Good morning and happy Monday.

Google is ready for Mortal Kombat. Shares in leading video game companies came crashing down harder than a barrel hurled by Donkey Kong on Friday, in the wake of the Alphabet subsidiary and search giant’s debut of an artificial intelligence model that can create virtual worlds based on simple user prompts. Grand Theft Auto maker Take-Two Interactive fell 8% and online gaming platform Roblox dropped 13%, mimicking the ragdoll physics of an open-world character that fell off a cliff.

Project Genie, Google’s AI model, can also use uploaded images to build out its simulated environments. That helped push Unity Software, which licenses its popular software framework for the development of video games and their environments, to an even more dramatic 24% loss. While it’s not game over, the industry’s difficulty setting has gone from “expert” to “nightmare.”

*Presented by Betterment. Stock data as of market close on January 30, 2026.

Betterment’s tax-saving tech can help you maximize after-tax returns.*

As Disney’s Bob Iger Runs Out the Clock, Some Protegés ‘Can’t Wait to Be King’

CEO turnover has reached a record high, according to a report Friday from leadership advisory firm Russell Reynolds Associates. Apparently, the only safe job in Corporate America is being Bob Iger.

The Walt Disney Company’s never-can-say-goodbye boss is slated to walk away from the top spot (again) at the end of the year, with a successor supposedly to be named in the near future. While no one is necessarily expecting the heir apparent to be named on the company’s earnings call today, analysts began to note last week that the drawn-out replacement process is starting to weigh on Disney’s share price. We know moving on is hard, but we would think, of all people, Bob understood The Circle of Life.

Magic Kingdom Monarch

We do have some clues as to when a new CEO will be named. “Disney’s board has confirmed plans to announce the next CEO in ‘early 2026’ — we expect prior to the Annual Shareholder Meeting on March 18,” JPMorgan analyst David Karnovsky wrote in a note last week seen by Yahoo, though added he isn’t expecting any white smoke to rise from Cinderella’s castle today. And despite Iger’s previous replacement — former parks chairman Bob Chapek — getting thrown to the proverbial hyenas, plenty of Disney higher-ups are still throwing their mouse-eared hats into the ring amid a succession race overseen by current chairman and former Morgan Stanley executive James Gorman.

Those names include TV head Dana Walden, films chief Alan Bergman, ESPN president Jimmy Pitaro, and head of parks Josh D’Amaro. Each has a case for and against:

- D’Amaro is the current odds-on favorite, according to contracts on predictions market Kalshi; Parks and Resorts is the biggest revenue driver in the Magic Kingdom. But as Chapek’s brief stint proved, talent relations is the core of the CEO gig. “You’ve got to be able to manage creative people and the egos around Hollywood,” Kevin Mayer — Candle Media CEO, former Iger lieutenant and one-time heir apparent — told Yahoo last year.

- Walden, meanwhile, drew criticism and then praise for her handling of the Jimmy Kimmel suspension fiasco last year (Kimmel eventually endorsed her for the top job), while Bergman has overseen a rocky few years at marquee studios Marvel, LucasFilm and Pixar. Pitaro has had the tough task of saving ESPN from the sinking cable ship.

Big Shoes: Whoever gets named will have the tough job of turning Iger’s late-era ambitions into reality. Disney is in the midst of a five-year, $60 billion expansion of its parks and cruises business. On the content side, it’s still digesting a deal to take over NFL Networks — in exchange for the football league taking a 10% stake in ESPN, forging a new kind of partnership. Meanwhile, a potential pairing of Netflix and Warner Bros. may empower Disney’s chief content rival even more. “While the change is not likely to result in major strategic shifts, we do believe the uncertainty around the process has been an overhang to shares and see a catalyst in the announcement and any visibility into a smooth transition process,” Karnovsky wrote.

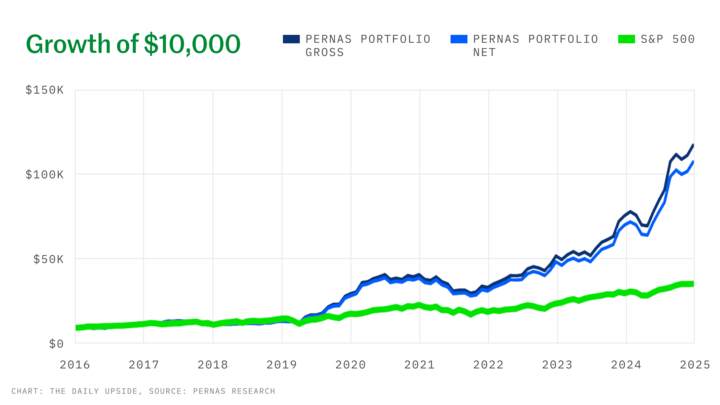

Two Brothers vs the S&P 500 — Guess Who Won?

Most investors can’t match the S&P 500, let alone beat it. So how have two brothers nearly doubled its returns since 2017?

Deiya Pernas (former exec at a $3.5 billion fund) and Dean Pernas (trained chemical engineer) follow these simple rules:

- Respect the power of “no.”

- Stay in your investment lane.

- Select just a few investments per year.

The results? 31.4% returns annualized per year for the Pernas Portfolio, crushing the S&P’s 15.1%.

Here’s where you come in: You can join their exclusive email list and receive weekly market insights and stock research absolutely free.

(Some of their recs have returned +200%.)

Ready to get in on the action? Join the Pernas brothers’ distribution list here.

Will Lunar New Year Mark Start of China’s Luxury Comeback?

The luxury market is saddling up for the Year of the Fire Horse, hoping that diamond-encrusted horse merch will have Chinese shoppers splurging this Lunar New Year. Luxury sales have been dragged down for years by slow spending in China, where the sector’s biggest spenders have yet to shop like they did before the pandemic.

The Lunar New Year, an extended holiday that people celebrate by traveling and shopping, reflects the Chinese economy’s health. Last year, tourism revenue and travel rose from the year before, but daily spending was still below prepandemic levels. To help reverse the trend and boost spending, China extended the official holiday this year by one day, to nine days total, starting on February 15.

The Year of the Fire Horse — which astrology lovers might know is all about rebirth — could be the beginning of a comeback for spending in China. Recent earnings reports, along with an analysis from Bain, suggest the country’s luxury spending could soon bounce back above 2019 levels.

Still Waiting on that Red Envelope

As China copes with a real estate crisis and a long-lasting hit to consumer confidence from the country’s Covid shutdown, its luxury market has struggled. Bain found it contracted as much as 5% last year. But that was a comeback from the year before, when it fell nearly 19%, and Bain spotted signals of a recovery starting in the third quarter.

That shallowing of the crisis is reflected in recent earnings reports, although performance has been a mixed bag from brand to brand:

- Cartier owner Richemont said sales in China, Hong Kong and Macau ticked up 2% in the holiday quarter. China makes up about a fifth of the Van Cleef & Arpels parent’s revenue, and the boost helped its overall sales climb 11%. Burberry also posted expectation-beating sales in the December quarter, buoyed by Chinese shoppers (Burberry’s logo is a horse if astrology has anything to do with it).

- LVMH, which owns brands like Dior and Louis Vuitton, has had less luck but is still showing signs that a comeback could be on the horizon. Europe’s biggest company by market cap said its sales in China rose in the fourth quarter. Its overall sales remained tepid, slightly above expectations, while its core biz (apparel, leather goods) fell 3%. Investors pulled down shares of a whole basket of luxury stocks after LVMH’s call — including Birkin-maker Hermes and Gucci-owner Kering, both set to report this month.

Red Thread: The luxury sector is tethered to consumer confidence in China. The Lunar New Year may be when shoppers in the country feel most like splurging, so how much they spend will be seen as a bellwether for the broader luxury market. It’s off to the races.

There’s a New Rising Star That’s Setting the Bar for What “Time-To-Value” Means in FP&A. Hint: It’s measured in hours, not months. Aleph is an AI-native FP&A platform that seamlessly connects your cross-system data, spreadsheets and strategy at the speed of startups with the power to support enterprises.

The Daily Upside readers can try out Aleph right now (with your own data) for free.

As Tesla Doubles Down on AI and Robots, EVs Look More Like a Side Hustle

While Tesla romances AI investors with promises of a robotic future, the carmaker is saying “sayonara” to two ground-breaking EVs.

CEO Elon Musk told investors on an earnings call last week that the time has come for its revolutionary Model S sedan and Model X sport-utility vehicle to receive an “honorable discharge.” It’s enough to make investors wonder whether Tesla, once the face of electric vehicles, will next attempt a Facebook-to-Meta style rebrand, awarding side-hustle status to the car business that made Musk the world’s wealthiest man.

‘No Room for Retreat’

There are other signs supporting that theory. Earlier this month, Tesla lost its title as the world’s best-selling EV maker to Chinese company BYD; Tesla said it delivered 1.64 million EVs last year, while BYD sold 2.26 million. (Volkswagen had already beaten Tesla’s EV sales in Europe.) The replacement for Tesla’s retiring EV models? Robots, of course. The company’s Fremont, California, factory that was home to Model S and X production will now be where it builds Optimus humanoid robots that Tesla says will be “capable of performing unsafe, repetitive or boring tasks.”

Tesla is “really moving into a future that is based on autonomy,” Musk said on the company’s earnings call. And it plans to spend more than $20 billion this year to do it, which is more than double the $8.5 billion it spent in 2025. Tesla can afford it. Its balance sheet (with a whopping $44 billion in cash) and operating cash flow provide significant flexibility as the company continues to pivot from a hardware-centric automaker to a diversified technology firm, Garrett Nelson, an analyst at CFRA Research, told The Daily Upside.

“Forget the Tesla you knew,” Canaccord Genuity analysts wrote in a recent note. “The Tesla of yesterday is gone. We believe Elon Musk has reached a definitive ‘burn the ships’ inflection point — a total commitment to a vision that leaves no room for retreat.”

The company is also increasing ties to Musk’s other businesses:

- Tesla said it has agreed to invest about $2 billion into xAI — best known for developing Grok, the AI chatbot integrated into the social media platform X — amid a financing round announced earlier this month.

- Last week, Bloomberg reported that SpaceX is considering a potential merger with Tesla or xAI, citing people familiar with the matter. They added that a deal could attract significant interest from infrastructure funds and Middle Eastern sovereign investors.

Robotaxi Rivals: Tesla faces more competition from Waabi, an autonomous trucking startup that has raised $1 billion in funding in part to grow its robotaxi business. Waabi Driver-powered robotaxis will be exclusively offered via Uber, the company announced last week.

Extra Upside

- Passing the Buck: English businessman Daniel Levy is considering selling his roughly 30% stake in London’s Tottenham Hotspur, one of the world’s most valuable soccer clubs, to a Hong Kong group for $1.4 billion. Meanwhile, the estate of late Microsoft founder Paul Allen is set to sell the NFL’s Seattle Seahawks after they play in Sunday’s Super Bowl LX, with some believing a sale could fetch $8 billion.

- Pedal off the Metal: Silver fell 30% Friday and gold 10% as the safe haven metals were dented by the pragmatic reputation of President Trump’s pick to be the next Federal Reserve chair, Kevin Warsh, whose nomination renewed some confidence in the central bank’s independence.

- Like Chess Grandmasters, Winning Traders See 3 Moves Ahead. VantagePoint’s AI forecasts the next 3 days with up to 87.4% proven accuracy while others still scramble with yesterday’s price data. Discover the 3-Day AI Advantage — register free.**

** Partner

Just For Fun

Disclaimer

*Betterment does not provide tax advice. Investing involves risk. Performance not guaranteed.