Good morning, and happy Monday.

News alert: The vast majority of people don’t want news alerts. A new global survey of nearly 100,000 people by the Reuters Institute for the Study of Journalism found that 79% of people have either never gotten a news alert on their phone, presumably because they have no interest in downloading news apps to begin with, or actively disabled them because they “get too many or they are not relevant to their lives.”

Of those respondents, 43% identified themselves as having disabled notifications. The report noted that many respondents said they were wary of over-sensationalized headlines, the stuff of tabloids, and too many non-relevant alerts, both signs of clickbait. That’s why we here at The Daily Upside would never tell you that it’s rumored Hailey Bieber and Selena Gomez are feuding – but read on if you want to know what the fight was really all about.

‘Uncertain’ 2025, M&A Deadlock Freeze $1 Trillion in PE Assets

The word of the year on Wall Street, without a doubt, has been uncertainty. It’s the catch-all to describe everything from the fog of trade to nonstop geopolitical tensions.

The inherent uncertainty of uncertainty also makes it hard to put a price tag on its impact, but last week, accounting firm PwC offered up a number: $1 trillion. That’s the value of unsold assets that would have been returned to investors if it weren’t for private equity groups holding on to them while remaining in an uncertainty-driven holding pattern.

Auditing Uncertainty

With New Year’s fireworks in January, Wall Street was full of hope for an M&A boom driven by an incoming Trump administration with deregulation at the heart of its agenda — and lighter scrutiny from regulators when rules come into play. You know the deal: President Trump has focused on other priorities to start his second term, and the resulting market limbo has put deals on hold. According to PwC analysts, plans for initial public offerings (IPOs) of companies worth a combined $120 billion were shelved in the first three weeks of April.

The Federal Reserve’s decision to hold off on rate cuts to wait for the potential impacts of tariffs has had a resulting domino effect: a lack of cheap debt, as higher interest rates make debt more expensive. PwC noted that 30% of the $3 trillion that private equity firms have invested in roughly 30,000 companies has been held for more than five years, an unusually long period compared with the typical timetable for PE shops to turn a profit on an investment. This, they surmised, is in part because they have been less able to finance growing companies without cheap debt. “In a typical M&A cycle, $1 trillion would have already been put back into the market,” Josh Smigel, a PwC partner, said on a media call. The data, meanwhile, looks like a set of spinning wheels:

- Deal volume and value have been more or less flat year-over-year, PwC said, with roughly 4,500 deals worth a total of $567 billion through May.

- In response to PwC’s May Pulse Survey, 30% of respondents said they have paused or revisited deals because of tariff concerns, which would delay investor returns. “While nearly half (48%) of the business executives surveyed expect today’s uncertainty to last less than a year, many anticipate it could extend through the next presidential election,” reads the report.

May Change Your Mind? With the possibility that the worst of the tariff warring is over, May data provides a more optimistic scenario. The number of deals worth more than $100 million climbed 6.1% from April, according to an EY-Parthenon analysis of Dealogic data, though overall deal volume fell 6.2% from May 2024.

Macro Forces Are Shaping Your Brokerage Account

Many of the most successful hedge funds in the history of capitalism — Bridgewater Associates, Citadel, Renaissance Technologies — leverage a John Nash-level understanding of macroeconomics to generate alpha.

Allio is designed to help you understand (and act on) these macro forces so you can build a resilient portfolio:

- Allio’s proprietary ALTITUDE AI™ uses predictive models and macroeconomic data to guide portfolio construction and manage risk.

- The Macro Dashboard illustrates how your portfolio is positioned relative to real opportunities and threads in the global economy.

- Their Net Worth Tracker gives you a real-time view of your full financial picture.

Most importantly, Allio meets you where you are, and is built for either hands-on or hands-off investors.

Take the emotions out of investing and download Allio now to harness the power of macro investing.

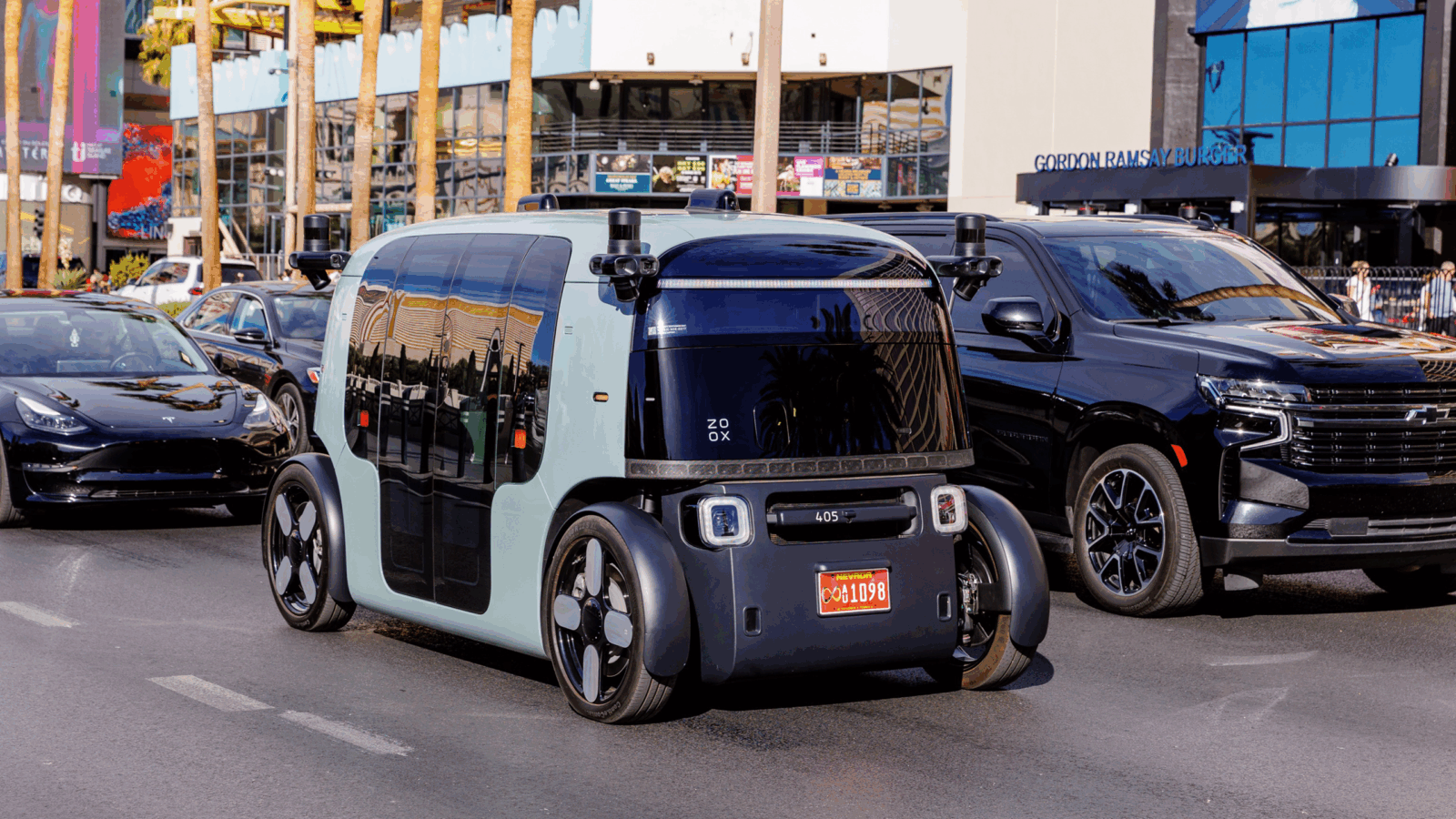

Amazon’s Driverless Cab Company Zoox Revs Up ‘Toaster Taxis’

Amazon hopes ride-hailers love direct eye contact because its carriage-style robotaxis feature four seats facing each other. After cutting the ribbon on a new factory in California, Amazon is ramping up production of its bidirectional, self-driving cabs ahead of a planned launch in Las Vegas later this year. The Bay Area facility currently churns out one robotaxi a day, but Zoox hopes to boost that rate to three an hour by next year.

After buying Zoox five years ago for $1.3 billion, Amazon is prepping a big push onto the roads of major cities (first, Las Vegas and later, San Francisco, Austin and Miami). But rivals are already there.

The Road More Traveled

Alphabet’s Waymo said it provides 250,000 rides a week in its self-driving cabs, up from 10,000 two years ago. Riders can hail a driverless Jaguar from Waymo’s app in Austin, Los Angeles, Phoenix and San Francisco. Waymo also recently applied for a permit to operate in New York City, where state law will require a driver, though the company is pushing to change that provision.

So far, Waymo is the only fully operational self-driving taxi service in the US, but Tesla is trying to join it ASAP:

- CEO Elon Musk promised in 2021 that Tesla would have a million robotaxis on the road by now, which … didn’t happen. Tesla did, however, put a small group of robotaxis on the road in Austin, Texas, last weekend, which Musk described in a virtual victory lap as “the culmination of a decade of hard work.”

- Regulators are investigating Tesla’s self-driving tech in connection with fatal accidents as critics raise red flags about its robotaxi’s lack of lidar and radar, which Waymo and Zoox use. Waymo and Zoox have been investigated after incidents including erratic driving.

Yellow Light. Zoox is trying to join a race that Waymo’s already a few laps into, but Waymo may have made the road a little smoother. Waymo eased riders into the concept of driverless taxis with its fleet of Jaguars, which look like regular cars with some extra gadgets whirring around. Zoox’s autonomous taxis don’t even have a steering wheel, so Zoox has planned a marketing push to persuade riders to hop into its toaster taxis. What’ll probably be more important for swaying would-be riders is how safe upcoming robotaxi rollouts are.

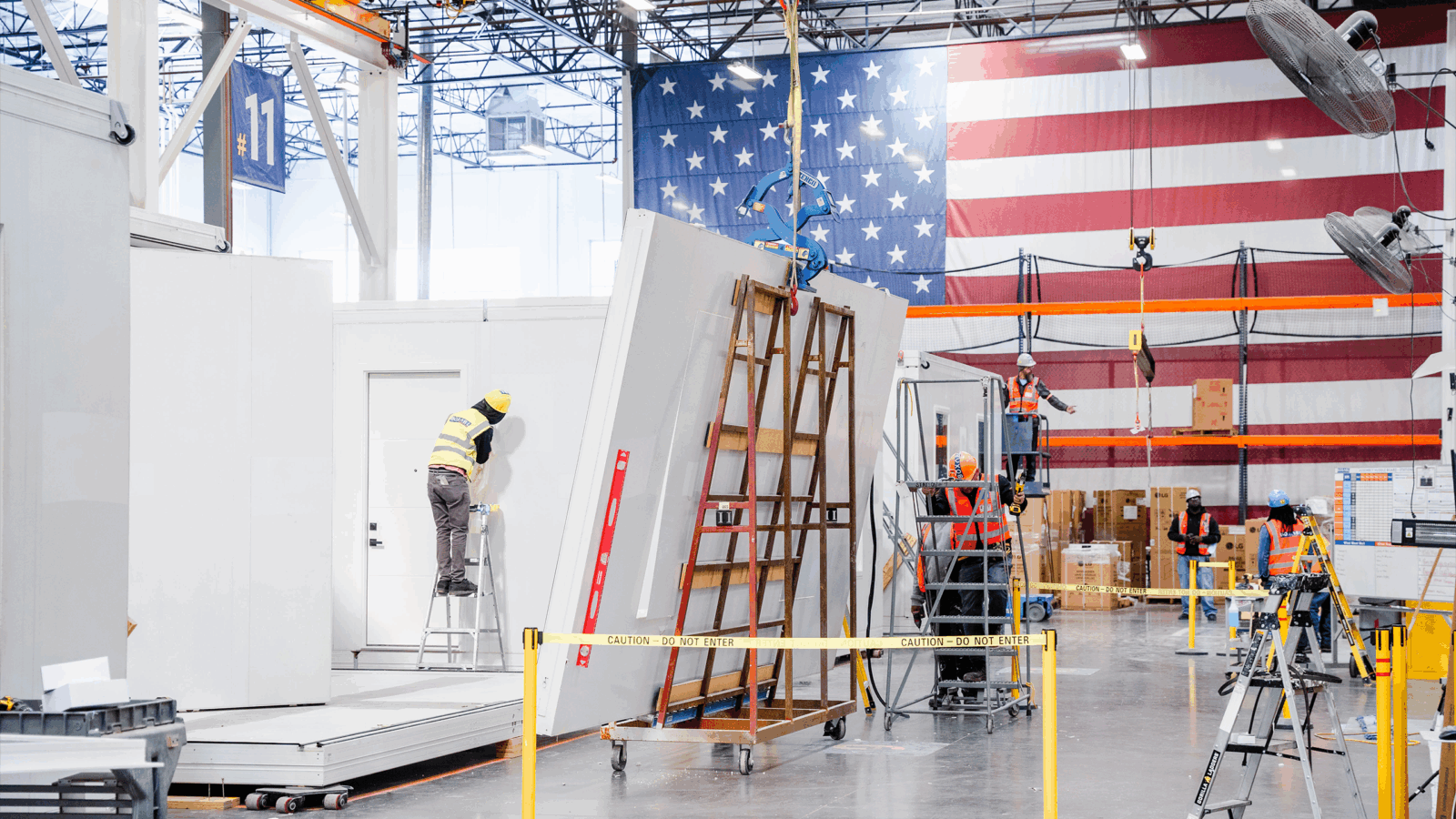

Cars Are Built In Minutes; Why Not Houses? That’s what BOXABL asked about the outdated ~$5T homebuilding industry. So, like 20th-century cars, they introduced assembly-line automation. BOXABL homes are factory-built, folded, shipped via truck, and unfolded on-site in one hour. It’s working, too: an initial prototype was delivered to SpaceX, the firm completed a 156-home DoD order, and there are active developer and consumer deliveries. Invest in BOXABL before the opportunity ends tomorrow.*

Cybersecurity Giant Palo Alto Networks Caught Between Opportunity and Maturity

As the world’s largest standalone cybersecurity company, Palo Alto Networks has potentially much to gain from a splintering world. Not to mention, its stock offers a relatively unfiltered view of investor confidence in the sector.

But while the company has risen nearly 9% so far this year, and some analysts are gung ho, a look under the hood suggests that astronomical growth can’t carry on forever, even if geopolitics feels like a dice roll in a game of Risk at the moment.

The Maturity Equation

Back in January, almost 60% of organizations including private companies told the World Economic Forum that geopolitical tensions have impacted their cybersecurity strategies. Many are also on edge about risks: One in three CEOs said they were worried about losing sensitive information or intellectual property to cyber-espionage, and 45% of cyber leaders expressed concern about operational and business disruptions. The rise of state-sanctioned cyberattacks, with China and Russia the best-known sponsors, and recent warnings to US companies to prep for potential cyberattacks from Iran have inflamed tensions.

All that suggests a market for Palo Alto Networks to grow into, what with its next-generation firewalls, cloud security services and AI-powered security operations. Goldman Sachs analysts are among those who see this logic: They maintained a buy rating on the company earlier this month, citing its revenue growth of roughly 14% in the past 12 months and its success in selling new products to existing customers. But, on the other hand, there’s a maturity challenge:

- Palo Alto Networks sales growth has slowed — its revenue growth was in the mid-20s percentage points in 2023, and its latest quarter saw revenues grow 15.7% year over year. Meanwhile, the growth of annual recurring revenue — which offers a glimpse into the company’s ability to retain customers — has declined in five straight quarters, and it’s expected to be around 32% this year, compared with 45% or more in previous years.

- Even as Palo Alto beat revenue and earnings expectations in its latest quarter, the slowdown suggests the company may be maturing and reaching a plateau where customer adoption is slowing —a reality that cybersecurity firms will have to learn to live with, as other industries have. Nevertheless, the sector is expected to grow by hundreds of billions of dollars in the next decade, meaning there will be plenty of dollars to compete for, but likely more competitors. Palo Alto, at the very least, proved more resilient during a week of concerns about conflict with Iran than the broader tech industry. Its shares rose 0.8% last week, while the iShares Expanded Tech-Software Sector ETF fell 1.8% over the same period.

Hitting the Firewall: Nikesh Arora, the CEO of Palo Alto Networks, makes a living putting up firewalls, but he also knows the feeling of rejection. He told the Humans of Bombay podcast earlier this month that after graduating from university, he was rejected from more than 400 jobs. “I saved all the rejection letters,” he said. “They’re my motivation.”

Extra Upside

- Oil Markets on Edge: Oil prices hit a five-month high Monday before falling as US strikes on Iranian nuclear facilities escalated fears the Persian Gulf nation could close the Strait of Hormuz, an essential supply route.

- Trump Train: Fed Governor Christopher Waller said he doesn’t think tariffs will increase inflation in the short term and called on the central bank to cut interest rates next month, something the president has been clamoring for.

- You Have a Choice When It Comes to Crypto: Since they launched the first publicly traded Bitcoin fund in 2013 (when Bitcoin was trading at just $133), Grayscale has been at the cutting edge of digital asset investing, with the most robust selection of crypto investment products in the US, including their just-introduced income-focused ETFs. Explore Grayscale’s suite of products now.**

** Partner

Just For Fun

Disclaimers

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

**Investing involves risk and the possible loss of principal. ETFs distributed by Foreside Fund Services, LLC.