Good morning, and happy Wednesday.

It turns out that some people like to gamble.

NYSE owner Intercontinental Exchange is betting on the booming prediction market, this week announcing a deal for a slice of Polymarket. The exchange owner is putting up an ante of as much as $2 billion for the prediction market and information business, with the valuation for that company at $8 billion. It’s a two-way street: Intercontinental will be a distributor of Polymarket’s event-driven data, and the companies said they’ll partner on tokenization. Just um, don’t call it “betting” … Polymarket “allows users to express their views on events by buying and selling shares of potential outcomes.”

What are the odds that this will be a success?

Gold ETFs Shine as Price Hits $4,000

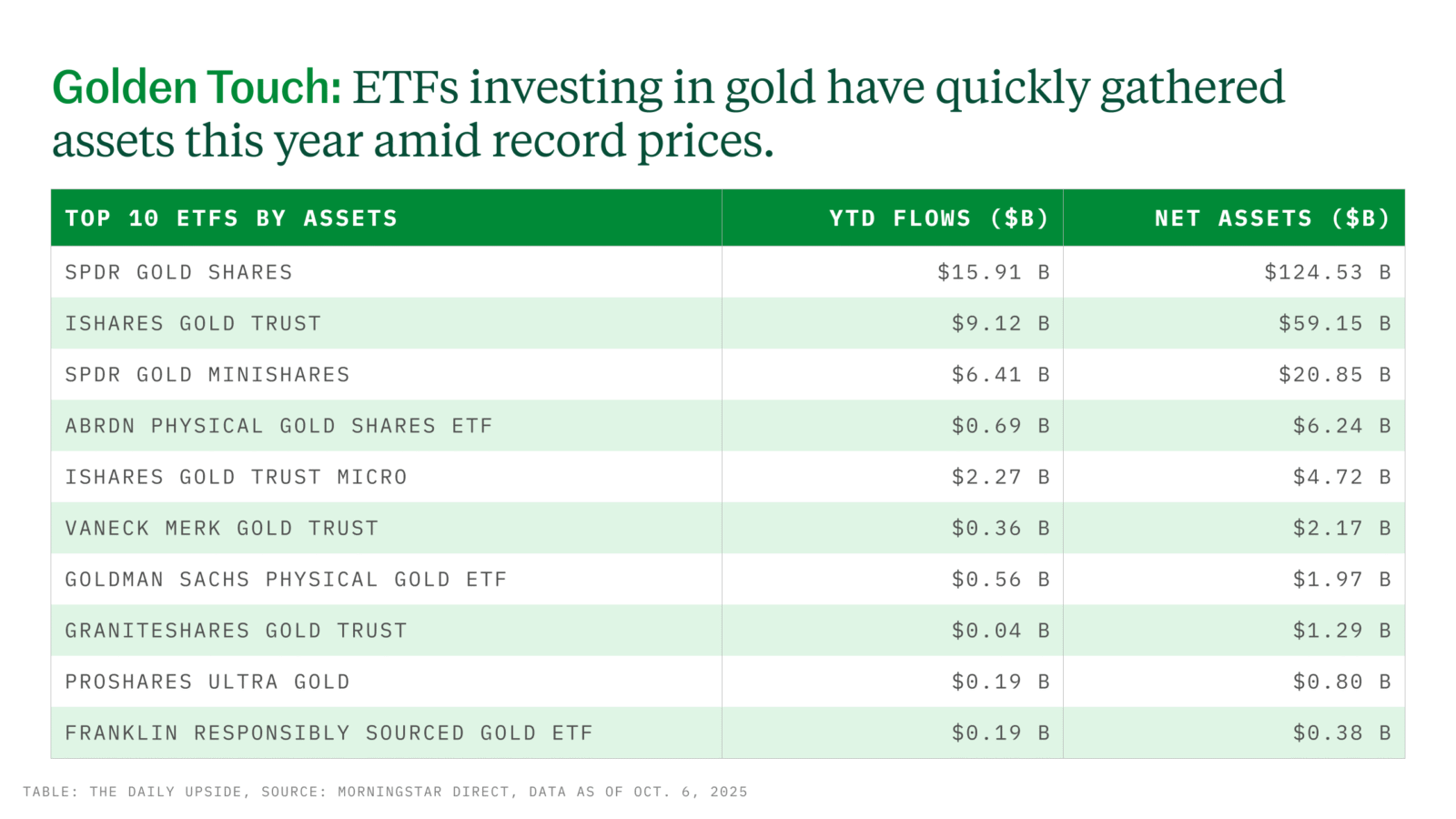

It’s not just a flash in the pan. Gold is having a moment, and ETF sales have gone technically… well, bonkers, as its price crushed records, reaching $4,000 per ounce on Tuesday.

Despite this year’s strong stock market performance, uncertainty is a major concern for investors, with the latest contributor being the US government shutdown. That has people leaning into decentralized stores of assets like gold and cryptocurrencies, said David Schassler, VanEck’s head of multiasset solutions. The current government shutdown feels more severe than prior ones, given that the Trump administration has proposed making permanent workforce cuts. Further, jobs data for September is being delayed by the shutdown, compounding concerns over the Federal Reserve’s independence, inflation and other issues, Schassler said in a statement.

“Shutdowns used to be sideshows,” he said. “Each week brings another hit to institutional trust: political violence, weaponized agencies, fraying alliances and now the shutdown. Investors are beginning to connect the dots.”

Gold ETF Prospectors

More than $9 billion flowed into US gold ETFs in September, the highest-ever figure for a single month. The big winner from that was State Street’s $124 billion SPDR Gold Shares (GLD), which raked in $3.5 billion, according to data from Morningstar Direct. Despite that fund being the biggest seller among gold ETFs last month, it took in even more in August, at $4.1 billion in net sales.

What advisors are saying:

- “I started recommending my clients take an allocation in gold in early 2023 and have not stopped recommending it,” said John Bell, owner of Free State Financial Planning. “While gold has been called an inflation hedge, I think that is a little overdone. In my opinion, gold does best in times of crisis.”

- “We have increased exposure, not as a performance driver, but to protect against market surprises,” said Assunta McLane, senior wealth advisor at Summit Place Financial Advisors.

Golden Eye: Historically, gold has performed well, with annualized returns over 20 years being 11%, compared with 9% for equities and 2% for global bonds, according to a recent report by Pictet Asset Management. Meanwhile, Goldman Sachs analysts are predicting a near $5,000-per-ounce spot price by the end of 2026, The Wall Street Journal reported. However, Citadel CEO Ken Griffin told Bloomberg that he is concerned about the moves investors have made to gold and away from the US dollar.

At least people aren’t just burying gold in their backyards anymore (hopefully).

Active Investing Is Part Of Capital Group’s DNA

“Smart beta and active ETF investing are absolutely not the same,” says Capital Group’s Zahid Nakhooda, drawing a clear line between hands-on research and rules-based execution with little room for manager discretion.

So what does true active investing look like?

It comes down to good old-fashioned diligence and bottom-up analysis. Meeting management teams, dissecting the competitive landscape, scrutinizing suppliers, and dissecting financial statements. It’s just part of the search for signals that other firms without such a dedicated proprietary research effort may miss.

See what sets active management apart from smart beta.

Capital Client Group, Inc.

From 2x To 3x: Behind the Rise of Leveraged Single-Stock ETFs

You might think 2025 has plenty of built-in risk. Some fund managers, however, are betting investors want more.

A flurry of 3x filings hit the SEC’s desk this past week from Defiance ETFs, Themes ETFs and Direxion, according to a recent report from Bloomberg. ProShares also filed Monday for an array of single-stock offerings, holding companies like Amazon and Nvidia but also cryptocurrencies like Bitcoin, Solana and Ether. The products are the latest example of issuers displaying an appetite for risky ETFs and betting that regulators will prove willing to move beyond their prior opposition to 3x strategies. Despite the frenzy, however, experts said the average retail investor should be cautious about getting involved with 3x funds.

“They’re great tools for day traders,” said Brian Glenn, chief investment officer at Premier Wealth. “For our space, wealth management, I think they’re generally horrible.”

Risk, Amplified

Leveraged ETFs work by amplifying the performance of their underlying holdings by a set multiple: if a stock is down 10%, its 2x leveraged ETF would be down 20%. In 2020, the last year of President Donald Trump’s first term, the SEC established a framework prohibiting the creation of new 3x leveraged ETFs, setting a maximum leverage of 2x. As a result, the approval path for current 3x filings is murky at best, with issuers likely betting on a more lax regulatory environment in Trump’s second term. “I’m not sure how exactly these new filings are betting on going through,” said Morningstar research analyst Lan Anh Tran. “It’s either a bet on a change in the framework at the SEC, or a change of mind from the regulators.”

Other recent filers include:

- REX Shares, which filed Tuesday for 59 new 3x single-stock leveraged funds, holding companies like Google, Robinhood and Uber.

- Tidal Financial Group, which filed in June for 12 “LevMax” ETFs holding stocks ranging from Reddit to Palantir.

Glenn thinks the rising number of 3x filings is the result of a few developments. One is broker-dealers wanting to be a one-stop shop for investors; another is the rise of a prolific gambling culture. Many products will close as they lose assets and as the current crop of stocks they’re based on lose notoriety, he added. “In 20 years, with Tesla or Nvidia — it will be like today, if we had an IBM 3x ETF. No one really cares about trading IBM in a leveraged fashion,” Glenn said. “That’s just the life cycle of a company. I imagine as an individual product, they’ll cease to exist, and money leaves, and then they close down.”

Useless Case? For most investors, leveraged single-stock funds aren’t a wise choice, Tran said. The only scenario in which they might work out well is with an underlying holding that increases slightly day by day, but that’s not typically how stocks move. “The more leverage you have … the more you have to make back [when the stock is down],” Tran said. “Usually they don’t make back that much to crawl themselves out of the hole that they dug themselves in.”

International ETFs Are Up 30% This Year

Sometimes all it takes is a phone call.

The iShares MSCI Brazil ETF took in $285 million in investor assets in the week leading up to President Trump’s call on Monday with Brazilian President Luiz Inacio Lula da Silva to reportedly discuss the possibility of lowering tariffs. According to figures from Bloomberg, it marked the first net inflows into the funds since the 50% tariffs on goods from Brazil were announced in July. It didn’t hurt that the ETF is up over 37% year to date, data from VettaFi show, illustrating that while the tariffs may have affected ETF sales, they didn’t necessarily hurt performance. In Brazil’s case, its exports to countries other than the US increased, offsetting the effects of the tariffs, Bloomberg reported.

“You’ve had a pretty strong rally in risk assets over the last six months. India’s been the outlier in what has not worked,” said Todd Sohn, senior ETF and technical strategist at Strategies Securities. “The tariffs haven’t necessarily been a factor for a lot of these single countries.”

International Affairs

India, also facing steep tariffs on US-bound goods, has not been a strong performer this year in the ETF category. The $9 billion iShares MSCI India ETF, for example, has returned 0.23% year to date, VettaFi data show. “While there was a short-term negative reaction, the benchmark Nifty-50 index is up marginally (2%) in local currency terms since the 50% [tariff] rate went into effect,” said Aniket Ullal, head of ETF research and analytics at CFRA Research. “This muted reaction is likely due to the large cap Nifty-50 index being more driven by domestic oriented sectors like financials (36% of the index) and consumer discretionary (12% of the index). Also, critical export-oriented sectors like IT and pharmaceuticals are not subject to the 50% tariffs.”

Meanwhile, China, which has avoided much of the larger tariff rates, has done better. The $10 billion KraneShares CSI China Internet ETF has returned nearly 46%, while the $8.6 billion iShares MSCI China ETF returned 43%. Those figures come as some institutional funds, namely state pension programs, have moved to divest from China, despite the growth prospects.

Nonetheless, investors in single-country funds should be cautious, particularly in emerging markets, Sohn said. “The US has always been a set-it-and-forget-it market, but with other countries, in the emerging space, you have to watch more frequently,” he said.

Performance is similar for some of the biggest ETFs with regional or international exposures:

- The $28 billion Vanguard FTSE Europe ETF has returned 31% year to date.

- The $181 billion Vanguard FTSE Developed Markets ETF is up 30% this year.

- The $8 billion Vanguard FTSE Pacific ETF is up 29% year to date.

Change It Up: While emerging markets can help diversify portfolios, it’s notable that investors “are starting to take some risk off the table” this year, Sohn noted. Allocating to Europe and Japan currently gives more value and industrials than the US, which “is very tech and growth dependent,” he said.

Extra Upside

- No one’s laffing now: The Laffer Tengler Equity Income ETF is beating Vanguard dividend ETFs.

- Put any stock in this? Why S&P 500 Index funds could be riskier than the dot-com bubble.

- Underhanded business: Tom Lee’s Granny Shots US Large Cap ETF just crossed the $3 billion mark.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.