Fed Chair Jerome Powell, whom almost no one expected to do something, didn’t do anything. The US Federal Reserve kept interest rates at the target range of 4.25% to 4.5% after its May meeting. The central bank’s Federal Open Market Committee said in a statement that it believes “the risks of higher unemployment and higher inflation have risen” amid increased uncertainty about the economic outlook.

Powell, who has advocated a cautious approach to rate cuts, said policymakers are in a “good position” to monitor the impact of the Trump administration’s tariffs, thanks to the “resilient” economy “doing fairly well.” With the market betting a rate cut is not in the cards until July, according to 30-Day Fed Funds futures prices tracked by CME Fedwatch, consumers won’t be able to count on the favorable domino effect a rate cut would have on consumer loans.

Auto loan rates, of note, are persistently high, with 7.1% annual interest on the average new car loan in the first quarter, according to Edmunds. So until July, sit back and enjoy the trade fireworks.

Fed Declines to Bet Economy on Outcome of US-China Trade Talks

What begins in Switzerland over the weekend could have a dramatic impact on the US and global economies … or be a total nothing-burger.

In so many words, such was the dry and sage analysis of Federal Reserve Chair Jerome Powell, when asked at a Wednesday news conference about plans for US and Chinese officials to hold negotiations about tariffs in the Alpine nation. Markets digested the Fed’s decision to hold interest rates steady amid the tariff uncertainty, and Beijing’s confirmation that the meeting is a go, with similar caution.

Decoupling Therapy

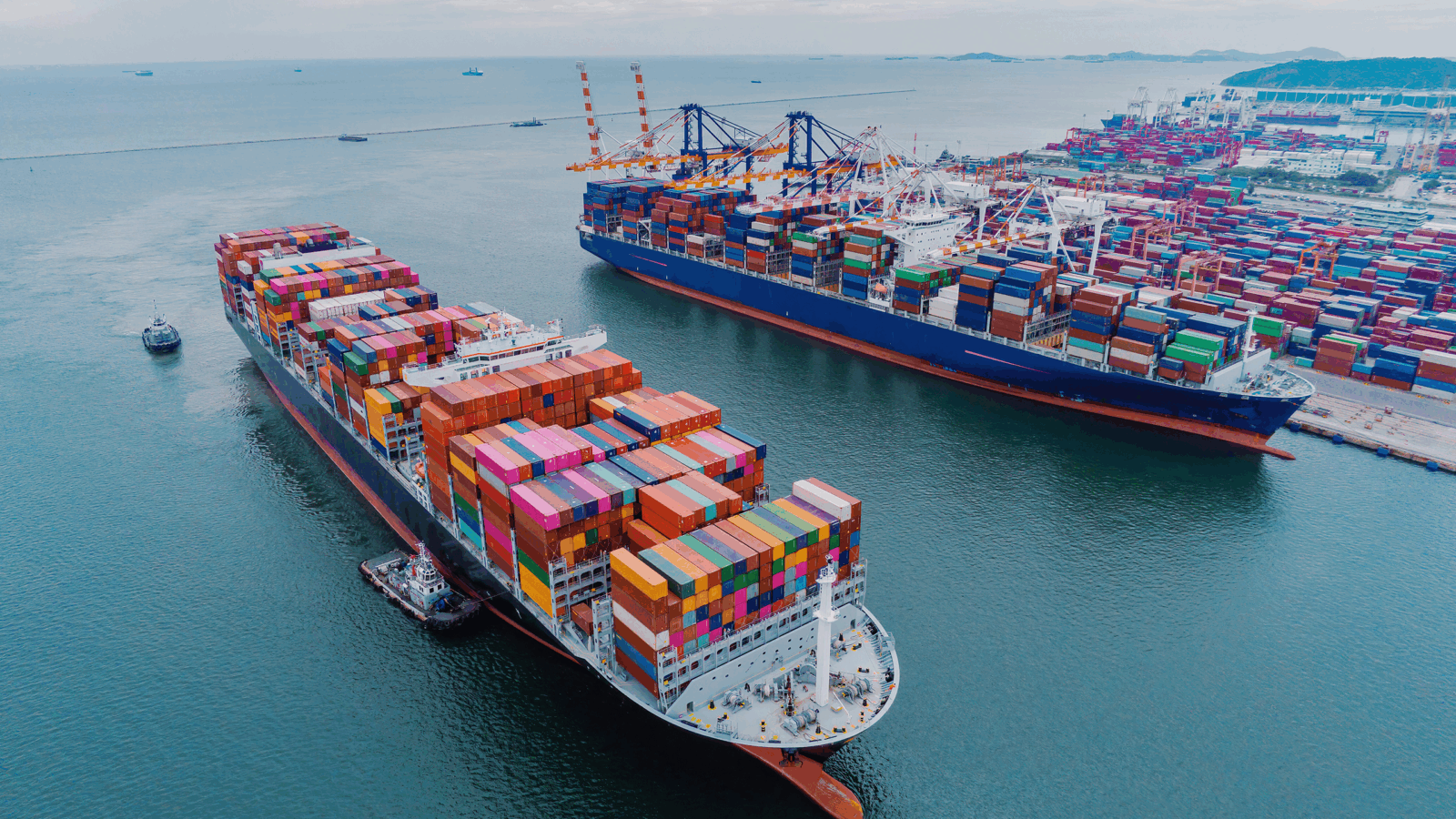

You know the short of it: President Trump placed a 145% tariff on most goods from China last month and China retaliated. Economists have said the impact of the tariffs — including a 10% baseline levy on many other countries — will likely begin to show up in the second quarter’s hard economic data. In the meantime, there are already statistical breadcrumbs that signal a downturn in the US-China goods trade, which amounted to $582 billion last year.

Chief among them is a slowdown at the largest port complex in America and the country’s gateway to Pacific trade. The Port of Los Angeles said it expects a 35% year-over-year decrease in imports for the week of May 4 to 10. The Port of Long Beach — whose CEO Mario Cordero warned last week that many retailers are only stocked up for eight weeks or less and could be “depleting in a very short time” — is expecting a 38% decline. This weekend’s meeting in Switzerland could be the first step toward reversing that trend, and cooling rhetoric has led some on Wall Street to hope for the best:

- Treasury Secretary Scott Bessent, who will participate in the Switzerland talks and first mentioned them on Fox News on Tuesday, said “We don’t want to decouple — what we want is fair trade.” Goldman Sachs Chief Economist Jan Hatzius, in a note that same day, picked up on the softening tenor, writing: “The mood music with China has improved, and we expect the US tariff rate on China to drop from around 160% to around 60% relatively soon.”

- Powell, who has perhaps the most scrutinized poker face on earth, remained neutral about the outcome of negotiations. “We’re in a new phase where the administration is entering into beginning talks with a number of our important trading partners, and that has the potential to change the picture materially or not,” he said. The Fed won’t make “conclusive judgments” about things that haven’t happened, he added, having earlier noted that Trump’s April 2 tariffs were “substantially larger than in our forecasts” as an example of why that’s a wise approach.

Markets closed higher as investors digested Beijing’s confirmation of the talks, Powell’s remarks, and the Fed’s decision to leave interest rates unchanged for now. The S&P 500 rose 0.4%, the Dow Jones added 0.7% and the Nasdaq gained 0.3%.

What Does He Know? Tariffs outside of the US-China trade rift may soon be reduced, according to BMW. The German luxury carmaker reported a 25% drop in first-quarter profit, but boldly stuck by its annual profit guidance for 2025. CEO Oliver Zipse predicted the 25% US tariffs on foreign cars will fall, citing the company’s discussions with US officials. “Our reading, based on all the networks that we have at our disposal, is that we assume that something will change in July,” he said. Certain traders would say that about the Fed, too.

The Multi Billion Dollar Battle Over Your Living Room

Tech giants have made trillions mining your screen time, but there’s a quiet battle happening on another playing field: your physical environment.

When Google acquired Nest ($3.2 billion), or Amazon acquired Ring ($1 billion), the strategic rationale was written on the wall: connected tech is coming for the homefront.

RYSE, having recently secured distribution in Best Buy and protected by 10 patents, is pulling ahead in this fast-growing market.

They’ve achieved 200% growth and investors are paying attention. A veteran from Shark Tank called their tech a “game-changer.”

RYSE is offering early shares at just $1.90, with a limited-time bonus of up to 25%.

Click here to learn how to get in before this story goes mainstream.

Netflix’s New Homepage Pushes Users to Watch, Not Scroll

New Netflix, who dis? The streaming giant is rolling out the first major redesign of its home hub since 2013. To encourage people to watch more — instead of endlessly scrolling through its 18,000+ shows and movies — fewer titles but more animation and video will appear on what the company has dubbed “the new Netflix.”

The new homepage showcases how the streamer has evolved in the past 12 years as it has grown from 30 million subscribers to 300 million. The navigation bar now sits prominently at the top of the hub and features sections dedicated to live programming and games, categories in which it has been investing.

The change will deploy to subscribers’ TV screens (where 70% of Netflix viewing happens) over the coming weeks and months.

‘Squid Game’ Supremacy

Netflix is far and away the top streaming service, and rivals are likely to take notes on the new homepage, considering Netflix’s hub has long been the industry’s go-to template. Plus, Disney’s CEO said earlier this year that the Disney Plus home screen is too static and needs to be more dynamic.

But while Netflix leads streaming by a wide margin, in the wider media sector, it’s losing eyes to YouTube:

- When it comes to binging content on TV screens, Netflix owns 8% of all viewing compared with YouTube’s 12%. According to Nielsen, YouTube’s share grew 19% annually while Netflix’s stayed flat.

- Converting users more quickly from scrolling to viewing could help Netflix catch up. In unveiling its new home screen, Netflix said half of its users don’t open up the platform knowing what to watch and that proportion is growing.

Change the Channel: As Netflix nips at YouTube’s heels, streaming competitors are still fighting for viewers’ limited subscription budgets, even if it’s as add-on services. Disney, Paramount, NBC (Peacock), and Warner Bros. Discovery (Max) all managed to turn profits on their streaming businesses last year as they invested in content, joined bundles, and cracked down on password-sharing. Yesterday, Disney said it expects its streamer to keep growing after sharing rosy first-quarter earnings. It also plans to compete with Netflix on the live-TV front with a standalone ESPN streamer launching this fall.

Zillow’s Co-Founder: “I Wish We Did This Before Our IPO.” Spencer Rascoff co-founded Zillow and scaled it to a $16B valuation. But everyday investors couldn’t invest until the IPO, missing early gains. So he’s opening his latest venture — Pacaso — to investors like you. Pacaso introduced co-ownership to the luxury vacation home market, earning them $110M+ in gross profits already. Invest for $2.80/share by 5/29.*

Space X’s Mars Mission Gets a Boost From Accelerated Launches at Texas Colony

One small step for SpaceX; one giant leap for Elon Musk’s fever dreams.

Musk’s space company is getting a boost to fulfill its long-publicized mission to Mars. The Federal Aviation Administration (FAA) on Tuesday approved SpaceX’s request to quintuple annual Starship launches out of its home base at the southern tip of Texas, which, as of Saturday, has its own city — a testing site, perhaps, before eventual Mars colonization.

Company Towns

Starbase, the city Musk built around SpaceX, was added onto the Texas map through a near-unanimous local vote, reportedly made up of mostly employees and their families. The first mayor will be SpaceX vice president Bobby Peden, who ran unopposed.

Call it a company town, a patch of 1.6 square miles close to Mexico’s border. An official request written in December by General Manager Kathryn Lueders said that the incorporation would drive workforce growth, enabling the development and manufacturing of the company’s Starship. A Texas bill granting Starbase control over Boca Chica beach, which it could close on weekdays to accommodate the stepped-up number of launches that were just greenlit, has been revived.

Musk’s Texas takeover is not limited to Starbase. He’s also building up Snailbrook, a new settlement in Bastrop County, 35 miles east of Austin, Texas, that is also part of a broader vision to integrate work and life for Tesla, Boring, and SpaceX workers. The idea is hardly new. Company towns have existed for as long as there have been very ambitious men:

- Hershey, Penn., is the town it is today because the Hershey chocolate company founder needed milk, or an area known for its dairy farms. Fordlandia was established in the Brazilian rainforest because Henry Ford needed rubber for auto production, and was eventually abandoned due to a series of technical and cultural failures.

- Celebration, Fla., a suburb of Orlando near the amusement parks, was founded by the Disney company and envisioned to be a sanctuary, free of crime and drugs. It has since been divested.

More recent efforts include Meta’s Willow Village or “Zucktown” in California, and Google’s San Francisco Bay Project, which has stalled after the company ended an agreement with its development partner to review its options. One of the bigger problems with company towns is their link to commerce. Detroit, for example, has been a difficult city to revive following the decline of auto manufacturing. And Washington, D.C., might suffer a similar fate.

Bully for SpaceX: The company’s business prospects look good. The White House’s 2026 budget proposal would top up funding for Mars-related projects by $1 billion. There’s also NASA’s latest pivot to Mars. The surprise development looks auspicious for the only rocket maker with preexisting plans to land on the red planet.

Extra Upside

- Under Oath: Shares in Alphabet fell 7.4% Wednesday after an Apple executive testified in court that he believes AI search engines will replace standard search engines like Google, and that Apple is already considering adding them to its Safari browser.

- Euroclash: As early as today, the European Union could announce retaliatory tariffs that target Boeing in response to 10% US levies that impact Airbus planes.

- Want To Get Even Smarter About Stocks? Join 200,000 investors who get Opening Bell Daily in their inbox. It’s packed with markets and macro analysis you won’t find anywhere else. Subscribe for free.**

** Partner

Just For Fun

Disclaimer

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. There’s no guarantee that Pacaso will file for an IPO. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.