Good morning.

It doesn’t take Don Draper and the team of creatives at Sterling Cooper to tell you to stick with a revered brand name if you’ve got one. But apparently the message only made its way to Warner Bros. Discovery executives this week (after all, “Mad Men” belongs to rival AMC Networks).

On Wednesday, the company announced it will restore the name HBO Max to the streaming service it rechristened Max two years ago. By controversially dropping the initialism of the Home Box Office brand, one virtually synonymous with prestige television, executives originally said they wanted to avoid associating it with other content available on the streaming service, like Discovery’s fleet of reality shows whose stars don’t exactly bring the same artful construction as Jon Snow, Tony Soprano, Carrie Bradshaw, or the fictional Larry David. At least they can explain the 180 with a simple tagline: It’s Not Max. It’s HBO Max.

Nvidia, ADM Buoyed by Saudi AI Deals, Softer US Export Controls

With deals in the Middle Kingdom on hold, US semiconductor firms have a new geographic hotspot: the Middle East.

Santa Clara-based chip companies Nvidia and Advanced Micro Devices (AMD) announced this week that they inked deals with a newly launched Saudi AI venture. They form a fraction of a $600 billion pledge by Saudi Arabia to invest in the US that President Trump unveiled Tuesday, and behind the announcements is a regulatory shift analysts say is poised to reshape the global AI economy and the geopolitics surrounding it for years to come.

Oh, the Humainity

While the US and China may have struck a temporary truce in a trade war over most goods, semiconductors are a different story. The Trump administration recently toughened export rules to bar American-made AI processors from being sold to China (the Middle Kingdom) and Nvidia disclosed last month that it would take a $5.5 billion writedown because of restrictions on high-end chips.

But with one market walled off, a whole host of them opened up on Tuesday. The Commerce Department rescinded Biden-era export controls on dozens of other foreign countries that would have introduced tiered access to US chips as of yesterday. That will allow more semiconductors to be exported without federal approval, including to Gulf nations where the previous administration was concerned that China, seeking a technological edge, could secure them through go-betweens.

Enter Saudi Arabia’s sovereign wealth fund, which is launching its very own AI company focused on seemingly everything under the sun in the sector: “data centers, AI infrastructure and cloud capabilities, and advanced AI models and solutions.” In what was surely no coincidence, Humain, as the Saudi venture will be called, had massive deals lined up with Nvidia and AMD right in time for Trump’s trip to Riyadh on Tuesday:

- Nvidia will sell 18,000 of its advanced GB300 Grace Blackwell chips to Humain for a start, with “several hundred thousand” high-tech processors to follow in the next five years. The company’s shares rose 4.2% Wednesday as markets digested the news — and the Trump administration is also considering letting Nvidia sell a million advanced chips to the UAE.

- Rival AMD struck its own $10 billion deal with Humain to provide software and chips for data centers “stretching from the United States to Saudi Arabia,” sending its shares up 4.6% Wednesday. BofA Securities analyst Vivek Arya wrote in an investor note that the combined AI projects could generate $3 billion to $5 billion in annual chip sales, and in the process “offset headwinds from restrictions on US companies shipping to China.”

Keep ‘Em Coming: Humain also struck a $5 billion partnership with Amazon Web Services to build an “AI Zone” in the kingdom a little over a year after AWS said it would invest $5.3 billion to bring data centers and other infrastructure to the country. And, in keeping with the week’s theme, the deals kept coming on Wednesday: Majority state-owned oil giant Saudi Aramco said it signed 34 deals with US companies worth up to $90 billion, including a pact with Nvidia to build AI factories and digital-transformation deals with tech firms Amazon and Qualcomm and more traditional energy agreements with Exxon Mobil, SLB, Halliburton and Baker Hughes.

Rub Shoulders With The Brightest Minds In Crypto

A friendly regulatory environment and widespread institutional adoption have many saying that 2025 will be the year of digital assets.

The biggest crypto event of the year — Bitcoin 2025 — is coming to Las Vegas, May 27–29, and it’s your chance to connect with the people shaping the digital currency.

Vice President JD Vance, White House A.I. and Crypto Czar David Sacks, Robinhood CEO Vlad Tenev will mix it up with 30,000+ attendees and a huge slate of A-list financial speakers.

The fun doesn’t stop at 5PM. Each night features exclusive networking events and unforgettable after-parties across the Vegas Strip.

30% off with code UPSIDE30 when you register with this link.

Retirement-Platform Giant Turns On Private Markets Tap

Private credit, equity, and real estate markets won’t have to rely on the assets of the very wealthy for much longer if the broader investing public starts to buy in.

Empower, the second-largest retirement plan provider in the US, said on Wednesday it would make private market investments available to its 19 million participants with the help of a consortium of Wall Street’s Who’s Who. They include Apollo, Franklin Templeton, Goldman Sachs, Neuberger Berman, PIMCO, Partners Group, and Sagard.

Do It For Me

Private equity, private credit, private real estate, and other alternative investments have been historically reserved for institutional investors and the ultra-wealthy, in part because funds carrying those types of assets have required high minimums, long time horizons, and some level of professional savvy to navigate their complex structures. That appears to be changing with more fund managers teaming up with alternative asset managers:

- State Street and Apollo launched a first-of-its-kind private credit ETF.

- Vanguard, Blackstone, and Wellington Management have teamed up to develop more multi-asset investment products, the first of which could be an interval fund holding a mix of public and private investments.

- Capital Group and KKR launched two public-private funds focused on the fixed income space.

The arrival of private-asset “democratization” would appear timely. Initial public offerings (IPOs), a payout avenue for private markets investors, have been put on ice amid the market hurly burly; institutional investors have hit their limits on private equity allocations lately; and individually managed retirement accounts and defined-contribution 401(k) plans have virtually zero exposure to private markets.

A major selling point of private assets is their potential to generate double-digit returns — an enticing proposition for investors who have squeezed all the juice out of public markets and want more. At the same time, alternative investments typically mean higher fees, lower liquidity, and less public disclosure. Read: Harder to figure out, though advice models and ETF wrappers make them more approachable.

Make Cakes: The push to make private market investments available to all is reminiscent of the invention of prepackaged cake mix in the 1930s and its boom in the late 1940s. The first effort came from a Pittsburgh canning company making use of a molasses surplus. The second wave followed the end of WWII, when flour companies pivoted the dry mixes they made for troops to housewives. Easy-make alternative returns look pretty on the box, but results will vary.

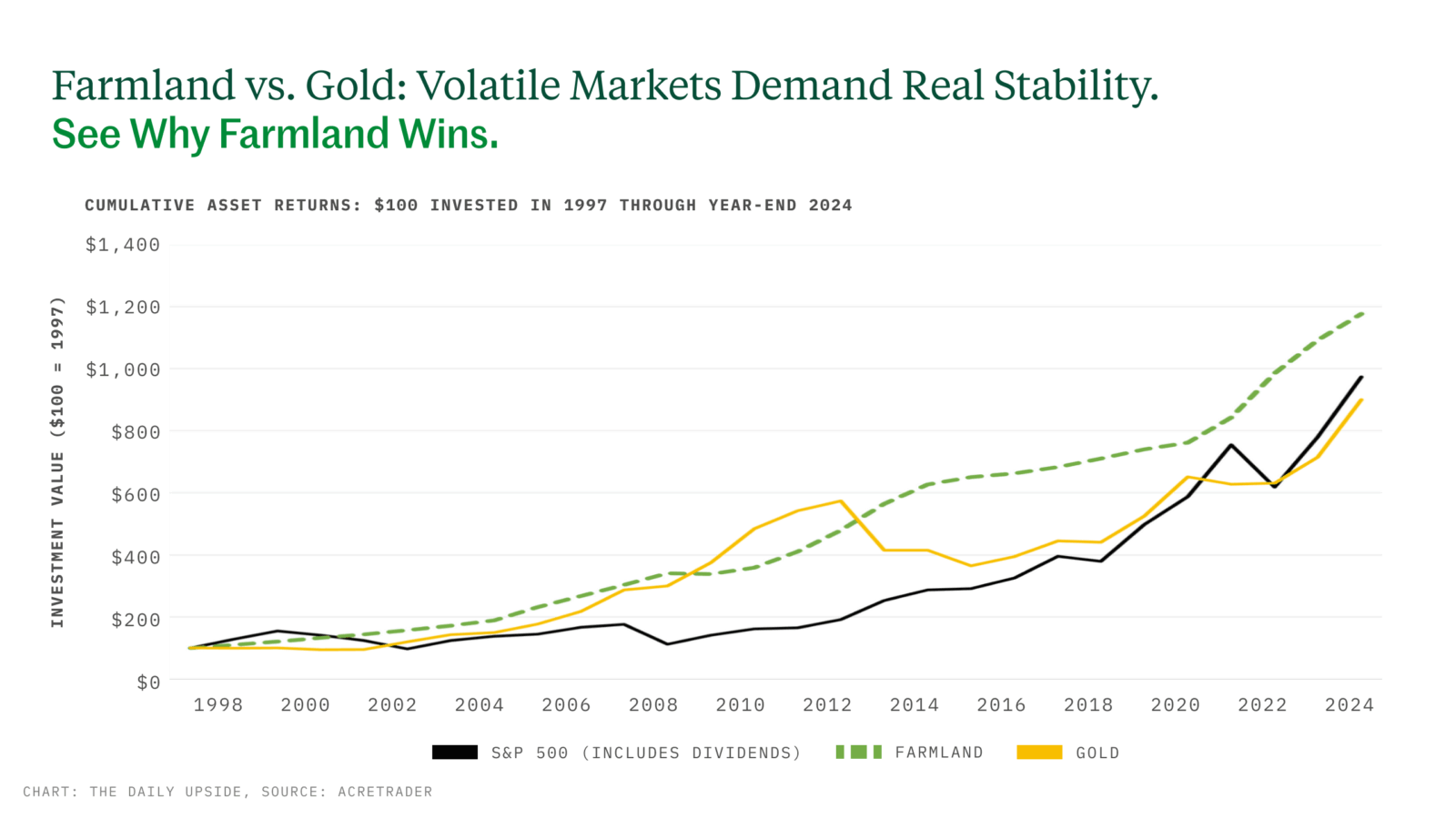

The Headlines Say “Buy Gold.” The Data Says “Look Again.” Gold’s been dominating the financial news cycle, but a data-driven investor might pause before jumping in. Since 1998, farmland has quietly delivered higher average annual returns and lower volatility than gold. See why farmland wins.*

Airbnb Reinvents Itself to Regain Rizz

AirBnB wants to be AirAtoZ. The short-term rental platform overhauled its app to let guests add hotel-like services to their stays, including room service and spa treatments.

The company also updated its “Experiences” offering, bookable tours and events hosted by locals. New options include a tour of the Notre-Dame Cathedral hosted by one of the architects who worked on its restoration and a ramen-making class with Michelin Bib Gourmand winner Saburo Ishigoka.

Beyond that, Airbnb added an upper tier of experiences it’s calling “Originals” that’ll include a day playing football and eating BBQ with Patrick Mahomes and a chance to cosplay as anime characters with Megan Thee Stallion.

Airbnb n’ a Lot More

Airbnb’s investing as much as $250 million to expand beyond the couch-surfing economy. Its revenue-diversifying plan also includes becoming more like a social platform with expanded profiles and group chats and adding an AI-powered travel concierge.

Airbnb has tried to expand beyond home rentals before (Experiences started in 2016), but switched its focus to its core business when the pandemic wiped out 80% of its bookings. Business eventually bounced back to 2020 levels, but Airbnb faces other threats:

- Last month, Airbnb forecast weaker-than-expected revenue for the current quarter, pointing out falling demand for travel from Canada to the US. Summer flight bookings from Canada to the US are down 21%, reported The New York Times.

- A handful of major cities have banned or strongly regulated short-term rentals in recent years. Airbnbs are illegal or tightly controlled in Barcelona, New York City, Montréal, Berlin, and several cities on the California coast including Santa Monica.

Cleaning Fee Crisis: Airbnb rose to popularity with the promise of accommodations that were both cheaper than traditional hotels and more authentic. But over time, Airbnbs became pricier without any of a hotel’s perks. Travelers complained about having to, for instance, run dishwashers and start loads of laundry. New services could help Airbnb better compete with hotels, which CEO Brian Chesky has said is core to his plan. But the company also seems to want to go beyond that and become the virtual version of a hotel lobby’s wall of travel pamphlets.

Extra Upside

- Trench Coat Trouble: Luxury fashion house Burberry said it plans to cut one fifth of its workforce after reporting a £66 million ($87 million) loss in its latest financial year.

- Ketchupgrade: Kraft Heinz will invest $3 billion in upgrading its US manufacturing facilities, despite falling sales, to offset the threat of tariffs.

- “A Quantum Leap In Stock Investing”: Unlock 21.6% Annual Average Returns In 5 minutes Per Month. Rigorously tested over 16 years, powered by 5TB of data from investing masters like Buffett & Lynch, Prophet is a breakthrough in stock investing that removes guesswork. Get 60-days free access instantly.**

** Partner

Just For Fun

Disclaimers

*Past performance is not a guarantee of future results. Alternative investments are considered speculative, including complete loss of principal and are not suitable for all investors. Investments are illiquid, not listed on an exchange, and not a short-term investment. Securities offered by NCPS, member FINRA/SIPC.

**As measured annually from January 2009 to January 2025.