Good morning.

Ferrari is lapping tariffs so far. The ultra-luxury carmaker reported Tuesday that revenue revved up 13% in the first quarter to €1.8 billion ($2 billion) and operating profit climbed 17% to €412 million ($466.3 million), besting expectations. While the company warned last week that profitability faces an eventual tariff hit, Ferrari backed its full-year guidance of revenue over €7 billion and adjusted EBITDA of at least €2.7 billion. The lap of honour takes place as global automakers including Ford, GM, Mercedes-Benz and Volvo have suspended their guidance due to auto tariff uncertainty.

The automaker — whose founder Enzo Ferrari famously pledged it would “always deliver one less car than the market demands” — famously keeps production to a minimum in order to maintain its exclusive allure and cultivate a customer base of the richest of the rich. Only 13,752 Ferraris were shipped last year, a 0.7% increase. In March, Ferrari said 40% of new buyers are now under the age of 40, up from 30% in 2023. So as long as there’s a fresh supply of newly flush people — or, let’s face it, nepo babies — tariffs shouldn’t be a big worry.

Microsoft Holds Out on OpenAI Nonprofit Plan

Unless you are ChatGPT itself — the training data of the OpenAI chatbot’s latest model only runs to October 2023 — you’ve heard the explosive news.

OpenAI said it is rowing back on plans to spin off a more traditional for-profit company on Monday, after facing backlash from former staff and experts who called the move a betrayal of its nonprofit mandate. One thing that remains unclear is how a seemingly frayed relationship with key backer Microsoft could play out.

A Microsoftening Relationship

OpenAI was founded as a nonprofit in 2015 with a founding mission “to ensure that artificial general intelligence benefits all of humanity.” But that lofty ideal clashed with the massive fundraising demands that came with developing world-leading advanced AI systems. So, in 2019, the non-profit created a for-profit subsidiary that capped investor returns at 100 times what they put in, allowing it to tap venture funds and corporate backers. Microsoft invested $1 billion that year.

In December 2024, OpenAI said it was changing again — the nonprofit, it said, would give up control of the for-profit entity and become a minority shareholder. In the intervening years, Microsoft had become an even bigger backer, contributing $13.75 billion in total. But its relationship with OpenAI has appeared strained in recent months. First, Microsoft staff reportedly worried in early 2024 that Microsoft was too reliant on ChatGPT. Then, in December, the company began working to add its own AI models to its Copilot chatbot and, by March, was testing third-party models including from DeepSeek, Meta, and xAI. As of this month, xAI’s Grok is reportedly nearing testing with Microsoft’s developer platform Azure AI Foundry. All of which serves as a curious backdrop to the new plans:

- OpenAI’s nonprofit, with its mission to work for the benefit of humanity rather than providing value to shareholders, will now maintain control of the for-profit entity and be a “big shareholder.” The for-profit entity will also become a public benefit corporation — this was also part of the original for-profit conversion plan — which must “consider the interests of both shareholders and the mission.”

- Bloomberg reported that Microsoft, whose approval is key to advancing OpenAI’s new proposal, has not signed off. The tech giant, the outlet said, is seeking protections for its investment in negotiations — one notable item likely to please investors is that OpenAI said the cap on investor returns will be lifted for a “normal capital structure where everyone has stock.”

X-Partner: SoftBank, another key corporate stakeholder, plans to move ahead with a recently announced $30 billion investment, OpenAI CEO Sam Altman said, in a sign that the Japanese conglomerate is comfortable with the about-face. OpenAI will also need the greenlight from regulators in California, where it’s based, and Delaware, where it’s incorporated. Elon Musk, an OpenAI cofounder who left in 2018 and sued to stop the for-profit plan, said he’s continuing his lawsuit because the new proposed structure would still be for “the benefit of Altman, his investors, and Microsoft” instead of its do-good mission. Musk’s for-profit xAI, surely a coincidence, is also trying to catch up with OpenAI.

The Real Estate Stars Opening $1.3T Doors

Zillow helped millions buy their first home under co-founder Spencer Rascoff and executive Austin Allison.

Now, they’ve left Zillow to reimagine how people buy second homes through Pacaso – maximizing the $1.3T vacation home industry.

Pacaso has already facilitated $1B+ in real estate transactions, helping 2,000+ happy customers co-own homes across 40+ top destinations.

Their model earns fees on every transaction, with 80% of homes selling out fast. No wonder Pacaso’s adjusted gross profits grew 18% last year, topping $123M+ in total. Top firms like SoftBank and GreyCroft even invested.

While Zillow soared post-IPO, Pacaso offers investors like you the chance to invest privately for just $2.80/share. But with this growth, the share price will only last until 5/29. Reserve your stake today.*

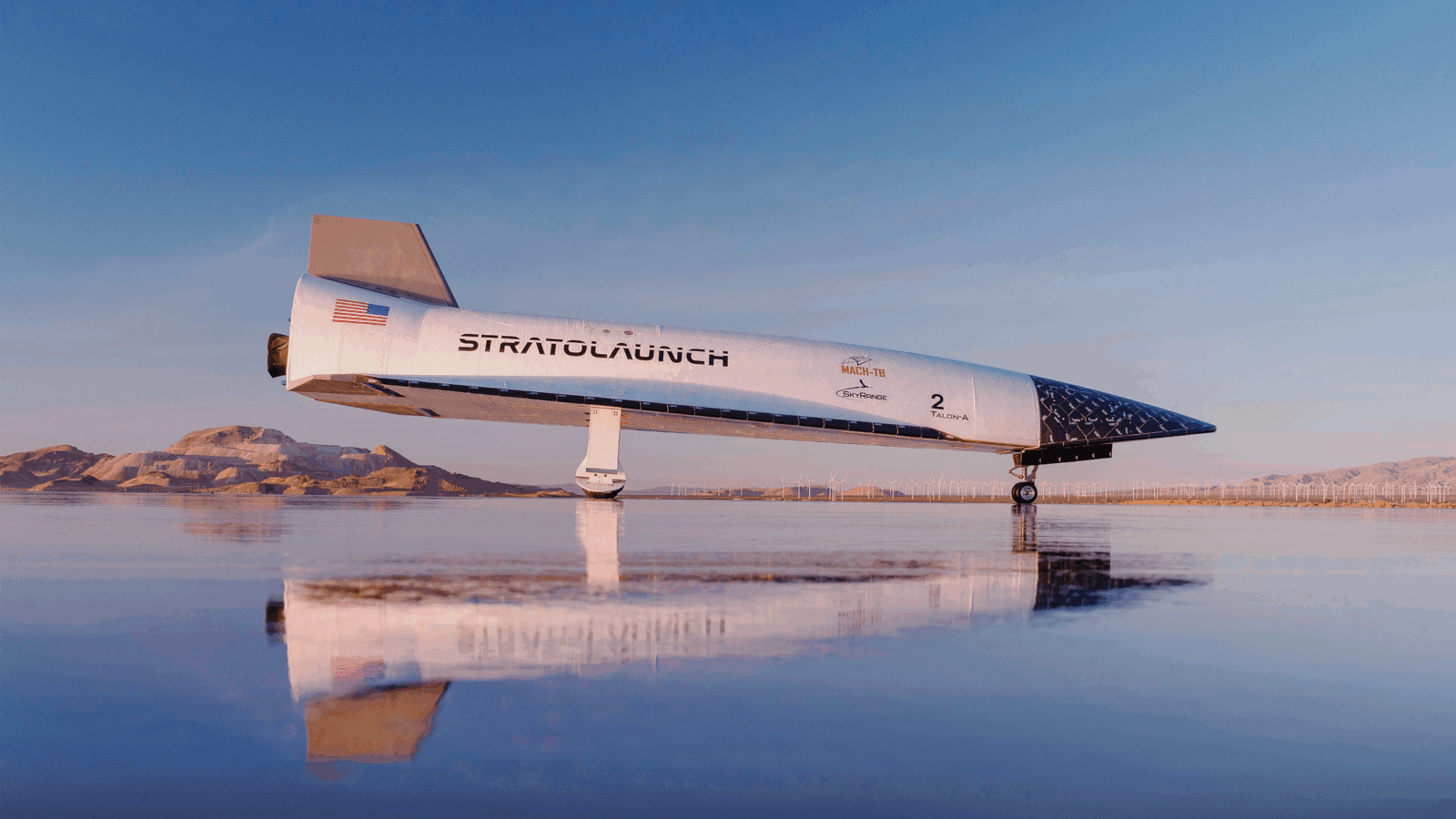

US Gains Ground in Hypersonic Arms Race

It’s a bird! It’s a plane! No, it’s the US breaking past Mach 5 — flying at speeds five times faster than the speed of sound — and catching up to China and Russia in hypersonic military technology.

The Department of Defense on Monday announced that its Test Resource Management Center (TRMC) completed two flights of a recoverable hypersonic test vessel, marking the nation’s return to experimenting with such aircraft for the first time since 1968.

Startup Propulsion

The flights were part of the Pentagon’s Multi-Service Advanced Capability Hypersonic Test Bed (MACH-TB) program, which aims to speed up development of that type of tech for integration into existing weapons and related systems. Both flights met performance benchmarks and were proven reusable — the keyword in their most recent breakthrough. “Lessons learned from this test campaign will help us reduce vehicle turnaround time from months down to weeks,” TRMC director George Rumford said in a press release.

The milestone achievement spotlights two startups giving DoD the boost it needs: aerospace and defense company Ursa Major and high-speed flight test service provider Stratolaunch. Both shops were born from their respective founders’ space ambitions:

- Ursa Major was founded in 2015 by Joe Laurienti, an engineer who worked on propulsion systems at Elon Musk’s SpaceX and Jeff Bezos’s Blue Origin, to help government and private space companies build faster with 3D printing. Laurienti was succeeded by Dan Jablonsky in August. The Berthoud, Colorado-based company’s first product, the Hadley, named after a character in a Ray Bradbury book, powered the vessels that DoD has been testing. Ursa Major recently nabbed a $28.5 million Air Force contract to flight-test its Draper engine.

- Stratolaunch was founded by Microsoft co-founder Paul Allen and aerospace engineer Burt Rutan in 2011. Its rocket-enhanced carrier aircraft, Roc, was built to launch satellites and eventually people into space (recall Richard Branson’s Virgin Orbit also wanted to do this), but was at risk of shutting down after Allen’s death in 2018. After Cerberus Capital Management acquired Stratolaunch in 2019, the Mojave, California-based company’s focus shifted to hypersonic flight testing. Steve Feinberg, co-founder of Cerberus, is now the deputy secretary of defense.

The Pentagon’s flight tests in December and March involved Stratolaunch’s Roc, the mobile platform to launch its Talon-A2, the autonomous, reusable test vessel powered by Ursa Major’s Hadley. Future flights will push speeds beyond Mach 6, Stratolaunch Chief Product Officer Aaron Cassebeer said in an interview with Aviation Week. The US still has some catching up to do. China and Russia both have likely fielded operational hypersonic glide vessels, possibly armed with nuclear warheads.

Golden Dome: President Trump’s defense plan, inspired by Israel’s missile shield, might move the needle for hypersonic missile development.

Smarter Insights, Built For The Modern Financial Advisor. Financial advisors don’t just need information, they need insight they can act on. Advisor Upside delivers twice-weekly briefings on market trends, regulation, technology, and practice management. Trusted by over 75,000 advisors and backed by The Daily Upside, it’s the edge you need to advise with confidence and clarity. Subscribe free, because smarter guidance starts here.

DoorDash Scoops up British Rival Deliveroo in Global Push

DoorDash must be in the mood for bangers and mash: It struck a $3.9 billion deal to take over British rival Deliveroo. And for dessert, the company plans to shell out another $1.2 billion on hospitality software company SevenRooms.

The multi-billion dollar deal spree comes after DoorDash posted a $193 million profit in the first quarter, reversing its loss from the same time last year. Moving forward, international expansion could help DoorDash own the global economy of direct-to-porch pad Thai.

Competing to Fill Your Sunday Pho Order

Nearly 30% of Americans order from food delivery apps at least once a week, YouGov found, and that figure rises to nearly 40% among Gen Z and Millennials. DoorDash accounts for most of those orders: It’s the top US delivery app with 67% market share.

But DoorDash isn’t stopping with the states. In 2022, DoorDash bought Wolt, a delivery app serving 23 countries, for $8.1 billion. Once it acquires Deliveroo, DoorDash will serve about 50 million monthly users in more than 40 countries:

- Deliveroo’s strongest market is the UK, where it commands a leading 38% share, according to Bernstein. But rival Just Eat has been gaining ground, and DoorDash may have been in a rush to nab Deliveroo after investment group Prosus agreed in February to buy Just Eat for $4.6 billion.

- Uber, the No. 2 US delivery app with 23% of the market, has also been going global. Yesterday, it announced an agreement to buy an 85% stake in Turkish delivery biz Trendyol Go. Uber also tried to buy, but ended up pulling its bid for, Taiwanese delivery app Foodpanda recently.

Messy Food Fight: Uber sued DoorDash in February, claiming the US market leader shut Uber Eats out by using anti-competitive tactics such as threatening restaurant owners with less visible spots on the DoorDash app. DoorDash sought to dismiss the suit last month, calling it a “calculated scare tactic.” While the US market is essentially a duopoly, smaller rivals abroad have come to dominate other regions and DoorDash and Uber now want a bite.

Extra Upside

- Swiss Degrees of Separation: New York private equity firm General Atlantic and Swiss banking giant UBS are entering the private credit market under a joint partnership.

- Legal Grilling: A US judge ruled Burger King must face a lawsuit alleging it misled customers by making Whopper hamburgers appear larger than they are in advertisements.

- “Like X-Ray Vision For Markets.” VantagePoint’s proprietary, A.I.-powered system has flagged abnormal institutional buying and a rare setup for investors. Attend this no-cost live class to learn more about this potentially explosive trade.**

** Partner

Just For Fun

Disclaimer

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.