Good morning.

Like ‘em or not, plastic bag fees and bans at the grocery store make a big difference. That’s according to a new study published on Thursday in the peer-reviewed research journal Science, which examined 180 local programs in the US that either charge for plastic shopping bags or prohibit them.

The key finding: Those programs contributed to a 25% to 47% decrease in the amount of plastic bag litter collected during shoreline cleanups. So yes, that cheesy $15 tote is now officially a green badge of honor.

OpenAI Careens Toward Messy Divorce From Microsoft

Quick, someone call TMZ: There’s an even messier celebrity breakup than Trump-Musk with countless billions at stake.

Relations between OpenAI and its largest investor, Microsoft, are continuing to fray as the ascendant artificial intelligence firm struggles to get approval from its investor on the fine points of reorganizing into a for-profit public benefit corporation. According to a report in The Wall Street Journal last week, OpenAI is now even considering a “nuclear option” to sever ties for good.

Lover’s Quarrel

At the heart of the matter is how large a stake Microsoft will own in OpenAI’s public benefit corporation, a subsidiary of the ChatGPT maker that will still be controlled by the nonprofit parent. According to a recent Reuters report, OpenAI wants the Big Tech player to hold a 33% stake while relinquishing its rights to future profits. Microsoft hasn’t agreed, and the two sides are at loggerheads over the matter, though it’s far from their first fight.

Microsoft already loosened its grip on the AI firm in January, allowing some key terms of their agreement to change so that OpenAI could tap data centers outside of the Microsoft Azure infrastructure. That resulted in “Stargate,” a high-profile $500 million data center joint venture between OpenAI, Softbank, and Oracle (with Microsoft, Nvidia, and Arm serving as “technology partners”). But opening the door to more independence may be objectionable to Microsoft: Earlier this month, Reuters reported OpenAI is now planning to tap Google’s cloud services to meet its growing need for computing capacity. In another line-crossing move, The Information reported last week that OpenAI has been offering a suite of ChatGPT enterprise tools at discounts of up to 20%, directly undercutting sales of competing Microsoft services like Copilot.

In other words, tensions are at an all-time high, and now both sides are throwing around fighting words at a time when level-headed communication is crucial:

- According to the WSJ, OpenAI executives have discussed a “nuclear option” of formally accusing Microsoft of antitrust violations if it can’t come to an agreement with the Windows-maker over transition terms.

- According to a Financial Times report published Wednesday, Microsoft is prepared to walk away from negotiations altogether and simply ride out its existing commercial contract with OpenAI, which is set to last until 2030. That would leave OpenAI stuck with its current structure, which means it’d lose out on half of the $40 billion investment SoftBank committed to making in April, which was contingent on a successful restructuring to for-profit by the end of the year.

Burn Book: Microsoft isn’t the only Big Tech firm OpenAI has waded into a blood feud with. The company now finds itself openly at war with Meta, which is offering $100 million signing bonuses to poach OpenAI talent as it seeks to bolster its AI efforts. OpenAI founder Sam Altman last week jabbed back by saying, “I don’t think that [Meta’s] great at innovation.” At this rate, we have to imagine Altman isn’t exactly the most popular player at our imagined weekly poker night among Silicon Valley bigwigs (actually, let’s be honest, they’re probably playing Magic: The Gathering).

Business Credit 101: Your Guide to Scores, Funding, Contracts, and More

Knowledge is power — especially when it comes to your business credit file. Understand and monitor your scores and ratings.

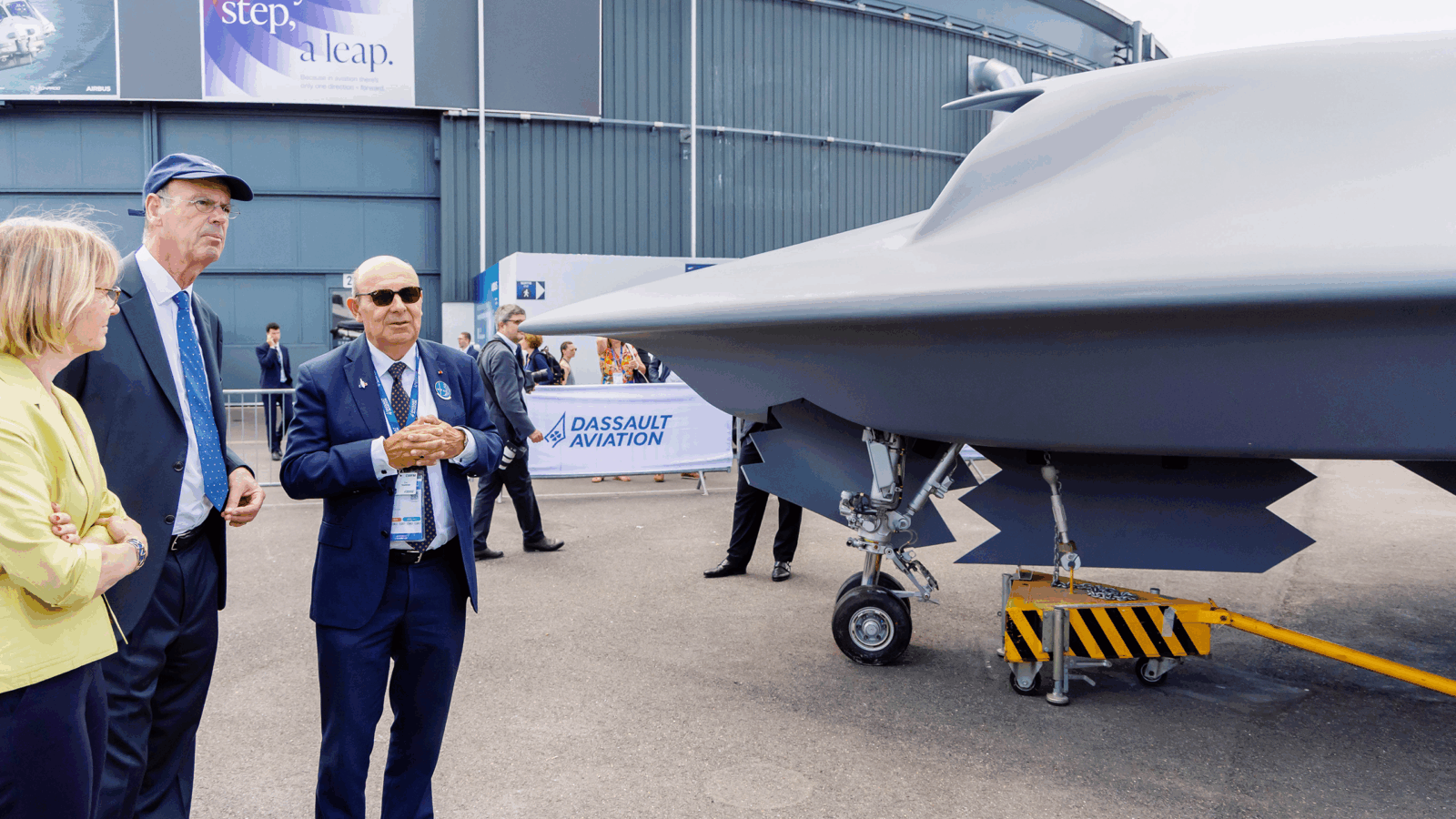

Drones Steal the Paris Air Show

The Paris Air Show has a lot of buzz this year — literally. A record number of drones are on display at the world’s largest aerospace event. Concluding this weekend, 2,400 exhibitors from 48 countries are showing off planes and other aircraft for 300,000 visitors. And this year, the smallest aircraft on the tarmac made a big impact.

As airlines placed billions of dollars worth of orders for commercial planes, the defense industry made deals for drones, the small, remotely controlled aircraft that are increasingly important in modern conflicts.

Modern Warfare

Drones are defining 21st-century warfighting, with thousands deployed in both the Russia-Ukraine war and the Iran-Israel conflict. Drones have been used in the Russia-Ukraine war to destroy weapons factories, oil refineries and ammunition stores, and they inflict more than 70% of casualties on both sides, according to The Japan Times. Both countries plan to produce millions of drones this year. Meanwhile, the Israeli military said it has already intercepted hundreds of Iranian drones in its airspace.

As drones become more prevalent, defense companies are eyeing new deals. Drone updates at the Paris Air Show came from:

- Anduril, which made its debut there, showing off its 17-foot autonomous Fury drone. These “wingmen” drones fly alongside fighter jets to provide support for combat and surveillance. The US Air Force has plans to deploy 1,000 larger drones like the Fury.

- Germany’s Rheinmetall, which announced at the show that it’ll partner with Anduril to develop versions of the Fury and another drone that can act as a cruise missile, called the Barracuda, for European markets.

AI-viation Nations: Today’s drones are more than pricey toys or tools to put on light shows. Their military uses are top-of-mind as global tensions rise around the world, and AI is expected to make drones more accurate, deadly and autonomous. At the same time, as drones are developed for the defense sector, the technology is also evolving for non-military uses. At the Paris Air Show, Czech startup FlyinDiamonds showed off its one-pound Mandrake drones (they make a high-pitched noise like the magical plants in “Harry Potter”), which it plans to use to deliver medical supplies in emergencies.

Balance Transfer Cards That Actually Help. If you’re managing credit card debt, these 0% intro APR cards can help you cut interest entirely — until 2027. Don’t let high rates slow you down: See how you can stop the bleeding and start paying off your debt faster.

Berkshire Slips Amid Concern Retiring CEO May Take “Buffett Premium” With Him

The “Warren Buffett premium” at Berkshire Hathaway is melting faster than a forgotten Dilly Bar.

Since the conglomerate’s legendary CEO announced in May that he plans to retire at the end of this year, four months after his 95th birthday, Berkshire shares have fallen roughly 10%. The selloff can be attributed to a handful of factors, chief among them the Buffett premium, which refers to the extra price investors are willing to pay for the billionaire Oracle of Omaha’s stock-picking talent. Clearly, there’s curiosity about whether his handpicked successor, Greg Abel, is ready and, er, able.

In Search of the Abel Premium

Berkshire was one of the most resilient major stocks in April after President Trump’s tariff announcements pushed the S&P 500 into a correction. On May 3, the day Buffett announced he was passing the torch, Berkshire ranked as one of the top-performing large-cap stocks in 2025. But after the Oracle of Omaha prophesied his own future, his company’s momentum shifted to reverse gear.

Even with the endorsement of Buffett and the expectation that Abel will maintain Berkshire’s culture and value-oriented investment strategy, investors have yet to see that Buffett’s successor is capable of buying big, concentrated blocks of stock in companies like American Express, Apple, Bank of America, and Coca-Cola at precisely the right time. Berkshire also has another major succession in order, as the mastermind of its juggernaut insurance business, Ajit Jain, said he offered the company a shortlist of successors last year. But while there’s no doubt the transition has contributed to the selloff, there’s also the matter of simple performance:

- Berkshire’s operating earnings fell 14% in the first quarter to $9.6 billion. And despite saying for years that he is hunting for an “elephant-sized” acquisition, Buffett hasn’t found one. The company is sitting on a record cash reserve close to $350 billion and has also been a net seller of stocks for 10 consecutive quarters.

- Berkshire is trading at a forward price-to-earnings ratio of 23.6 times its estimated future earnings this year, or a slight premium over the S&P 500. That suggests there may still be room to fall and a handful of analysts have predicted more selling, but Berkshire’s massive cash hoard could end up positioning the company well if there is an economic downturn that would allow it to go bargain-hunting.

His Magnificent Seven: Buffett has little more than half a year until he plans to pass on Berkshire’s top job to Abel, and he’s going out betting on many of the staples that made him a stockpicking legend. Just over 70%, or a little more than $200 billion, of the company’s $280 billion portfolio of publicly traded stocks is held in a mere seven companies: Apple, American Express, Coca-Cola, Bank of America, Chevron, Moody’s and Occidental Petroleum.

Extra Upside

- Jumbo-Sized Scissors: President Donald Trump called for a gargantuan 2.5% reduction in interest rates Thursday, roughly equal to the size of 10 typical rate cuts.

- Ti(c)king Clock: The deadline for China’s ByteDance to divest its TikTok assets in the US has been extended by another 90 days.

- Wall Street Projects a $14 Stock Price. But for a limited time, you can purchase units for $3.50 that include 1 share of convertible preferred stock + 1 warrant.*

* Partner

Just For Fun

Disclaimer

*This is a paid advertisement for HeartSciences Regulation A+ offering. Please read the offering circular at https://invest.heartsciences.com/