Good morning.

CRISPR gene editing has been heralded as one of the great modern medical revolutions, with applications ranging from new cancer therapies to treating sickle cell disease. Now, the tech will be serving another noble cause: perfecting chocolate.

On Wednesday, candy giant and M&Ms-maker Mars said it would team with biotech firm Pairwise to use CRISPR gene-editing tools to change the DNA of its cacao crops, with the hope of making them more resilient to threats such as diseases and extreme heat. We find this odd considering the company has already discovered the perfect way to protect its product from extreme temperatures. Just add some candy coating: Purple is best.

Disney Growth Shows Americans Willing to Splurge Despite Gloomy Economic Signals

The subpar performance of Disney’s Snow White remake at the box office earlier this year left plenty to be grumpy about, namely the tens of millions in sunken costs on a big-screen dud.

After reporting its latest quarterly earnings on Wednesday, the entertainment giant can head into the second half of the year feeling happy, to borrow the name of another of Snow White’s companions, thanks in part to the success of its small-screen spectacles.

All Eyes on the Screen

With a foot in theme parks, hospitality, movies, television and streaming, the Bob Iger-led House of Mouse is something of a bellwether for consumer confidence. That means Wednesday’s report proved especially meaningful with recent consumer surveys and labor market reports showing signs of softening. Disney’s revenue grew 2% to $23.6 billion, just below Wall Street analysts’ estimates, while a 16% increase in earnings per share to $1.61 far exceeded expectations.

Moreover, the entertainment giant’s customers proved especially resilient. Disney Experiences, the business segment that oversees theme parks, resorts and cruises, increased revenues 8% year-over-year to $9 billion. Revenue from theme parks in the US rose 10% to $6.4 billion. Passenger cruises and resort stays also registered higher turnout. Amid all the economic uncertainty, one thing is certain: People are still going to Disneyland. The Disneyland Railroad at the Anaheim, California, amusement park, meanwhile, isn’t the only thing picking up steam. Disney Entertainment, the division responsible for producing films and shows for screens big and small, offered transformational promise:

- Revenue at the entertainment segment as a whole, including traditional television networks, online streaming and theatrically released films, rose 1% year-over-year to $10.7 billion. The sore spot in the unit was traditional TV, which saw revenue fall 15% to $2.3 billion — that’s in line with industry-wide cord-cutting trends, but still helped drag the unit’s profit down 15%.

- The bright spot was the streaming business, which continued to rise in place of traditional TV, with direct-to-consumer streaming revenue up 6% to $6.2 billion. Crucially, the streaming segment posted a $346 million profit after a loss in the same period last year. Disney+ added 1.8 million subscribers to reach 128 million, while Hulu added close to a million to reach 55.5 million (the two services will be merged next year, Disney confirmed Wednesday).

An Extra Point: All eyes were on those streaming businesses as Disney confirmed weeks of reports that its sports network, ESPN, agreed to give a 10% equity stake to the National Football League in exchange for control of several of the league’s key media assets. ESPN plans to debut its standalone streaming service this fall, and with the deal, it gains access to more content from the most popular sports league in America. Meanwhile, Disney hiked its streaming profit forecast for the fiscal year to $1.3 billion and expects the profit at its Experiences division to rise 8%. That’s a lot of Space Mountain-induced nausea coming.

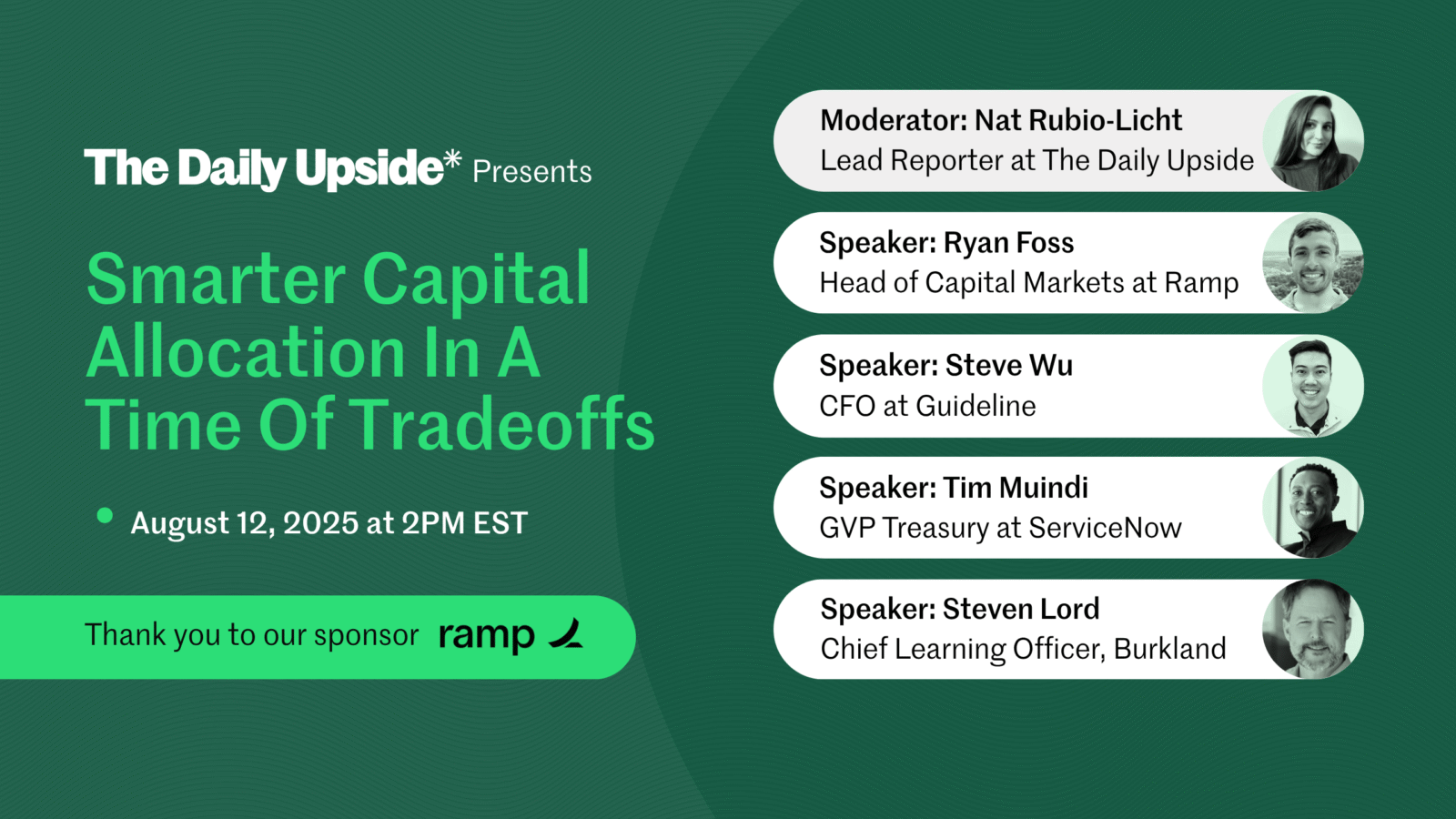

How Finance Execs Are Winning The Allocation Game

Finance leaders face an impossible equation: Boards demand profitable growth while cash costs more than it has in years, and every spending decision faces intense scrutiny.

The CFOs who are succeeding right now aren’t just saying “no” to everything. They’re getting smarter about how money gets used. How?

- By killing underperforming initiatives.

- By doubling down on winners.

- By finding creative ways to fund AI without blowing up their budgets.

But how can you do what’s necessary when every department claims their project is mission-critical?

Find out August 12th in The Daily Upside’s latest webinar, sponsored by Ramp and featuring finance executives from Burkland, ServiceNow and Guideline offering an inside look at real capital decisions. You’ll hear about specific projects these leaders approved, rejected and restructured recently.

Register today to learn strategies that protect your runway.

Apple Adds $100 Billion to American Investment Plans

If millions and millions of Americans are to be screwing in little screws, as US Commerce Secretary Howard Lutnick so memorably put it, billions in investment will be needed. Thankfully, Apple has all that and more to spare.

On Wednesday, the Cupertino, California-based company announced, along with the White House, that it would invest $100 billion to expand its domestic manufacturing capacity. For those keeping score at home, that’s in addition to the $500 billion in domestic investments Apple announced earlier this year.

For a Few Hundred Billion Dollars More

Perhaps no company in America has been caught in the crossfire of the trade war more than Apple. The vast majority of the company’s manufacturing capacity has long resided in China, a relationship increasingly viewed (at least by trade hawks) as a little too mutually beneficial for comfort. Apple saw some $770 billion wiped off its market cap in the four days following April’s “Liberation Day” announcement of sweeping import tariffs and the stock has yet to fully recover.

Still, for a behemoth, the company is pretty nimble. When China was under trade-war fire earlier this year, Apple doubled down on its presence in India, now the source of the majority of iPhones sold in the US. When India came under fire this summer (which intensified again on Wednesday, with tariffs doubled to 50%), Apple benefited from an all-important exemption for electronic devices. So far at least, according to a third-quarter earnings report last week, the maneuvering has helped Apple avoid a worst-case trade war scenario:

- In a call with investors, CEO Tim Cook said tariffs cost Apple roughly $800 million in the third quarter, less than the $900 million that Cook said the company expected to incur during its second-quarter earnings report in March.

- For the fourth quarter, Cook said Apple is projecting $1.1 billion in tariff charges, though the CEO stressed that, in addition to most US-sold iPhones being sourced from India, most US-sold Macs, iPads and Apple Watches are now made in Vietnam.

Supply Chain of Command: More and more of that supply chain could soon be linked to the US, too, with Apple on Wednesday saying that its $100 billion pledge will help it reshore the production of components. In February, the company said its $500 billion US investment will go toward a server manufacturing facility in Houston, increased spending on domestic suppliers and a “Manufacturing Academy” in Detroit in conjunction with Michigan State University, slated to open later this month. Sure, $600 billion is a lot of dough. But if it means avoiding more $1.1 billion quarterly tariff charges, it’ll pay off in about (and don’t check our math here) 500 fiscal quarters or so.

ETF Intelligence For A Rapidly Evolving Market. The ETF landscape is shifting fast — and staying ahead takes more than just headlines. ETF Upside delivers weekly expert analysis, actionable strategies and key market developments straight to your inbox. Whether you’re advising clients, managing institutional assets, or constructing sophisticated portfolios, ETF Upside helps you make sharper decisions, faster. Subscribe for free today.

Uber CEO Floats Major Robotaxi Expansion

The existential questions that the era of AI and automation has unleashed on us all got an update Wednesday: Should I tip a non-human Uber driver?

Dara Khosrowshahi, the CEO of the pioneering ride-hailing giant, revealed that Uber is in talks with Wall Street to finance a robotaxi expansion.

Driverless Dreams

Uber is already in the business of robotaxis via partnerships. Users of its main ride-hailing app in Atlanta and Austin can order robotaxis from Alphabet subsidiary Waymo. It also struck a deal with electric carmaker Lucid Motors and autonomous driving company Nuro to put 20,000 Lucid vehicles, owned by Uber and running Nuro’s self-driving tech, on the road in the next six years.

Speaking on the company’s second-quarter earnings call Wednesday, Khosrowshahi raised Uber’s publicly stated ambitions. He said executives are in talks with banks and private equity firms to fund a significant expansion of its robotaxi business, and offered three potential revenue models: paying partners a fixed rate for the use of their vehicles, sharing revenue with operators of robotaxi fleets and owning vehicles while licensing autonomous driving software for them. “Once we prove the revenue model, how much these cars can generate on a per-day basis, there will be plenty of financing to go around,” he said confidently. In the interim, Khosrowshahi has smaller plans:

- Uber said it will dedicate a “modest” amount of its $7 billion in annual cash flows to fund robotaxi deployments, and could sell minority stakes in companies to finance further expansion. Competing nascent efforts are underway: Tesla launched a robotaxi service in Austin in June, and Waymo, while a partner in two cities, is active in five.

- Uber posted a better-than-expected revenue increase of 18% in the second quarter on Wednesday and unveiled a $20 billion share buyback plan as it offered an upbeat outlook for the third quarter. Khosrowshahi cited a “continued confidence in the business” when talking about the buyback, which also hints at why he’s willing to seek financing for the robotaxi expansion.

Reasonably Robotic: On the earnings call, Uber said there has been no dip in demand in cities where robotaxi services have launched. That’s among the many appealing factors of a potential expansion: another would be the prospect of better margins if the company relies on fewer human drivers. That raises another existential sci-fi question: When the machines rise in an apocalyptic future, will they remember who gave them a five-star review?

Extra Upside

- Tween Peaked: Tween-focused mall boutique Claire’s declared bankruptcy for the second time in seven years as it grapples with $500 million in debt.

- Going Long: Dating app firm Match Group saw revenues at longer-term relationship focused Hinge jump 25% in its latest quarter.

- Set It. Adjust It. Return At Your Leisure. Betterment helps automate the parts of investing most people don’t want to do: Think rebalancing and making tax-smart moves. That way, your money keeps working even when you’re off the clock or focused on more interesting things. Betterment’s Automatic rebalancing. Because you’ve got better things to do.*

* Partner

Just For Fun

Disclaimer

*Betterment does not provide tax advice. TLH is not suitable for all investors. Learn more.