Good morning.

With preliminary deals with Japan and the European Union done and negotiations with China ongoing, President Donald Trump directed his tariff ire elsewhere Wednesday. In a post on his Truth Social platform, he announced a 25% tariff on goods imported from India beginning Friday, along with an unspecified penalty for the country’s economic relationship with Russia. The pain would be felt acutely not just in New Delhi but also in Cupertino, California.

A report from Canalys earlier this week found that India has overtaken China as the leading exporter of smartphones to the United States, in large part due to tech giant Apple accelerating the diversification of its supply chain away from China, which earlier this year was poised to be ground zero for Trump’s most onerous tariffs. CEO Tim Cook affirmed earlier this year that he expects India will produce most of the iPhones sold in the US. But in addition to a “China Plus One” strategy, Cook may also need a “He Posted What, Now?” strategy.

*Stock data as of market close on July 30, 2025.

Bottom Line Undercuts Hot Quarter for Top-Line US GDP

When a car’s engine runs hot, it’s best to take a look under the hood. When the country’s economic engine does the same, peek at the underlying data.

US gross domestic product grew at an annualized rate of 3% in the second quarter, the Commerce Department said Wednesday, a seemingly white hot turnaround from 0.5% in the first three months of the year. Economists anticipated a 2.5% rate, so the better-than-expected top-line figure was cause for celebration, right?

Don’t Ignore the Core

As ING Chief International Economist James Knightley noted Wednesday, the primary driver of growth in the second quarter was net trade whiplash. In the first quarter, companies went into overdrive importing as much as they could to beat President Donald Trump’s tariffs. In the second quarter, those elevated import rates came crashing down. “This meant that net trade contributed 5pp to the headline growth rate, but a run-down in inventories, as companies put their first-quarter imports to work, subtracted 3.2pp,” he wrote.

That sort of dramatic trade reversal is not going to be a constant phenomenon, which is why analysts and investors looked especially closely at underlying data points. Take consumer spending — just 70% of the US economy, no big deal:

- On Tuesday, the Conference Board released its latest Consumer Confidence Survey, a closely watched gauge of Americans’ financial attitudes. Among the data, the all-important Expectations Index, which measures how consumers view the short-term outlook for income, businesses and the job market, rose 4.5 points to 74.4, but that left it below the threshold of 80 that historically signals a recession in the next 12 months, for the sixth straight month.

- The underlying data from the Commerce Department released Wednesday aligned with the less rosy picture: Core GDP, which strips out volatile economic activity like inventory changes and net exports to give a better view of consumer spending and private sector investment, slowed in the second quarter to an annualized 1.2% rate from 1.9% a year earlier. Many economists consider core GDP a better indicator of the economy’s health, and it registered the weakest since the fourth quarter of 2022.

Nationwide Chief Economist Kathy Bostjancic put it succinctly in a note Wednesday: “Headline numbers are hiding the economy’s true performance, which is slowing as tariffs take a bite out of activity.” The S&P 500 taking a minor 0.1% dip on Wednesday suggests markets are taking the underlying signals seriously.

No Reservations: Ridiculed by President Trump as a “numbskull” and a “moron” for not cutting interest rates, Federal Reserve Chairman Jay Powell and his colleagues on the central bank’s monetary policy committee left rates unchanged on Wednesday for the fifth straight meeting. But two governors broke ranks in a 9-2 vote, siding with Trump’s demands to lower rates and marking the first time there have been multiple dissents since 1993. On top of that, Fed officials downgraded their fiscal outlook, reasoning that “economic activity moderated in the first half of the year” in a hint they’re not far off from agreeing on interest rate cuts. Annex Wealth Management’s Brian Jacobsen wrote they could soon regret that: “The Fed probably wishes it waited until next Wednesday to have this meeting so they could have the employment numbers [scheduled for release Friday] to look at. It’s setting up to be an awful lot like last year when, in hindsight, they wished they’d have cut in July and so they did a catchup cut in September.”

Global Reach, Stateside Convenience And Clarity

US investors looking for offshore exposure have questions. Do they have to trade on non-US exchanges? Can that complicate their financial plans?

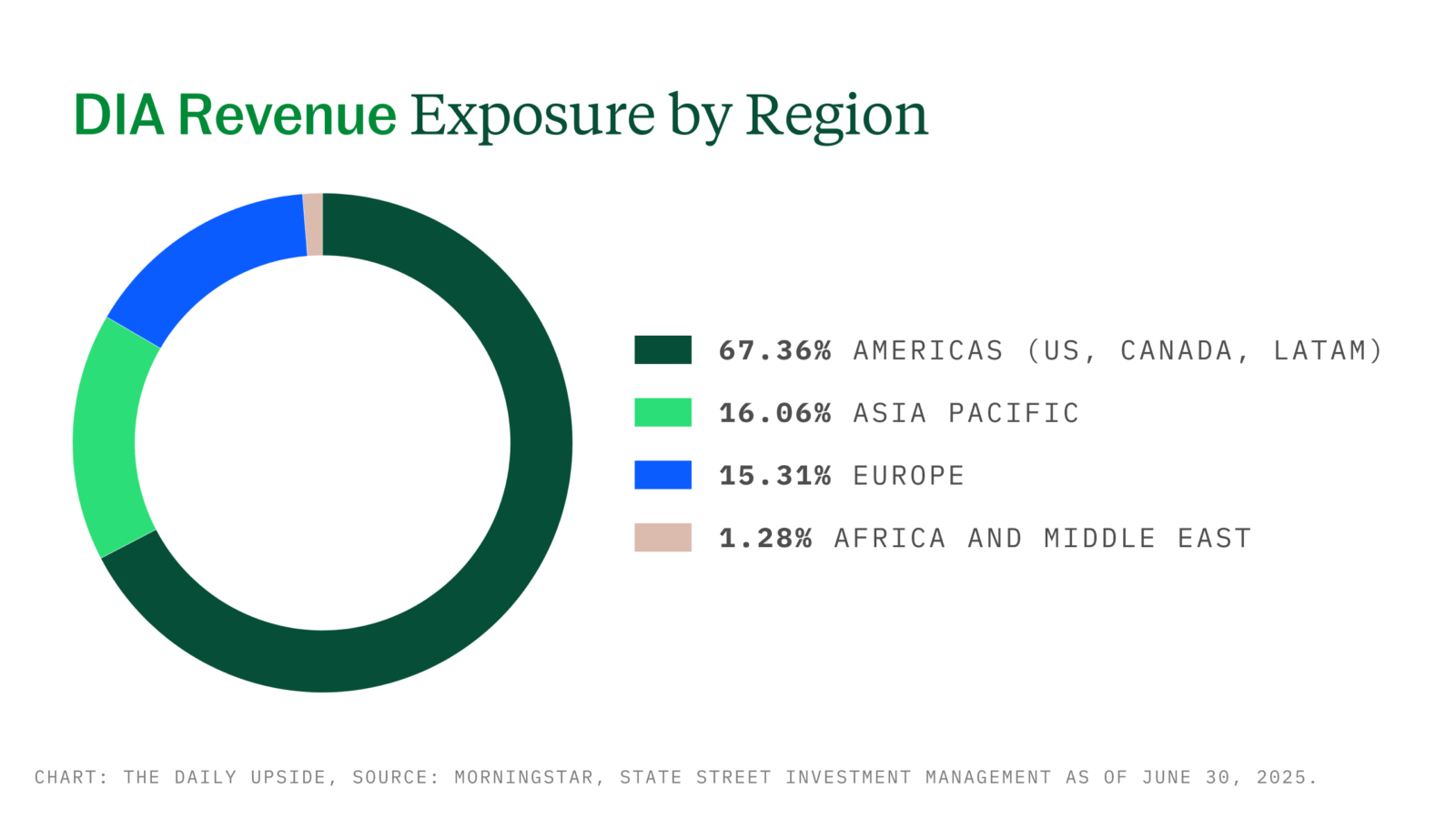

Consider DIA, the only ETF that tracks to Dow. DIA, the SPDR® Dow Jones® Industrial Average℠ ETF Trust, packs 30 blue chips into a single fund, offering revenue diversification across global regions and industrial sectors without making portfolio oversight harder.

Managed by State Street Investment Management — the firm behind the first-ever ETF and a consistent leader in indexed strategies — DIA offers:

- 30 US blue-chip stocks that derive 35% of revenue from overseas.

- Coverage touching 150+ industries in 172 countries.

- Exposure to a global market and 30 of the world’s most recognizable companies.

DIA delivers global exposure through US-based businesses.

Evercore’s Purchase of Robey Warshaw May Birth Trans-Atlantic M&A Titan

It’s a deal designed to launch a thousand others.

On Wednesday, Evercore announced that it’s acquiring London-based investment bank Robey Warshaw, a similarly modest boutique firm with an outsized presence in the M&A space, for nearly $200 million. The only question: Who’s soaking up the advisory fees?

International Man of M&A History

Founded by former US Deputy Treasury Secretary Roger Altman in 1995, Evercore has grown into something of a full-fledged rival of major Wall Street banks in the M&A space. Last year, the firm finished sixth in PriceWaterhouseCoopers’ US advisory fee-ranking report after advising on 151 deals worth a total of $291 billion. In its second-quarter earnings report this year, Evercore touted its advisory business scoring record first-half revenues after handling four of the 10 largest transactions so far in 2025, including Dick’s Sporting Goods’ $2.5 billion acquisition of Foot Locker and Cox Communications’ merger with Charter Communications.

Now, Evercore is applying its M&A expertise to its own business, with the Robey Warshaw acquisition marking its largest deal since buying research and brokerage firm ISI Group over a decade ago. Why? Strategic expansion, of course, and perhaps because Evercore sees something of itself in Robey Warshaw:

- Despite employing just 18 people in total, Robey Warshaw has made itself a mainstay in the UK (which remains the second-largest market for investment banking fees behind the US), advising on some of the biggest UK deals in recent memory, including SoftBank’s £24 billion acquisition of chipmaker Arm and AB InBev’s $79 billion purchase of SABMiller.

- Much of the firm’s success has been credited to its leadership team, including co-founders Simon Warshaw and Simon Robey, with the latter receiving nearly 50% of the firm’s profits each year, per the Financial Times. The deal locks in each of Robey Warshaw’s five partners, including the 65-year-old Robey, for at least six years.

European Vacation: The deal will help bolster Evercore’s presence in Europe, where it placed 13th by deal volume in PwC’s advisory rankings last year. It’s the bank’s first major acquisition on the continent since its roughly £86 million takeover of boutique investment firm Lexicon in 2011, though it has recently pulled off some high-profile talent poaching in France, including the hiring earlier this year of former top Citigroup dealmaker Luigi de Vecchi to serve as Evercore’s European chair.

This Plastic Disappears Like Magic. With 450M metric tons of plastic waste yearly, you can imagine how revolutionary a new kind of plastic that completely dissolves in water would be. Major players are partnering with Timeplast for their patented material. Just hours left – become a Timeplast shareholder by tonight, July 31st, at midnight.**

Palo Alto Networks Broadens Cybersecurity Consolidation With $25B Deal

Faced with something of an identity crisis, Palo Alto Networks is going all-in on identity security.

The cybersecurity firm, which has been seeking ways to bulk up and expand its portfolio of services, announced Wednesday an agreement to buy Israeli identity security company CyberArk for $25 billion. It’s just the latest in a massive wave of dealmaking in cybersecurity, though investors aren’t exactly digging Palo Alto’s new look.

Check Your Privilege(d Access)

Palo Alto’s big splurge isn’t exactly surprising. The company has been open about its push for “platformization” of its services, the bundling of lots of different cybersecurity offerings into a single package to better serve customers seeking to slash vendors and limit costs. As a result, the company has spent roughly $7 billion on about 20 acquisitions since 2018, according to a Financial Times analysis, including most recently a $500 million deal in April for AI security firm Protect AI.

The CyberArk purchase marks Palo Alto’s entrance into the “identity security” market, which includes services such as privileged access management, secret-keeping and customer access. The acquisition comes at an “inflection point” for the space, thanks to the rise of agentic AI, Palo Alto Networks CEO Nikesh Arora said in an interview with CNBC’s “Squawk Box” on Wednesday.

So no-brainer, right? Not exactly. Palo Alto has also been quite open about its push (more like desperate need) for growth. And given the deal’s hefty price tag, which makes it the biggest acquisition in company history, analysts on Wednesday highlighted concerns that the transaction is an all-too-simple, potentially clunky solution to its problem:

- “Our initial take is negative since we think the message implied is that Palo Alto is concerned about the organic growth runway, and thus is potentially seeking to acquire into a new market segment and new growth,” BMO Capital Markets analyst Keith Bachman wrote in a note seen by Investor’s Business Daily. In its third-quarter earnings report in May, Palo Alto announced lower revenue forecasts for its next quarter than Wall Street expected.

- RBC Capital analyst Matthew Hedberg, meanwhile, said the “glaring” size of the deal, struck at a roughly 26% premium to CyberArk’s shares over a 10-day period through July 25, is a potential red flag. Palo Alto’s share price has plunged more than 12% since The Wall Street Journal reported on a potential deal on Tuesday, while CyberArk’s has risen more than 15%.

Wiz Kids: The mega deal is part of a fad. Last year, Cisco closed its $28 billion purchase of cyber firm Splunk, while Alphabet’s $32 billion acquisition of cloud security firm Wiz, announced in March, remains the biggest deal of 2025 so far. If it’s completed, that is. In June, multiple outlets reported that the US Department of Justice’s antitrust division began investigating whether the tie-up could illegally limit competition. According to a Reuters report earlier this year, the two sides had accelerated acquisition talks following November’s presidential election, believing the new administration would usher in a laxer era of antitrust scrutiny. For now, it seems Big Tech still hasn’t built a regulatory firewall.

Extra Upside

- Oh, the Humanity: Starbucks plans to close its mobile-only, pick-up stores, launched in 2019 to appeal to Gen Z consumers, because they lack “warmth and human connection.”

- Your Cue to Shop: President Trump will close the so-called de minimis trade loophole — which allows shipments of $800 or less imported to the US to enter duty free — on August 29, allowing a little more than four weeks of tariff-free online shopping first.

- Global Reach Doesn’t Require Offshore Stocks. DIA tracks iconic US firms with international income streams and unparalleled industry exposure — all in one ETF. Think of it as a core portfolio holding with global exposure. See full fund details.*

* Partner

Just For Fun

Disclaimers

*Important Risk Information

State Street Global Advisors (SSGA) is now State Street Investment Management. Please click here for more information.

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member FINRA, is distributor for DIA, MDY and SPY, all unit investment trusts. ALPS Portfolio Solutions Distributor, Inc., member FINRA, is the distributor for Select Sector SPDRs. ALPS Distributors, Inc. and ALPS Portfolio Solutions Distributor, Inc. are not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 for ETFs, 1-800-997-7327 for mutual funds, or 1-800-242-0134 for ELFUN, download a prospectus or summary prospectus now, or talk to your financial advisor. Read it carefully before investing.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Adtrax Code 8163629.1.1.AM.RTL DIA000726

Expiration date: 07/31/26

**This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

Correction: If you paid attention in World Geography, you probably noticed that the description of India’s location in the original version of the intro to today’s newsletter wasn’t up to our usual standard of accuracy. It’s north of the equator, not south. We’ve got Google Maps running in the background now, so we promise to do better next time.