Good morning — and gamers, rejoice.

The Nintendo Switch 2 is here. The next-generation hybrid video game console, which can be used as a portable handheld or tablet device, is in the hands of its first proud purchasers after launching at midnight (there’s already a video of someone taking it apart, an essential component of nerding out about devices).

Nintendo expects to sell 15 million units of the new console, priced at $449.99 in the US, in the fiscal year ending March 2026. To market the new console, Nintendo recast actor Paul Rudd in a commercial as a flashback to his appearance in a 1991 TV ad promoting the Super Nintendo Entertainment System, on which the Mario Kart series debuted. Thirty-odd years of throwing turtle shells and dodging banana peels is enough to make any nostalgic gamer feel the presence of Father Time. Except for the infamously timeless Rudd, who somehow looks like he hasn’t aged a day.

Unshackled Wells Fargo Fights to Regain Momentum Lost in Penalty Box

Wells Fargo shares rose over 2% early Wednesday, hitting a three-month high, after the Federal Reserve lifted an asset cap imposed following regulators’ determination that the bank had exploited its own customers.

The stock, a little hot out of the gate, spent the rest of the day ticking downward and, by the time the closing bell rang, had fallen 0.3% for the day. While a banking juggernaut may have been unshackled to pursue a determined growth strategy, some Wall Street observers think its ambitions are already priced in.

The End of the Lost Years

There was a period in the late 2010s when Wells Fargo tallied up more scandals than the National Enquirer, the most notorious being when its employees juiced sales numbers by setting up millions of fake deposit and credit card accounts in customers’ names without their consent. US regulators got so fed up that they imposed a $1.95 trillion asset cap in 2018, ordering the lender to keep its balance sheet frozen at 2017 levels.

Obviously, that left the lender — which Bloomberg estimates lost out on $39 billion in profits under the cap — hamstrung for seven years in the face of fierce competition. From the end of 2017 to March of this year, JPMorgan Chase’s assets grew from $2.5 trillion to $4.3 trillion, while Bank of America’s rose from $2.3 trillion to $3.3 trillion. Now, Wells Fargo is free to pursue growth, which post-scandal CEO Charlie Scharf has been plotting for years:

- Once home to the largest US mortgage operation, Wells Fargo has retreated from the multi-trillion-dollar sector under Scharf, who has sold the bank’s asset management business, corporate trust division, student loan portfolio, rail equipment leasing unit, and most recently, the bulk of its commercial mortgage-servicing unit. What he’s positioned for expansion are trading and investment banking, which were handcuffed by the cap.

- Wells Fargo has added over four dozen senior bankers since 2020 and scored a major coup last year when Scharf convinced the departing head of JPMorgan’s North American investment banking, Fernando Rivas, to run the San Francisco-based lender’s corporate and investment bank. Early results are promising: Investment banking fees grew 62%, investment advisory fees 13%, and trading revenues 10% in 2024 — though Wells’ operations are a fraction of the size of JPMorgan’s.

Taking Stock: Apart from the muted performance on Wednesday, Wells Fargo shares have climbed 7.3% in 2025, outperforming the 4.3% gain by the S&P 500 Banks Index. But that explains why some investors are cautious. HSBC analysts noted in a report that “markets have been increasingly pricing in the asset cap removal, possibly limiting near-term upside.” Shares are already up 28% in the past year. JPMorgan analysts, for example, kept their $73.50 price target after the news of the cap removal. But others on Wall Street are betting Wells Fargo will muscle its way higher as it beefs up investment banking operations: Bank of America hiked its target to $90 a share from $83 after the asset cap’s removal, and Morgan Stanley raised its target to $87 from $77.

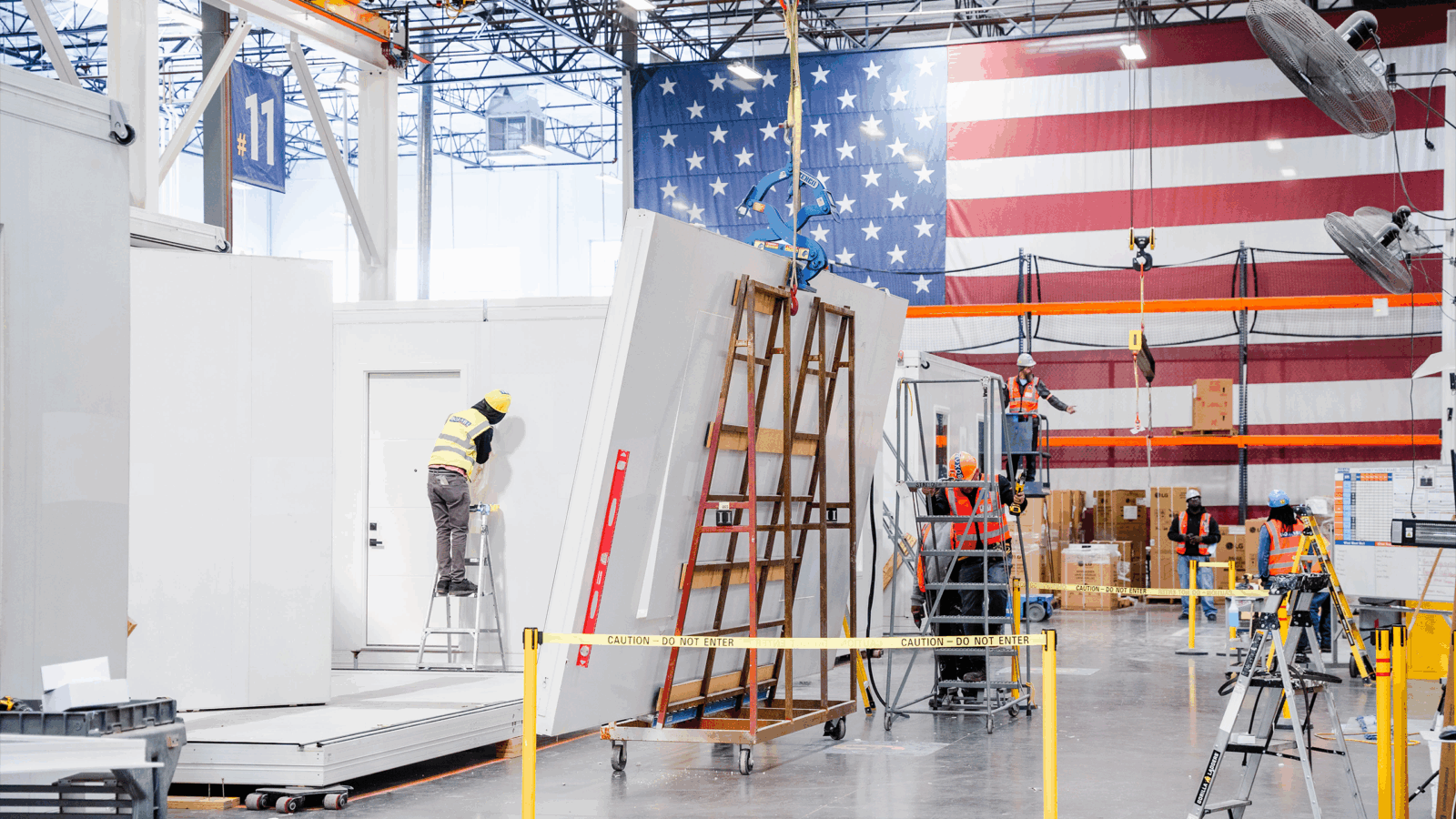

They Modernized Homebuilding in Just 4 Steps

Step 1: Invent foldable housing units called “Casitas” that can be rolled off assembly lines in hours.

Step 2: Sell, build, and deliver hundreds of units, making BOXABL a household name in the ~$5T home construction industry.

Step 3: Gain attention from one of America’s top homebuilders, who went on to become investors.

Step 4: Begin preparing for Phase 2 production, which allows for future modules to combine into townhomes, single-family houses, and apartments.

Final step? Invite everyday investors to share in your growth for just $0.80/share. But there’s not much time to act.

Become a BOXABL investor before their investment opportunity ends on June 24.*

US Service Economy Suffers Unexpected Trade War Blow

Don’t look now, but another economic indicator is blinking red.

New data from the Institute for Supply Management (ISM) on Wednesday showed that the US services sector unexpectedly contracted in May, bucking a nearly year-long trend. The surprising news comes just ahead of an all-important jobs report from the Labor Department due out Friday.

At Your Service

While much has been made of the decades-long decline of US manufacturing amid this year’s trade war, much less attention has been paid to the US services sector, which ran a $293 billion surplus in 2024. Now, it appears that trying to boost the former may be coming at the expense of the latter. The ISM’s purchasing managers’ index for service providers fell 1.7 points to 49.9 in May (anything below 50 signals a contraction). That’s the first contraction since June 2024 and only the fourth reading below 50 since June 2020.

Why? Tariffs and economic uncertainty. Still, not every service sector has been hit equally:

- Among the 10 services sectors that actually grew in May, per the ISM, was accommodation and food services, perhaps surprising given the other red flags recently raised by the industry. On the flip side, eight industries reported a contraction in May, after just seven in April; those sectors include retail trade, finance and insurance, transportation and warehousing, and construction.

- “Tariff variability has thrown residential construction supply chains into chaos,” one survey respondent in the industry told the ISM. “Many items are still manufactured in southeast Asia, and suppliers are beginning to test the waters for increases. Major heating, ventilation, and air conditioning equipment manufacturers are passing on their cost increases due to higher refrigerant and steel commodity prices.”

Inflation Strikes Back: Numbers under the hood are cause for even more concern. The survey’s price index increased near levels not seen since November 2022, when headline inflation numbers ran around 7%. On the flip side, services employment figures looked rosy by comparison — increasing 1.7% since April. A separate report from ADP Research on Wednesday, however, showed private-sector hiring cooling to its slowest pace in two years in May. “We’re not getting the warm fuzzies [about Friday’s jobs report] given what has been seen so far,” Jennifer Lee, senior economist at BMO Capital Markets, told MarketWatch Wednesday. That, of course, puts the Fed in a tough spot heading into the monetary policy committee’s next meeting on June 17: The economy is contracting, the labor market could be softening, and inflation may be back on the rise. Complicating matters further? The Wall Street Journal reported on Wednesday that economists are growing skeptical about the quality of inflation data from the suddenly short-staffed Bureau of Labor Statistics, which hasn’t cast as wide a survey net as it typically does.

Countries Fight Over Periodic Table as China Hoards Rare Earths

Quick geology lesson: There are 17 types of rare earths, and they’re used as the building blocks in cars, semiconductors, missiles, drones, and more. China mines 70% and processes 90% of the world’s supply.

China’s massive rock collection has become one of its most important bargaining chips, and as the country tightens its grip on rare earths exports, the global supply chain is showing cracks. This week, world leaders raised the alarm, with EU trade officials emphasizing yesterday the bloc’s urgent need to reduce its dependence on rare earths from China.

Rocky Relationships

When POTUS Trump raised global import tariffs in April, China said, “Bet,” and rolled out retaliatory restrictions on seven kinds of rare earths and the magnets made from them. At the same time, China cracked down on illegal smuggling of the valuable elements that had made previous export curbs less effective. Last year, China halted exports of three rare minerals critical for making computer chips, EV batteries, and military weapons systems.

Now, auto manufacturing seems to be the first major industry feeling the effects of its mineral deficiency:

- Ford temporarily stopped churning out SUVs at a Chicago plant last week because of a shortage of magnets, which are used not only in electric vehicle power systems but also in various components of gas-powered cars, such as power windows and headlights. Finance chief Sherry House said yesterday that restrictions are putting stress on Ford’s system. Mercedes-Benz’s production chief noted that it’s chatting with suppliers about building up reserves, while BMW said its supply chain has been disrupted but its factories are still running.

- China’s passing out a limited number of export permits, but experts say it’s not enough to keep production running smoothly. For now, the auto industry has a stockpile of magnets to fall back on, but it’s only expected to last a few months at most.

Digging Deep: The US has spent hundreds of millions of dollars to bring rare earth production stateside since 2020, but it’s still in the early stages of building the complicated supply chain (rare earths require more than 100 steps to process). In the meantime, US officials are pushing for access to Ukraine’s rare earths, while automakers are trying to develop parts that require fewer or no rare earths. Trump and Chinese President Xi Jinping are expected to have a discussion this week that’ll highlight export restrictions. It could be a tad awkward after Trump posted on social media that Xi is “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH.”

Extra Upside

- Check Your Work Devices: Google Threat Intelligence Group said in a report Wednesday that hackers are tricking workers at some companies into installing a modified Salesforce app in order to steal data.

- Big, Beautiful Deficit: The Congressional Budget Office said Wednesday that the GOP tax bill President Trump wants passed by Independence Day would add $2.4 trillion to federal budget deficits in the next 10 years. Trump ally Elon Musk called for a new bill to be introduced.

- Crypto Curious? With over a decade of experience, Grayscale helps investors gain exposure to crypto right in their brokerage or IRA. Start by exploring Grayscale’s suite of crypto investment products today.**

** Partner

Just For Fun

Disclaimers

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://www.sec.gov/

**Investing involves risk, including possible loss of principal. Visit grayscale.com for more information and important disclosures.