Good morning.

All politics is local. New York City is no exception.

After a long and somewhat bitter campaign, Wall Street is starting to extend some olive branches to New York’s new mayor-elect, Zohran Mamdani. “Congrats on the win. Now you have a big responsibility. If I can help NYC, just let me know what I can do,” billionaire Bill Ackman wrote in an unusually concise post on X after spending a fortune trying to defeat him. In an appearance on Good Morning America on Wednesday, Mamdani said he “appreciated [Ackman’s] words.” It’s a nice reminder to all billionaires: A kind tweet costs you nothing, and the effect can be priceless.

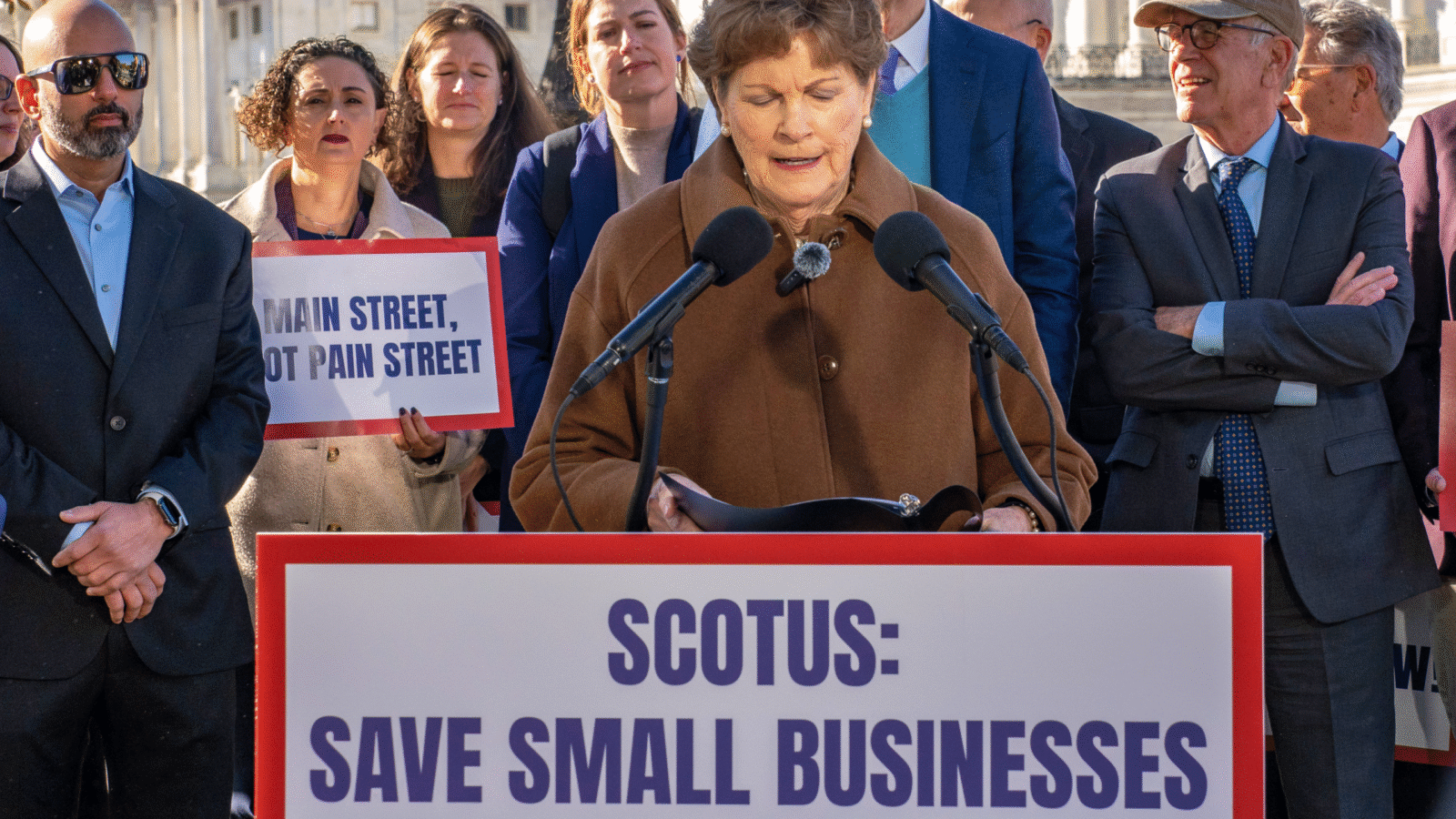

Supreme Court Questions White House Rationale for Tariff Regime

Sometimes, the nine justices on the highest court in the land hold their cards close to their robes. On Thursday, as the Supreme Court of the United States heard oral arguments in a blockbuster case challenging President Donald Trump’s wide-ranging global tariffs, they laid a hand of healthy skepticism right out on the table.

Justices expressed doubt that a national emergency law can be interpreted as giving the executive branch the power to impose billions of dollars’ worth of taxes on imports without the approval of Congress. Their ultimate decision could redefine the great economic issue of 2025.

Question Time

20th-century President Theodore Roosevelt, a protectionist Republican, had a patented diplomatic approach: “Speak softly, and carry a big stick.” With tariffs, Trump has brought the big stick, but traded the soft talk for threats of sky-high import levies to pressure trading partners over issues from immigration to fentanyl trafficking and a television commercial he didn’t like. To justify its actions, his administration has cited the 1977 International Emergency Economic Powers Act (IEEPA), which allows a president to regulate commerce during national emergencies but has never been used to impose tariffs.

The case before the Supreme Court was brought by groups of small businesses and 12 states, which argue that the tariffs are causing economic harm and that Trump lacks the authority to set them under IEEPA. Lower courts agreed, leading to a fast-track hearing from SCOTUS, where the Trump administration was confronted Wednesday with skepticism from both ideological opposites and allies:

- “The Constitution is structured so that if I’m going to be asked to pay for something as a citizen, that it’s through a bill that is generated through Congress,” Justice Sonia Sotomayor, a member of the court’s liberal wing and an appointee of former Democratic President Barack Obama, said during the hearing.

- Neil Gorsuch, a member of the court’s conservative majority and a Trump appointee, said he was “struggling” to grasp the administration’s arguments and pointedly asked: “What would prohibit Congress from just abdicating all responsibility to regulate foreign commerce?” The majority of justices signaled they believe tariffs amount to taxes and that raising revenue is a constitutional power reserved for Congress.

While Trump has bragged that “we’re making a fortune” from tariffs, Solicitor General John Sauer, the administration’s lawyer, argued that the levies aren’t intended to raise revenue and are instead “regulatory.” If the court doesn’t buy that argument, it’s unclear what would happen to the $90 billion in collected revenue addressed by the case. As Justice Amy Coney Barrett said, “It seems to me like it could be a mess.”

The Waiting Game: Since the Supreme Court agreed to fast-track the case, a ruling could be handed down by year’s end. The mere hope of a change to the tariff regime was enough to boost shares in trade-sensitive companies: Automakers General Motors and Ford rose 2.8% and 2.5%, respectively, on Wednesday.

Meet The $17 Trillion Market Most Founders Miss

Most founders and fund managers don’t realize that individuals can use their retirement funds to invest directly in private market companies and funds.

That’s where Alto comes in.

Alto simplifies access to self-directed IRA capital, enabling investors to deploy retirement funds into private markets and issuers to raise efficiently from that channel.

That means your:

- Startup can raise capital from anyone with an IRA, no integration required.

- Next fund — venture, private equity or credit — can align with long-term, tax-advantaged capital.

- Company can access growth funding outside of the traditional channels like banks or growth equity partners.

Alto handles the ongoing compliance, rollover and funding flows, and end-to-end support for your investors.

Lovin’ It: Snack Wraps Bring Smiles Back to McDonald’s Investors (and Customers)

2000s kids can be thanked in part for strong third-quarter sales at McDonald’s, where the recent relaunch of chicken Snack Wraps was a cluckin’ success. McD’s said 20% of customers added a $2.99 Snack Wrap to their order in the product’s first month back on sale, exceeding expectations.

As nostalgic millennials nom’d on the new-again menu item, the fast food giant’s same-store sales climbed 3.6%, rebounding from a 1.5% fall this time last year. Despite the restaurant’s earnings missing analysts’ expectations overall, its shares ticked up as investors banked on value items to bring in budget-conscious customers.

Happy Meals, Tough Times

McDonald’s is struggling to sell chicken nuggies and fries to customers who are feeling increasingly cash-strapped:

- Chairman and CEO Chris Kempczinski warned yesterday that economic pressures will keep weighing on the chain’s sales into 2026. The chain has been losing patronage for the past two years from lower-income consumers, who are avoiding going out to eat and instead cooking at home. Concerns about SNAP benefits have sparked fears that McDonald’s and other restaurants may be increasingly cut off from the dining dollars of lower-income households.

- Promotions like the $2.99 Snack Wrap, along with the Extra Value Meals and McValue Menu that McDonald’s rolled out over the past year, are part of the fast food company’s strategy to reel in customers with deals. Higher-income consumers who’re trading down from chains like Chipotle and Cava (both have also seen sales slump) are also on the hunt for deals like these.

Cheap’s Costly: To support its deals, McDonald’s is subsidizing its value-driven efforts. CFO Ian Borden said the chain will pay franchisees back half the cost of price reductions on Extra Value Meals; those cuts totaled $15 million in September and will cost $75 million for the fourth quarter. The fast food chain also put $40 million toward marketing its Extra Value Meals. So while deals are bringing in customers and boosting same-store sales, they could be cutting into profits. Net income for McDonald’s grew just 1% in the third quarter. McDonald’s and other restaurants started rolling out value meals to make sure economic pressure didn’t choke orders, but at some point, they simply need customers to feel more financially secure and trade up their homemade PB&J for a Big Mac.

Even Strong Plans Miss Hidden Opportunities. Discover Yours. Built by a CNBC Top 100 advisor with 40+ years of fiduciary expertise, Plancorp’s analysis tool helps you validate your wealth strategy and uncover overlooked potential, paired with actionable insights. Secure, confidential, and complimentary for The Daily Upside readers. Claim your analysis today.*

Private Employers Add 42,000 Jobs, Marking First Net Gain Since Summer

Figuring out what’s going on with jobs is hard work.

New data on Wednesday from payroll processor ADP showed that private companies added 42,000 jobs in October, marking the first net gain since July. But is it a sign that pervasive economic fears (of an AI bubble, an equities pullback and a deteriorating jobs market) were simply symptoms of Spooky Season? Not quite, unfortunately.

‘A Welcome Surprise’

A Bloomberg survey of economists projected a job gain of 30,000, and the beat comes after ADP data showed a loss of 29,000 jobs in September. It’s why new Federal Reserve governor and rate-slashing advocate Stephen Miran called the data “a welcome surprise” in an interview with Yahoo News on Wednesday. Rest assured, Miran saw the good news as “an indication that rates could be a little bit lower than where they are now.”

That’s likely because the data provided plenty of evidence of continued macroeconomic headwinds:

- The job gains were offset by losses of 17,000 positions in information, 15,000 in professional and business services, and, perhaps more notably, 6,000 in leisure and hospitality, as well as 3,000 in manufacturing. ADP’s chief economist, Nela Richardson, called the drop in leisure “the most concerning trend” in the report and a sign of a struggling consumer base.

- In another sign of a stagnating labor market, year-over-year pay growth remained largely unchanged from September, with gains of 6.7% for job changers and 4.5% for job stayers, according to the report. That’s around the lowest the growth rates have been since the first half of 2021, according to Bill Adams, chief economist for Comerica Bank. Adams also said that overall employment was likely roughly flat in October due to layoffs in the federal government amid the longest shutdown in history.

Service Elevator: Meanwhile, data from the Institute for Supply Management, also released Wednesday, showed that services-sector activity returned to growth in October, while its index for prices in the sector climbed to the highest point since October 2022. Looks like Miran will face plenty of opposition when the Fed’s monetary policy committee reconvenes next month.

Extra Upside

- Grounded: Transportation Secretary Sean Duffy says that flight capacity will be reduced by 10% at 40 major airports due to the government shutdown, affecting up to 4,000 flights daily.

- FTC to NYC: Lina Khan, the antitrust expert who led the Federal Trade Commissioner under former President Joe Biden, has been tapped by New York City mayor-elect Zohran Mamdani to serve as his transition co-chair.

- Bring Structure to AI Agent Access: WorkOS delivers enterprise ready access controls, audit logs and permission limits built to secure AI agent workflows. See how teams limit what agents can access without slowing down their work. Make your agents secure and scalable.**

** Partner

Just For Fun

Disclaimer

*For informational purposes only; should not be used as investment tax, legal or accounting advice. Plancorp LLC is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. All investing involves risk, including the loss of principal. Past performance does not guarantee future results. Plancorp’s marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage our services, and may include lists or rankings published by magazines and other sources which are generally based exclusively on information prepared and submitted by the recognized advisor. Plancorp is a registered trademark of Plancorp LLC, registered in the U.S. Patent and Trademark Office.