Good morning and happy Monday.

A standoff between the US central bank and the Trump administration sent shivers through Wall Street early this morning. S&P 500 futures dipped, the dollar sank and Treasury yields rose, according to Bloomberg, after the Federal Reserve confirmed receiving grand jury subpoenas from the Justice Department threatening criminal indictments related to the renovation of its headquarters.

Fed Chairman Jerome Powell said in a statement that the subpoenas used statements he made to the Senate Banking Committee about the renovation as a “pretext” but are, in reality, “a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president.”

President Trump, who has engaged in a long-running feud with Powell over interest rates, denied any involvement with the investigation, according to The Wall Street Journal. The subpoenas came from the office of Jeanine Pirro, the US attorney for Washington, DC, who is a close ally of the president and a former Fox News host. While it’s too soon to gauge the long-term effects of the developments, one thing is clear: Twelve days into the new year, 2026 has thrown markets a dollar-denominated curveball.

Why Lower Interest Rates May Not Deliver the Affordability Washington Wants

The nonpartisan Congressional Budget Office said last week that it expects the Federal Reserve’s key interest rate to dip to 3.4% by the end of the year, where it will settle until the end of President Trump’s term in 2028. That’s down from 3.9% in the fourth quarter of 2025.

But not everything that happens afterward will necessarily follow a seemingly logical pattern. Despite the Fed rate cuts, the CBO projects the yield on 10-year Treasury notes — which matters to you because it influences interest rates on auto loans, mortgages and credit cards — will rise little by little, from 4.1% in Q4 2025 to 4.3% at the end of 2028. (Mind you, this was before Fed Chair Jerome Powell revealed on Sunday that Trump’s Justice Department threatened him with a criminal indictment for testimony about agency building renovations, in what he suggested is a “threat” to the Fed’s independence.)

Inflation Nation

Last year, the Fed’s rate-cutting spree that trimmed 75 basis points was the key driver of a bond market rally. That’s because lower policy rates typically push down yields, and that increases the value of earlier bonds that were sold with higher payouts. At the same time, robust corporate profits kept the additional yield investors require to hold corporate bonds instead of Treasuries near historic lows (analysts estimate S&P 500 firms’ earnings rose 13% last year, according to LSEG). At the end of the day, the Morningstar US Core Bond TR YSD index returned 7.3% last year, the highest in five years.

The Trump administration would prefer that the past remain prologue and interest rate cuts continue to signal a bond rally, pushing down yields, and ultimately lowering borrowing costs. The White House has even taken steps that seem designed to reduce the key 10-year Treasury yield, most recently instructing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities to apply downward pressure on interest rates. Meanwhile, markets are pricing in roughly a 33% chance of two quarter-point cuts this year, according to CME FedWatch.

But the 10-year yield has remained stubbornly high of late, especially relative to the two-year yield: In recent days, the spread between the two, which registered at 63 basis points on Friday, has been hovering near the highest levels since April. Markets call this a steepening yield curve, and it potentially signals a few things:

- Namely, that investors foresee higher long-term inflation and/or economic growth, which makes them demand a higher yield to offset those things eating into their return. Indeed, Morningstar predicts inflation will rise to 2.7% in 2026 from 2.6% last year, as businesses increasingly pass on tariff costs to consumers.

- Another investor concern that may keep yields on longer-dated bonds elevated is the federal deficit, which the CBO projects will be $1.7 trillion (or 5.5% of GDP, zoinks!) in fiscal year 2026.

Still A Good Bet: “For investors, the bond market remains a source of stability and reliability in uncertain times,” analysts at Raymond James wrote earlier this month, noting Treasurys remain a tried and true safe haven. “We do not expect any dramatic sustainable moves and see the 10-year Treasury yield ending 2026 in the 4.25% to 4.5% range.” Things could change, however, depending on the relationship between the White House and the Federal Reserve. “The market will punish people if we don’t have an independent Fed,” Bank of America CEO Brian Moynihan said last month.

See How You Compare to 3,000 Fellow Investors

State Street Investment Management surveyed 3,000 US retail investors to examine how Americans are building wealth heading into 2026. The research looks at use of savings, retirement and brokerage accounts, the balance between saving and investing and the financial priorities that cut across age groups, including retirement security.

Maxwell Gold, Head of Direct Retail at State Street Investment Management, explains what the data shows about investor behavior and portfolio construction. The discussion addresses differences in account usage, measured adoption of newer technology tools like AI, and the role ETFs play in providing market access and diversification.

This Q&A provides vital context for comparing individual investing habits with those of peers and for understanding the broader trends shaping retail investing in 2026.

The $5 Trillion Question: Can Humanoid Robots Handle Jobs as Well as People?

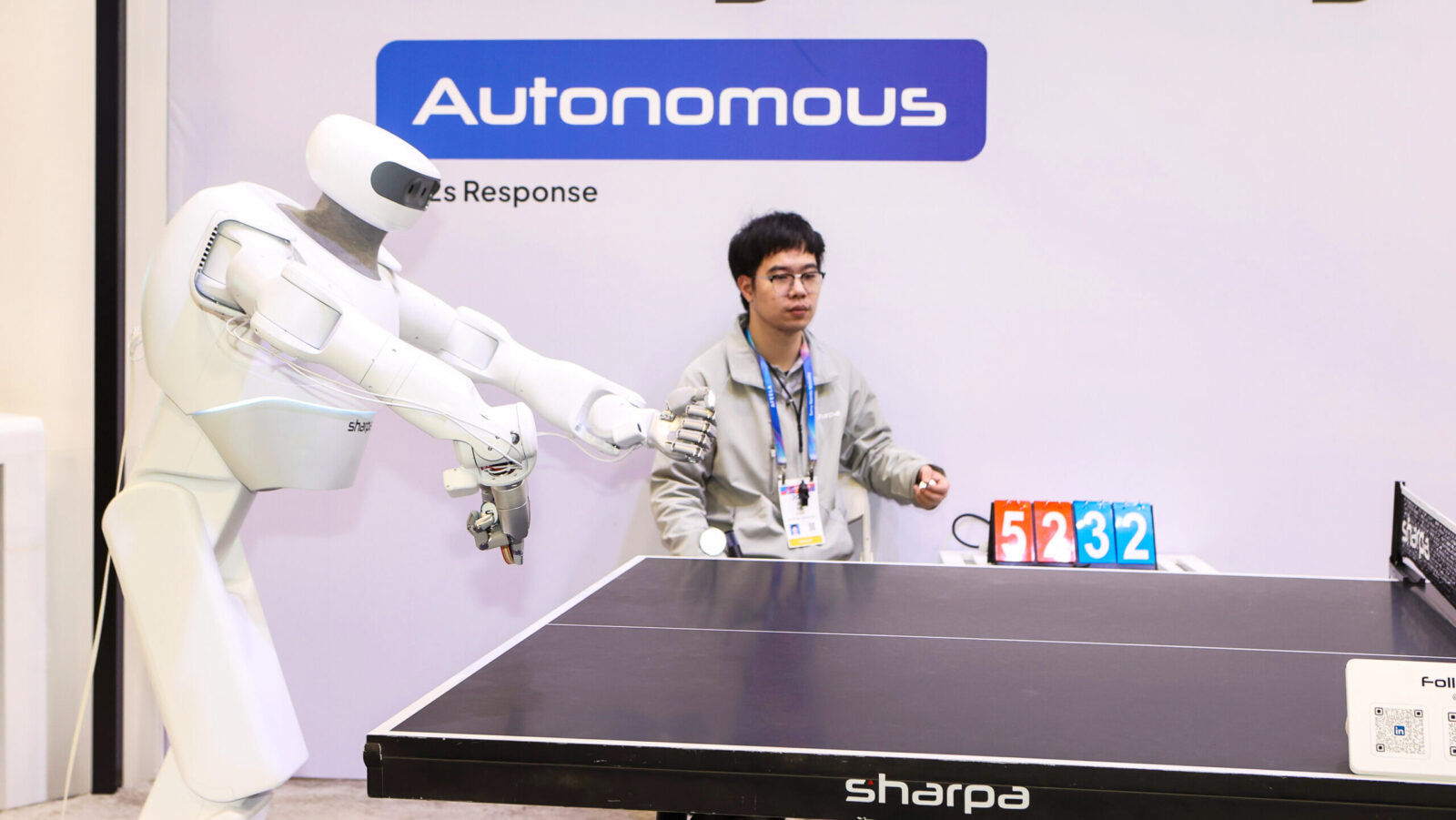

Step aside, Marty Supreme. There’s a new table-tennis champ in town: a robot from Singapore-based AI company Sharpa, which showed off its ping-pong skills (and card-dealing skills) at the Consumer Electronics Show (CES) last week.

Sharpa’s new product — which appears to boast especially dexterous hands, for robots at least — was one of countless new humanoids making a big splash at the big tech showcase. And, sure, these robots walk like humans and some talk like humans and some play ping-pong like humans. But can they really perform in the workplace like humans? Consider it the $5 trillion question.

Are We Humanoids, or Are We Dancers?

That’s how big Morgan Stanley thinks the humanoid industry could become by 2050. Over that time, the bank expects an invasion of more than 1 billion humanoids, who will dominate industrial and commercial landscapes in the coming decades. Right now, humanoids represent a roughly $2 billion market globally, by most estimates. There’s a lot of room to grow — which is why robots were such a major theme at CES this year. “Physical AI” became the conference’s biggest new buzzword, with Nvidia CEO Jensen Huang saying the “ChatGPT moment … when machines begin to understand, reason and act in the real world” is nearly upon us for humanoids.

As CES made abundantly clear, one country appears to be in the lead. “China’s humanoid robotics market is innovating at an extraordinary pace,” Nadav Orbach, founder and CEO of California-based computer-vision startup RealSense, told Bloomberg. The proof isn’t just in the chorus line of choreographed robot dancers at CES (courtesy of Chinese-firm Booster Robotics), but in the actual sales numbers, too:

- Chinese firms were responsible for the vast majority of the 13,000 humanoid robots shipped globally last year, research firm Omdia told Bloomberg last week. Industry-leader Shanghai AgiBot Innovation Technology shipped 5,168 robots on its own.

- In total, sales more than quintupled in 2025 compared with 2024, Omdia said. The Chinese models tend to be considerably cheaper than what’s expected to come out of America; AgiBot’s baseline model goes for $14,000, compared with the $20,000 to $30,000 price tag Elon Musk says Tesla’s yet-to-reach-full-production Optimus bots will go for.

Speaking of Musk, the Tesla founder knows full well the competition he’s up against. “I’m a little concerned that on the leaderboard, ranks 2 through 10 will be Chinese companies,” Musk said of the robotics market last year. (Musk, of course, has Tesla penciled in for the top spot.)

The Real Deal: Show floor party tricks are one thing, but a robot takeover is still a long way off. “Although the humanoids were the ones that grabbed everyone’s attention, and it was the best kind of eye candy for the show, we’re still a very, very long way from the commercial implementation of these,” Ben Wood, chief analyst for CCS Insight, told CNBC.

Ready To Plan Your Retirement? It starts with understanding your goals. When to Retire: A Quick and Easy Planning Guide from Fisher Investments can help you define your objectives, time horizon and financial needs. If you have $1 million or more, get your guide to start building a retirement strategy today. Get the guide.

Will ‘Choppy’ Hiring, Low Firing Prompt More Job Hugging?

The Federal Reserve has its work cut out for it figuring out this job market.

Bureau of Labor Statistics data released Friday showed 50,000 jobs added in December, fewer than economists had expected. That caps off the worst year for hiring since 2020. While unemployment ticked down to 4.4% from a revised 4.5% in November, figures overall point to continued weakness for a labor market that spent most of 2025 in a “low-fire, low-hire” state.

What does that mean for employment? The data is “a good representation of what I think the market will look like for 2026,” characterized by choppy hiring and weak overall labor force growth, but relatively low layoff numbers, says Ross Mayfield, investment strategist at Baird. Last month, JPMorgan’s research team predicted “uncomfortably slow growth in the labor market” in the first half of 2026, which will reverse later in the year.

Labor Productivity

Come Jan. 28, the Fed has to decide what the state of the labor market means for monetary policy. While the central bank cut interest rates three times at the end of last year, minutes from the Dec. 9-10 meeting show that policymakers are divided about whether the sluggish labor market or inflation is a bigger threat to the economy, and how much to lower rates in 2026.

Some experts say investors may be overestimating the likelihood of further decreases:

- The market is “too optimistic about the Federal Reserve’s ability to cut rates this year,” Dennis Follmer, chief investment officer at Montis Financial, wrote in a statement shared with The Daily Upside.

- “Though Fed leadership is firmly focused on arresting any additional labor market weakness, this print should provide ammunition for the hawks advocating for more of a focus on inflation and a pause at the January meeting, which we now think will occur,” Christopher Hodge, chief US economist at Natixis, told Morningstar after the December jobs numbers were reported.

AI Effect? Labor productivity climbed in the third quarter to its strongest pace in two years, but while roughly 18% of firms in the US say they’ve used artificial intelligence in the past two weeks, it’s unclear yet if that’s causing the productivity boom, Bloomberg reports.

Extra Upside

- Waiting Game: The Supreme Court did not rule on the legality of President Trump’s tariffs on Friday, despite expectations that it might. Wednesday is now the next day that justices could issue a decision.

- Transatlantic Accent: Despite French efforts to block the deal, EU member states voted in favor of a trade pact with a group of Latin American countries that would create the world’s biggest free trade zone.

- Reset Your News Habits For 2026: The Pour Over helps readers make sense of the news with simple explanations and unbiased reporting — so you can stay informed without the overwhelm. Join more than 1.5M readers who rely on it to stay focused on what truly matters. Subscribe for free.**

**Partner

Just For Fun

Disclaimer

*Important Risk Information

Investing involves risk, including the risk of loss of principal.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

State Street Global Advisors (SSGA) is now State Street Investment Management. Please go to statestreet.com/investment-management for more information.

© 2026 State Street Corporation. All Rights Reserved.

Adtrax Code: 8691039.1.1.AM.RTL

Expiration date: 1/31/27