Good morning.

The United States of America added over 1,000 new millionaires a day last year, as 379,000 people saw their net worth in dollars reach seven figures, according to the latest global wealth report from UBS. The report, released on Wednesday, came a day after Commerce Secretary Howard Lutnick said almost 70,000 people have signed up for a new visa that would grant legal residency status to foreigners willing to pay $5 million for the privilege.

While money may not buy happiness, it can buy rich Europeans the chance to set up shop in Jackson Hole.

New Home Construction Sinks to Lowest Point Since Pandemic

The last time there was anything like a true buyer’s market in the United States, Barack Obama was still president. However, the momentum is clearly shifting toward buyers.

On Wednesday, fresh data from the US Census Bureau showed that new housing starts declined 9.8% in May, falling below consensus expectations and slowing to the lowest levels since … May 2020, when the world was briefly frozen in anxious pandemic amber. It may well be another indicator that the market is finally tipping in buyers’ favor, as the construction industry faces multiple gale-force headwinds.

Home is Where the Start Ain’t

It’s rare, but sometimes winning can’t come without first giving up. After multiple years of a clear-cut seller’s market effectively pummeling prospective buyers into resignation, the worm is beginning to turn. The result? The housing supply seems to finally be outstripping demand. Sellers are outnumbering buyers by nearly half a million, according to a RedFin report published in May. And Wednesday’s figures from the Census Bureau all but confirm the trend: The inventory of completed houses now stands at the highest level since 2009. It proved sufficient to push housing starts down to 1.26 million on an annualized basis, significantly lower than the 1.39 million in April. And it’s probably not going to turn around anytime soon: The number of building permits issued — an indicator of construction to come — also fell to a five-year low in May.

Still, over-inventory isn’t the sole reason for the slowdown. The cost of building materials has surged amid the White House’s trade war, while a spike in immigrant deportations has intensified a construction labor shortage, Danielle Hale, chief economist at Realtor.com, told MarketWatch on Wednesday.

It’s enough to keep tipping the scales in buyers’ favor — though we’re not quite at a buyer’s paradise just yet:

- 37% of home builders reported cutting prices to boost sales in June, according to a survey released Tuesday from the National Association of Home Builders. That marks the highest proportion since at least 2022.

- However, the same report showed that builder sentiment has fallen to its lowest level since 2022 and the third-lowest level since 2012 — largely because builders don’t see a buyer’s market materializing, thanks mainly to elevated mortgage rates. (The Federal Reserve, unsurprisingly, said Wednesday that it opted to hold interest rates at current levels, though policymakers still project two rate cuts before year’s end.)

“Despite an increase in housing inventory, we are not seeing higher home sales,” Lawrence Yun, chief economist at the National Association of Realtors, said in a statement in May. “Lower mortgage rates are essential to bring home buyers back into the housing market.”

Work-Life Balance: Meanwhile, the office space market looks like the mirror image of the suddenly overstocked housing market. For the first time in 25 years, the supply of US office space is expected to contract this year, according to recent data from CBRE Research. Why? Because some 12.8 million square feet of space is on track for conversion to other uses: Much of it will go to new housing, though another 10.5 million square feet is slated for demolition this year. We’re not sure this is what Jamie Dimon meant when he demanded people return to the office, but we’ll take it!

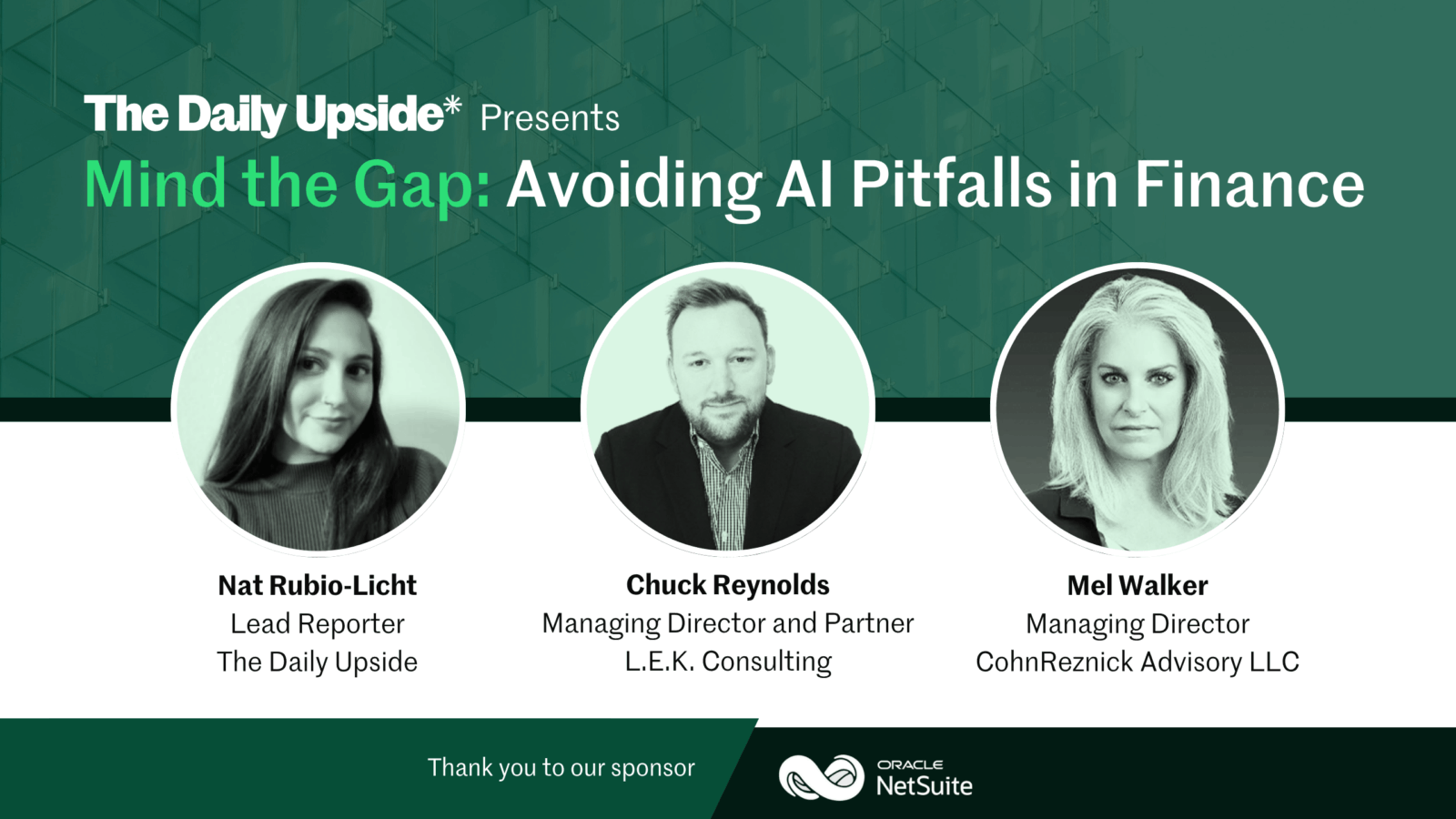

Avoiding AI Pitfalls: What Finance Leaders Need to Know

AI adoption has accelerated across business functions, but for finance teams, the stakes have remained uniquely high. Move too fast, and you risk compliance issues and costly inaccuracies. Move too slow, and you fall behind.

That’s why The Daily Upside hosted a can’t-miss webinar featuring our lead tech reporter, Nat Rubio-Licht, alongside experts from L.E.K. Consulting and CohnReznick. Together, they unpacked how finance leaders can drive performance with AI without compromising oversight or risk management.

Magnificent 7 May Need to Make Room for Broadcom

Broadcom joined the trillion-dollar club late last year, and its market value has continued to climb since. The software and chip company has been riding the AI wave as companies like Alphabet and Meta place orders for its custom AI chips.

The tech giant’s stock doubled in each of the past two years, climbing more than 350% from the start of 2023 to yesterday’s close. With a $1.2 trillion market cap, Broadcom is the S&P 500’s seventh-most-valuable company, worth more than either Walmart or Berkshire Hathaway.

Broadcom’s skyrocketing value has some Wall Streeters wondering whether it’s time for a shakeup of the Magnificent Seven, which currently includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Pulling into Tesla’s Parking Spot

Analysts expect Broadcom’s sales to soar 22% this fiscal year and 21% in 2026. Broadcom reported earnings earlier this month that topped analysts’ estimates after raking in $15 billion in revenue in its most recent quarter.

Nvidia is the only company in the Magnificent Seven whose sales growth surpasses Broadcom’s. In contrast, Tesla’s revenue has contracted 1% this year, and its shares have tanked. The automaker’s market cap is just above the $1 trillion mark. Four of the companies in the Magnificent Seven have seen their shares fall this year.

Meanwhile, Broadcom’s business is booming, especially its AI arm:

- Broadcom has a sprawling empire of technology that ranges from Wi-Fi and Bluetooth chips to cybersecurity software, but its custom AI chips now make up nearly a third of its revenue.

- The tech company made $4.4 billion of its revenue from AI in the second quarter (a 60% annual uptick) and expects $5.1 billion next quarter as cloud providers like Alphabet place more orders. The company predicts AI growth will continue next year.

Name Games: The Magnificent Seven is a way of grouping together some of the S&P 500’s most influential companies, similar to its predecessor FAANG (made up of Facebook, Amazon, Apple, Netflix, and Google before Facebook and Google changed their names). But some experts say the purpose of these groupings is to track trends, not just the most valuable companies. If the trend investors are eyeing now is AI, then swapping Tesla out for Broadcom may not make sense since Tesla is also leveraging AI (for robotaxis and humanoid robots). Another option might be to simply expand the Magnificent 7 to a Magnificent 8.

Put Interest Payments On Pause. Top-rated credit cards now offer 0% intro APR until 2027. That’s years to pay down debt without racking up more. Our experts reviewed the best options; see how you can stop the bleeding and start saving.

SPAC Comeback Draws Renewed Interest from Wall Street

They’re SPAC! Just when the market seemed dead and buried, special purpose acquisition companies have risen from the grave.

The re-emergence of the once, maybe still, controversial vehicles that let companies go public outside of traditional IPOs is underscored by strong hints this week that one of yesteryear’s biggest Wall Street underwriters of the blank check firms is once again ready to make deals after bowing out of the space three years ago.

Return of the SPAC

To remember SPACs is to take a time machine back to their golden age of 2021, when the song of the summer didn’t matter because you were at home in pajamas during pandemic lockdowns. That’s when these blank-check companies, which list on public markets in order to later merge with a target company and take it public, were all the rage. There was a time when it felt like there were as many celebrity SPACs — Martha Stewart, Jay-Z and Shaquille O’Neal each got in on the craze — as there are celebrity tequila brands.

Roughly 600 SPAC deals in 2021 raised a record $163 billion. But a year later, the market froze after interest rates were hiked and the S&P 500 turned in its worst year since the late-2000s financial crisis, falling 19% in 2022. The value of many companies that went public during the SPAC craze crashed, too. They were not helped by the Securities and Exchange Commission stepping in to protect investors. The regulator introduced rules in 2022, finalized two years later, that aligned SPAC disclosure and conflict of interest requirements more closely with the rigorous standards of traditional IPOs. But this year, finally, has marked a mini-comeback of sorts, thanks to maybe the biggest celebrity SPAC figure of all:

- That, of course, would be President Trump, whose Truth Social went public via SPAC merger in 2022. The expectation that Trump and Paul Atkins, his pick for SEC chair, would focus more on capital formation than clampdown has sparked a return to the vehicles: According to SPACInsider data, there have been 58 SPAC offerings so far this year, one more than the total in all of 2024.

- In fact, the most active bank on SPAC deals this year, Cantor Fitzgerald, has deep ties to the Trump administration: Commerce Secretary Howard Lutnick is its former CEO and upon taking his job in Trump’s Cabinet, he handed control to his sons Brandon and Kyle. However, the fuss has been enough to lure back Wall Street’s former titan of the SPAC space: Bloomberg reported earlier this week that Goldman Sachs is prepared to start underwriting SPAC deals again after it largely withdrew from the space in 2022.

The Fine Print: Performance among private companies that went public by merging with SPACs this year has not exactly been spectacular. According to data from ListingTrack on 20 such firms, the median return has been a decline of 74%.

Extra Upside

- Alphabet City: Waymo, Google’s self-driving car company that runs a taxi service in several western US cities, has applied to start testing in New York City.

- Off the Buss: The Buss family agreed to sell a majority stake of the Los Angeles Lakers at a $10 billion valuation to Mark Walter, co-founder of Guggenheim Partners and majority owner of the Los Angeles Dodgers.

- High Earners Plan. The Rest Guess. Get matched with a fiduciary advisor for a complimentary strategy session — built around your retirement, investing, and tax goals. Find your match today.*

* Partner