Good morning.

It’s an IPO for the Age of Aquarius.

According to a Financial Times report, Elon Musk wants the public market debut of SpaceX to coincide with a rare planetary near-alignment of Jupiter and Venus. It’s what astrology types call a conjunction, and with those two planets, it’s believed to foster prosperity, joy, optimism and all-around good vibes. The conjunction also just so happens to align with Musk’s 55th birthday on June 28 (yes, that’d make him a Cancer; yes, we did have to Google that). And if you’re wondering why Jerome Powell and the Federal Reserve didn’t lower interest rates yesterday, you no doubt overlooked the fact that the moon was in the Seventh House.

Meta, Microsoft Confront AI Spending Concerns Head-On

Yesterday was a tale of two hyperscalers.

Both Meta and Microsoft held after-the-bell earnings calls (for Meta’s fourth quarter and Microsoft’s second). Both have faced recent shareholder skepticism about the scale of investment in AI-powered data centers and their seemingly far-off returns. Both companies announced capex projections that blew past consensus expectations. And yet only one firm, Meta, seemed to overcome Wall Street’s wariness. Double standard?

Tip of the CapEx

“If we end up misspending a couple of hundred billion dollars, I think that that is going to be very unfortunate, obviously,” Meta CEO Mark Zuckerberg told independent tech journalist Alex Heath during a podcast interview in September. He wasn’t kidding. In its earnings call, Meta said it is projecting capital expenditures of $115 billion to $135 billion for its fiscal year 2026, blowing past both last year’s $72 billion capex spend and consensus 2026 expectations of around “just” $110 billion. Microsoft had a big capex surprise of its own. The Windows-maker said its capital spending in the most recent quarter reached $37.5 billion, about $3 billion higher than anticipated and a staggering 66% year-over-year increase.

Translation: Fret about overspending and an AI bubble all you want, neither of these giants is tapping the data-center-buildout brakes yet. But there’s more to both of these companies than that. Investors seem relatively happy with Meta’s other circus attractions, so it doesn’t get punished for spending like there’s no tomorrow; Microsoft was a different story entirely:

- Meta reported fourth-quarter revenue of nearly $60 billion, besting expectations and marking a 24% year-over-year increase, as well as net income that topped estimates. Its guidance for the current quarter also — you guessed it — bested expectations, and its share price jumped as high as 10% in after-hours trading because nothing soothes the shareholder soul like continuing to operate one of the most lucrative advertising operations in human history.

- Microsoft, meanwhile, saw its share price plunge more than 5% in after-hours trading as shareholders grew concerned its internal engines were starting to slow. While revenue and net income figures were beyond solid, its Azure cloud-computing unit posted revenue growth of “only” 38% — a slight dip from the previous quarter, and probably enough to disappoint investors who were looking for continued growth, DA Davidson analyst Gil Luria told Bloomberg.

Open Wide: A look under the hood revealed more trouble spots that could make Microsoft’s future spending plans look a little costly. The company said that its expected total revenue from customer contracts that have not yet been paid stands at about $625 billion, more than double last year’s. Sounds good, right? Microsoft also conceded that 45% of that figure is expected from its pseudo-sibling OpenAI, and that has analysts a little worried. “The backlog is really good, but the disclosure that OpenAI is 45% of their backlog, it goes back to the situation where, ‘Can OpenAI achieve these financial goals to pay Oracle, Microsoft and many of the providers?’” Jefferies analyst Brent Thill said on CNBC.

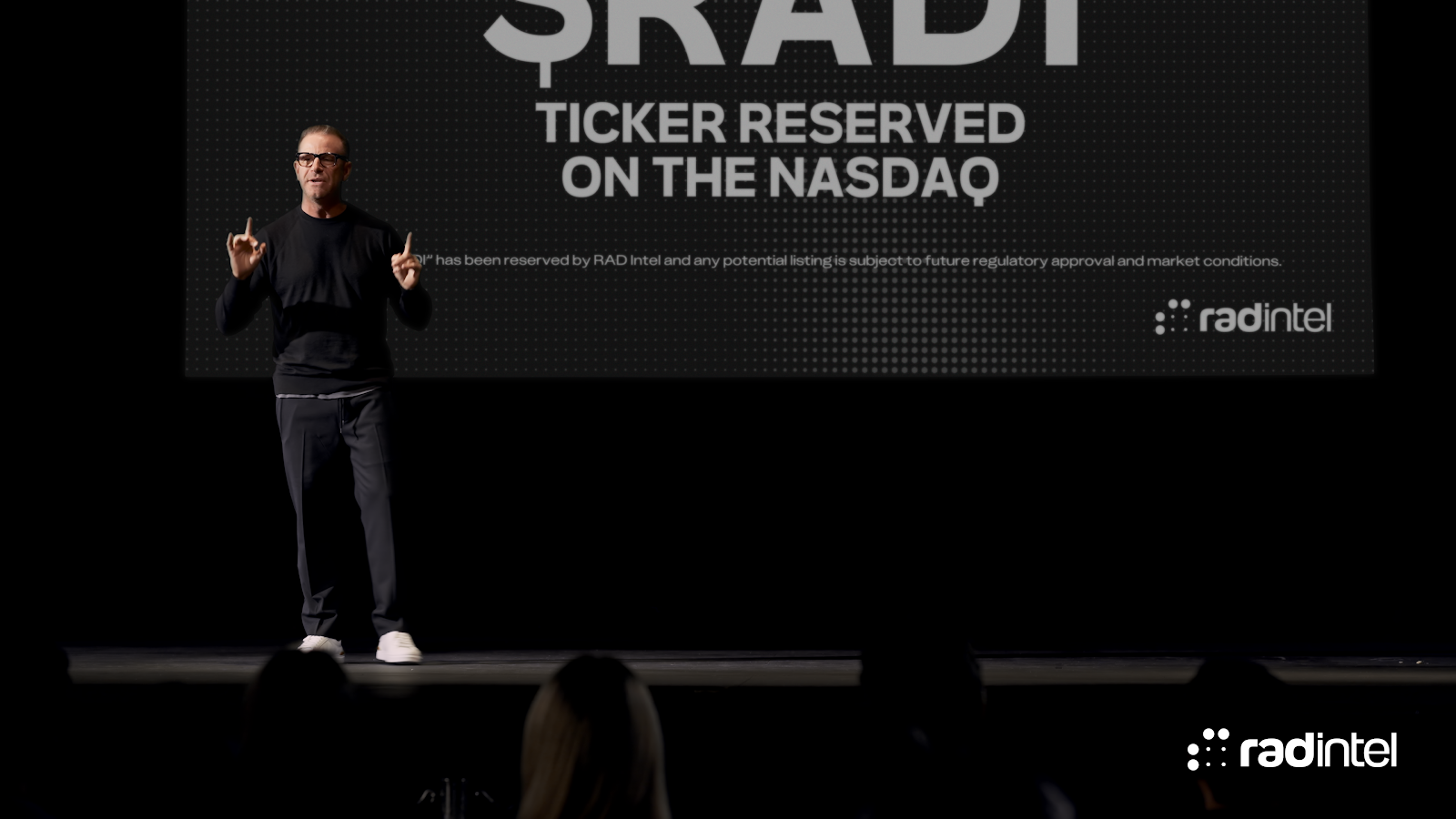

Nasdaq Ticker Secured: $RADI

Nasdaq ticker secured: $RADI. Still private. That’s a rare window. RAD Intel just locked $RADI as momentum keeps building. $60M+ raised from 14,000+ investors, backed by multiple Fidelity funds and selected by the Adobe Design Fund. Shares are still available at $0.85 in an SEC-qualified Reg A+ offering, subject to availability.

Tether Outbuys Most Central Banks in Gold Bunker Buildup

Tether, the company behind the largest stablecoin by market cap, is amassing a huge pile of gold bullion in a former Swiss nuclear bunker. The “James Bond kind of place,” as its CEO, Paolo Ardoino, described the storage facility to Bloomberg, houses a gold collection of more than 140 tons. With gold’s ongoing rally, that’s about $24 billion worth.

The crypto company bought at least 70 tons of gold last year, Bloomberg calculated, or more than was reported by any central bank besides Poland’s. Now, Ardoino said, it’s stockpiling two tons a week and plans to continue that pace at least through this quarter.

You’re So Golden

Tether’s main business is its eponymous stablecoin, also called USDT, which dominates the sector with more than $186 billion in circulation. Tether then invests the money it gets from folks buying USDT in other assets such as Treasuries and gold, profiting from the interest.

The company’s been piling up gold both for its own reserves and for its Tether Gold product, a token that’s growing as an alternative way for investors to gain exposure to the precious metal:

- Tether has issued about $2.7 billion worth of its gold-tied token, XAUT, and thinks its circulation could expand to $5 billion to $10 billion this year. That’s small compared with ETFs, but Tether’s CEO expects it to grow as foreign countries eventually launch their own version of tokenized gold that could compete with USD.

- Tokenized gold is meant to be redeemable for physical gold, meaning Tether should be stockpiling enough gold to at least match the amount of XAUT its customers own (no selling out like Costco). If that promise is kept, it makes the product distinctive from so-called “paper gold” like ETFs, where the institution doesn’t necessarily have investors’ gold stored in a Swiss bunker.

Feeling Existential: Tether seems to be prioritizing buying gold because its value isn’t tied to governments as tightly as fiat currencies are. That degree of separation appeals to the crypto industry and its anti-centralization ethos, as well as the CEO’s very Gen Z-esque sense that, as he told Bloomberg, “The world is going towards darkness.” However, depending too much on the commodity could become a problem when its No. 1 stablecoin’s promise is a 1:1 tie with the US dollar, not gold. Plus, mainstream competitors are coming for Tether’s stablecoin throne, with Fidelity yesterday announcing a token of its own.

Starbucks Posts First US Sales Growth in Two Years as CEO Serves up Grande Vision

When Brian Niccol took the helm of Starbucks in September 2024, becoming its fourth CEO of the 2020s, the former Chipotle boss had a tall (grande, really) order to fill: reverse a worrying sales slump that shareholders hated with an Iced Passion Tango.

On Wednesday, the world’s largest coffee chain reported the first major breakthrough of his tenure. In the fourth quarter, Starbucks ground out its first increase in US same-store sales in two years. A tasseography reading of the coffee grinds on the balance sheet, however, shows the company’s ongoing turnaround remains a delicate corporate balancing act.

Bean Counting

Niccol, who was hired by the Starbucks board as the company’s share price dwindled, suspended financial guidance after taking over. He shifted focus to a “Back to Starbucks” strategy aimed at slashing wait times and improving service to renew customer interest and put the roaster back on a growth trajectory.

On Wednesday, the company reported US same-store sales climbed 4% year-over-year in the quarter, besting Wall Street’s expectations (global same-store sales also rose 4%). Foot traffic at US stores ticked up by 3%, and the amount of money spent per customer ticked up by 1%. These factors helped drive revenue up 6% to $9.9 billion, also ahead of market forecasts.

Naturally, this is good news for Starbucks’ brews, but turnarounds aren’t free:

- One of Niccol’s key initiatives is hiring more baristas in response to concerns that laggard service during peak hours was hurting sales and traffic. Along with especially high coffee bean inflation and US tariffs, this squeezed earnings: Net profit of $293 million was down 62%, and less than half of analysts’ estimates.

- Starbucks shares finished Wednesday flat, though they are up 13% this year. Investors may be waiting for later today, when Niccol and the executive team are slated to present a long-term plan at the company’s first investor day in over two years.

Waiting on the Plan: Investors will be watching the presentation for any hints about store openings. Starbucks closed hundreds of underperforming locations in the fall, which many analysts reasoned would contribute to better same-store sales figures. Niccol, who has previously said Starbucks could add significantly to its 18,000 US locations, told analysts on an investor call Wednesday that the company has identified “thousands of sites” for potential new openings.

Extra Upside

- Sent Packing: Amazon said it was cutting 16,000 corporate jobs on Wednesday, completing plans made in the fall to eliminate 30,000 jobs, and left the door open to additional cuts.

- Reverse Gear: Tesla beat fourth quarter expectations, but revealed that it suffered its first ever annual revenue decline last year.

- Get 100 Hours Of Your Life Back. Accounting teams are getting crushed by reconciliations and manual tasks at month-end. But not with Rillet. This AI-native ERP enables modern businesses to close on the first day of the month. See how you can close in hours instead of weeks.**

** Partner

Just For Fun

Disclaimer

*This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company’s Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Please read the offering circular and related risks at invest.radintel.ai.