Good morning and happy Monday.

How’s that for a birthday present?

Vanguard, which turned 50 last week, saw its $608 billion S&P 500 ETF (VOO) bring in $21 billion in April. Not only is that ETF the world’s largest, but the haul was the biggest in any single month in its 15-year history, according to Bloomberg. Those numbers are huge, but here is some additional context: The total flows into all US equity ETFs last month were $33 billion, meaning VOO’s sales represented most of that, the publication noted. Not only were people buying the dip in the market, but they did so with a cut-rate vehicle — VOO’s fees are a scant 3 basis points.

Hopefully, the company didn’t have to skimp on birthday cake.

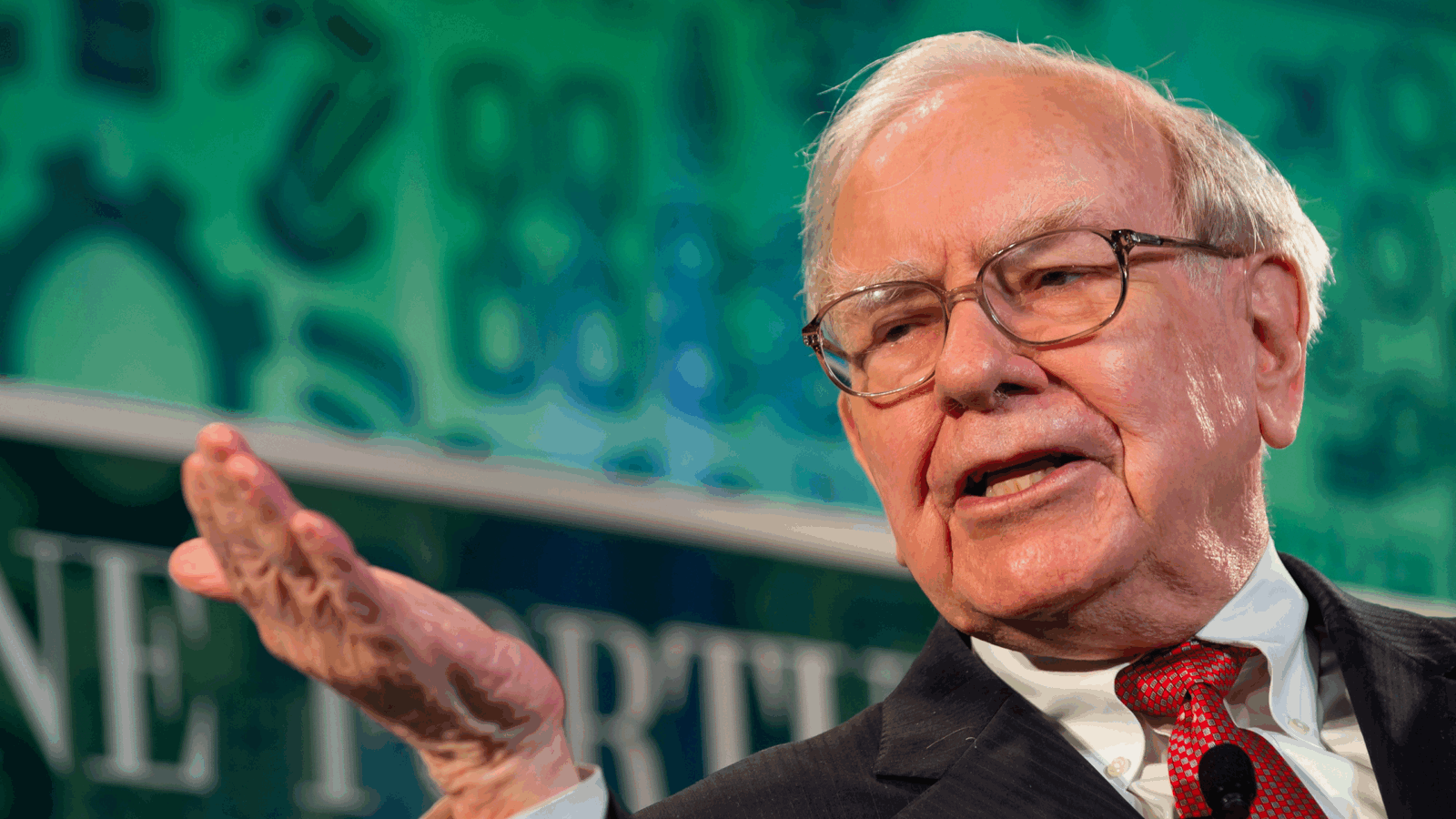

ETF Shop Bets on Allure of Warren Buffett’s Berkshire

There are few large companies doing better this year than Berkshire Hathaway, whose annual meeting on Saturday drew tens of thousands to hear from its CEO, nicknamed the Oracle of Omaha.

Now, a new ETF seeks to invest like Warren Buffett, with a twist — it aims to pay out income of 15% per year, or 1.25% monthly. With Berkshire Hathaway stock being up 20% this year, that might be something a lot of investors are looking for. There’s at least one early indication of that — the VistaShares Target 15 Berkshire Select Income ETF (OMAH), which launched March 5 but has only been selling for two weeks, has attracted nearly $100 million. “It came out of the gate very strong,” VistaShares CEO Adam Patti said. “It’s coming from a combination of RIAs serving their clients, and retail.” At just over $19 per share, the ETF is more accessible than Berkshire’s Class B stock (BRK.B), at $540, or especially its Class A shares (BRK.A), at nearly $810,000.

Betting Like Buffett?

The ETF invests in 21 securities, with the top holding being Berkshire Hathaway (BRK.B) and the other ones being the largest public holdings in that firm’s portfolio, Patti said. The ETF uses an active options overlay, and it rebalances quarterly to bring it in line with Berkshire’s portfolio, he noted. “Berkshire clearly has a massive following, but doesn’t pay a dividend. And we wondered if there was something there.” To that point, the company has paid a dividend once in its history, which happened in 1967. The two use cases for the ETF are traditional core equity exposure and income, the latter of which acts like a synthetic dividend for BRK.B, he said. “We’re coming off of a market that was largely momentum driven for a couple of years…It’s in the bull’s eye of where investors are looking now.”

Data show that the ETF’s returns diverge from those of BRK.B:

- OMAH is down 3% since its March 5 inception.

- BRK.B is up 20% year to date.

Incoming ETFs: “We’ve seen an income version of every strategy come to market in the past couple years,” said Bryan Armour, Morningstar’s director of ETF and passive strategies research for North America. Single-stock ETFs have been part of that trend, and the benefit for individual investors is unclear at best, in part because the potential returns are limited by the income features, he said. “It ends up not being, in my opinion, one of the better strategies you could have.”

Are ‘Black Swan’ ETFs Worth a Gander?

A positive return for any fund this year is quite an achievement — but one with an unusual thesis is up 14%. What’s the catch?

The Cambria Tail Risk ETF, which earned the impressive number, has still fallen 45% over the past five years. That’s the rub with the small category of tail risk ETFs, also known as “black swan” funds. Such funds can shine when the market tanks and can add some insurance as a small portion of an investor’s portfolio. But in good times, which is a lot of the time for the stock market, the category doesn’t do so well. Tail risk funds “share a simple objective: profit during periods of maximum panic,” Morningstar manager research analyst Zachary Evens wrote in a recent post about them. The Cambria ETF and others use put options on indexes, which “is a losing bet in steady markets, but it can pay off big when markets decline.”

Test Case

The broader market has bounced back somewhat from its lows in recent weeks, so it’s anyone’s guess whether the utility of tail risk funds is over for now. And that’s a sticking point for advisors. Several told ETF Upside that they don’t use tail risk ETFs in client portfolios because of the cost and the timing requirement. “When we build a financial plan, we’re bucketing assets by time horizon so short-term needs are out of the market entirely and stocks live in the long-term bucket,” said Grant Joiner, founder of Vinyard Wealth Group. “Volatility is expected there, and we’d rather stay invested for the upside than pay to avoid normal market swings.”

Asset allocation, liquidity buffers, and scenario planning are preferable for managing risk, another advisor said. “Even during market drops, timing matters — a tail risk ETF can be directionally right but still lose value if the volatility spike doesn’t align with its structure,” said Daniel Milks, owner of Woodmark Advisors. “If clients are nervous about tail events, I’d rather adjust exposure or build cash cushions than rely on instruments that are difficult to explain and even harder to stick with.”

Here’s how a few tail risk ETFs have performed year to date:

- Amplify BlackSwan Growth & Treasury Core ETF — (1)%, 49 basis points in fees

- Cambria Tail Risk ETF — 14%, 59 basis points

- Alpha Architect Tail Risk ETF — 1%, 63 basis points

- Global X S&P 500 Tail Risk ETF — (5)%, 25 basis points

Just Say No: If market drawdowns rattle investors, portfolio construction is to blame, said Sarah Maitre, founder of Camriel Advisors. “Many tail risk ETFs also fail to perform as expected in real world scenarios. Investors often discover this only after the fact,” she said. “While some advisors attempt to time these products during periods of economic stress, that approach amounts to market timing, and the odds are not in their favor.”

Amplify CEO Christian Magoon on the Past 2 Decades of ETFs

Amplify CEO Christian Magoon has worked in the ETF industry for almost two decades, and with over 100 fund launches under his belt, things are getting much more complex.

In the beginning, ETF customers were “diehard indexers” buying equity funds, and even fixed-income ETFs were “late bloomers.” Now, asset managers are prioritizing unique strategies that use derivatives, like options and covered calls, to create additional income, he told ETF Upside. Case in point: Amplify launched two Bitcoin ETFs last week — Amplify Bitcoin 24% Premium Income ETF (BITY) and Amplify Bitcoin Max Income Covered Call ETF (BAGY) — which seek to deliver monthly income through weekly call options. “We didn’t want to be the 12th fund provider launching a spot Bitcoin ETF,” Magoon said.

ETF Upside caught up with Magoon last week to discuss the industry’s influence on crypto, the market downturn, and some controversial new products coming from companies tied to President Trump.

Extra Upside

- Tax Slap: Gold ETFs have capital gains taxes that may surprise investors.

- Strong Demand: Managed futures ETFs have raked in assets as investors seek diversification.

- Buffering Expectations: Investors should think twice about defined outcome ETFs, according to Morningstar.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.