Good morning, and happy Friday.

What’s in the president’s Spotify queue headed into the weekend? If we had to guess: “Go Your Own Way” by Fleetwood Mac and, perhaps, “Since You’ve Been Gone” by Kelly Clarkson. In other words: breakup songs, as his relationship with key-financial-backer-turned-DOGE-honcho Elon Musk (very publicly) unraveled on Thursday. On Musk’s playlist? We’d guess the slightly more spite-filled “Good 4 U” by Olivia Rodrigo — matching the tone of his X feed, where he posted, among other jabs, that the White House tariff regime would cause a recession by the second half of this year.

One thing the breakup has not been good for? Tesla’s share price, which tumbled more than 14% Thursday after threats that government contracts with Musk’s companies could be terminated. What happens next? Hard to say, but it’s more likely than not that you’ll hear all about it from both of them (each on their respective social media platforms, of course).

Tariffs Deliver Record Drop in US Trade Deficit

Call it the gravitational pull of Trump’s tariffs: First came the tidal wave; now, the tide is receding.

After a record-breaking trade deficit in March, as businesses rushed to order goods ahead of a massive spike in import duties, data from the US Commerce Department on Thursday shows that April delivered a record-breaking decrease in the trade deficit. Does that mean the US has won the first big battle of the trade war? Well, it’s complicated.

Trade-Offs

So just how big was the drop? In April, the trade deficit narrowed to just $61.6 billion — way, way, way smaller than the record-setting, Grand Canyon-sized $138.3 billion chasm seen in March. That marks the largest month-over-month deficit contraction on record, according to the Commerce Department, and comes in below consensus expectations of approximately $66 billion. Overall, imports of foreign goods fell about 16% month-over-month to $351 billion, the report said. According to a data analysis by The New York Times combining figures from the Commerce Department and tracking by Moody’s Analytics, the decrease included importing fewer cell phones from China, pharmaceuticals from Switzerland and Ireland, and automotive parts from South Korea, Japan, Mexico, and Canada. Canada reported a record trade deficit of its own on Thursday, of about $5.2 billion (in US currency) in April, as its auto industry gets crushed by tariffs.

Curbing America’s reliance on imports was just Step One of the White House’s economic plan. In April, at least, it looks like Mission Accomplished (Note: Economists don’t tend to think deficits are inherently negative). But Step Two in the plan was reviving America’s manufacturing core, and it remains unclear if tariffs will prove an effective tool to that end:

- Helping shrink the deficit gap was a 3% bump in US exports to $289.4 billion in April, per the Commerce Department — also good for nearly $16 billion more than recorded in April 2024. From March to April, the US swung from a trade deficit to a trade surplus with several countries, including Australia, Switzerland, and Spain.

- That said, US manufacturing isn’t exactly thriving under the new stop-and-start tariff regime. Manufacturing activity contracted for the third consecutive month in May, according to an Institute for Supply Management survey released earlier this week, as tariffs spike the prices and delivery times of inputs; the materials shortage has caused particular headaches in the auto industry, with Ford even temporarily halting production at a Chicago plant last week.

Deals, Deals, Deals: Step Three in the White House’s plan has been to use the threat of major tariffs to renegotiate trade deals with countries the world over. Thursday also provided some updates on that front, with German Chancellor Friedrich Merz visiting the White House as the European Union continues to hash out trade agreements with the US. “He’s a very great representative of Germany,” POTUS Trump said of Merz, adding, “We’ll have a good trade deal.” The White House also agreed to further talks with leaders in Beijing on Thursday, with the president saying “we’re in very good shape with China and the trade deal” after the two sides had gotten “a little off-track.”

Circle Spirals Upward in $1 Billion IPO

Circle raised more than $1 billion in its NYSE debut yesterday, and that’s not a round-ing error. The stablecoin issuer’s shares opened at more than double their $31 IPO price to peak above $100.

Circle — which issues USDC, the No. 2 stablecoin behind Tether — joins a short-list of crypto-only companies that have gone public, including Coinbase, Mara Holdings, and Riot Platforms.

This is Circle’s second attempt at going public, after its reverse SPAC in 2022 sputtered under regulatory scrutiny. Circle is benefiting from better vibes this time as the US government, businesses, banks, and retail traders clamber aboard the crypto train.

Mainstream-ification

Bitcoin’s price is hovering above $100,000, and the Senate is pushing through a stablecoin bill as the two digital assets — which are generally seen as more reliable than, say, fartcoin — stand at the vanguard of President Trump’s pro-crypto era.

Vice President JD Vance spoke at a bitcoin conference last week, saying the administration would continue to push forward pro-crypto policies. Trump, whose family crypto venture (World Liberty Financial) launched a stablecoin in March, boasted at last year’s conference that he’d make the US the world’s “crypto capital.”

Big banks are following the government’s lead:

- JPMorgan Chase is planning to start accepting crypto ETFs as loan collateral, Bloomberg reported Wednesday, and begin including crypto assets in its net-worth calculations of clients (which could help determine borrowing limits). Translation: One of the biggest banks will treat crypto more like stocks or art.

- Morgan Stanley is said to be exploring adding crypto-trading to its E*Trade platform next year after rolling out bitcoin ETFs to clients last year.

Coin Toss: Brookings published a report Monday raising red flags about the potential risks to the public that could come with the pro-crypto era — including fraud, as well as volatility in retirement plans as big banks embrace crypto. Regulatory confusion is also brewing: The SEC is said to have walked back its approval last week of two crypto ETFs after questioning whether the firms behind them counted as investment companies by its definition. Still, Circle’s IPO shows crypto hype is running hot and isn’t likely to be tempered too quickly by a few red flags.

This Plastic Disappears Like Magic. With 450M metric tons of plastic waste yearly, you can imagine how revolutionary a new kind of plastic that completely dissolves in water would be. Major players are partnering with Timeplast for their patented material. For a limited time, you can become a Timeplast shareholder.*

NBA Finals Kick Off With an Old (Footwear) Friend

Nike’s Swoosh logo — and its Air Jordan silhouette — are virtually synonymous with the concept of unrepentantly slamming an inflated sphere of leather down over the top of someone’s head. That’s thanks to the shoemaker’s savvy endorsement deal with His Airness Michael Jordan in the 1980s that exploded its market share and paved the way for later deals with poster artists like Vince Carter and Lebron James and scoring machines like Kobe Bryant and Kevin Durant.

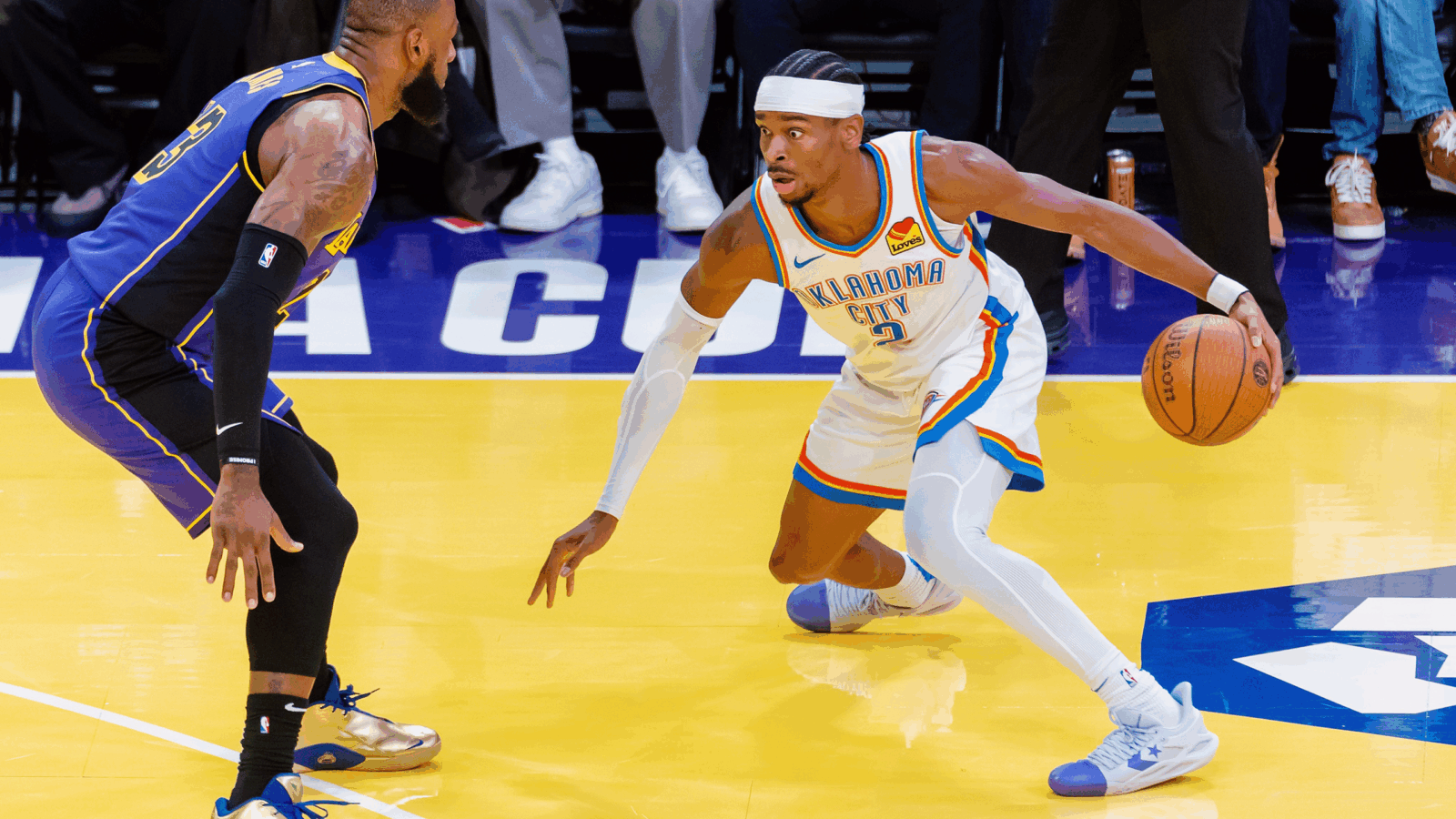

But when the NBA Finals kicked off last night, the high-flying MVP of the National Basketball League and the biggest star of the series, Shai Gilgeous-Alexander of the Oklahoma City Thunder, was laced up in Converse. A sputtering brand that dominated basketball half a century ago, it sure could use the publicity. Lucky for Nike, it owns Converse now, unlike in the 1980s.

Bringing Back the Magic

The art of dunking all over people — heck, the balletic majesty of the entire modern NBA — was pioneered by Julius “Dr. J” Erving in the 1970s at a time when he, and most basketball players, wore Converse high-top sneakers that you’re more likely to see today at a beer league softball game or a pop punk show. He made Chuck Taylors so cool that Jordan himself, who idolized Dr. J, wore them before inking the Nike deal that turned the Portland-based upstart into the world’s biggest sneaker company and inspired a half-decent big-screen reunion of Ben Affleck and Matt Damon.

Nike’s Jordan-fueled rise, ironically, would contribute to Converse filing for bankruptcy in 2001 after it failed to keep pace with the emerging competition. Nike bought it for $305 million two years later, though results have been up and down since — revenue for Converse dropped 18% to $405 million in Nike’s latest quarter, reflecting the parent’s own struggles to maintain relevance in an increasingly crowded field. Global Data estimates Nike’s share of the global sportswear market fell to 14.1% last year from 15.2% in 2023, while Adidas, New Balance, On, and Hoka all gained ground. Having Gilgeous-Alexander’s rising star attached to its subsidiary could be a way of capitalizing on the fraying:

- An increasing share of NBA endorsement deals has been spread among shoe firms fighting for a piece of Nike’s market share: Philadelphia 76ers star Joel Embiid is inked with Skechers, Golden State Warriors icon Steph Curry rocks Under Armour, and Tyrese Haliburton, the Indiana Pacers star whose underdog team stole the first finals game from Gilgeous-Alexander’s Thunder on Thursday, is signed with Puma.

- This fall, Converse will release the league MVP’s own basketball shoe, the $130 Shai 001, capitalizing on its highest-profile talent since the days of Magic Johnson and Larry Bird, but with Nike reaping the windfall of the market’s move away from the swoosh.

Drink Up: The decentralization of endorsements has hit other sports products where competition is fierce. The star of this year’s Stanley Cup Finals and the world’s undisputed best hockey player, Connor McDavid of the NHL’s Edmonton Oilers, signed with Coca-Cola-owned sports drink Bodyarmor last year and became one of the faces of a rebrand launched in April. It’s trying to win market share from Pepsi’s dominant Gatorade, which has the weight of longstanding partnerships with the NFL and NBA behind it.

Extra Upside

- Hot AIr: Indirect emissions from operations at Amazon, Microsoft, Alphabet, and Meta increased 150% from 2020 to 2023 as the AI boom created rocketing demand for data centers, according to a report from the UN’s digital technologies agency.

- Cheerio, Bye, Ta-Ta: UK fintech giant Wise is switching its main listing to New York in a huge setback for the London Stock Exchange, which has seen a record number of companies quit in recent months.

- The Hustle Is A Must-Read For Budding Billionaires. Their daily newsletter delivers the latest stories in business and tech — what to learn from them, and how to capitalize. Follow their lead.**

** Partner

Just For Fun

Disclaimer

*This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.