Good morning and happy Monday.

Who’s your hedge-fund manager doppelganger?

ETFs that replicate the investment strategies of pros like Warren Buffet and millionaire members of Congress are an easy pitch for fund issuers: Hey, they did it, and now you can, too. Last week, VistaShare filed for a series of ETFs that aim to mimic the strategies of hedge fund tycoons Bill Ackman, Stanley Druckenmiller, and Michael Burry, based on regulatory disclosures from their respective firms. The problem is that those 13F filings hit quarterly, and by the time they’re public, the hedge funds’ investing strategies may have already shifted.

The funds may not be a carbon copy of Ackman’s or Druckenmiller’s, but who really wants to look like them anyway.

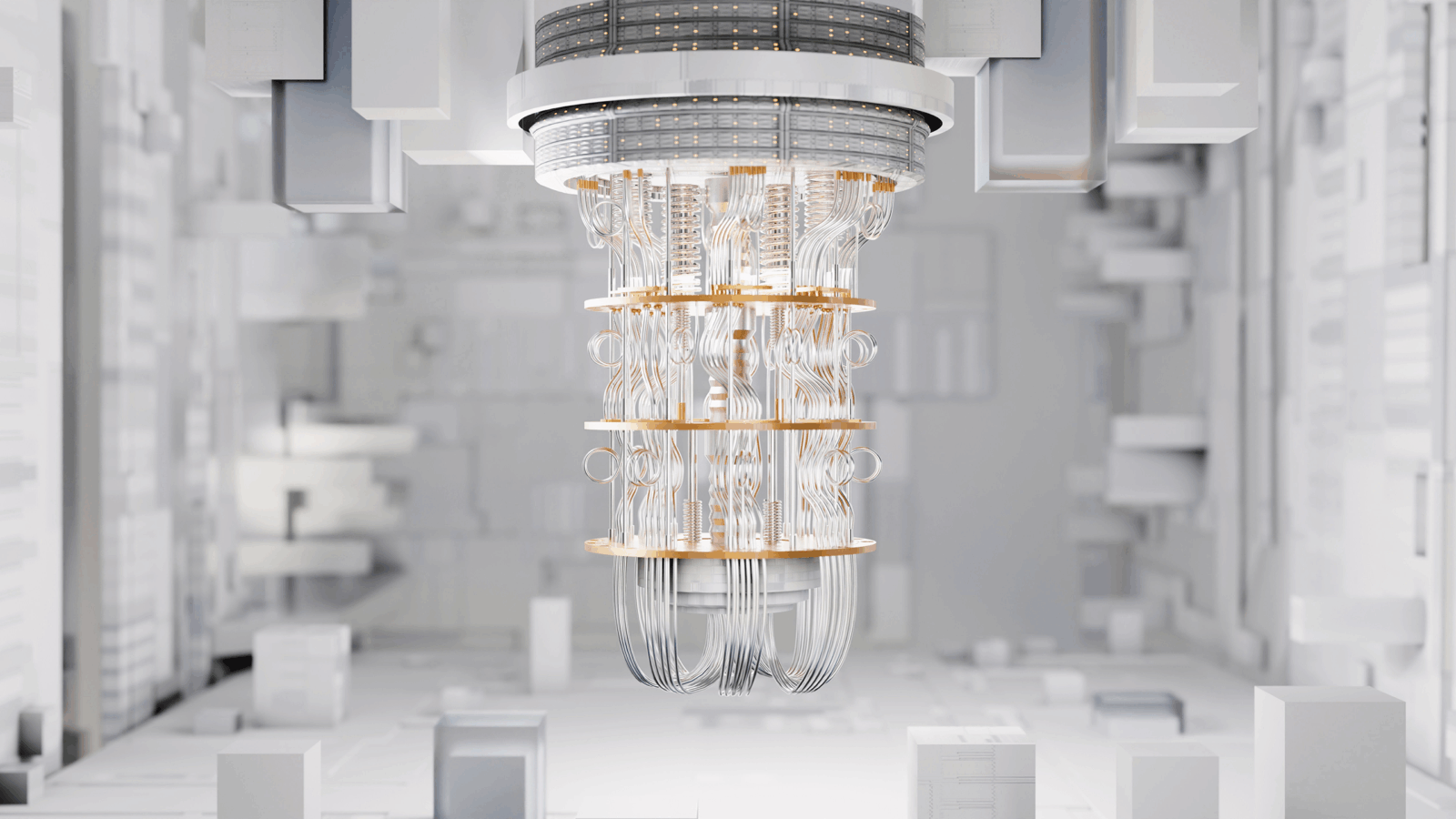

Grayscale Wants in on Quantum Computing ETFs

Who says a crypto asset manager has to focus on crypto asset management?

There’s a world of possibilities out there, and one of the big crypto ETF issuers appears to be branching out. Grayscale filed on Thursday with the Securities and Exchange Commission for the Quantum Computing ETF. The Stamford, Connecticut-based firm started in the US ETF business in 2022 — and, thanks to the move of assets from its Bitcoin Trust to the spot bitcoin ETF it launched in 2024, temporarily had the biggest bitcoin ETF by assets. By August 2024, the significantly cheaper iShares Bitcoin Trust ETF surpassed it.

Since then, Grayscale has been building out a line of ETFs with four focused solely on digital assets, two focused on income, two with equities exposure, one dedicated to bitcoin mining companies, and one to adopters of the digital asset.

Quantum Leap

The proposed ETF, which is pending SEC approval but could launch by mid August, would be passively managed, tracking an index of companies “producing proof-of-concept or commercialized quantum computing technologies” and makers of components enabling the technology, according to the prospectus.

There is a lot of hype around quantum computing, which benefits from using both the wave and particle natures of matter, though the technology has not been developed in a mainstream capacity yet. It could improve upon the power of classical computers exponentially and make extraordinarily complex calculations in very short times. The technology could even pose a threat to crypto, as it could be used to break the security and gain access to wallets — something BlackRock recently warned investors about.

Stop Being Disruptive: There are a handful of tech and artificial-intelligence-focused ETFs with exposure to quantum computing technology. But at least one ETF is already dedicated to the area: the $1.3 billion Defiance Quantum ETF, which launched in 2018. That fund has seen average annualized returns of 21% since inception, per Morningstar. “It’s performed very well,” said Bryan Armour, director of ETF and passive strategies research for North America. Even so, “investors are pushing to get in early by virtue of the shift in first-mover advantage of new technologies … It’s never as smooth as investors would think.”

Armour cited examples of other high-flying technology investments that later sputtered, including:

- The internet (back when it was spelled with a capital “I”) and the dotcom bubble that led to the famous bust.

- One of the most disruptive technologies over the past century, commercial aviation, has long struggled with profitability, despite its popularity.

Spot On: Grayscale is still primarily focused on digital assets. It, along with other firms, is waiting for decisions from the SEC on spot-price Solana and XRP ETFs that it has requested, for example. Whether the company intends to branch out in other ways is a question, but the firm didn’t respond to a request for comment. “Obviously crypto is its core competency, and it made most of its money by offering a private trust,” Armour said. Quantum computing, on the other hand, “is not a core competency.”

BlackRock’s ‘Widow Maker’ ETF Is Suddenly in High Demand

With a nickname like “widow maker,” you’d think investors would stay away.

The iShares 20+ Year Treasury Bond ETF (TLT), which got its moniker because of its recent poor performance — took in $1.3 billion assets in the past week, according to CFRA Research. Since long-term Treasury bonds are more susceptible to the effects of interest rate changes as they mature, short or intermediate bonds are often more appealing. And for TLT, if investors bought the fund five years ago, they would have lost some 45% of their original assets, according to the Financial Times. But, it looks like long-term products are increasingly on the menu.

“TLT is often used by investors to buy the dip when they think [Fed interest] rates have peaked,” said Aniket Ullal, head of ETF Research & Analytics at CFRA. “We may be seeing similar behavior here since inflation numbers have been fairly benign recently.”

Is This the Bounce Back?

The bond market had a small win last week as both 20-year and 30-year Treasury yields began trading just below 5%, the first time since May 20. And while President Donald Trump doesn’t have the authority to lower interest rates, he’s made his position well known, recently telling Fed Chair Jerome Powell he’s making a “mistake” by not lowering them. Plus, who could forget all that volatility? All this could be contributing to TLT’s momentum.

“Investors in long-term Treasury bond ETFs like TLT will win if the US economy weakens significantly and investors believe the Fed will need to cut rates aggressively,” said Todd Rosenbluth, head of research at VettaFi. However, he noted that TLT doesn’t have the strongest track record, and taking on significant duration risk has not been rewarding for investors:

- Over the past five years, the fund has taken in roughly $50 billion in inflows, per VettaFi data.

- But, its performance is down nearly 50% in that same time.

“Timing this trade can be very difficult,” Ullal told Advisor Upside.

Nasdaq Wants to Wrap This $11.5B Altcoin in an ETF

Forget Ethereum, there’s a new altcoin coming for the $10 trillion ETF industry.

Nasdaq and the European crypto issuer 21Shares filed for an exchange-traded fund in May that would hold $SUI, a relatively new coin from a blockchain technology called Sui. While XRP and Solana filings are already in the works, the secret behind the Sui network is its focus on instant settlements that allow unrelated transactions to close simultaneously. The Palo Alto, California-based startup behind the technology is backed by Andreessen Horowitz and FTX Ventures, among others, with a valuation of about $2 billion. $SUI’s market cap stands at around $11.5 billion, far lower than more prominent coins like Ethereum at $307 billion.

“SUI presents a differentiated bet on speed, developer adoption, and novel architecture,” said Mike Cahill, CEO of the crypto developer Douro Labs. “Not to mention, the fact that an ETF provides the cleanest way to express that view under compliance constraints.”

Extra Upside

- Ether or: Some BlackRock and Fidelity Ether ETF investors may face significant losses.

- Rising Sun: Japanese ETF inflows reached a record $614 billion at the end of April.

- Have a Look-see: Goldman introduces ‘ETF Look Through’ feature, so RIAs can combine ETF positions with SMAs.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.