Good morning.

Sometimes, something that’s broken can’t be fixed. That’s the case for the October jobs report from the Bureau of Labor Statistics, which was delayed by the US government shutdown. The agency said Wednesday that it won’t publish a report for the month because it was unable to collect key household statistics that are typically included and can’t be gathered retroactively.

The bureau will, however, include October payroll figures from employers in its November jobs report, which is due December 16. That means neither the October nor November figures will be available to Federal Reserve policymakers at their December 9 and 10 meeting, leaving them somewhat blindfolded when they decide whether to cut interest rates at the height of the holiday shopping season. The stakes will be high not only for the economy but also for gift-givers trying to decide whether to channel a pre-ghost or post-ghost version of Ebenezer Scrooge.

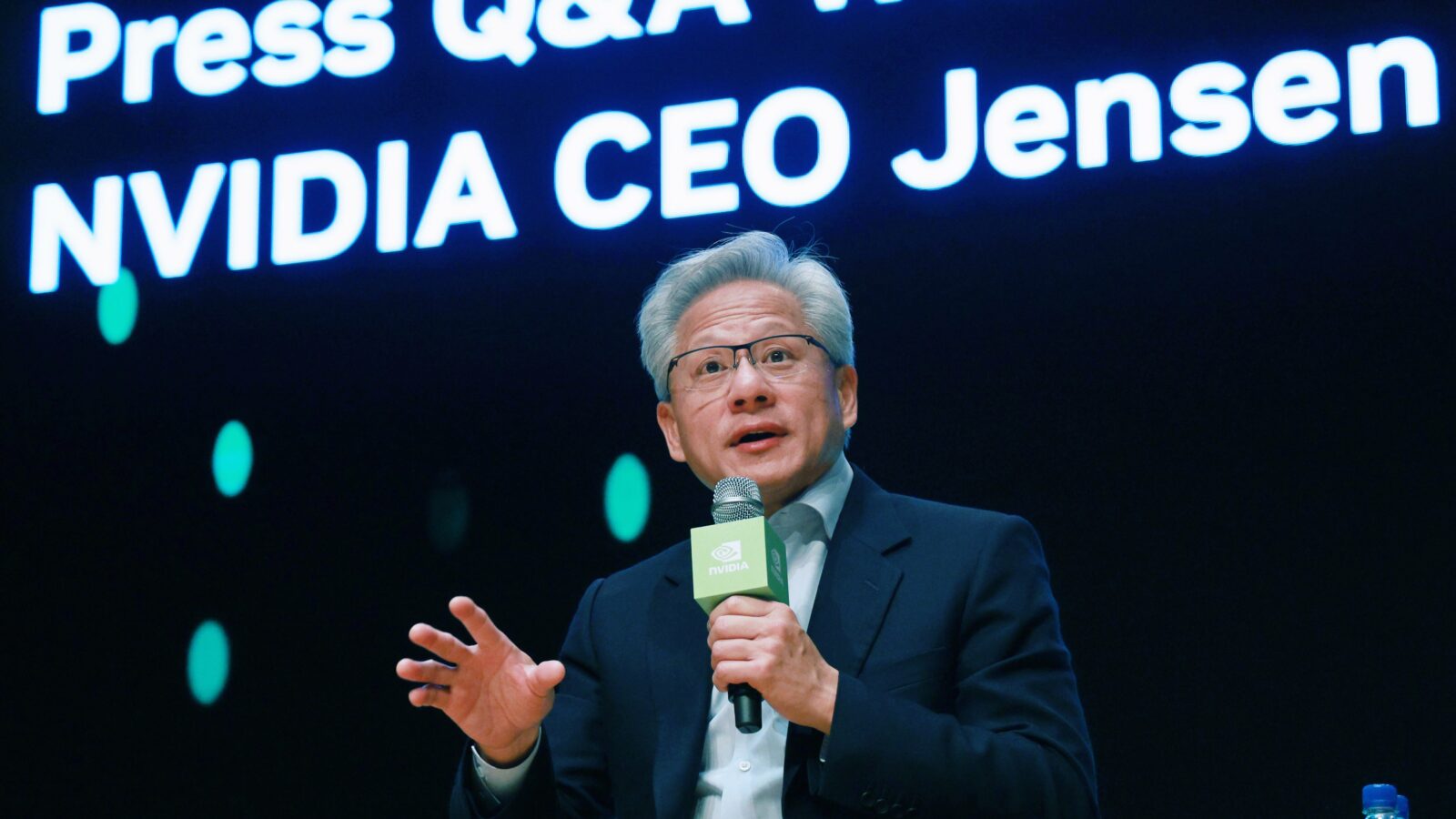

With AI Bases Loaded, Nvidia Bats a Quarterly Earnings Home Run

You can stop holding your breath now.

Nvidia, batting clean-up this earnings season, reported its quarterly earnings on Wednesday just as bubble jitters were manifesting in a four-day losing streak for the S&P 500. Investors who had feared anything short of a home run were instead delighted by an out-of-the-park dinger. A record $57 billion in revenue blew past Wall Street’s expectations, profits soared, and the chipmaker even raised its guidance for the fourth quarter.

The Earnings Call to End All Earnings Calls

While the party is still in full swing, for now, all eyes were on the largest company in the world for a reason. While each of the five major tech hyperscalers has already reported beats this earnings season, massive capital expenditures in the present, with more planned for the future, were beginning to spook investors. Meanwhile, big names had started to bow out of Nvidia. SoftBank sold off its stake in October (though it swore the move “had nothing to do with Nvidia itself”), as did Peter Thiel’s hedge fund, while Michael “Big Short” Burry drew attention for his own short position on the semiconductor king.

In all, that meant Nvidia entered its call on Wednesday facing “the tough task of meeting high earnings expectations and high skepticism around AI capex,” according to analysts at Bank of America. In a call with analysts following the earnings report, CEO Jensen Huang said that many of Nvidia’s biggest customers (i.e., hyperscalers) are already making money off of their AI investments. Nvidia itself has been among the biggest beneficiaries:

- Sales were up 62% from a year ago, while the company said revenue in the current quarter is expected to climb as high as $65 billion, about $3 billion more than analysts had expected.

- Net income for the previous quarter jumped to nearly $32 billion, also besting expectations, while Nvidia’s gross margin reached 73.4%; executives said that will climb to 75% in the current quarter after dipping earlier this year amid the costly rollout of its high-end Blackwell chips. “Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said in a statement.

Soothe Yourselves: Nvidia climbed more than 5% in after-hours trading on Wednesday. “Every investor has been waiting for an air pocket in demand, but supply looks like it is continuing to be the problem as the former continues to be off the charts, specifically in Blackwell and cloud GPUs,” David Wagner, head of equity and portfolio manager at Aptus Capital Advisors, wrote in a note seen by The Daily Upside. In a call with analysts, Huang stressed that deals with AI firms like Anthropic and OpenAI, which have sparked concerns of circular financing, ensure that Nvidia tech remains at the heart of the industry. “We run them all,” Huang said, referring to major AI models.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking out in the spotlight — and it’s still early.

Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta and Amazon, RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Their tech is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies — with recurring seven-figure partnerships in place. Their Nasdaq ticker is reserved: $RADI and the share price is set to change in just a few hours.

Get $0.81 shares now — Share price moves tonight, 11/20 @ 11:59 PM PT.

White House Touts $270 Billion Worth of Deals at Saudi-palooza

Maybe $1 trillion has become the new $1 billion, but even the wealthiest country in the world isn’t scoffing at checks with just nine zeroes.

A day after the White House proclaimed that Saudi Arabia boosted its spring pledge to invest $600 billion in the US to a tidy $1 trillion during Crown Prince Mohammed bin Salman’s visit to Washington, DC, President Donald Trump said companies from both nations inked $270 billion in deals at a US-Saudi business forum.

Deals and Details

The details remain fuzzy. No timeline was given for Saudi Arabia’s $1 trillion in investments and, while the US-Saudi Investment Forum on Wednesday drew corporate royalty from Chevron, Tesla, Nvidia, Qualcomm, Cisco, General Dynamics, Pfizer and more, it wasn’t immediately clear which companies inked deals. Trump did say GE Aerospace will “deliver dozens of new engines” while a handful of other pacts, while short on financial details, highlighted some international bargaining.

The day before Wednesday’s forum, Trump said he would approve plans by Saudi Arabia to buy dozens of F-35s, a deal that Jefferies analysts estimate will net defense contractor Lockheed Martin roughly $4 billion in sales. That coincided with a strategic defense pact, with Saudi Arabia being designated a “major non-NATO ally.” Despite human rights controversies including the 2018 assassination of Jamal Khashoggi, Saudi Arabia has remained strategically important to US Middle East policy and a key source of oil. Among the crown prince’s strategic goals, however, is rapidly diversifying his country’s economy beyond the energy sector by 2030:

- MP Materials, the US rare earths miner in which the Defense Department became the biggest shareholder earlier this year, agreed with state-owned Saudi mining company Maaden to build a rare earths refinery in the Kingdom. MP and the Pentagon will have a 49% stake in the project.

- The news drove MP Materials’ shares 8% higher, to $63, on Wednesday. Even before the deal was announced, Goldman Sachs analysts had set a price target of $77, implying there’s still plenty of upside. If all works out, the US gets a pipeline that helps curb its reliance on China, which has a near-monopoly on global rare earths refining, and Saudi Arabia strengthens its mining industry.

Because It’s 2025: It wouldn’t be the current year without some artificial intelligence deals, would it? Advanced Micro Devices, Cisco Systems and Saudi AI startup Humain said Wednesday they will form a joint venture to build data centers in the Middle East, starting with a 100-megawatt project in the Kingdom. Elon Musk’s xAI will also team with Humain to build a major new data center in Saudi Arabia. While details of those deals weren’t disclosed either, Grok may be able to help fill in some of the blanks.

Correction: This article has been revised to show that Saudi Arabia agreed earlier this year to invest $600 billion in the US. A previous version misstated that amount.

Get Clarity On Payables – And Cozy For The Winter. Vermont Flannel streamlined accounts payable to just minutes a day with BILL. By automating approvals and payments, they got better visibility on cashflow with much less busywork. Demo BILL Accounts Payable this holiday season and get a $200 Vermont Flannel gift card for shirts, blankets and more. Get that demo.**

Prada’s Heir Positioned to Restyle Versace

Prada struck a $1.4 billion deal to buy Versace intending to stop the brand from turning to stone (Versace’s logo is a Medusa head). And Prada’s giving the job of reviving Versace to Italian fashion royalty: Lorenzo Bertelli, designer Miuccia Prada’s son and heir to her eponymous empire.

Bertelli, who’ll become Versace’s executive chairman once the purchase is completed, told Bloomberg yesterday that the brand is bigger than its revenue, which has been bleak lately. Capri Holdings, which is selling Versace, said it expected the design house to make $810 million in revenue this fiscal year, a steep fall from $1 billion last year. Bertelli pushed for the Versace deal, Reuters reported, as he prepares to inherit the now-expanded company.

Italy’s Answer to LVMH

Its holdings consist of namesake, pricey brand Prada and trendy, affordable offshoot Miu Miu, as well as pastry-maker Marchesi, America’s Cup sailing team Luna Rossa and two smaller shoe brands. The thread tying the panettones, catamarans and handbags together is Italian luxury. Versace fits right in, and its acquisition helps position Prada against larger rivals on the global stage:

- Prada has proven immune to a larger slump in the luxury sector as shoppers, especially in China, limit brand names in their budgets. The Prada Group has grown for 19 straight quarters, with its 2024 revenues jumping 17%. Miu Miu has been a standout, with 93% sales growth last year as Gen Z splurged on its micro-mini skirts and “Arcadie” bags.

- French luxury conglomerate LVMH’s sales, meanwhile, grew a tepid 1% annually last quarter after two consecutive quarters of declines, while Gucci-parent Kering’s fell 10%. Capri Holdings has struggled to turn a profit and is attempting to pay down billions in debt and rebuild core brands like Michael Kors with the proceeds from selling Versace. The Federal Trade Commission shut down a planned merger of Capri and Coach-parent Tapestry last year.

Haute and Cold: The luxury market has been in a prolonged downturn as shoppers tighten their purse strings. But a mixed bag of results from fashion brands shows that they’re still up for the occasional splurge: They’re just being more selective about it, and making the luxury market more competitive. Bertelli isn’t ruling out further acquisitions that would make Prada a larger fashion powerhouse, but also didn’t confirm any plans, even as Giorgio Armani’s death last month puts that brand’s future in flux.

Extra Upside

- Change of Hart: The Netherlands paused its state seizure of Chinese-owned chipmaker Nexperia, ending a six-week row in which Beijing’s retaliatory measures threatened to disrupt global auto manufacturing.

- High Note: It’s no Bob Dylan or Joni Mitchell, but Suno, an AI-powered music platform that generates songs from users’ text prompts, is now valued at $2.5 billion.

- When To Retire: A Quick And Easy Guide. Thinking about retirement? Investors with $1,000,000 or more, download our free guide for help preparing a comfortable future. Learn more.***

*** Partner

Just For Fun

Disclaimers

*This is a paid advertisement for RAD Intel’s Regulation A offering. For more information, please read the offering circular at invest.radintel.ai.

**Terms and conditions apply, see offer page for details.