Good morning, and happy Wednesday.

As pro-crypto as the current Securities and Exchange Commission’s stance is, it hasn’t been shy about hitting the snooze button on ETF approvals. Even those linked to the president of the United States haven’t been an exception.

On Monday, the SEC gave itself a longer timeframe for making a decision on a proposed rule change that would let the Trump family’s Truth Social Bitcoin ETF list and trade on NYSE Arca. The exchange had filed with the regulator nearly two months ago, with its request published in the Federal Register on June 20. The SEC has a standard 45 days from publication to give a thumbs up or thumbs down, though it can easily extend that deadline to 90 days. Among the giant wave of crypto ETF requests this year, extensions have been common for a range of proposed spot-price funds, ETFs that would use staking, and modifications that would allow in-kind redemptions.

For what it’s worth, before Trump’s love affair with crypto, the president had previously been quoted saying Bitcoin “seems like a scam.” One could forgive the SEC for taking its time.

ETF Sales: A Tale of Bitcoin and the S&P 500

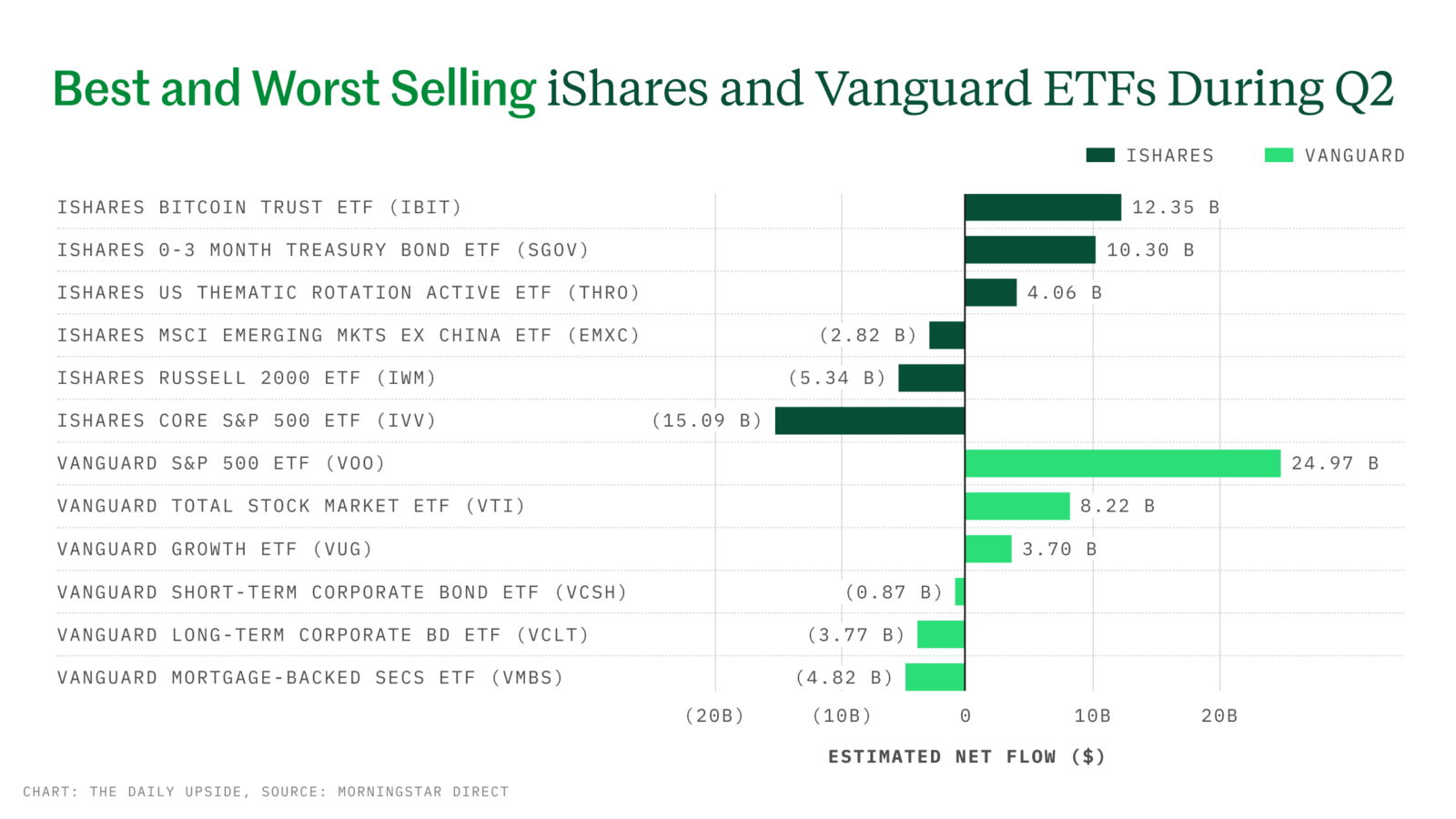

Looking at ETF sales at two asset management giants, you’d think they’re from different worlds.

Flows at BlackRock were all about Bitcoin during the second quarter, while sales at Vanguard reflected demand for US equity. BlackRock’s iShares Bitcoin Trust ETF (IBIT) has become the fastest-growing exchange-traded fund ever, raking in $12.3 billion in that time, currently representing more than $87 billion in total assets, a report this week from Morningstar shows. Meanwhile, Vanguard’s S&P 500 ETF (VOO) brought in $25 billion. While investors seemed to pull back from large cap US equity in iShares’ line, the opposite was the case for Vanguard. That has a lot to do with the types of clients the firms attract, said Morningstar’s Daniel Sotiroff, one of the authors of the paper.

“People are buying VOO because it’s a forever fund,” he said.

Different Strokes

Assets in the ETF, Vanguard’s largest, are now over $714 billion, while the broader strategy, which includes mutual fund share classes, sits at more than $1.5 trillion. Investors buy that fund for different reasons than the SPDR S&P 500 ETF Trust (SPY) or the iShares Core S&P 500 ETF (IVV), Sotiroff said. Flows in and out of SPY seem to correlate more with performance, while those for IVV seem to be somewhere between SPY and VOO, he said. In IVV’s case, about $15 billion evaporated from the fund in Q2, at least a small part of which appears to be due to BlackRock’s model portfolios shifting allocations, as about $4 billion flowed into the US iShares Thematic Rotation Active ETF (THRO), the report noted. Additionally, “since IVV is so large and so liquid, I have to imagine there are people out there using it for other tactical reasons,” Sotiroff said.

One advisor said that recent ETF decisions have been all about taxes. “We’ve maintained ETF positions largely in dividend-paying strategies and funds with high turnover, where using ETFs helps us avoid large capital gain distributions,” said Sean Beznicki, director of investments at VLP. “This structure has been particularly useful in managing tax exposure while maintaining desired allocations.”

While some of the flows at Vanguard and BlackRock show performance chasing, none of the top-selling ETFs at those firms were among the best performers during Q2. A separate Morningstar report found the best returns at two ARK ETFs and others:

- The ARK Innovation ETF (ARKK) returned nearly 48% during Q2, while the ARK Space Exploration & Innovation ETF (ARKX) returned 36%.

- The TCW Transform Systems ETF returned over 29%, and the Franklin Focused Growth ETF returned nearly 26%.

I Bet on IBIT: While it’s hardly a clear-cut case of Bitcoin vs. the S&P 500 in ETF land, there are some unusual things happening, Sotiroff said. Investors have tended to buy IBIT while Bitcoin is on a hot streak, but they aren’t really selling when it’s down. “It’s like people buy in and hold,” he said. “It’s very odd. I’ve never seen a pattern like that before.”

The Smarter Income Strategy For 2025

Treasury markets are pricing in higher deficits and inflation risks from new spending and trade policies. While stocks remain buoyant, fixed income tells a harsher tale of what’s in store.

This split creates opportunity for income investors. Traditional bonds expose portfolios to duration risk. Conventional dividend strategies sacrifice upside for yield. But ProShares’ Global Investment Strategist Simeon Hyman has identified a middle path that’s well worth exploring.

Join Hyman and his team for an August 7 discussion covering:

- How to generate income from equity without rate dependency.

- Why dividend strategies cap upside potential.

- How to build portfolios for both income and returns.

These approaches solve the rate sensitivity plaguing traditional fixed income strategies.

Why Goldman Sachs Jumped Back into Lead Market Making

Goldman Sachs is retaking the lead.

After an eight-year absence from lead market making, the Wall Street firm has taken on the role for the $35 million CG US Large Growth ETF (CGGG). It’s a shift in strategy for Goldman, which exited the LMM role in hundreds of ETFs it supported back in 2017 to avoid high regulatory and operations costs and focus instead on issuing its own ETFs. With about 500 ETFs having launched in the US so far this year, however, Goldman may see it as the perfect opportunity to make some scratch on the spread as well as support the ETF industry.

“The addition of Goldman Sachs as a market maker is a net positive as these ETFs will need liquidity and orderly trading,” said Todd Rosenbluth, head of research at VettaFi.

Capital Idea

Capital Group launched the actively managed CGGG at the end of June. Since then, it has taken in roughly $6.4 million in inflows, and its performance has risen about 6%, according to VettaFi data.

Capital Group is excited to have Goldman as the fund’s LMM. “We’re always looking to partner with high-quality liquidity providers and with so much activity and expected growth within the ETF category, it’s great to see Goldman Sachs in the lead market maker role,” Scott Szever, head of ETF product and capital markets at Capital Group, said in a statement.

Goldman declined to comment.

Make or Break. Market makers play a crucial role in the ETF ecosystem, providing continuous liquidity by being ready to buy or sell shares at any time. In return, they profit from the spread between bid and ask prices, a dynamic that has attracted several major Wall Street players.

- Jane Street serves as LMM for more than 800 ETFs across the NYSE Arca, Cboe and Nasdaq, Bloomberg reported.

- Meanwhile Virtu, Susquehanna and Citadel cover about 1,750 funds combined.

As those numbers suggest, there’s quite a lot of profit in the infrastructure of the ETF industry: In the first quarter of the year, Citadel generated $3.4 billion in trading revenue. Meanwhile, Jane Street was estimated to have garnered more than $7 billion from trading.

No wonder Goldman wants back in.

Are Faith-Based ETFs the Answer to Clients’ Prayers?

Gotta have faith … in ETFs.

Though still niche, faith-based ETFs are gaining traction. Six have launched this year, including two just last week from Crossmark, led by industry veteran Bob Doll, and the segment now holds roughly $10 billion in assets. The funds aim to align investment strategies with religious values, but that often means a stronger focus on beliefs than returns. Plus, like ESG or tech funds, many end up looking similar to S&P 500 products, only with higher expense ratios. While clients may be looking to practice what they preach, it’s up to advisors to make sure any investments are truly aligning with their values and financial goals.

“Are you just buying an expensive S&P 500 tracker at the end of the day?” asked Daniel Sotiroff, Morningstar research analyst.

Keeping the Faith

Currently, there are 46 faith-based ETFs in the US — 38 Christian, 7 Muslim and 1 Jewish — according to Morningstar. And year-to-date, they’ve seen roughly $832 million in inflows, per CFRA Research.

Some funds have strict filters. The Inspire 100 ETF (BIBL), for example, excludes companies with ties to abortion, LGBT activism, gambling and more. Its largest holding is Caterpillar, and it doesn’t contain any of the Mag 7. Similarly, the SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS) omits over half the index for non-compliance with Sharia law, and it has slightly underperformed the broader market.

“The goal of these funds is generally not to generate alpha; rather, it is to be a faith-aligned alternative to a core holding,” said Aniket Ullal, head of ETF research & analytics at CFRA Research.

Not So Different, You and I. Then there are also faith-based funds that come off as fairly typical:

- The JLens 500 Jewish Advocacy US ETF (TOV), which aims to combat antisemitism, and the Global X S&P 500 Catholic Values ETF (CATH), the largest Christian ETF, have quite a lot in common with the Vanguard S&P 500 ETF (VOO).

- When compared with VOO, TOV and CATH have “active shares” of 4.7% and 17%, respectively, according to Morningstar. The lower an active share, the more alike two funds are in terms of holdings, weight and strategy.

- But while VOO’s expense ratio is just 0.03%, TOV’s and CATH’s are significantly higher at 0.18% and 0.29%, respectively.

“Some faith-based funds look very different to a comparable broad market fund, but then others might just have a light touch and very low active risk,” Sotiroff told ETF Upside.

Extra Upside

- Here Come the Grannies: Tom Lee’s Fundstrat Granny Shot US Large Cap ETF hit $2 billion in record time.

- RIAs Love ETFs: Registered investment advisors held $4 trillion in exchange-traded funds, or 40% of the market, last year.

- Bull, Market: eToro launches tokenized trading.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.