Good morning and happy Wednesday.

The marketing strategy was hardly a slam dunk.

First Trust wholesalers allegedly showered client firm reps with hundreds of thousands of dollars worth of event tickets, including courtside basketball seats, and then fudged expense reports to cover up most of the costs, according to Finra. The self-regulatory organization makes exceptions for gifts of less than $100 per person, which seats valued at $3,200 a pair obviously exceeds. The company is settling Finra claims related to the activity, from 2018 to 2024, without admitting or denying the findings. But it is paying $10 million.

It’s unclear if, after $10 million is factored in, the alleged strategy led to enough sales to break even. But in any case, that same amount would’ve bought at least five Taylor Swift concert tickets, give or take.

Getting Down and Dirty on Clean Energy’s Performance Tear

Other investors might be green with envy.

This year, clean energy investments have been absolutely smashing it, technically speaking. Even with headwinds such as turbine projects being halted and tax credits for renewable energy fast-tracked for expiration, returns in the sector have outpaced the wider market, running laps around the S&P 500. That has caused a crunch to get projects done sooner, ramping up demand for materials and parts like solar panels. So far this year, the S&P Global Clean Energy Transition Index is up 50%, compared with about 17% for the S&P 500.

“Despite the rhetoric we’ve seen in the US, private companies are going to still continue with the transition,” said Peter Krull, director of sustainable investing at Earth Equity Advisors. “It’s just cheaper to install clean energy than it is to build a new fossil fuel plant.”

Sunny Days

Globally, new investments in renewable energy have continued at a record pace, reaching nearly $400 billion during the first half of 2025, according to data from BloombergNEF. Over half of that has come from solar, which has boomed as the prices of panels have dropped and made projects more attractive. That trend has persisted in the US as well, where spending on wind and solar was about $35 billion in the first half of the year, down 18% year over year, a recent Deloitte report found. While policy changes could slow demand, a major factor countering that is energy use by new AI data centers, the group noted. This year, renewables have accounted for 93% of the growth in US energy capacity. Last week, the country’s biggest panel manufacturer, First Solar, boosted the lower end of its 2025 sales forecast following record sales volume during the third quarter. Its stock is up 42% year to date, and that of another firm, Bloom Energy, is up 460%.

Still, the major player in clean energy is China, which accounted for 40% of spending globally, compared with 42% among developed economies and 18% in emerging markets, Bloomberg’s recent Climatescope report found. Emerging markets represent the most opportunities for investment, and many have committed to fighting climate change, said Sofia Maia, head of country transition research at BloombergNEF. Investments in emerging markets, excluding mainland China, went from $49 billion in 2015 to $140 billion last year, although “the progress is still very concentrated in just a handful of markets,” Maia said, citing differences in policies by country.

Here’s how the biggest US ETFs have performed:

- The $2 billion iShares Global Clean Energy ETF (ICLN) is up over 50% year to date.

- The $623 million Invesco WilderHill Clean Energy ETF (PBW) is up 59%.

History Repeated? It seems counterintuitive that clean energy was an outperformer during the first Trump administration but a laggard during Biden’s term, Krull noted. “Now, of course, we’re seeing it happen again,” he said. “From that perspective, there’s not a whole lot of logic to it.” Whether that will actually affect flows in clean energy funds is another matter.

“People are scared of the volatility. They’re scared of the political uncertainty,” he said. “They may not be looking at it from a long-term trend perspective.”

What This Money Manager Means By “Going Nuclear”

John Campbell has degrees in nuclear and mechanical engineering. He spent years building systems that require absolute precision, absolute stability.

Today, John leads Allspring’s Systematic Core Equity team, where he combines systematic and fundamental models to manage US equity portfolios. His engineering background shows in how he builds portfolios.

- Ten stocks now control 30% of the S&P 500. John’s direct indexing captures tax losses daily while moving portfolios beyond mega-cap concentration.

- Most managers pick stocks or build models. John does both. His systematic screens catch opportunities his fundamental research validates before execution.

- Company-level tariff analysis identifies which firms source domestically and which face import risk from trade-policy shifts.

John brings reactor-level precision to portfolio construction.

Get market insights informed by reason and science.*

*All investments contain risk. Your capital may be at risk. The value, price, or income of investments or financial instruments can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Past performance is not a guarantee or reliable indicator of future results.

Why Money Market ETFs Haven’t Lost Popularity, Yet

Money market funds aren’t the most lucrative. So why do investors keep buying them?

The strategies continue to see massive inflows, with $20 billion flowing in last week alone, bringing total assets to about $7.4 trillion and heightening interest in money market ETFs, a small but growing adjacent niche. Issuers have been quick to hop on the bandwagon, with JPMorgan, Vanguard and Schwab all introducing their own money market ETFs, despite a lower interest-rate environment that can diminish returns for money market funds because of their focus on Treasury bills and municipal bonds. Continued interest in the products is a result of both relatively high yields despite the low rates as well as an uncertain macroeconomic environment, experts said.

“On a risk-adjusted basis, [money market funds are] still a good tradeoff because you’re getting a 4% yield with zero risk,” said Aniket Ullal, head of ETF Research at CFRA. “Over time, if rates keep falling, we should see a reversal in interest. But right now, the returns are high enough that it’s worth it for investors.”

Money Marks the Spot

Part of the interest stems from the relative safety the funds provide amid an ongoing trade war with China and other headwinds. The SEC’s current guidance on the funds, Rule 2a-7, dictates that their holdings consist of conservative investments, with an average maturity not exceeding 60 days. “They have to have a low average maturity; there’s liquidity requirements,” Ullal said. “All of those rules make money market funds a much safer investment.”

But the rule doesn’t apply to ETFs that invest in money market funds, so most of them don’t actually adhere to 2a-7. There are only five such ETFs that comply, according to Ullal, in part because of their relative newcomer status. “Issuers launching money market fund ETFs is a fairly recent phenomenon,” Ullal added. “Money market ETFs have over $5 billion in assets. That’s very small compared to what’s in traditional money market funds.”

According to the Investment Company Institute:

- Money market funds are appealing to both institutions and retail investors, who have $4.4 trillion and $3 trillion invested in the asset class, respectively.

- Government funds make up $6 trillion of the investments, while prime money market funds make up roughly $1 trillion.

Reversal of Fortunes. Ullal predicts interest in money markets will eventually reverse as interest rates continue to drop, particularly following an expected 25 basis-point cut in December. “Money market demand may stay strong into next year,” he added. “It’ll probably take a few more rate cuts for investors to slowly move out of them.”

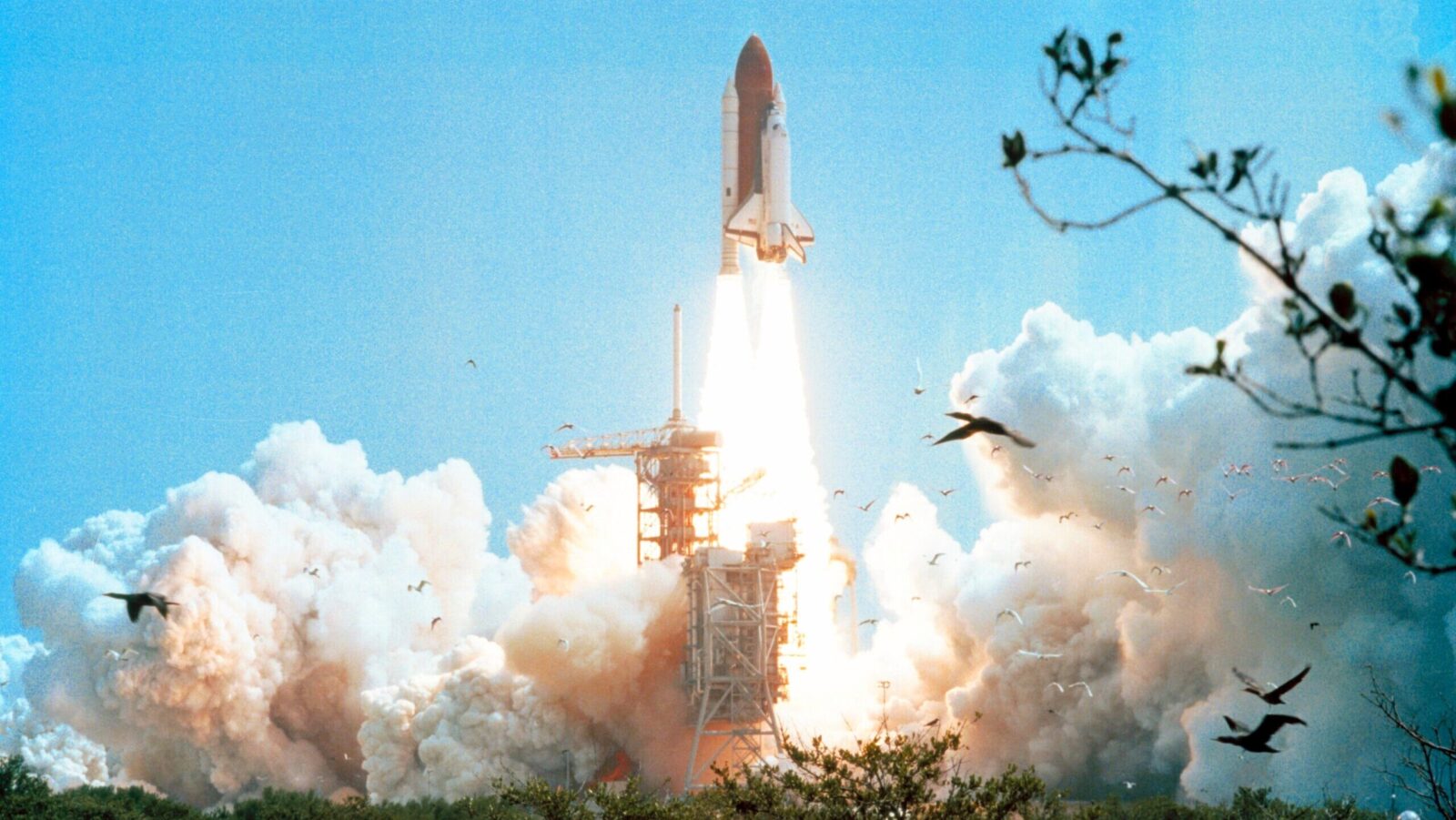

ETF Sales Rocket Upward in October

Everything is coming up ETFs.

Last month marked the latest record for inflows to exchange-traded funds, continuing a trend that has pushed asset levels higher and encouraged numerous funds to add products to an ever-growing pile. US ETFs garnered $171 billion in new assets in October, lifting year-to-date net sales to more than $1.1 trillion, nearing the total inflows in all of 2024, according to a report late last week from State Street Investment Management’s Global Head of Research Strategists Matthew Bartolini. Coupled with an equity market rally of 16% year-to-date through October, that seems encouraging … almost, he wrote.

“Similar to the Gilded Age’s titans of industries, much of the market’s strength is concentrated in a handful of tech-focused firms — like the Magnificent Seven and leaders in artificial intelligence,” he said. “And this narrow leadership masks some underlying weakness. In fact, 48% of US equity firms are down this year, and 70% are trailing the overall market.”

Actively Engaged

In any case, it’s a good time for active management. During the first three quarters, active ETFs pulled in more money than ever, and the number of such products recently surpassed the count of passive ETFs, thanks in part to the wave of niche funds recently added to the market. Through September, active ETFs raked in $338 billion, which is more than all of 2021 through 2023 combined, Morningstar Associate Manager Research Analyst Brendan McCann wrote in a report published Tuesday.

Some of the highlights around active ETFs this year, per Morningstar:

- JPMorgan brought in more sales than anyone, at nearly $45 billion, led by flows into its Nasdaq Equity Premium Income ETF (JEPQ) and Equity Premium Income ETF (JEPI).

- The iShares US Equity Factor Rotation Active ETF (DYNF) led all others by sales, at $10.1 billion.

- First Trust, Innovator and YieldMax launched the highest numbers of active ETFs, at 24, 23 and 19, respectively. For the third quarter alone, State Street launched the most products, at 14.

And Then There Are Dual Share Classes: The SEC’s pending approval of dual share classes “should push active ETFs’ market share even higher,” McCann noted. “That’s good for investors since ETFs usually charge lower fees and are more tax-efficient, allowing investors to keep more of their gains.”

Extra Upside

- It’s Not Getting Easier: There are nuances to fixed-income ETF investing.

- Penny For Your Thoughts? One case for investing in small-cap copper miners.

- Atomic Engineering Meets Portfolio Management. Nuclear engineer John Campbell uses systematic models and direct indexing to help investors move beyond mega-cap concentration while harvesting tax losses. His engineering background brings precision to equity selection across markets, in all conditions. Read Campbell’s latest market analysis.*

* Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.

Disclaimer

*Allspring Global Investments™ is the trade name for the asset management firms of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P. These firms include but are not limited to Allspring Global Investments, LLC, and Allspring Funds Management, LLC. Certain products managed by Allspring entities are distributed by Allspring Funds Distributor, LLC (a broker-dealer and Member FINRA/SIPC).