Good morning.

The real bubble may be in tech terms rather than new tech. Collins English Dictionary’s word of the year is “vibe coding,” telling a chatbot to write code based on your ideas. Cambridge English Dictionary chose “parasocial,” a connection someone feels to a person they follow on social media. Oxford English Dictionary nominated “rage bait,” making people angry to drive traffic.

Merriam-Webster has now weighed in with its pick: “Slop,” already defined as food waste fed to pigs, has taken on an additional meaning, referring to the low-quality output of artificial intelligence. The road to AI superintelligence seems to be paved with nightmarish images full of distorted faces and people with too many human fingers and countless hallucinations.

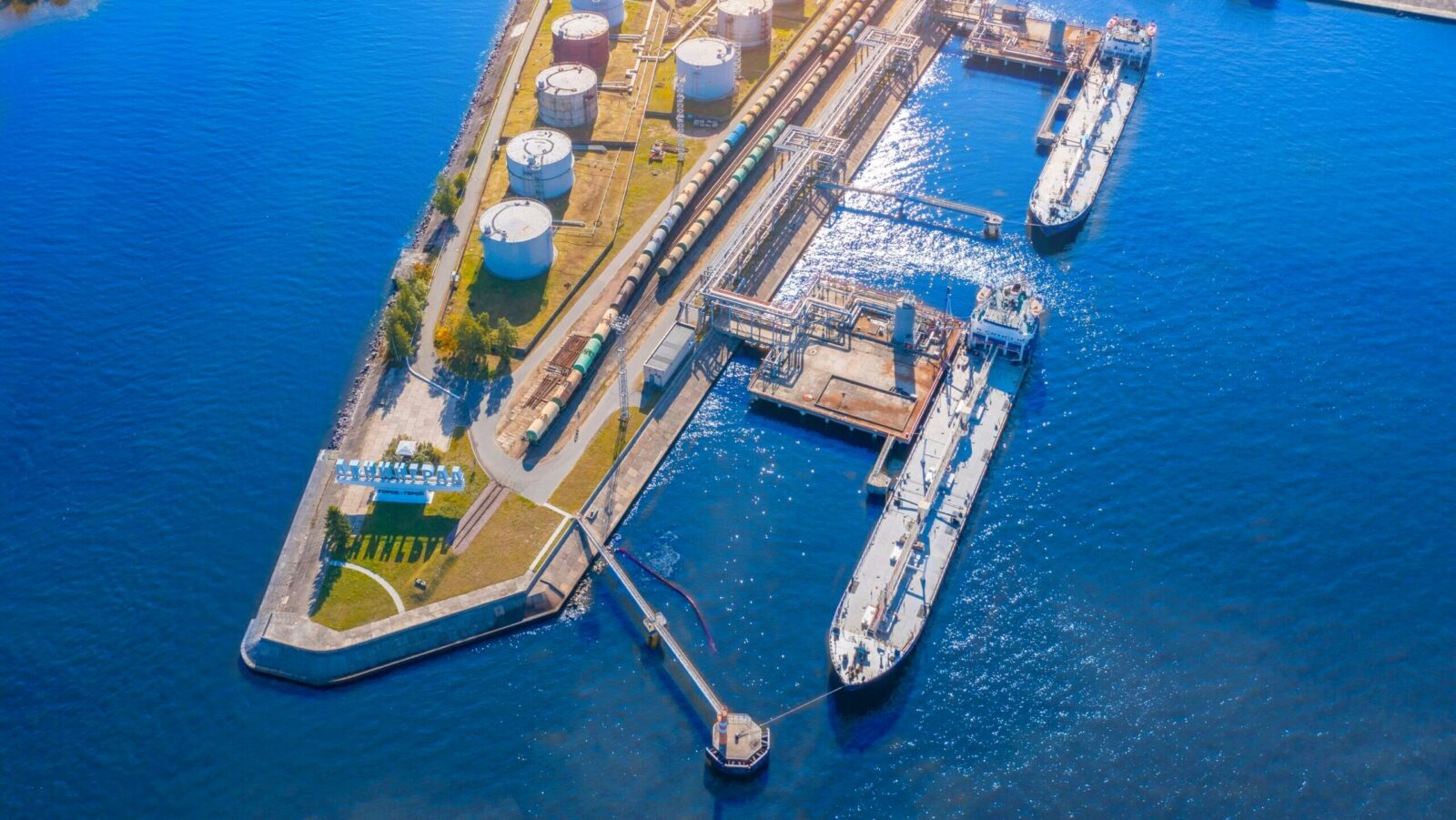

US Crude Slides Toward Worst Year Since 2018

Billy Bob “Landman” Thornton is back on Paramount+ as a Permian Basin fixer, and real-life Texas oil firms could use some of his swagger.

US oil prices sank 3% on Tuesday, continuing a nearly two-year trend that has now left them near their lowest point since early 2021 — a.k.a., the tail end of worldwide Covid shutdown mandates. We’ll take anything cheap at this point, so cool. But it could be another sign of a broader economic slowdown. Meanwhile, geopolitical maneuvers in both the Eastern and Western hemispheres may rattle the market.

Hit The Gas

So how low have prices fallen? US crude is down 23% year-to-date, its worst performance since 2018; the global Brent benchmark, by comparison, is down 21%, its worst performance since 2020. Correspondingly, Americans are enjoying the lowest prices at the pump in about 4 years, according to drivers’ organization AAA, with the average price for a gallon of gas at long last falling below $3.

The dollars saved are sure to be welcomed by Americans facing otherwise persistent inflation and an economic slowdown that may well be spurring oil’s slump; in a shutdown-delayed October/November double-jobs report published Tuesday, the US Bureau of Labor Statistics reported the US unemployment rate has hit a four-year high of 4.6%. (Maybe Thornton’s next streaming series role could be a monologuing central banker caught between rising prices and slowing economic activity? We’d give it a watch!)

For the foreseeable future, at least, consumers can pencil in more price declines:

- According to a recent JPMorgan Commodities Research note seen by Reuters on Tuesday, 2025’s oil surpluses are expected only to widen through 2026 and 2027, with global supply expected to expand at three times the rate of demand growth next year.

- Behind the global surplus lies a trifecta of forces: a rapid uptick in production from OPEC+ member nations, slowing manufacturing activity in China (down to a 15-month-low in November), and growing US pressure on Ukrainian officials to accept peace agreements with Russia, which would free Ukraine’s oil infrastructure from Russian attacks while likely leading to loosened or lifted sanctions on Russian oil from western nations.

East to West: At the same time, mounting tensions around Venezuela have the market’s attention. The country’s oil exports have plummeted since US forces seized one of the country’s oil tankers last week. “The grind lower in oil prices and the achieving of month-to-date lows across the major futures complex last week might have seen more negative pricing if it were not for the upping of the ante by the United States with regard to Venezuela,” PVM analyst John Evans told Reuters.

Can Strong Global Market Performance Trends Continue?

Fisher Investments’ forecast suggests this bull market is supported by healthy fundamentals, like moderate GDP growth, rising corporate earnings and improving global trade conditions. Despite fearful headlines and skeptical investor sentiment, they believe this market has room to run and there are still opportunities for growth. Their latest forecast offers a grounded perspective on the current landscape, exploring both the tailwinds driving this bull market and the potential pitfalls — from policy changes to geopolitical shifts.

Databricks Snags $4B in Funding as AI Keeps Investors Enthralled

Why IPO when you can Series L?

That’s the question Databricks is answering this week with the announcement that it’s raising more than $4 billion in its latest funding round. That puts its valuation at $134 billion — a 34% jump from a previous funding round over the summer. This one was led by Insight Partners, Fidelity Management & Research Company and J.P. Morgan Asset Management, with additional participation from Andreessen Horowitz.

Gone are the days when startups fought for scraps in public markets. Today, many young companies are forgoing the opportunity to ring the stock exchange bell in order to sidestep the regulatory scrutiny that comes with an initial public offering. Research from the University of Florida shows that the median age of companies debuting on the public market was six in 2000, compared with 14 in 2024. In May, OpenAI closed the largest private tech deal on record with a $40 billion funding round.

But Databrick’s financing may still be somewhat of an anomaly, since Series L funding rounds aren’t common and aren’t expected to become common, Kyle Stanford, PitchBook’s director of US venture-capital research, told The Wall Street Journal.

All in on AI

The AI boom has been very good to Databricks.

The private tech giant provides a cloud-based platform for companies to store, process and analyze their data, as well as develop custom AI models. In the past year, it began partnering with AI safety and research company Anthropic to help companies make their own AI bots, and with OpenAI to make its models available in Databricks products. With this new funding, it’s continuing to go all in on AI:

- The company said it would use the new capital to grow its AI-driven applications, support future AI acquisitions, deepen AI research and provide liquidity for its employees.

- “Databricks investors are pricing in a world where every corporation is a data company and needs a unified platform to clean, analyze and operationalize information,” Michael Ashley Schulman, partner at Running Point Capital Advisors, told Reuters.

Revving up Revenue: Databricks said it topped $4.8 billion in annualized revenue during its third quarter — up 55% from a year earlier.

Blue Bottle Fever? China’s Luckin Coffee Weighs Offer for California Chain

From coconut latte to single-origin pourover: Chinese coffee-and-tea giant Luckin is said to be in the early stages of considering a bid on Blue Bottle Coffee as it expands its presence beyond Beijing.

Luckin is known for creative and low-cost takes on coffee, while Blue Bottle has built a name for itself by selling straightforward, high-quality classics. Blue Bottle Coffee’s majority-owned by Nestle, which bought a 68% stake for $425 million in 2017, according to Bloomberg. Luckin is also said to be considering buying other coffee chains, including China-based % Arabica and Coca-Cola-owned Costa Coffee — although sources say Luckin’s unlikely to move forward with Costa.

Feeling Fully Caffeinated

Luckin has expanded rapidly since opening its first stores in 2017. It now has more than 29,000 locations, mainly in China. Luckin surpassed Starbucks in China by number of stores in 2023 and by annual sales the next year. In the fall quarter, Luckin raked in $2.1 billion in revenue, up 50% from the same period a year before. Starbucks, meanwhile, agreed last month to sell the majority of its Chinese stores to private equity firm Boyu Capital and is in the middle of a comeback plan to regain its footing in North America.

Now, Luckin’s looking to bring its success abroad:

- Luckin opened 3,000 new stores in the last quarter, including a handful in Singapore, Malaysia and the US. The Chinese chain now has four stores in New York, according to its website, and plans to open two more.

- Acquiring new chains with a global presence could also help Luckin push beyond China: Blue Bottle has locations in California, New York, Japan, China and South Korea. % Arabica has a global footprint across the Middle East, Asia and Europe, as well as 12 locations in Canada and Mexico — though most of its outlets are in mainland China, per its website.

Quiet Siren: Starbucks has struggled to regain the same appeal it had during the peak PSL years. While the company helped spark China’s coffee-drinking habits in the 1990s, Luckin quickly knocked the Seattle company off balance with lower prices, localized flavors (like a latte flavored with China’s national liquor, baijiu), and efficient mobile ordering. Starbucks, meanwhile, has been hit with complaints about its slow app-order turnaround and is in the middle of a transformation effort that focuses more on an in-person vibe than on digital efficiency. That could create an opening for Luckin.

Extra Upside

- Rate Cut Fodder: The US gained 64,000 jobs in November, according to Labor Department data. But payrolls declined 105,000 in October, and the unemployment rate stands at an unexpectedly high 4.6%.

- Shifting Into Reverse: The European Union, which previously proposed to ban the sale of new gas-powered cars by 2035, is backtracking and now wants to allow up to 10% of sales to remain combustion-engine vehicles.

- You’ve Never Used Voice-To-Text Like This Before: Wispr’s Flow is AI-powered voice dictation that edits as you speak and turns your raw thoughts into clear writing, instantly. Use it across all your apps to work faster, stay sharp and reclaim your time. Download Flow for free.*

* Partner

Just For Fun

Correction

Our apologies for overstating the amount of Saudia Arabia’s payments to consulting firm McKinsey in an article in Tuesday’s newsletter. The kingdom shelled out about half a billion a year to McKinsey in the 10 years through 2024. We’ve replaced the battery in our calculator to prevent similar mistakes going forward.