Good morning.

Today is the last chance for travelers to purchase Southwest Airlines tickets under the carrier’s popular “two bags fly free” policy. The airline has been a longtime holdout in the industry, proudly touting that it checks bags without charging customers (“two bags fly free” is even a registered trademark).

In doing so, however, Southwest has sacrificed potential revenue: US airlines earned more than $7 billion from baggage fees last year, according to federal government data. And leaving money on the table was not to the liking of Elliott Investment Management, whose 10% stake makes it one of the airline’s largest shareholders. Amid pressure from the activist investor to boost profits, Southwest decided in March that it would end the perk. At least someone is benefiting from the skies becoming a little less friendly.

US Corporate Giants Tap Euro Debt Market

Why work hard for the Yankee dollar when better options beckon across the pond?

That logic would explain the surge in what are called reverse Yankees, which refer to US companies issuing euro-denominated debt. According to data compiled by Bank of America, non-financial US companies have borrowed some €40 billion (~$45 billion) this year as of May 9. If that pace keeps up, the annualized figure would eclipse the 2019 record of around €90 billion.

Euro Trip

A slew of factors is driving US companies to tap Europe’s debt markets, but perhaps chief among them is that the cost of borrowing is relatively cheaper there.

The European Central Bank cut its interest rate to 2.25% last month, while the Federal Reserve has maintained its target range at 4.25% to 4.5%. That dynamic is apparent in yields: Euro coupons are about two percentage points lower, on average, than dollar coupons in investment-grade corporate bonds.

Blue-chip companies with operations in Europe might find euro-denominated bonds particularly appealing because they wouldn’t have to account for the exchange of euros to dollars. They could then use their savings to pay off the interest and the principal.

US corporate giants that have tapped Europe’s credit market this year include:

- Alphabet, Google’s parent company, which raised its first-ever euro bonds in five tranches totaling €6.75 billion last month.

- IBM, which issued a €3.5-billion bond offering in February, a follow-up to its oversubscribed jumbo deal in 2023. Pfizer issued €3.3 billion in euro bonds in mid-May, tapping that debt market for the first time in seven years.

Tapping the euro bond market isn’t a new trend — reverse Yankees were also in vogue last year as the ECB started to lower rates in June for the first time since 2016. The wave of new issuance seen this year is probably driven by companies wanting to lock in funding, given the uncertainty around the Trump administration’s trade policy and its effect on markets.

Continental Flex. Companies that can show a strong appetite for their euro bonds among investors in the region reaffirm their standing with shareholders in the US. Plus, wealth managers’ penchant for investment-grade corporate bonds is rising for the same reasons companies want to issue them — income and stability.

Top Firms’ Secret Weapon Against Market Volatility

With JPMorgan, BlackRock, and Goldman Sachs upping their allocations to private credit, this $2 trillion asset class has emerged as a go-to strategy for smart-money players determined to check volatility in 2025.

Percent offers accredited investors access to the kind of private-credit deals that delivered 14.9% average net returns last year. Now, amid significant public-market disruption, thousands have turned to Percent’s transparent platform that has funded more than $1 billion in search of yield and portfolio stability.

- Preferred by the Street: An asset championed by JPMorgan, Goldman, and BlackRock.

- Portfolio Stabilizer: Low correlation to public markets, consistent monthly income.

- Flexible Timeline: Choose investments maturing from 6 to 36 months.

Home-grown Chinese Carmakers Edge Past Luxury Brands BMW, Mercedes

European luxury carmakers are shrinking in China’s rearview mirror as shifting dynamics in the world’s largest auto market threaten to leave them behind.

Case in point — a little-known, home-grown carmaker in China called Seres Group lapped BMW and Mercedes in car sales last year, enticing domestic customers with souped-up cockpits developed in partnership with the country’s telecom giant Huawei Technologies.

Stealth Wealth

Seres Group’s status as a luxury contender was cemented with its electric-vehicle brand AITO. Deliveries of its M9 SUV in 2024 totaled 151,000, surpassing BMW and Mercedes in the 500,000 yuan-and-up category (~$69,000), per a Bloomberg article citing data from Shanghai-based auto consultant ThinkerCar.

AITO, an acronym for “Adding Intelligence to Auto,” is something of a bellwether for shifting consumer preferences in China, where electrification and “smartification” are in the driver’s seat, according to McKinsey’s 2024 China Auto Consumer Insights report. Its models feature luxury appointments, including roomy interiors and intelligent driving assistance, but come at affordable prices and with a domestic brand name. Stealth wealth has become more culturally palatable given China’s macroeconomic challenges lately and President Xi Jinping’s distaste for flashing cash.

Legacy luxury automakers have acknowledged the environment while catering to customers there:

- “In all major sales regions outside of China, we increased our sales compared to the same period of last year,” Oliver Zipse, chief of BMW, said in an earnings call in early May. “Thanks to our strong performance in other markets, we were able to nearly offset the persistent challenges in the Chinese market.”

- Ola Källenius, chief of Mercedes-Benz, said the company is “ever strengthening its commitment to China” in a presentation in Shanghai late last month of the Vision V, a luxury van he called a “private lounge on wheels.” The German carmaker’s first-quarter sales declined slightly year-over-year, primarily due to weakness in China.

Per ThinkerCar data, BMW and Mercedes vehicle deliveries picked up in January and February this year, overtaking AITO.

EV Traction. China’s carmaking prowess, particularly in EVs, also shows up in other places, like Europe. BYD, the Chinese EV giant that has enticed investment from Warren Buffett, sold more of its cars in Europe than Tesla for the first time last month, according to London-based auto intelligence firm Jato Dynamics. However, BYD has hit roadblocks at home: Its shares plunged 8% on Monday as markets reacted to price cuts designed to clear inventory amid waning demand. Fears of a potential price war also dragged down other Chinese automakers, spurring slides of more than 5% for Li Auto, Great Wall Motor, and Geelo.

Turn AI Into Your Income Engine. Ready to transform artificial intelligence from just a buzzword into a real-world revenue generator? Harness its power with 200+ profitable AI income ideas crafted for entrepreneurs, creators, and forward-thinking professionals. Access these sharp insights from HubSpot today — and start boosting your income.

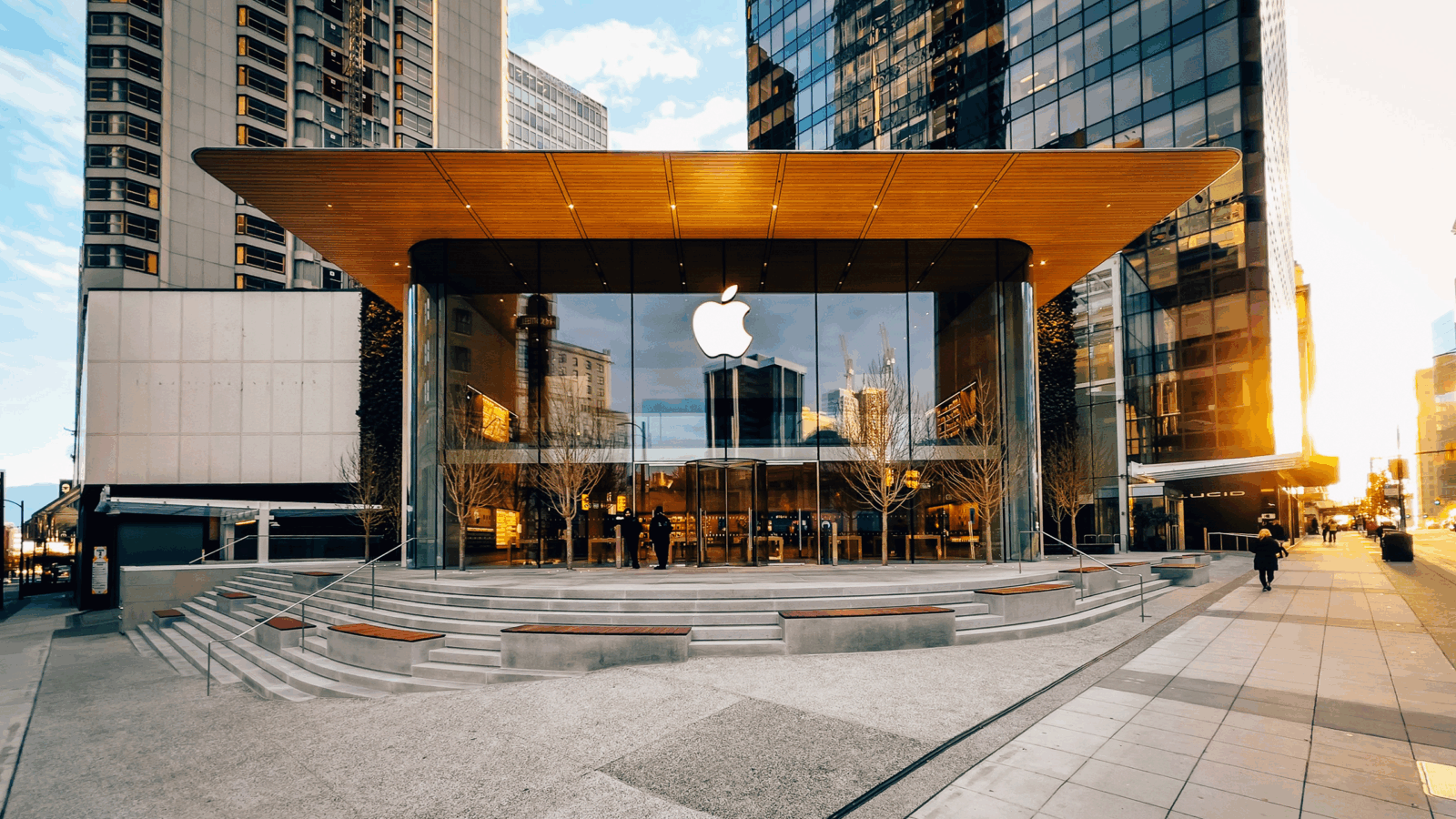

Is the iPhone Losing Power?

Apple’s running around looking for a charger as the iconic iPhone, which makes up more than half of the tech company’s revenue, faces threats on multiple fronts.

President Trump’s trade war could make iPhones prohibitively expensive, while AI hardware may make iPhones irrelevant. At the same time, Apple faces increasing competition from rivals looking to drain its market share.

Made in the USA … or Else

Apple’s supply chain could soon be upended. Trump has repeatedly urged CEO Tim Cook to make iPhones in the US, saying last week he’ll tack on a 25% tariff to any iPhones made abroad. Apple has been ramping up iPhone production in India, which Trump has in the past been on friendly terms with, to rely less on its main iPhone-production hub, China. But earlier this month, Trump said he doesn’t want iPhones to be made in India either, and he has threatened tariffs on the country that are nearly as high as those on China.

Even if the iPhone’s supply chain could be picked up and moved overseas tomorrow, an iPhone made entirely in the US might cost $3,500, a Wedbush analyst predicted, more than three times the latest model’s retail price.

A more expensive iPhone might have a harder time competing with rivals. Apple has been losing sales in China to homegrown companies like Huawei and Xiaomi, while US customers consider new options that range from foldable phones to so-called “dumb” phones built to reduce screen time.

And Apple could have new competitors built for AI hitting the market soon:

- Apple’s chief of services, Eddy Cue, said this month that AI devices from competitors, including OpenAI and Anthropic, could send the iPhone to the junk drawer within a decade.

- Last week, OpenAI brought on former Apple design chief Jony Ive, who led the design of the iPhone, acquiring his design firm, LoveFrom, for $6.4 billion. In the promo video announcing the team-up, Ive said people are trying to use decades-old products with AI — and that they need “something beyond.”

Meanwhile, Apple’s attempts to integrate AI into the iPhone have sputtered: An AI Siri upgrade was delayed earlier this year, and Apple’s main AI offering, Apple Intelligence, only handles basic queries. It outsources more difficult tasks to none other than OpenAI’s ChatGPT.

Not Locked: During Apple’s last earnings report, Cook said the impact of tariffs is “very difficult to predict.” And some analysts think Trump’s push to force iPhone production out of India is simply a negotiating tactic to clinch a better trade deal with the nation. While the iPhone’s global market share slipped last year to 18%, it still dominates more than half of the US market, according to Counterpoint. Plus, OpenAI has said it’s not immediately working on a smartphone, according to The Wall Street Journal, but rather a device that’ll work in conjunction with laptops and smartphones. A device like that could still butt into Apple’s ecosystem and hurt the iPhone’s value proposition. But Apple won’t power down the iPhone without a fight.

Extra Upside

- Dieselgate Fallout: Four former VW executives were convicted of fraud, with two sentenced to prison, for their roles in the company’s notorious emissions scandal.

- All in the First Family: Trump Media & Technology Group, the social media company controlled by the president’s family, plans to raise $3 billion to buy cryptocurrencies.

- Protect Your Most Valuable Asset: Home. SimpliSafe’s award-winning home security is now 60% off. No contracts, no hidden fees, and your first month of monitoring is free. Even the CFO would approve. Invest in peace of mind.**

** Partner

Just For Fun

Disclaimer

*Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk.