Good morning and happy Monday.

People are definitely getting less yippy. For the first time this year, American consumer sentiment improved in early June, according to the latest preliminary reading of the University of Michigan’s closely monitored consumer sentiment index. A 16% jump, from from 52.2 to 60.5, brought the reading back from the depths in late May, when sentiment fell to the second-lowest point in the survey’s 75-year history.

President Trump dialing back some of his heated tariffs rhetoric and his administration making progress in early trade talks with China seem to have helped. Joanne Hsu, the survey’s director, wrote that “consumers appear to have settled somewhat from the shock of the extremely high tariffs” but, on the other hand, noted they “still perceive wide-ranging downside risks to the economy.” Indeed, consumer sentiment remains 20% below December 2024 levels — so it’s less “shop till you drop” than a sense that it’s all right to stress-purchase that Big Mac.

Act of GENIUS or Blockheaded Bill? Congress Considers Stablecoins

The US Senate voted last week to advance the Guiding and Establishing National Innovation for US Stablecoins Act which, because D.C. lawmakers of all stripes love cringe acronyms, stands for the GENIUS Act.

The purported stroke of brilliance would lay out the first-ever regulatory framework for stablecoins, or digital tokens pegged to the value of the dollar. It has found both Republican and Democratic support and opposition. Those who see genius in GENIUS say it takes a commonsense approach to balancing innovation and regulation. Those who think it’s a blockheaded approach to blockchain have ideologically diverse critiques, which we’ll get to. A final vote has been scheduled for tomorrow.

Two Sides of the Stablecoin

The GENIUS Act, if passed, would let banks and private companies approved by federal regulators issue their own stablecoins. Those issuers would be required to back their stablecoins at all times with a 1:1 reserve of a stable asset, either cash or short-term Treasurys. They’d also be subject to some anti-money laundering laws and be required to adhere to US sanctions on foreign entities. The idea behind using the specified assets is implied in the term stablecoin: It means the tokens are more stable than most digital coins, which can exhibit dramatic price swings. Take, for example, 2022 — when bitcoin had a high of $46,000 in March and a low of around $16,000 in December.

The bill and its safeguards have managed to win the support of almost all the Republicans and 18 Democrats in the Senate. And, The Wall Street Journal reported Friday, the issue has generated enough excitement that both Amazon and Walmart are entertaining issuing their own stablecoins, a move that would allow them to sidestep billions of fees involved in cash and card transactions that involve the traditional financial system. But there are holdouts in the Senate, and their opposition comes from wildly different places:

- First, there’s Republican Senator Rand Paul of Kentucky. It’s no surprise that the libertarian-leaning lawmaker is leaning “against” the bill because he’s not convinced of the need for federal regulation of stablecoins at all. Then there’s his GOP colleague Josh Hawley of Missouri, a Silicon Valley skeptic who has called for the breakup of Big Tech companies. He has warned that the bill would let tech behemoths issue stablecoins that compete with the dollar and use them to collect inordinate amounts of data on people.

- Democratic Senator Elizabeth Warren, an expert in bankruptcy and commercial law, supports “a strong stablecoin bill” but says the GENIUS Act is not that, arguing it could trigger “the next financial meltdown” because it “folds stablecoins directly into the traditional financial system while applying weaker safeguards than banks or investment companies must adhere to.”

Warren noted that, in the past, some stablecoins have failed to maintain their pegs: The 2022 crypto crash, which led to bitcoin’s fall that year, was caused by the collapse of Terraform Labs’ Terra/Luna “algorithmic” stablecoin, which cost investors $42 billion. One 2023 study that analyzed 60 stablecoins found every single one of them had de-pegged from its underlying asset at least once.

A Bond Boon? ARK Invest argued, in a report earlier this month, that a turbocharged stablecoin would be good for the Federal Reserve by encouraging companies to become more active in holding US Treasurys. That, the investment firm said, could help offset the sharp decline in foreign holdings of US debt in recent years, which has accelerated amid the tariff pressures created by the Trump administration.

Trained Economist, Proven Founder

What’s Terrence DeFranco’s biggest takeaway from 30+ years as a tech entrepreneur with 2 successful exits? Wi-Fi can’t keep up.

As the needs of today’s businesses, schools, and hospitals evolve, he’s set out to build a network more scalable and affordable than Wi-Fi.

Terrence and his team at IotaComm have secured exclusive FCC-licensed spectrum to help connect everyday devices — like air monitors, energy systems, and safety sensors — into a single, intelligent network.

It has the potential to save up to 30% in energy and maintenance costs, which is why major brands like Crayola and GigNet are already customers.

The $1.5 trillion IoT market is accelerating, and this is your chance to tap in.

Invest in IotaComm by midnight tonight to claim 15% bonus shares.*

BlackRock’s Virtual Investment Analyst ‘Asimov’ Ushers in AI Era on Wall Street

“Hey AI, maximize my portfolio returns,” is a prompt that has moved from speculative fiction to Wall Street.

Last week, BlackRock, the world’s largest asset manager, unveiled an AI research platform called “Asimov” at the company’s investor day in New York. Chief Operating Officer Rob Goldstein described the research platform as a “virtual investment analyst” that can scan text in research notes, regulatory filings and emails to produce “portfolio insights.”

ChatBPS

BlackRock isn’t the first, nor will it be the last, asset manager to pick up AI tools as Wall Street firms jockey for a competitive edge.

Systematic hedge fund manager Man Group AHL, which has been using machine learning techniques for over a decade, described how the firm was using it to be more productive in a July 2024 report.

Man AHL was developing chatbots that could understand the firm’s internally developed code. It involved testing processes in which ChatGPT scans the intricate 200-page offering circulars of catastrophe bonds and inputs relevant information in a template that another person would check. ChatGPT could also answer investor queries, extracting relevant information from company documents including fact sheets, presentations, and investment commentaries. AI might also analyze macroeconomic data at the level of a junior quantitative analyst.

Others have deployed AI for portfolio construction:

- Bridgewater Associates CEO Nir Bar Dea stated at a Bloomberg Invest conference earlier this year that a fund launched in 2024, which utilizes machine learning to make decisions, delivered performance comparable to its human-led counterparts.

- Researchers at Stanford Graduate School of Business built an AI analyst that bested humans, beating 93% of human fund managers over 30 years by an average of 600%. The bot was fed portfolio data from about 3,300 actively managed US stock mutual funds between 1990 and 2020 and nosed out alpha by tweaking fund holdings once every quarter.

*AI Alpha: The academic exercise showed that, in hindsight, publicly available information wasn’t fully exploited. Though Stanford’s AI analyst was able to shoot the lights out in hindsight, it wouldn’t necessarily outperform in today’s market. And here’s the rub: “If every investor were using this tool, then much of the advantage would go away,” Suzie Noh, assistant professor of accounting, said in an interview with the university.

What C-Suites And Wall Street Are Reading: Semafor Business delivers sharp, deeply sourced reporting on the forces shaping global markets. Penned by Liz Hoffman — one of Wall Street’s best-sourced reporters — it offers behind-the-scenes insight, smart analysis, and the kind of scoops senior executives and market insiders rely on. Subscribe for free.

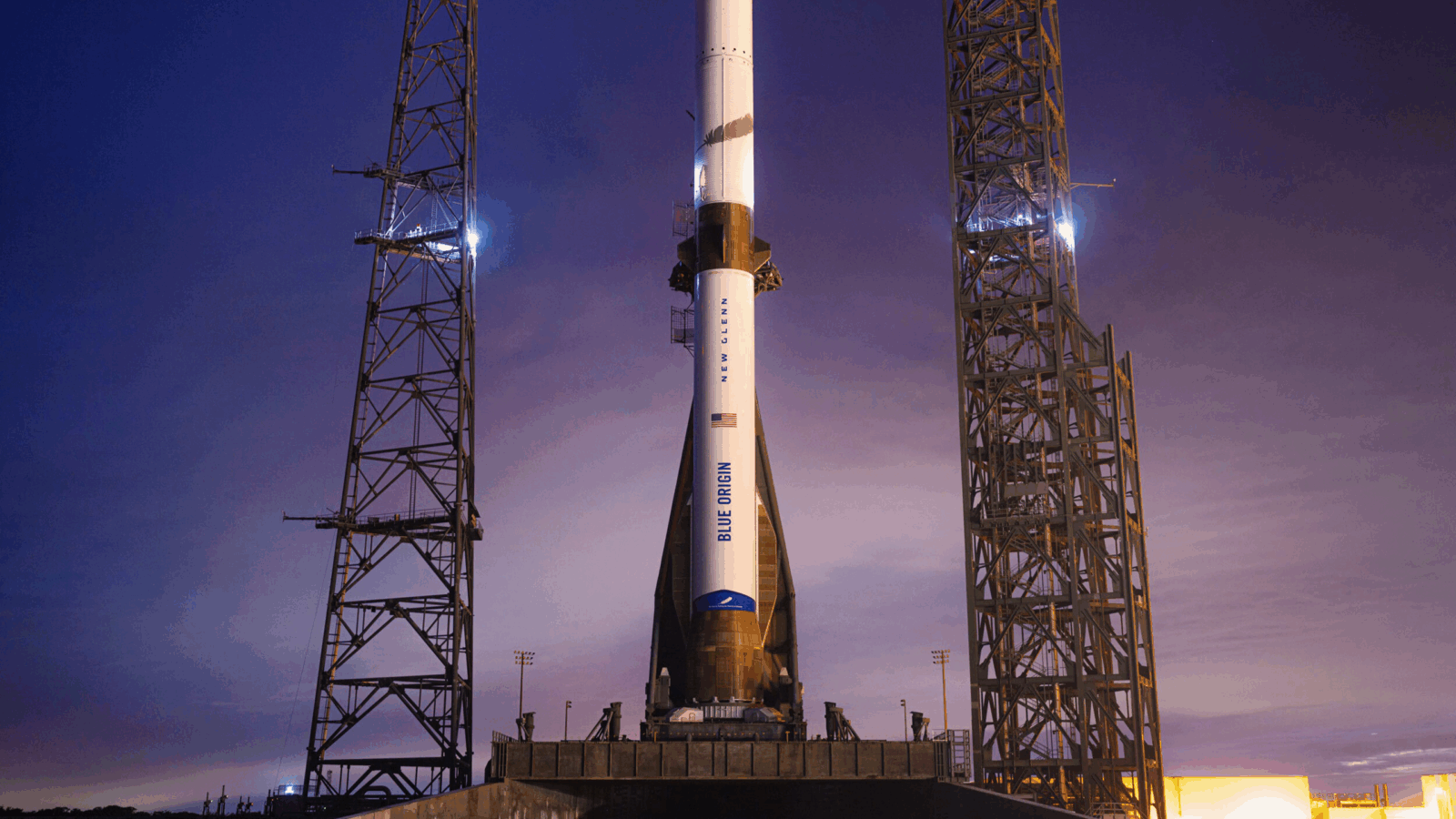

Can Blue Origin Fill NASA’s SpaceX Void?

The next Blue Origin flight is lifting off in five … four … three … two … wait one minute, please!

As POTUS and his First Billionaire Buddy Elon Musk (very publicly) work out their feelings for each other after a (very public) falling out, NASA is suddenly looking to decrease its dependency on key contractor SpaceX, according to a Washington Post report published last week. The crisis should theoretically be an opportunity for competitor Blue Origin, but Jeff Bezos’s space venture finds itself boldly going exactly nowhere at exactly the wrong time.

Ground Control to Major Jeff

Washington drama has turned from palace intrigue into downright space opera. At the end of May, POTUS rescinded the nomination of key Musk ally Jared Isaacman to be NASA Administrator. And last week, after his departure from the White House, Musk publicly threatened to “decommission” SpaceX’s ‘Dragon’ space capsule — which, at present, is the US’s only domestic option for transporting astronauts and cargo to the International Space Station. (The last time the US turned to a non-SpaceX contractor, Boeing, it resulted in a “Lost in Space” story the president mused could be good fodder for a romantic comedy). Musk has since moonwalked on his threats, ever so slightly, but even a warning proved enough to spook the government agency.

Since then, NASA has contacted Blue Origin, Rocket Lab, and Stoke Space about their near-term availability for government missions, sources told The Washington Post. Translation: We have billions of dollars worth of contracts that may suddenly be available; who’s ready for them? A successful mission to fly Katy Perry to the edge of the Earth’s atmosphere aside, Blue Origin hasn’t exactly inspired confidence this year:

- Last week, Blue Origin CEO Dave Limp announced that the next launch of the company’s New Glenn rocket, a competitor to SpaceX’s Falcon 9 rocket, would be delayed until August after originally targeting a “late spring” launch.

- That makes the company’s goal of eight launches this year look seriously unlikely. It has only completed one flight so far, in January, which saw the successful delivery of its payload into orbit — though its booster rockets exploded before completing a planned controlled landing. (We believe SpaceX prefers the term “rapid unplanned disassembly” in this context.)

Shoot for the Stars: Blue Origin’s failure to launch (so far) a successful New Glenn business doesn’t just make it an unlikely candidate to fill NASA’s SpaceX shoes — it could seriously imperil a key Amazon mission as well. That’s because Bezos’s other company, the e-commerce/multimedia/cloud computing giant, aims to become a provider of high-speed satellite internet in an initiative dubbed “Project Kuiper.” But in order to maintain its government license, the company must launch 50% of its 3,236 planned satellites by 2026. Blue Origin, unsurprisingly, is supposed to be a key player in the process… and now it can’t get its rockets off the ground. Hey, Jeff, would it help if we got out and pushed?

Extra Upside

- Taking a Pulse: Amazon is reorganizing its multibillion-dollar healthcare business as it tries to carve out a bigger share of the highly competitive market.

- Another BRIC in the Wall: Vietnam was officially admitted to the BRICS group of major emerging economies.

- Percent Investors Earned 14.9% Net Returns In 2024 … while equity investors were wiping sweat off their brow all of last year. That’s because private credit is largely immune from the volatility and swings of public markets. Explore private credit — and up to 20% yields — with Percent.**

** Partner

Just For Fun

Disclaimers

*This is a paid advertisement for IotaComm’s Regulation CF Offering. Please read the offering circular at invest.iotacomm.com.

**Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk.