Good morning and happy Sunday.

When the COVID pandemic (temporarily) freed millions of Americans to work from home and live virtually wherever they wanted, rather than within commuting distance of an office, the suburban housing market grew red-hot.

Americans abandoned pricey urban areas, where high six-figure housing prices had forced many to rent rather than own, in droves. Then, the other shoe dropped: Inflation took hold and interest rates soared as the Federal Reserve tried to tame it. The twin pincers of high home prices and high borrowing costs put the housing market in a chokehold, from which it’s only now starting to break free.

That’s the subject of today’s deep dive. But first, a word from our sponsor, Oracle NetSuite.

AI is no longer just a buzzword; it’s a reality of the modern business landscape, and the difference between reacting to numbers and predicting them.

Our friends at Oracle NetSuite are helping finance leaders bring order to the chaos with a unified cloud platform that uses AI to automate reconciliation, streamline forecasting, and deliver real-time insights.

The guide highlights how leading CFOs are using AI to strengthen forecasting accuracy, speed up month-end close, and make data-driven decisions with confidence (while freeing their teams to focus on strategy, not spreadsheets).

For today’s finance leaders, staying ahead means making every resource count. And the smartest teams aren’t waiting for the future — they’re running it.

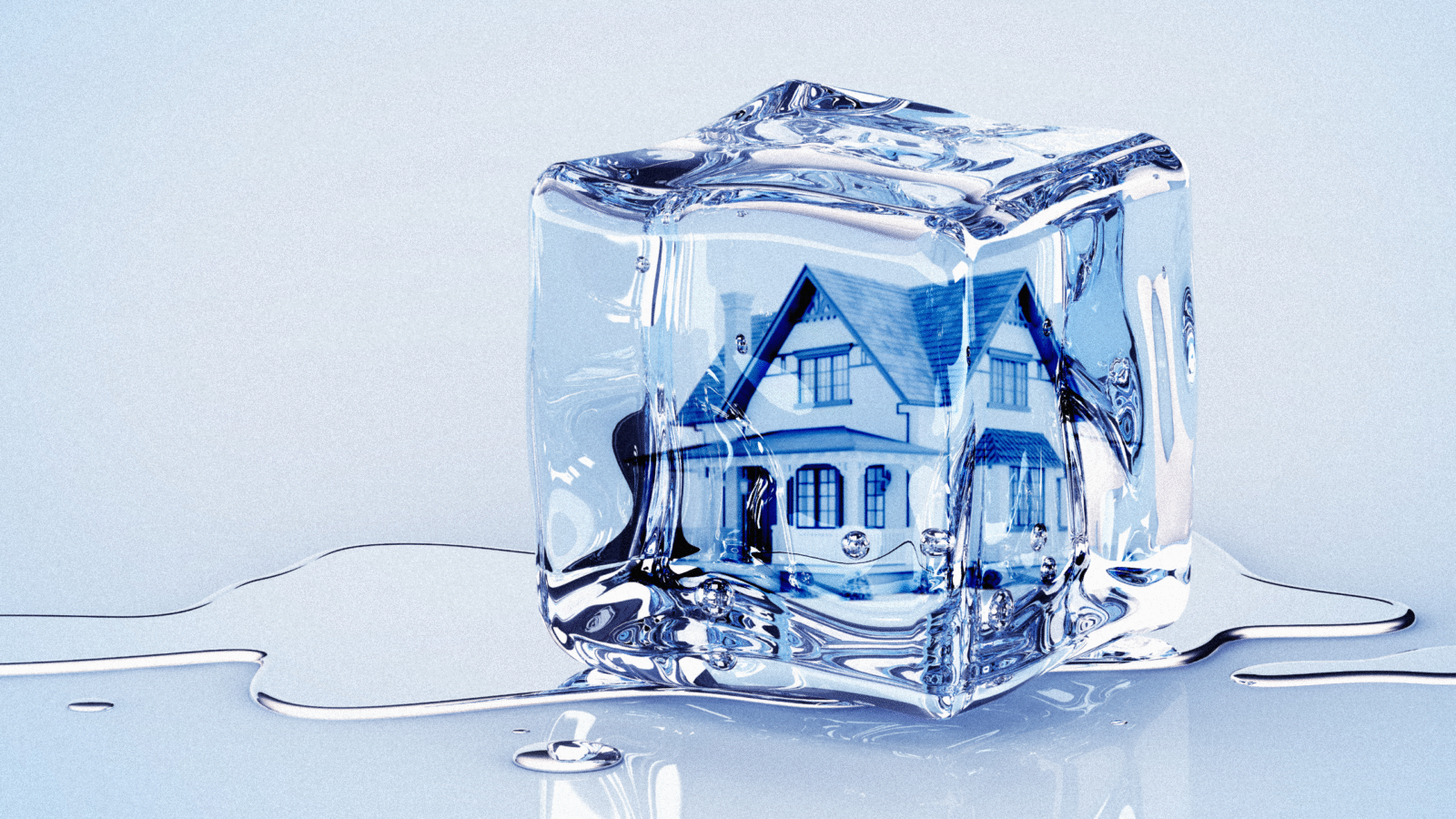

Thawing Housing Market Not Yet Liquid Enough to Jump-Start Sales

Since the 1993 classic Groundhog Day never specifies exactly how long it took Bill Murray’s character to escape his repetitive purgatory in Punxsutawney, Pennsylvania, fans devoted enough to run the numbers have come up with their own estimate: 33 years.

Players in the US housing market hope to escape the numbers-driven winter of their discontent quite a bit sooner, but green shoots are sparse so far and last week didn’t do much to help.

The nation’s largest homebuilder, D.R. Horton, saw its proverbial shadow, signaling on a Tuesday earnings call that it expects cooling housing sales to continue into next year, with angsty buyers chilled by relatively high mortgage rates and growing economic uncertainty. Earlier in the month, the National Association of Home Builders/Wells Fargo Housing Market Index measured builder confidence at 37 on a scale of 0 to 100, the highest since April, but still well below the level that would indicate most are optimistic about the short-term outlook.

“The housing sector remains weak,” Federal Reserve Chairman Jerome Powell said in a news conference on Wednesday after the central bank lowered its benchmark interest rate by a quarter-point in response to growing concern about employment, a key factor in home purchases.

The unemployment rate in the US ticked up to 4.3% in August, the last month for which the government collected data before a shutdown that has obscured the state of the job market despite anecdotal evidence of thousands of layoffs by corporate giants from e-commerce leader Amazon to shipping company UPS.

“Job growth absolutely has an impact on new household formations and consumer confidence, and where you see that flatness in those markets, that is going to have an impact,” D.R. Horton Chief Executive Officer Paul Romanowski said on the company’s earnings call on Tuesday.

Horton’s average sales price for single-family homes fell 3% from the previous year to $365,600 in the three months through September, D.R. Horton said. At the same time, leaning “pretty hard” into incentives such as buydowns that took mortgage rates as low as 3.99% for some purchasers trimmed 110 basis points from the company’s gross profit margin.

As for how long it might take the market to heat up again, Romanowski offered a gauge, but not a timetable: “We need to see consistent, sustainable job growth to drive growth in the housing market.”

Breaking Out of the Basement

From Romanowski’s mouth to the Federal Reserve’s ears. Still, the two rate cuts so far this year may not be sufficient to propel much of a rebound in the housing market, according to economists.

“Single-family home sales may be climbing out of the basement, but they haven’t reached the ground floor yet, let alone any higher level,” said Associated General Contractors of America Chief Economist Ken Simonson.

Despite data from the National Association of Home Builders showing that firms like D.R. Horton have succeeded in stimulating sales by building smaller houses, cutting prices and buying down interest rates for customers, “numerous policy initiatives are working against homebuilding and housing sales,” he said.

Steep US government tariffs on “Canadian softwood lumber and on steel, aluminum, copper products, kitchen cabinets, vanities, upholstered furniture and more are pushing up construction costs,” Simonson said. The fluctuation in levy amounts, meanwhile, makes home planning and pricing even more difficult.

Glimmers of hope are appearing in the market, however. The average 30-year fixed mortgage rate has fallen to a range of 6.2% to 6.3% from the level of 6.6% where it hovered most of the year. It’s encouraging, but “not enough of a cut to bring forth a surge of homebuyers,” Simonson said.

Following the Migration

Another interest-rate cut like October’s might help, but the improvement would be only incremental, and the reduction is far from a “foregone conclusion,” the Fed’s Powell said.

Still, after several years of surging mortgage rates and shrinking of home inventory, “a weaker economy, increasingly impatient sellers, and slowly receding mortgage rates are helping tilt certain housing markets toward buyers,” said economist and Sage Policy Group CEO Anirban Basu.

“The S&P Case-Shiller Home Price Index has dipped for five consecutive months,” Basu said. “Bottom line: 2026 will be the best year to buy a home in a number of years.”

Some parts of the US have shown firm demand, too, Basu said.

Among them is the country’s south, where states such as Florida, North Carolina, South Carolina, Alabama and Texas are attracting a steady stream of movers, said Nadia Evangelou, senior economist and director of real estate research for the National Association of Realtors.

“People continue to move toward areas with better affordability and growing employment opportunities,” she explained. “Follow the people to see where housing demand will be stronger.”

Demand is already spreading into Midwestern cities such as Des Moines, Omaha and Kansas City, she said, “with Kansas City experiencing a more than 50% increase in net domestic migration last year.”

Locked-In for the Long Haul

Thanks to comparatively high prices and labor market concerns, the supply of existing homes is approaching pre-pandemic levels, Oxford Economics Analyst Matthew Martin wrote in a report.

At the state level, Tennessee, Texas, Colorado and Florida have experienced some of the largest increases in listings compared with pre-pandemic levels, Evangelou said.

“Tennessee alone has about 35% more homes for sale than in 2019. Many of these same states have also seen the most new construction,” she said. “Exactly what the market has needed for years: more supply. Still, many of these homes are priced above what most buyers can afford.”

Another complication is spillover from recent periods of low interest rates, including those during the pandemic and previously, during and after the Great Recession. Buyers who financed homes at rates of less than 3% then are reluctant to give them up in favor of new loans that cost twice as much.

“But we have started to see some easing,” Evangelou added. “The inventory of existing homes available for sale is now at its best level in five years, suggesting more homeowners are finally listing.” She predicted a gradual improvement next year “as mortgage rates ease further and stabilize near 6%.”

In September, in fact, the number of US homes sold popped 7.3% to about 442,400, according to real estate company Redfin.

So if someone else gets stuck in a Groundhog Day time loop (in the unlikely event of a sequel), at least he or she will have a better chance of landing a new home after escaping Punxsutawney.

AI Is Rewriting The CFO’s Job Description

AI isn’t just making headlines for replacing warehouse jobs, it’s redefining how finance leaders operate.

Oracle NetSuite has released an exclusive guide that walks modern CFOs through using AI to move faster, make sharper decisions and set strategy with confidence.

From automating time-intensive workflows to improving forecasting accuracy, this playbook offers practical steps for building an AI-ready finance function that keeps your business ahead of the curve.

Here’s a glimpse inside:

- Build a stronger business case for AI adoption.

- Integrate AI into existing processes without disruption.

- Empower your team to champion innovation.

See how forward-thinking finance leaders are using AI to get ahead.