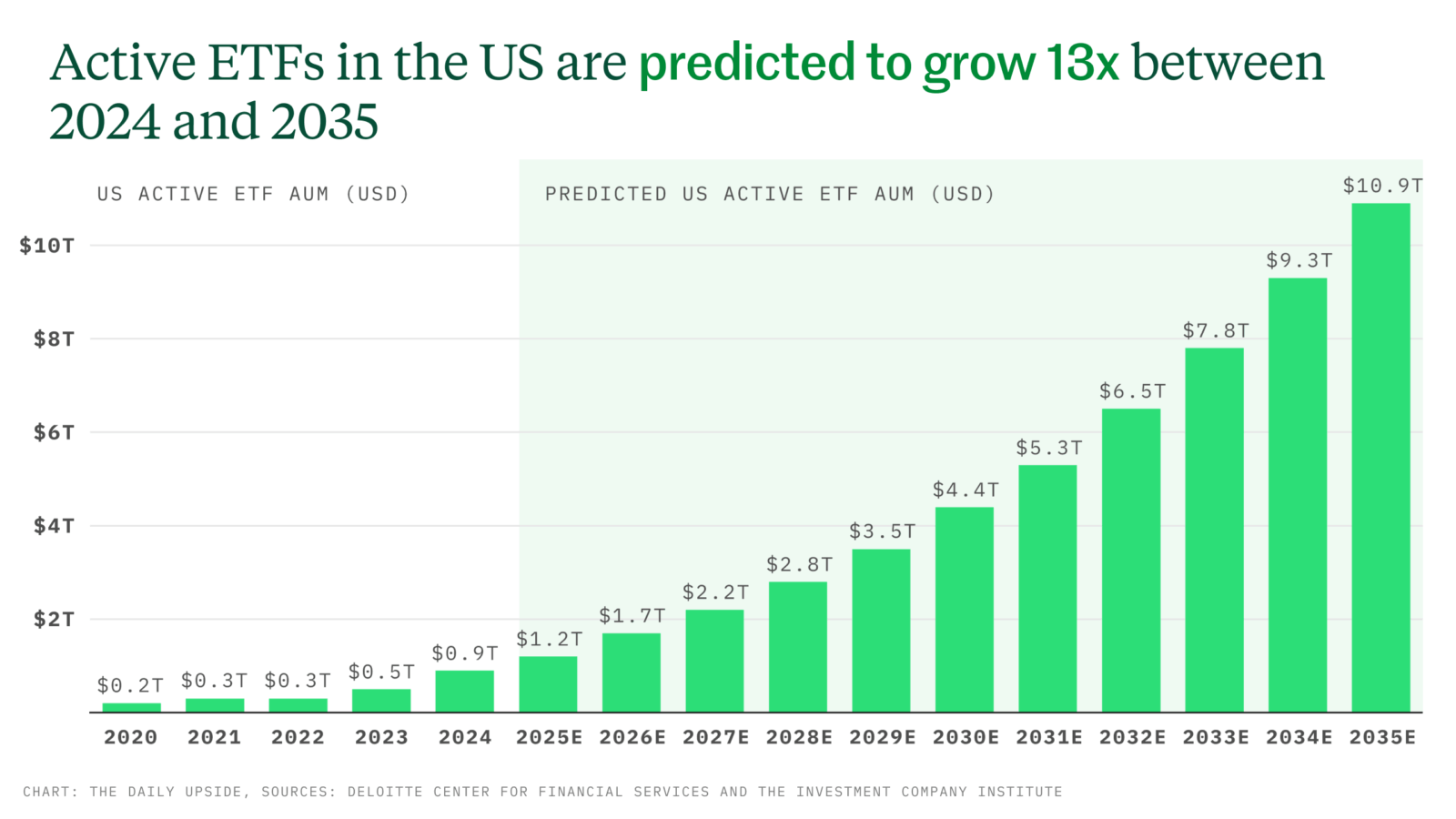

Active ETFs to Reach $11T by 2035, Deloitte Says

Active ETFs have gone from being a blip on the ticker to boasting over $1 trillion in assets — more than the combined wealth of Elon Musk, Jeff Bezos, Mark Zuckerberg, and Larry Ellison. These days, that has to count for something.

And though it’s been less than a month since active exchange traded funds hit that milestone, they apparently are just getting warmed up. In 10 years, active ETFs will reach $11 trillion, according to a prognostication late last week from Deloitte, which compared the vehicles to an “untapped goldmine.” By 2035, active ETFs will represent over a quarter of all ETF assets and 17% of all open-ended long-term fund assets, the consulting firm stated. The reasons for that growth are the same ones prompting many people to opt for ETFs today — low fees, tax efficiency, and transparency, according to Deloitte.

“On average, actively managed equity and bond ETFs have expense ratios of 22 basis points and 11 basis points lower than their respective actively managed mutual fund counterparts,” according to the company’s report.

ETF Everywhere All at Once

If there’s an investment strategy you want, odds are you can find it in an ETF. And if not, wait a bit. ETF issuers have been bringing hundreds of new products to the market every year, expanding into new categories like crypto and private debt, to say nothing of the thematic funds that account for many new filings with the Securities and Exchange Commission. There have been nearly 300 new US-listed ETFs this year, setting 2025 up for a record pace. Add to that the likelihood that the SEC will approve dual share class structures this year, and the trend could accelerate.

“Active ETFs gathered more than a quarter of the net inflows in 2024 and have been off to a great start in 2025,” said Todd Rosenbluth, head of research at TMX VettaFi. “We have seen demand for options-based active ETFs and security selection-based active ETFs. Firms like Capital Group, Fidelity, PIMCO, and T. Rowe Price are proving that there’s interest in active ETFs to support the core of the portfolio.” Companies like JPMorgan and NEOS Investments are showing that options-based ETF strategies can prove successful, he noted.

Data from Neuberger Berman and Cerulli Associates show:

- Assets in and net flows to active ETFs achieved over 50% compound annual growth rates between 2015 and 2024.

- ETFs will benefit from more inclusion in separately managed accounts as well as from assets being converted from SMAs to ETFs. Of Cerulli’s estimated market size of $2.7 trillion in SMAs, $1.6 trillion is in wirehouses and less than $500 billion is with RIAs.

Actively Changing: If there’s anything that active managers say shows their value, it’s a down market. And this year is shaping up to be an ideal time for active management to prove its worth. “Many people still prefer active management for the fixed income exposure and we have lots of strong choices today,” Rosenbluth said. “While ARK helped put active ETFs in vogue with thematic ETFs years ago, the strength of the active ETF market is so much more.”

ProShares Wants in on XRP Futures

Time keeps on slipping…into the futures.

ProShares aims to launch three XRP futures-based exchange-traded funds, according to a filing with the Securities and Exchange Commission on Monday. The issuer’s latest registration statement cited May 14 as the approximate launch date for the three ETFs. Earlier this week, news outlets reported the launch could come as soon as today, but those reports were inaccurate, according to ProShares. It did not provide any further information on the funds.

While spot ETFs, which directly hold the underlying asset, are a telltale sign of a cryptocurrency earning a place in traditional investing, futures ETFs are certainly a starting point toward wider XRP adoption.

“Spot ETFs represent a major step toward mainstream adoption,” said Martin Leinweber, director of digital asset research at MarketVector Indexes, adding that they more closely align with traditional asset allocation strategies and are appealing to long-term investors and financial advisors.

Extra Upside

- Variations on a Theme: Amplify ETFs launches Bitcoin 24% Premium Income ETF and Bitcoin Max Income Covered Call ETF

- Sales Bump: ETFs boosted Amundi’s inflows in the first quarter.

- Hurry Up and Wait: The SEC delays numerous decisions on fund listing for 45 days, including for Franklin Templeton’s Solana ETF and XRP ETF.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.