Good morning.

Meta launched a standalone app for its AI assistant on Tuesday, challenging existing offerings from Microsoft-backed OpenAI and Alphabet’s Google, among others.

While the much-hyped launch drew attention to the company’s latest grand initiative, a good question for the chatbot might be whatever happened to Mark Zuckerberg’s last love interest, the ever-lonely virtual reality “Metaverse.” The answer: layoffs as of last week and $60 billion in losses as of the fourth quarter of 2024. Here’s hoping Llama 4, Meta’s AI model, is good at accounting.

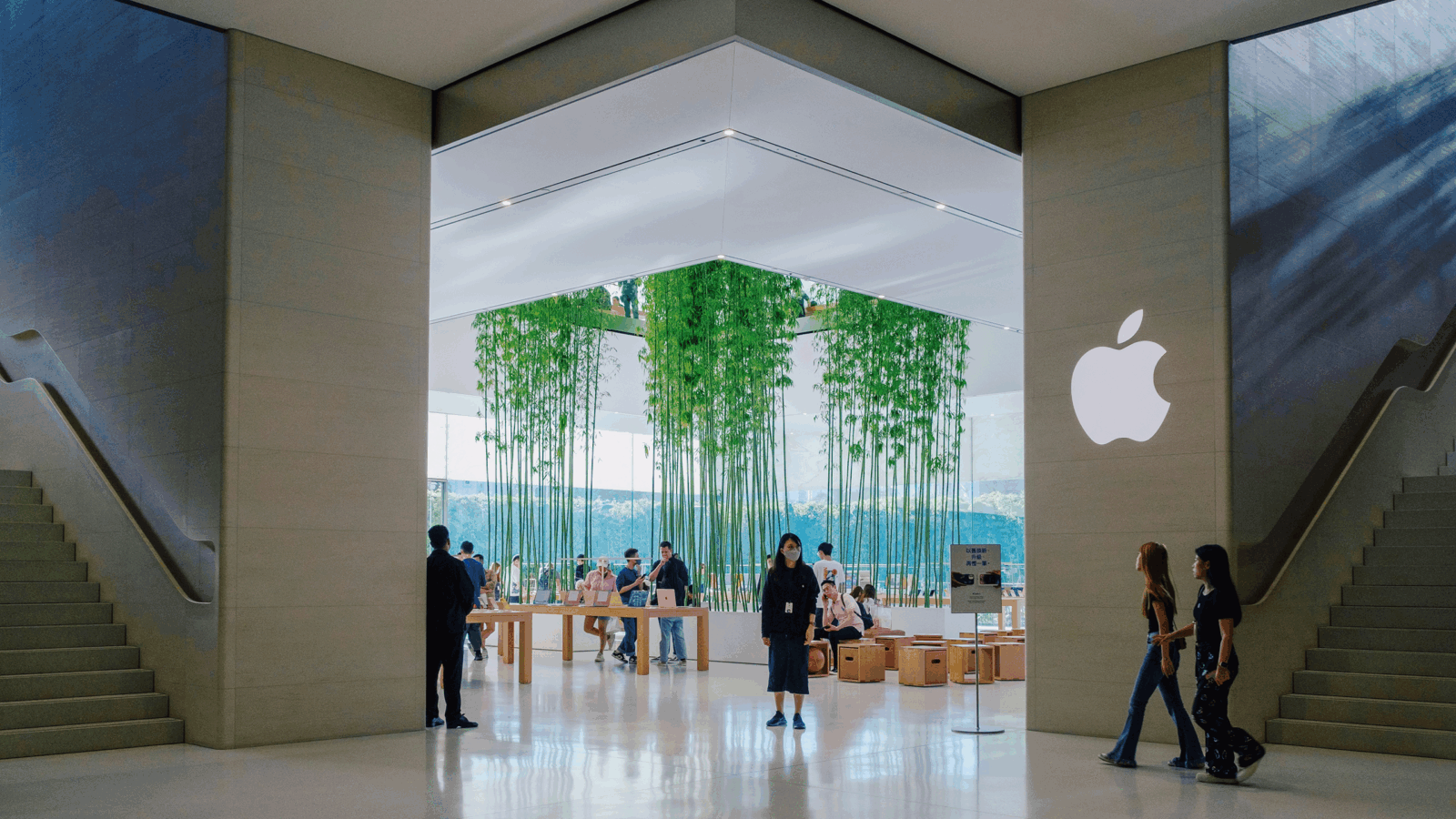

Apple Leads Manufacturing Pivot to India

Thanks to the trade war, Apple suddenly has a China problem. Its solution? India.

Last week, the Financial Times reported that Apple is planning to shift the assembly process for all US-sold iPhones from China to India by the end of next year. And, on Tuesday, Reuters reported that production has already started at one southern India plant, with shipments expected as soon as May. It’s just the latest sign that the world’s most populous nation could end up an inadvertent winner amid the global trade reordering.

An Apple Plant a Day…

To put a spin on the old saying: International mega-corporations plan, trade warriors laugh. Apple spent decades and billions of dollars building a world-beating production line for the single most successful consumer electronic device of all time in China. And, in just a few pen strokes (or, should we say, Truth Social posts?), the White House crushed its entire business model with 145% tariffs levied on Chinese imports.

Apple, of course, has been planning ahead. The Cupertino, California-based giant has been slowly diversifying its supply chains away from the Middle Kingdom for years, opening its first iPhone manufacturing plant in India back in 2017. India now assembles about 18% of the roughly 230 million iPhones shipped every year, according to Counterpoint Research. Assembling all of the roughly 60 million iPhones sold in the US every year will likely require Apple to double its current manufacturing capacity in India, according to the FT. It may just be enough for Apple to stave off raising the price of an iPhone, which has held roughly steady for years now:

- While data from industry research firm TechInsights seen by the FT suggest that tariffs could drive the cost of an iPhone 17 up 30% by the second half of the year, Morgan Stanley analysts say leaning heavier on India assembly plants, as well as sharing the burden of rising costs with suppliers, could help Apple maintain its current pricing. (And for reference: Even with a current 26% tariff rate on Indian imports, assembling iPhones in India is still likely to be far cheaper than assembling them in the US.)

- Apple isn’t wasting any time: In addition to the factory that opened Tuesday, Reuters reports that Foxconn has begun construction of a $2.6 billion facility in Bengaluru, India, which will be capable of assembling as many as 500 iPhones per hour.

Still, not everyone is buying the India pivot as a perfect solution. In a note to clients last week, MoffettNathanson analysts wrote, “The bottom line is a global trade war is a two-front battle, impacting costs and sales. Moving assembly to India might (and we emphasize might) help with the former. The latter may ultimately be the bigger issue.”

Start of the Deal: The 26% tariff on Indian imports may not hold, either. US Treasury Secretary Scott Bessent said Tuesday that the White House is “very close” to a trade deal with India, and Reuters reported that Indian trade officials are offering a rarely-granted “forward most-favored-nation” clause to the US as a sweetener to hasten talks. Perhaps India’s trade negotiators have hired advisors at Goldman Sachs, who, according to a Wall Street Journal report earlier this week, have been advising nation-clients that any form of “symbolic concessions” could be enough to quickly settle trade talks.

ETFs Are Built For Markets Like This

Market swings can rattle even the most seasoned investors. But ETFs offer something rare in uncertain times: flexibility, diversification, and cost efficiency — all in one.

That’s where ETF Upside comes in — a free newsletter from The Daily Upside delivering expert insights on ETF strategies, industry trends, regulatory shifts, and how they impact real portfolios. No noise. No filler.

Whether you’re building your own portfolio or managing money for others, ETF Upside will help you make sharper decisions, faster. Subscribe for free today.

Wegovy-Maker Novo Teams with Online Pharmacies as Lilly Rivalry Heats Up

All it takes to change a pest to a partner is a signature on a dotted line.

Danish pharmaceutical giant Novo Nordisk, the maker of leading weight-loss drug Wegovy, is signing a deal with online telehealth storefronts that ate a chunk of its business selling cheap knockoffs during shortages last year.

Slimmed-Down Offering

Novo Nordisk’s strategic partnerships with telehealth providers represent an aggressive bid to secure market dominance against key rival Eli Lilly, manufacturer of the competing GLP-1 weight loss medication Zepbound.

Novo has been saddled with the perception that Lilly’s pipeline looks much stronger, which has helped drag NY-listed Novo shares down 24% this year. The company’s next-generation weight loss treatment CagriSema has disappointed in trials, while Lilly has a GLP-1 drug in pill form that it expects to be approved this year that would be a game changer (current treatments require injections). BMO Capital Markets analysts said earlier this month that, after Lilly grew revenue 32% last year and Novo 26%, they expect Lilly to leave its rival in the dust in 2025 with another 32% increase compared with only 16% to 24% for Novo.

Last year, the two firms’ grip on the market took a dent when Hims & Hers and other telehealth firms were allowed to sell cheaper copycat versions of their brand-name juggernauts made by compounding pharmacies during a shortage — but Novo and Lilly have caught up on supply and the Food and Drug Administration has ordered the compounding pharmacies to stop by May 22. Novo teaming with the telehealth firms suggests it’s looking to claim additional market share as the compound knockoff tide recedes:

- Novo plans to let three telehealth companies — Hims & Hers, LifeMD, and Ro — sell Wegovy to patients at a major discount: as opposed to the drug’s $1,349 per month list price, Hims will charge $599 per month (which it says “includes access to 24/7 care, ongoing clinical support, and nutrition guidance”) while LifeMD and Ro will charge $499 with no such bells and whistles.

- That’s still considerably higher than the compounded version of Wegovy, which telehealth firms were able to sell for $165 per month. Nevertheless, markets saw it as a big win for the companies: Hims stock climbed 23% Tuesday and LifeMD gained 41% (Ro is privately held). Novo rose a comparatively muted 4%, but could benefit more along with Lilly when the knockoffs stop in late May.

Dissenting View: While Lilly, whose stock is up 14% this year, has been a consensus market darling, analysts at one firm broke ranks on Monday: HSBC downgraded the company from “Buy” to “Reduce,” making it the only firm with a sell rating on the stock. The rationale: Wall Street’s simply too giddy, and both Novo and Lilly have missed earnings expectations in the last year thanks to overeager estimates. Weigh your investments accordingly.

This Smart Home Company Grew 200% YoY. Ring and Nest transformed security and climate control — now RYSE is doing the same for window shades. With $10M+ in revenue and 127 Best Buy locations, RYSE’s patented tech is reshaping the $158B smart home market — no costly replacements needed. Invest at $1.90/share and get up to 25% bonus shares.

Starbucks Slings High-Speed Drinks in Caffeinated Comeback Plan

Running two minutes late to a meeting is bad. Running two minutes late while holding a “brown sugar oatmilk shaken espresso” is worse.

Starbucks doesn’t want that to happen anymore. A test pilot of the coffee chain’s new ordering algorithm sped up average beverage-wait times by two minutes, Starbucks said. Three-quarters of orders placed at the coffee chain’s test cafes were completed within four minutes.

Earlier this year, CEO Brian Niccol said customers waited more than four minutes for their in-store orders and six minutes on average for mobile orders. Niccol previously oversaw comebacks at Taco Bell and Chipotle and is attempting to turn his success into a three-peat at Starbucks.

The new ordering algorithm is part of Niccol’s turnaround plan, which includes tech updates focused on efficiency but also a push to create a cozy vibe by bringing back hand-written notes on cups and self-serve condiment bars.

Feeling French-Pressed

Niccol is grinding to revive Starbucks after the coffee giant notched five straight quarters of declining US revenue. The latest quarter, reported yesterday, showed no signs of a turnaround just yet.

Struggles at Starbs aren’t limited to the US. Its second-biggest market, China, notched flat sales yesterday after four quarters of consecutive declines.

- China, which was tea-dominated before Starbucks started opening stores there in 1999, now has more coffee shops than the US. The market grew 25% from 2018 to 2023.

- Starbucks lost a fifth of its market share from 2019 to 2024 (it plummeted to 14%), as rivals including Luckin Coffee, Cotti, and even KFC’s K Coffee foamed up growth. Local leader Luckin Coffee now makes more revenue than Starbucks and has nearly three times as many Chinese stores.

Channeling Central Perk. Starbucks could have a better chance standing out from its competition by focusing on its in-store experience. In China, Starbucks is still a go-to spot for studying, co-working, and chatting, while rivals focus on speedy take-out. Americans are also looking for a “third place” to hang out, and Niccol has said he wants Starbucks to reclaim that role. A focus on tech-driven efficiency, however, could clash with offering a laid-back hangout spot, and baristas, who’ve complained about understaffing, could have a hard time cultivating a chill vibe while slinging orders at top speed.

Extra Upside

- Five-Year Low: Consumer sentiment sank to the lowest since May 2020, raising fears spending could slow down.

- Cola Confidence: Coca-Cola said demand for its sodas is going strong while warning that consumer sentiment could deteriorate, but said tariffs are “manageable” thanks to its local operations.

- Trump’s Tariffs Triggered A Stock Wipeout. Many ran for the exit signs without a plan. Smart traders are using VantagePoint A.I. to quietly reposition their portfolios to take advantage of new opportunities. Take advantage of the crash here.*

* Partner