Good morning and happy Monday.

What would it say about a fund if its mustachioed portfolio manager was pictured in a tuxedo and top hat?

OK, Uncle Pennybags, aka Mr. Monopoly, doesn’t run money. But his famous game has shown generation after generation just how depressing money — or rather, a lack thereof — can be. Hopefully that won’t be the case for MPLY, an ETF from Strategy Shares that launched May 14. The Monopoly ETF primarily invests in companies that show “monopolistic attributes,” which range from brand dominance and industry concentration to having a history of antitrust reviews from the government, according to the firm. Maybe that’s akin to owning Boardwalk and Park Place, complete with hotels.

The actively managed ETF charges 79 basis points, or an equivalent to $200 (for passing Go) on $25,316 in assets.

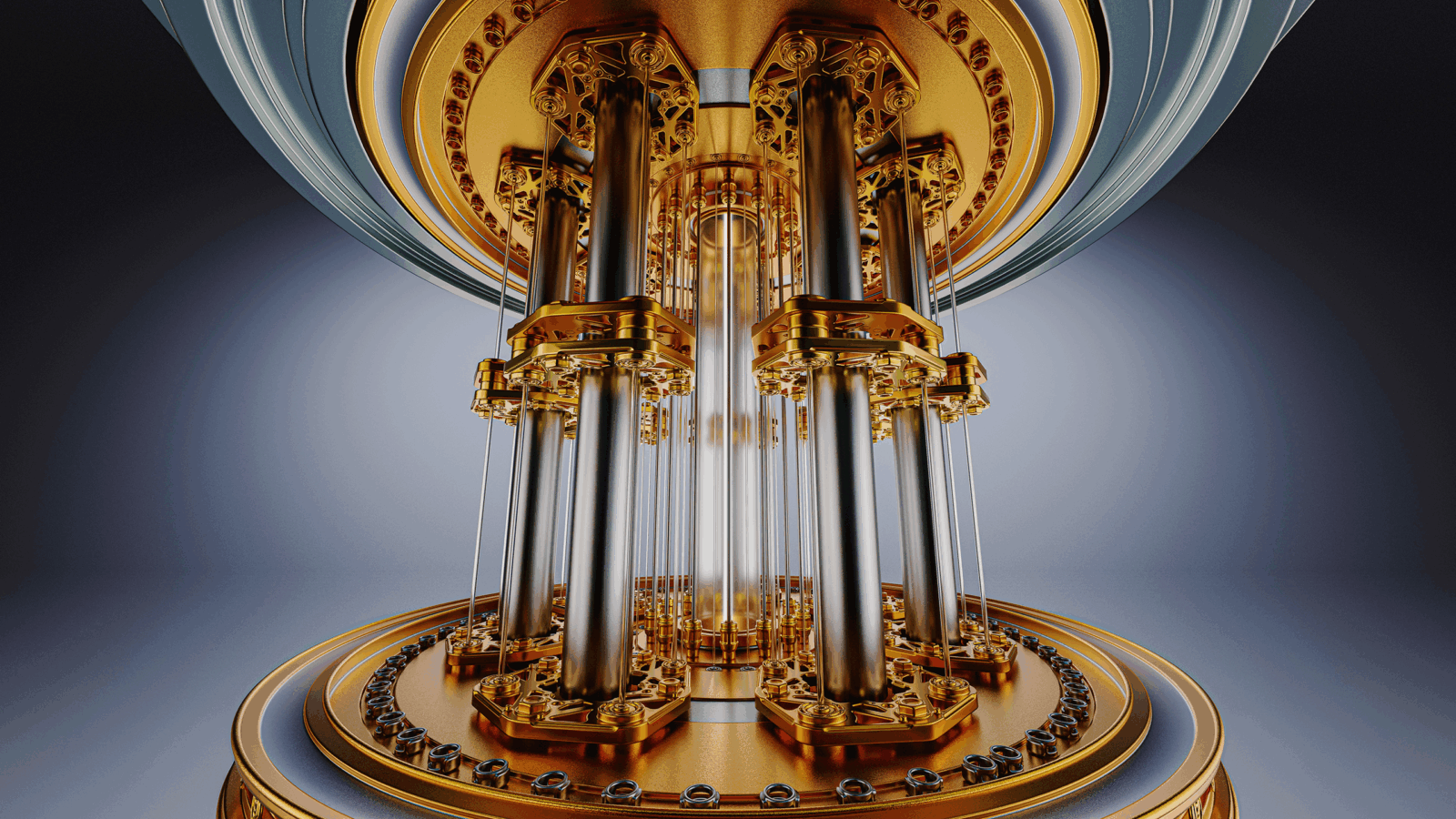

Why IBIT’s Spooked By Quantum Computing

One of the fastest-growing ETFs of all time may have an Achilles heel … or maybe it’s a Trojan horse.

BlackRock has officially acknowledged that quantum computing could become a cybersecurity risk to its iShares Bitcoin Trust (IBIT) in a filing this month, marking the first time the new technology has been formally recognized as a potential threat. As quantum computing power advances, the world’s leading asset manager said the cryptography underlying bitcoin could become compromised by quantum hackers leading to stolen coins. With a net asset value of $64 billion in IBIT alone, or just under 3% of the total coins that will ever be produced, that sounds like a very expensive problem. But how big a threat does quantum computing really pose?

“A large-scale quantum computer would be able to break the digital signature scheme that currently secures Bitcoin wallets,” said Jonathan Katz, professor of computer science at the University of Maryland.

High Probability Events

The worry is that advanced computers might break private keys by reverse-solving the mathematical puzzles based on Bitcoin’s elliptic-curve signatures, essentially gaining the password, according to a report. Flaws in digital assets have been exploited before, including flaws that disabled some functionality, exposed personal information and led to thefts, according to the filing. “In any of these circumstances, a malicious actor may be able to compromise the security of the Bitcoin network or take the Trust’s bitcoin, which would adversely affect the value of the shares,” the company said.

Still, that wouldn’t make Bitcoin obsolete. In fact, the underlying technology securing the blockchain, including the mining of new coins, would still be viable if Bitcoin upgraded to quantum-secure methods, Katz said. “The main danger to Bitcoin would be if large-scale quantum computers become available before this transition happens,” he told ETF Upside. “But people in the cryptocurrency community are well aware of the threat of quantum computers, so I don’t consider this a very high-probability event.”

Wake Up, Wallet. A bigger issue could be inside inactive Bitcoin wallets. Quantum hackers could make quick work of wallets that have been lost, or are otherwise dormant, said Tether CEO Paolo Ardoino. There may be anywhere from 2.3 million to 3.7 million bitcoins that are permanently lost, or about 11–18% of the fixed supply, according to Ledger Academy. “Any bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” Ardoino said in a post on X in February. “Quantum-resistant addresses will eventually be added to Bitcoin before there is any serious threat.”

ETF Market’s Riskiest Corner Keeps Getting Riskier

These funds are single, but should investors mingle?

Single-stock ETFs have surged since their 2022 debut, currently standing at roughly 130 funds with $24 billion in assets, according to CFRA Research. But despite their popularity, these funds are among the riskiest in the ETF market, with prospectuses that really hammer home their “buyer beware” nature. Risk levels are climbing further as newer ETFs track smaller companies in sectors like AI, consumer retail, and quantum computing.

“These ETFs are much more volatile than the ones linked to mega caps, and while they may be attractive to short-term traders, they are likely not appropriate for long-term investors and advisors,” said Aniket Ullal, head of ETF research at CFRA.

Risky Business

Originally, single-stock ETFs focused on larger companies like Tesla and Apple. Now, issuers such as Themes ETFs are expanding into new territory with funds linked to companies like Hims & Hers Health, Costco, and SoundHound AI. “There’s potential for [single-stock ETFs] to lose their complete value in a single day,” Bloomberg Intelligence analyst Athanasios Psarofagis recently said:

- Year-to-date, single-stock ETFs attracted $6.9 billion, and brought in $15.4 billion in all of 2024, according to CFRA data.

- Fund launches have also accelerated in 2025, with more than 60 launched so far. However, many are linked to smaller market cap, highly speculative stocks like IonQ, Lucid, and Rigetti Computing.

Never Tell Me the Odds: Due to their volatility, single-stock ETFs are typically geared toward professional day traders. Still, retail interest is growing, especially on platforms like Twitter and Discord. “There are no doubt morons and charlatans on these platforms, but there are groups of people I would put up against any hedge fund manager,” said Matt Tuttle, CEO of Tuttle Capital Management, which now oversees 17 single-stock ETFs, including one that tracks notorious meme stock GameStop.

“I’m a big believer that more tools are better, and we hope people are using tools in the right way,” Tuttle told ETF Upside. He cautioned that single-stock ETFs are not for beginners. “If someone is taking their entire net worth and betting that the S&P is going to go up over the next 10 minutes, that’s stupid,” he said.

ETFs Lose Some Edge Over Mutual Funds as Fees Decline

If a fund fee falls in the forest, does it make a sound?

ETFs’ pricing edge over mutual funds is shrinking, a report last week from Morningstar found. While fees for many passively managed exchange-traded funds and mutual funds are at or near single-digit basis point levels, ETFs as a category are not dropping in price as quickly as mutual funds. That’s largely because of the rise in actively managed ETFs, which have higher costs for clients. That might seem like a slight downside for the competitiveness of ETFs, but consumer behavior shows that fees may not matter very much.

For passive ETFs in particular, “fees are probably pretty close to a floor,” said Zachary Evens, a manager research analyst at Morningstar.

Extra Upside

- Crypto Shuffle: Institutional investors make big bets on spot bitcoin ETFs or sell their entire holdings.

- Inflated Expectations: What investors should know before buying TIPS ETFs.

- Keep It Coming: A record $620 billion poured into ETFs globally this year through April.

ETF Upside is written by Emile Hallez. You can find him on LinkedIn.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.