Good morning.

For its work advising video game giant Electronic Arts on a $55 billion take-private deal earlier this year, a.k.a. the largest leveraged buyout in history, Goldman Sachs is set to receive $110 million. That’s the largest such fee in the history of the storied investment bank, but remarkably enough, it would be lucky to get an honorable mention on Wall Street this year.

Filings show that boutique banker Centerview Partners stands to earn $113 million for advising Verona Pharma during its $10 billion acquisition by Merck earlier this year, while Bank of America is in line to score $130 million for advising Norfolk Southern during its $71.5 billion sale to Union-Pacific. That would eclipse JPMorgan’s record $123 million fee, which it earned advising Allergan’s $63 billion sale to AbbVie back in 2020. It’s not every day they get bragging rights over Goldman.

*Presented by Global X. Stock data as of market close on November 11, 2025.

The Global X Artificial Intelligence & Technology ETF (AIQ).

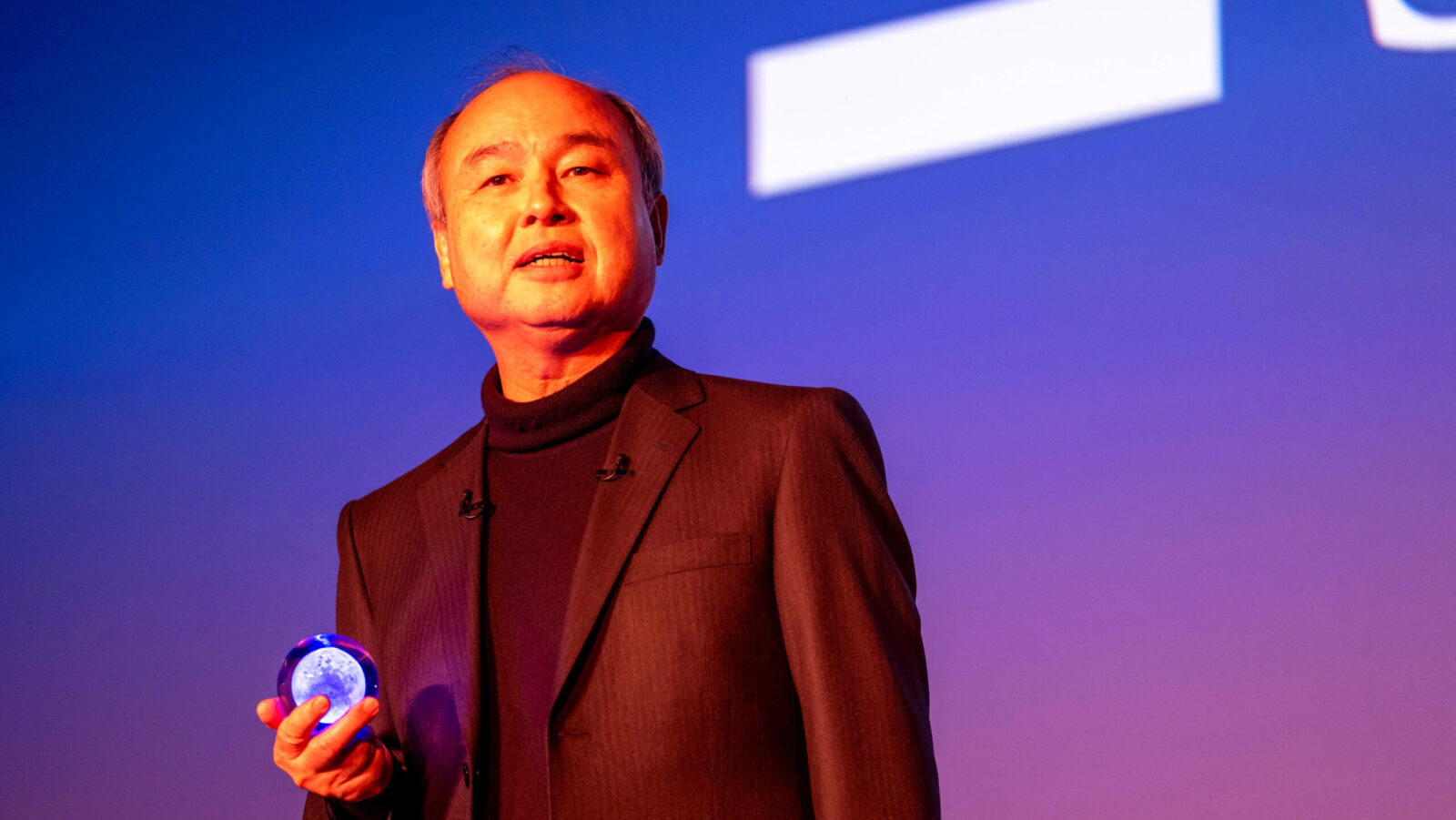

SoftBank Dumps $5.8B Nvidia Stake to Subsidize Other AI Bets

SoftBank, one of the world’s most prominent technology investors, has placed astronomical bets on the future of artificial intelligence. On Tuesday, it said Nvidia is no longer one of them.

Japanese billionaire Masayoshi Son’s firm sold its entire stake in the chipmaker at the heart of the AI boom, totalling 32.1 million shares, for $5.8 billion last month. The news reignited concerns among some investors about an AI bubble, but SoftBank said it was merely realigning its bets on the sector.

Attached at the Chip

CFO Yoshimitsu Goto said on an earnings call that SoftBank’s divestment had “nothing to do with Nvidia itself.” Nvidia has, in fact, consistently beaten analyst expectations, including in its latest quarterly report, and Citi hiked its price target for the semiconductor firm to $220 on Monday, suggesting the highly valued stock still has a 17% upside. SoftBank’s US-traded depository receipts rose 2.6% Tuesday, while Nvidia shares fell 3%.

Goto emphasized that the fresh capital from its divestment will bankroll other AI investments, namely an “all-in” bet on ChatGPT’s OpenAI. To finance its needs, Softbank also sold $9.2 billion worth of its partial stake in T-Mobile, and Son has unwound other positions to back his firm’s leading priorities. Softbank has also cashed out of Nvidia before, the last time in 2019, not long before the chipmaker began its meteoric rise. But given how firmly entrenched Nvidia is in the AI ecosystem, the two companies can hardly avoid each other:

- Along with OpenAI, Oracle and MGX, SoftBank is part of the joint $500 billion Stargate venture building AI infrastructure in the US; Nvidia is one of the initiative’s technology partners. Meanwhile, SoftBank’s sale of Nvidia shares helps finance an investment of up to $40 billion in OpenAI, which has pledged to invest up to $100 billion in Nvidia.

- Son’s other AI ambitions include a $1 trillion Arizona manufacturing hub, the $5.4 billion acquisition of ABB’s robotics unit, and a portfolio with TikTok-owner ByteDance and Perplexity AI. SoftBank and Nvidia stand to benefit if Big Tech firms follow through on pledges to spend hundreds of billions to fund the AI boom in the coming years.

Burry-ied in the Details: The doubters’ ranks are growing. On Tuesday, analysts at the Wells Fargo Investment Institute downgraded the S&P 500 Information Technology sector to neutral from favorable, citing high valuations. A day earlier, famed “Big Short” investor Michael Burry accused Big Tech “hyperscalers” of “artificially” boosting their earnings by “understating” the depreciation expenses of the semiconductors they’re buying. “By my estimates, they will understate depreciation by $176 billion [from] 2026-2028,” he wrote in a tweet.

Tax-Taming Strategies for Investors With $5M+

Managing significant wealth isn’t just about growth. It’s about ensuring you keep more of what you’ve earned. Luckily, Tax-Efficient Wealth Management for Affluent Investors features forward-looking advice to help strengthen and optimize your portfolio.

Inside, you’ll find actionable tax-planning techniques and straightforward investment strategies for affluent retirees like you.

You’ll also find insights to help with your estate planning, so you can ensure your financial legacy is distributed according to your wishes while minimizing tax exposure.

Why let your savings get eaten by excess taxes? Discover how tax-taming strategies can help you stay on track and keep more of what’s yours.

Download Tax-Efficient Wealth Management for Affluent Investors today.

Can the Fed Get Missing Economic Data in Time for Rate-Cut Decision?

What do airline pilots have in common with Federal Reserve policymakers? Both risk flying blind because of the government shutdown.

While a stopgap funding deal is officially in place and will likely be signed, sealed, and delivered by the end of the week, the government still has some work to do to fill in its backlog of missing economic data from September and October that would have been published already were it not for the longest shutdown in US history. Whether the catch-up will be complete before the Fed’s interest-rate committee holds its final meeting of the year, scheduled for December 9 and 10, remains an open question. As if Chair Jerome Powell’s life weren’t complicated enough.

Late Work Policy

Assuming the government reopens by week’s end, analysts at Goldman Sachs wrote in a note to clients seen by CNBC on Tuesday that the Bureau of Labor Statistics will likely release its September jobs report, which was initially scheduled for early October, by Tuesday or Wednesday, but is expecting delays for the October jobs report, as well as key spending and inflation reports from the Commerce Department.

Meanwhile, Morgan Stanley Chief Economist Michael Gapen told Barron’s on Tuesday that the October and November jobs reports could be released on December 8, just before the Federal Open Market Committee meeting, a projection based on what happened after the 2013 government shutdown.

In other words, Powell and company could be left a bit in the dark. That might only exacerbate the committee’s existing tension:

- After the Fed’s October meeting, Powell stressed that “strongly differing views” remained among members, though he added that there appeared to be a “growing chorus” to “at least wait a cycle” before cutting rates again.

- On the other hand, Fed Governor Stephen Miran said Monday that signs of a softening labor market and falling inflation could be grounds for a 50 basis-point cut in December. According to CME Group’s FedWatch tool, traders see a 67% chance of a quarter-point cut.

The Big Picture: At present, the Atlanta Fed’s GDPNow tracker predicts that third-quarter data will show US GDP growth of 4%, while Goldman predicts fourth-quarter GDP growth of 1.3%. That would put the US on pace for 2% GDP growth for the year, down slightly from 2.8% last year. Among those not worried about a slowdown? C-suite types, who have mentioned “economic slowdown” the least number of times this earnings season since 2007, according to a recent Bloomberg analysis. At least someone has their anxiety under control these days.

The Defense Tech Sector Is Taking Off. Global defense spending hit $2.7 trillion in 2024, the fastest surge since the Cold War. NATO members pledged to double military budgets by 2035. The Global X Defense Tech ETF (SHLD) tracks companies defining the next generation of military tech. Explore SHLD now.

Morgan Stanley Jumps on Private Market Research Bandwagon

Morgan Stanley analysts were not about to be left out of Wall Street’s private market gold rush as companies with mind-boggling valuations like OpenAI and SpaceX put off public listings.

On Tuesday, the investment banking giant launched a landing page within its research portal dedicated exclusively to private companies, according to an internal memo sent out by the firm’s global director of research, Katy Huberty, and shared with The Daily Upside. The page will “spotlight the innovators and trends that are reshaping traditional business paradigms and serve as a central hub for clients to access all our private industry research in one place,” the memo said.

Morgan Stanley has been publishing research on private markets since 2017, but it will now expand coverage to deliver deeper analysis and broaden its reach as client interest in unlisted firms grows.

Unicorns Galore

There are currently more than 1,500 active unicorns, privately held startups valued at more than $1 billion, that have raised roughly $1 trillion in venture capital funding, according to data compiled by PitchBook. So it’s no wonder that providing clients with insights into what these companies are up to is becoming a top priority.

In addition to the page launch, two of Morgan Stanley’s analysts who previously focused on public companies have jumped over to digging in on private ones, Bloomberg reported. And at the end of last month, the company announced plans to acquire private shares platform EquityZen.

Morgan Stanley is hardly the first investment research heavyweight to realize that investors are eager for a behind-the-scenes look at how private companies with soaring valuations are faring:

- JPMorgan Chase expanded its research to cover private companies in July. Citigroup followed suit just days later.

- Just last week, Charles Schwab announced it was buying Forge Global Holdings, a private market platform and trading marketplace, for $660 million.

Just the Beginning: “Both institutions and wealth management markets are looking for wide-scale research coverage of the alternative asset management industry and key industries such as private equity, private credit, real estate and energy infrastructure asset classes,” says Ken Leon, director of equity research at investment research firm CFRA. “There will be more firms to follow.”

Extra Upside

- Watch Collectors Rejoice: Switzerland, which the Trump administration hit with a steep 39% tariff in August, is close to securing a deal that could cut that rate to 15%.

- Grounded: Airlines warn that delays and cancellations will continue even after the end of the shutdown, complicating an expected record Thanksgiving travel season.

- 10K Steps Is A Myth. Try This Instead. The “10,000 steps” rule? A myth. Fewer steps, done the right way, can spark real fat loss. This viral method delivers 10x the benefits in 30 minutes. Join 18M+ users using Simple to burn fat. Take the quick quiz to start.**

** Partner