Good morning and happy Sunday!

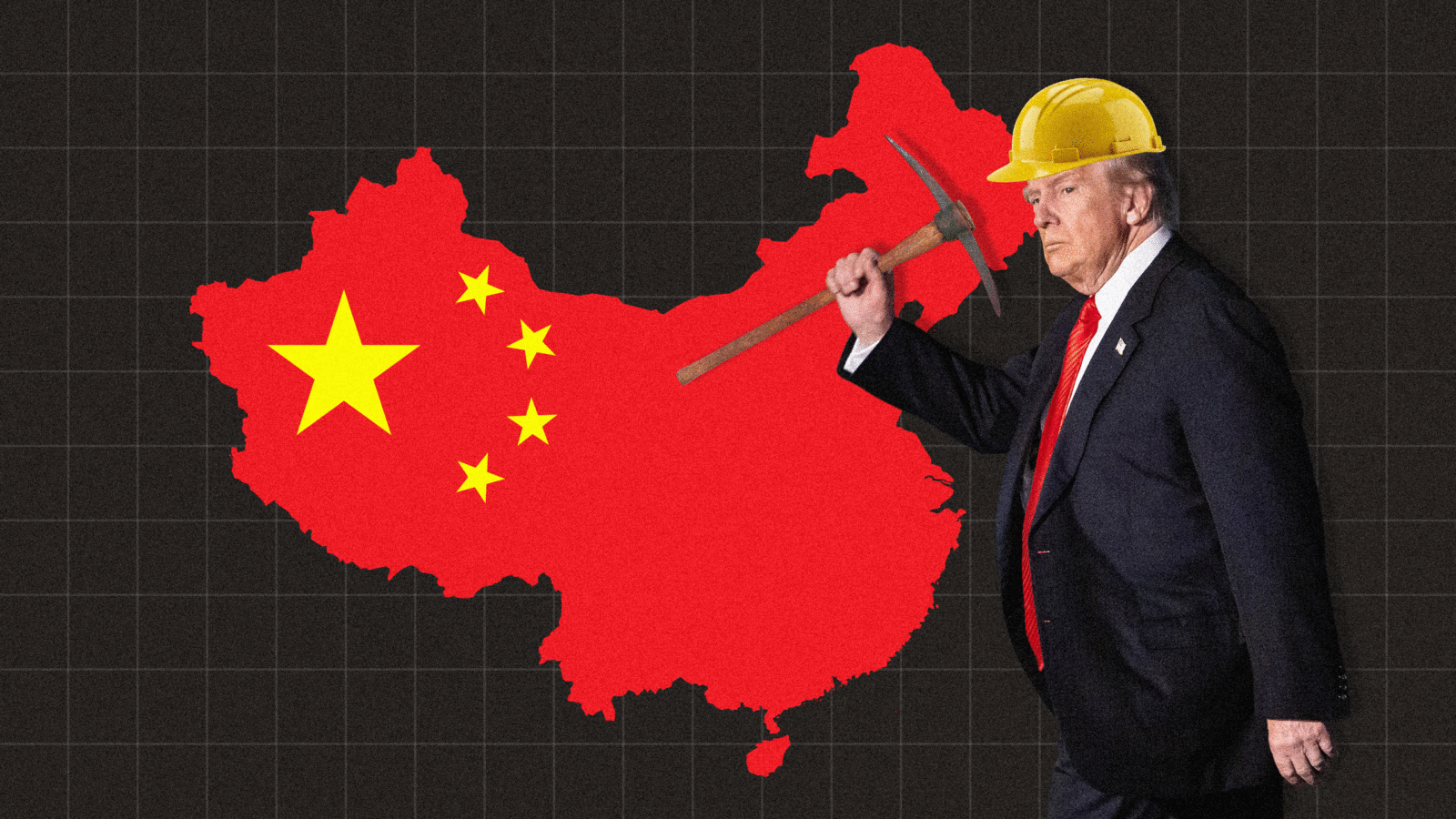

When President Donald Trump and Chinese President Xi Jinping agreed late last month on a one-year trade truce, a vital component was Beijing reopening its near-monopoly on rare earth minerals to US markets that it had shut out for months.

Now, the US is moving rapidly to avert similar crises in the future. Officials want to turn Beijing’s rare earths ace card into a weakling deuce. That’s the subject of today’s deep dive.

But first, a word from our sponsor, VanEck.

Amid the trade-war chest pounding of 2025, governments and corporations have woken up to their supply chain risks in an entirely new light.

Top of the list: China controls over 90% of rare earth refining capacity on planet earth.

For the uninitiated, rare earth metals power modern life. Smartphones, EVs, semiconductors, MRI scanners and fighter jets — all rely on rare earths.

It’s too vulnerable a position to be in, and the US, EU, Australia, and Japan are fast-tracking new projects to improve domestic capacity. Many analysts are calling it a tipping point, and one that presents a unique opportunity.

The VanEck Rare Earth and Strategic Metals ETF (REMX) tracks the companies that produce, refine and recycle the materials for our economy’s most critical products.

- Diversified with single-stock exposure caps to reduce concentration risk.

- Far more accessible than direct commodity investing.

- Over 15 years old, capturing both the enduring strategic importance and the current resurgence of rare earths.

US Seeks Rare Earths Outside China’s Control

One year. That’s how long the United States has before one of the most important mineral supply chains underpinning its economic might turns back into a geopolitical football.

China, which enjoys a near monopoly in the rare earths market, agreed in late October to reopen it to US buyers cut off during a protracted trade dispute. For months, high-tech, manufacturing and defense companies that rely on the minerals had watched their supplies dwindle and warned of potential production interruptions. At one point, a Ford Motor factory in Chicago temporarily shut down. The automaker’s CEO, Jim Farley, described the situation as living “hand-to-mouth.”

Now, with only a temporary reprieve from that ominous limbo, thanks to a 12-month trade truce, the US is rushing to establish supply chains that China does not control. A handful of companies stand to benefit enormously, with the US mobilizing hundreds of billions of dollars in resources to help. While that is almost certainly not going to happen in the year before China can negotiate again, there’s little question that the medium- and long-term supply chain will be transformed.

Science Class, Revisited

Rare earths are a group of 17 elements with similar chemical properties that appear as silvery-white metals in their pure form.

Unless you’re currently studying for an AP chemistry exam, their names (like dysprosium and terbium) are probably as recognizable to you as cuneiform.

What’s important to know about rare earths is that they’re crucial to running a modern economy, given how much advanced technology relies on them. They’re essential components in batteries, smartphones, magnets, electronics, wind turbines, catalytic converters in cars, electric vehicle motors, LED screens, lasers and alloys.

They’re also a matter of national security: F-35 fighter jets, military submarines, Predator drones, and Tomahawk missiles are among the dozens of advanced defense technologies that require rare earths (a Virginia-class submarine needs more than 9,000 pounds).

So, if you don’t want to live like ancient Sumerians, you need rare earths a-plenty.

The Cold, Rare Truth

Despite the name, rare earths are in fact “relatively abundant,” according to the US Geological Survey (USGS). The problem is that they are rarely found in concentrations in the earth’s crust that make them economically viable for extraction.

Decades ago, the US was the world’s top rare earths producer but, in the 1980s, Chinese officials identified them as a strategic industry. Through government subsidies, financing and lower costs, Beijing claimed the rare earths throne within a decade.

No less than Deng Xiaoping, the former Chinese Communist Party leader who transformed the once-agrarian nation into a socialist market economy, boasted about the achievement.

“The Middle East has its oil, China has its rare earths,” he said in 1992, comparing the country’s emerging dominance over rare earths to the Organisation of the Petroleum Exporting Countries’ powerful role in energy markets.

Which brings us to today. China controls nearly 70% of rare earths mining and is responsible for 90% of refining. According to Allianz analysts, China also holds between 40% and 50% of global reserves.

“China has a key advantage in terms of the balance of power as political leaders of Western economies will be forced to work hand in hand with China, or at least negotiate mutual interest deals, to reach their green and digital transition targets,” Allianz analysts wrote in a report last month. That’s suboptimal, to say the least.

In 2024, the US imported 80% of the rare elements it used, according to the USGS. Macquarie analysts estimate 70% of those imports came from China.

To make matters more urgent, the increase in demand for electric vehicles, clean energy and defense technology is poised to broaden the consumption of rare earths. The International Energy Agency forecasts that it will grow 5.1% annually from 2024 to 2030.

Which brings us to the future. China’s use of export controls this year has motivated the US like never before to reduce its long-term reliance on the country for rare earths.

Early moves and negotiations are already underway, and early winners are emerging.

Potential Winners

America’s approach to reducing its reliance on Chinese rare earths is two-pronged. First, there’s diplomacy: Officials have been working hastily to establish alliances with other trading partners, where local economies stand to gain from America’s healthy appetite for resources.

This month, President Trump announced a mineral deal with Kazakhstan, which announced in April the discovery of a rare earths deposit believed to be the third-largest in the world.

Weeks earlier, the US and Australia signed a pact to support $8.5 billion in “ready-to-go” projects to expand the mining of rare earths and other critical minerals. Shares in Aussie producers Arafura Rare Earths and Iluka Resources, both involved in the deal, have climbed 130% and 29% this year, respectively.

Shares in Lynas Rare Earths, an Australian firm that is the world’s largest rare earths supplier outside China, are up 115% this year.

Rare earths have additionally come up in the Trump administration’s trade talks with leaders from Japan, Brazil, Saudi Arabia, Greenland, Africa and Central Asia.

The second prong of the US approach is building its own domestic supply chain. Before Trump’s second term, the Department of Defense committed to establishing “a sustainable, mine-to-magnet supply chain capable of supporting all US defense requirements by 2027.”

Between 2020 and early 2024, the department awarded more than $439 million to companies including MP Materials, Lynas USA and Noveon Magnetics to expand processing capacity.

Investment escalated dramatically in July when the department became MP Materials’ largest shareholder, agreeing to buy $400 million of its preferred stock. The company owns the only rare earth mine operating in the US, about 60 miles southwest of Las Vegas in Mountain Pass, California.

As part of the public-private partnership, MP Materials will build a second facility, from which the government pledged to buy 100% of output for 10 years at a set price floor.

Since the July announcement, MP Materials shares have risen 106%. The company has also agreed to collaborate with state-owned Saudi mining company Maaden on rare earths mining, processing and magnet production, adding to the supply chain outside of China.

US government stakes don’t stop there. Earlier this month, the Defense and Commerce Departments entered a $1.4 billion deal with two rare earth startups, Vulcan Elements and ReElement Technologies, that includes warrants giving Washington the right to buy equity at a set price in the future, meaning it could take advantage of any upside.

Long Way to Climb

ING analysts, citing BNEF data, wrote in a report last month that, even if currently planned rare earths refineries outside of China are up and running by 2030, their total capacity will only be half of China’s 2024 supply. “In the near term, China will likely maintain its edge, thanks to technical expertise, low costs, and an extensive supply network,” they said, adding that “breaking Beijing’s grip on rare earths will be slow and expensive.”

But the creation of an alternate supply chain, however expensive, shows that Beijing’s “wolf warrior” play may have backfired.

“Export controls that give China leverage today will ultimately spur global efforts to develop non-Chinese supply chains,” ING wrote. “The more the world invests in onshoring and alternative suppliers, the less control China will wield in the long run.”

Invest In The Race To Secure Rare Earths With REMX

You know the adage about looking beneath the surface to find what matters. Around the world, governments are digging deeper to secure the materials that power modern life. From both the US Department of Defense and Apple funding new processing capacity with MP Materials, to Europe’s Critical Raw Materials Act aiming to source 10% of demand domestically, global policy momentum is accelerating.

With VanEck Rare Earth and Strategic Metals ETF (REMX), gain exposure to companies that produce, refine, and recycle rare earth and strategic metals — materials that are integral to our global economy.

See how rare earth and strategic metals can position your portfolio for the global shift ahead.*

Important Disclosures

*Investing involves substantial risk and high volatility, including possible loss of principal. Visit vaneck.com to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. VanEck mutual funds and ETFs are distributed by Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.