Good morning, and happy Friday.

Who could have predicted?

This week, 27-year-old Polymarket founder Shayne Coplan became the world’s youngest self-made billionaire tracked by Bloomberg’s Billionaire Index, after his company scored a $2 billion investment at an $8 billion valuation from New York Stock Exchange-owner Intercontinental Exchange. Along the way, Coplan and his crypto-based prediction market have received a $1.4 million fine, a ban from operating in the US, and a raid courtesy of the FBI.

Now? Polymarket, which allows users to bet on everything from election results to sports outcomes to the number of Elon Musk X posts in a given day, is set to make its official return to the US soon, and by some estimates, is already seeing hundreds of millions of dollars in trading volume each week. Its founder’s biggest bet was on himself, and it has paid handsomely.

*Presented by VanEck. Stock data as of market close on October 9, 2025.

Invest in a future built on semiconductors with the SMH ETF.

*Please see important SMH disclosures below.

Intel Bets Its Newest Chip Will Power a Comeback

Whoever’s naming chips at Intel is having a lot of fun: “Panther Lake” is the tech company’s latest and most advanced semiconductor, shown off yesterday for the first time. Intel will make the chips at its Arizona factory, which it said is now fully up and running.

Intel has invested more than $20 billion in the new factory, which will churn out the company’s chips in the US for the first time in nearly a decade. The foundry uses lithography machines made by ASML that cost $250 million each to perform the complicated processes needed to make the semiconductors (the RV-sized machines draw designs on nanometers-wide silicon wafers).

Intel’s CTO has called Panther Lake “foundational to our future.” And it’s not just the success of Intel hanging in the balance, but also the success of US chip manufacturing.

The Chips Are Down But Not Out

Intel’s stock was worth nearly half a trillion dollars in 2000 as everyone bought Dell PCs with Intel chips for their family computer rooms. But then Intel made a series of missteps:

- First, it turned down a chance to supply chips for Apple’s iPhones and missed the mobile phone boom. Competitors including Arm Holdings and TSMC took up Intel’s slack.

- Then Intel missed the AI wave, failing to make a chip that could rival Nvidia’s. Nvidia rapidly grew from a small gaming-focused manufacturer to the world’s most valuable company. And while Nvidia became the leader in designing chips, TSMC dominated the manufacturing side. Taiwan-based TSMC now makes more than 90% of the world’s semiconductors for companies including Nvidia, Apple and Google.

This March, Intel appointed a new CEO who is determined to revive the company’s dot-com-era glory days. Intel has been cutting costs with layoffs that’ll amount to 15% of the company, and it’s counting on its newly opened factories to bring in revenue. As Intel poured money into the construction of new plants (remember the $250 million machines?), its foundry biz has lost about $10 billion a year, according to Morgan Stanley analysts.

Great Expectations: Intel’s under pressure to carve out space for itself in the semiconductor industry as the US government backs its comeback. After President Donald Trump and Intel CEO Lip-Bu Tan had a chat at the White House about bringing chip production back to the US, the US government scooped up a 10% stake in Intel in August. The Trump admin is trying to reduce US dependence on overseas factories as it prioritizes slapping “Made in America” stickers on high-value tech. Restrictions on China’s chips haven’t slowed the industry down much, and top chip-maker TSMC’s Taiwan factories are a little more than 100 miles away from the Middle Kingdom. Panther Lake, no pressure, little guy.

Your Cross-Border Payments Should Be Costing Less

Every time you pay an overseas supplier or run ads in a foreign market using the wrong currency setup, you lose money on conversion fees. These costs add up fast when you’re operating across multiple markets.

Airwallex analyzed payment data from over 150,000 businesses and found that companies expanding internationally see significantly faster growth, but only when they set up proper payment infrastructure to avoid bleeding margins on every transaction.

The Daily Upside and Airwallex hosted a webinar on how to reduce these costs. Learn:

- What account types to open, and where.

- How to fund international spending without unnecessary conversion hits.

- When expansion into markets like LATAM or EMEA makes financial sense.

Watch the webinar now, and discover how to structure payments to save budget.

Delta Bookings Show Luxury Travel May Insulate Airlines From Gloomy Consumers’ Cost-Cutting

“Better than expected” is a description that may, on very rare occasions, be applied to the mostly mediocre wine on a long-haul flight. Thursday, however, Delta Air Lines’ investors applied it to the carrier’s latest quarterly earnings instead of its vino.

The first US airline to report its performance for the three months through September, Delta topped profit estimates and predicted that demand for luxury travel and climbing airfares will help it maintain higher altitudes through the end of 2025 and early 2026.

Put a Premium On It

In the third quarter, Delta reported $16.7 billion in revenue (up 6% year-over-year), $1.7 billion in operating income (up 21%), and an operating margin of 10.1% (up 1.2 percentage points). All better than what Wall Street anticipated. Meanwhile, the Atlanta-based carrier expects to make record earnings in the fourth quarter, with an adjusted profit of $1.60 to $1.90 a share.

Lifting Delta’s growth like a Rolls-Royce engine in the third quarter was a 9% year-over-year increase in premium bookings and an 8% increase in corporate bookings. On the company’s earnings call, Delta CEO Ed Bastian said demand for premium travel hasn’t shown any signs of waning, a good omen for the broader airline industry amid wider consumer pessimism. In fact, Delta made $5.8 billion in premium sales in the quarter, nearly as much as economy travel revenue, which fell 4% to $6 billion. Glen Hauenstein, the airline’s president, said revenue from high-end travel is expected to pass main cabin revenue in 2026. All in all, it was a broadly positive report for the US airline industry after a year of unexpected turbulence:

- In April, major carriers were hit with Wall Street downgrades in the aftermath of the Trump administration’s early tariff policies. A slowdown in travel demand left a glut of open seats on flights, but after airlines culled routes, airfares soared and helped to bring about some stability.

- Shares in Delta rose 4.3% on Thursday and rival United Airlines rose 3.3%, although American Airlines took a 1.6% dip in altitude. United and American are scheduled to report their earnings later this month.

No Shutdown Slowdown (Yet): Air traffic controllers and airport Transportation Security Administration officers are working without pay amid a government shutdown, and Bastian told CNBC there haven’t been “any impacts at all” to Delta’s operation yet. “If this doesn’t get resolved, say beyond another 10 days or so, you probably will start to see some impacts,” he cautioned.

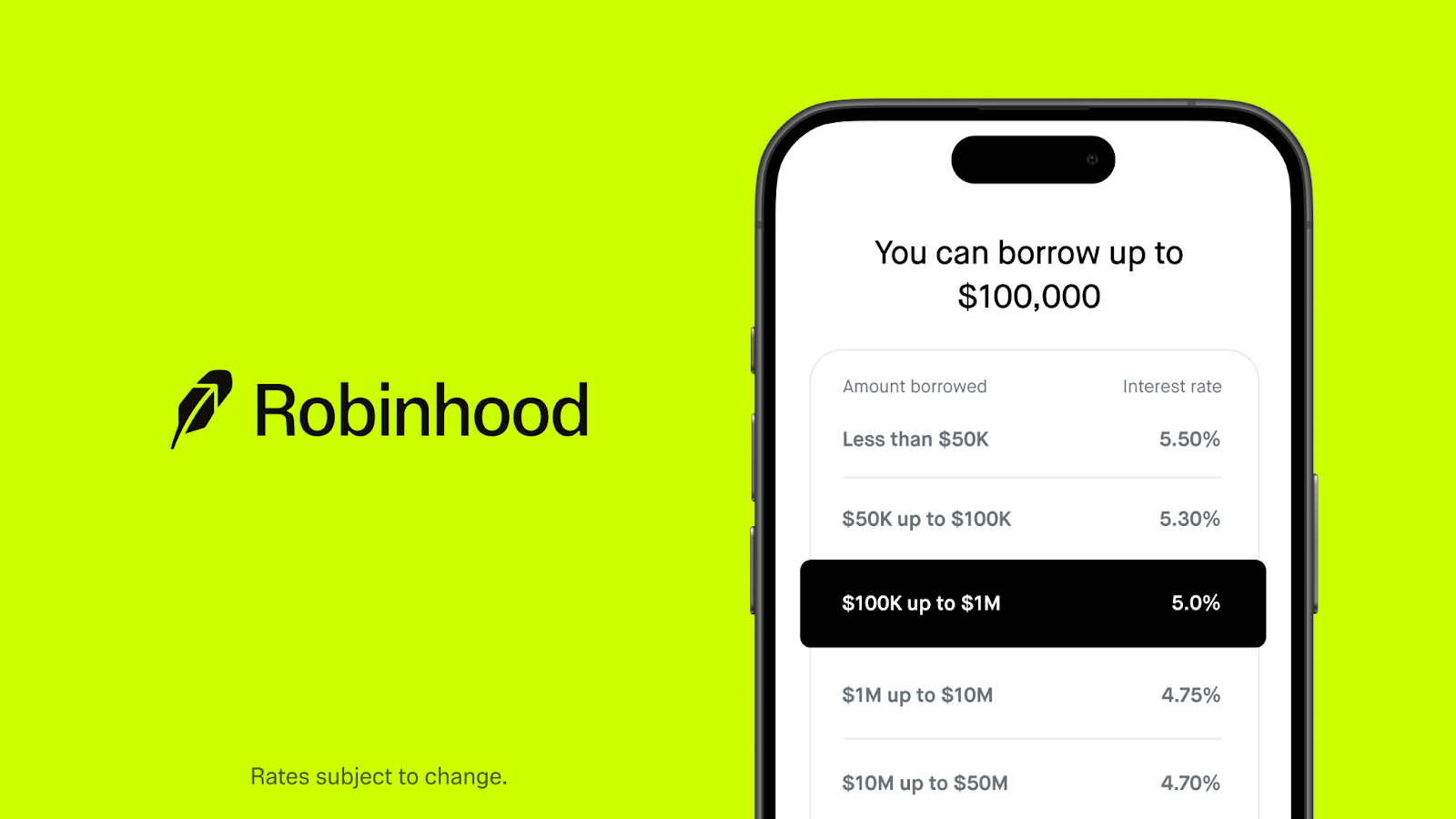

Margin Rates as Low as 4.45%, Zero Haggling. Robinhood offers margin rates from 4.45% to 5.5%, among the lowest in the industry. Your rate depends on your balance and gets assigned automatically. No phone calls, no irksome negotiations. Gold members get their first $1,000 of margin interest-free. Competitive rates, transparent pricing, automatic approval. Stop paying more for less.**

Novo Nordisk Seeks to Expand Liver Disease Treatments in $5.2B Deal for Bay Area Biotech

Novo Nordisk has reshaped countless waistlines. Now the Ozempic maker is aiming a little higher in the abdomen.

The Danish pharma giant announced Thursday that it will acquire San Francisco-based Akero Therapeutics for $5.2 billion, adding a promising liver-treatment candidate to its pipeline as new CEO Mike Doustdar tries to revive once meteoric growth that has come crashing down to earth this year.

Metabolic Reset

Novo Nordisk became a household name because of Ozempic, its multi-billion-dollar weight loss and diabetes treatment that’s also marketed as Wegovy. Its cultural cache is such that Golden Globes host Nikki Glaser jokingly dubbed the Hollywood ceremony “Ozempic’s biggest night” back in January. In the months since, however, talk about Novo has centered on its plunging shares. After all, investors want stocks forever bulking, not slimming down. Novo has shed 33% of its value in 2025 amid heightened competition from rival Eli Lilly and a wave of copycat drugmakers. Wall Street is worried about cuts to sales forecasts amid an increasingly crowded weight-loss drug market, and last month, Novo announced 9,000 layoffs.

Doustdar took over in July after his predecessor stepped down under pressure from the board. A month later, Wegovy became the first GLP-1 drug to get the US Food and Drug Administration’s accelerated approval for treatment of metabolic dysfunction-associated steatohepatitis, or MASH. Formerly known as fatty liver disease, it occurs when fat builds up in the liver and causes scarring, known as fibrosis. The condition can be treated with drugs that help curb metabolic risk factors, such as blood sugar, body fat and insulin sensitivity. With about 5% of adults affected by the disease, it’s a huge market opportunity. Which is where Akero Therapeutics comes in: The Bay Area biotech is testing its drug efruxifermin on MASH, and it’s considered a potentially “transformational” breakthrough:

- MASH can eventually lead to permanent liver damage called cirrhosis, at which point patients typically need a liver transplant. Efruxifermin, which is currently in Phase 3 trials, is the only treatment to have shown a significant decrease in fibrosis levels in patients with cirrhosis.

- Combined with Wegovy, which can treat lower levels of MASH, Doustdar said efruxifermin will form “an important building block” of Novo’s turnaround efforts. BMO Capital said, in a note to clients, that it views the deal “positively as Doustdar works to bring the ship back on course.”

The Fine Print: Novo will acquire Akero for $54 per share, representing an upfront payout of $4.7 billion. A $6-per-share contingent value is payable if efruxifermin wins FDA approval to treat compensated cirrhosis resulting from MASH by 2031, which would bring the full payout up to $5.2 billion. Akero shares rose 16% after the announcement, something investors no doubt hope will wear off on the soon-to-be parent firm, whose shares slimmed down another 1.5% on Thursday.

Extra Upside

- Mouse Hunt: Disney opts out of OpenAI’s Sora video generator, as top Hollywood talent agency CAA warns Sora exposes artists and creatives to “significant risk.”

- “Second Chance”: YouTube plans to invite some creators who were banned for spreading pandemic or election-related misinformation back to the platform.

- How Are Companies Like NVIDIA, OpenAI, And AMD Shaping White House Decisions? What private strategies helped Intel’s CEO avoid a public firing? Discover it in Semafor Business, a twice-weekly briefing delivering exclusives on the deals, back channels, and power plays shaping corporate America. Sign up for free.***

*** Partner

Just For Fun

Disclaimers

*Important Disclosures

VanEck Semiconductor ETF (SMH): Average Annual Total Returns Quarter End as of 6/30/2025* (%)

*Returns less than one year are not annualized.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Please call 800.826.2333 or visit vaneck.com for performance current to the most recent month ended.

*Investing involves substantial risk and high volatility, including possible loss of principal. Visit vaneck.com to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. Past performance is no guarantee of future results. VanEck mutual funds and ETFs are distributed by VanEck Securities Corporation, Distributor, a wholly owned subsidiary of VanEck Associates Corporation.

**Lowest margin rates among leading brokerages is based on published rates as of 06/24/25. Schwab, IBKR Lite, and E*Trade (Morgan Stanley) were selected based on publicly disclosed margin balances with commission-free trading. Firms that aren’t publicly traded, without margin rates available to the public were not included. Rates correspond to the minimum margin balance tier offered by each competitor and are subject to change at any time.

All investments involve risk and loss of principal is possible.

Margin investing involves the risk of greater investment losses. Before using margin, customers must determine whether this type of strategy is right for them given their investment objectives and risk tolerance. For more information please see our Margin Disclosure Statement.

Brokerage services are offered through Robinhood Financial LLC, (“RHF”) a registered broker dealer (member SIPC) and clearing services through Robinhood Securities, LLC, (“RHS”) a registered broker dealer (member SIPC).

RHF and RHS are not banks. All are separate but affiliated entities. Securities offered by RHF are not FDIC insured and involve risk, including possible loss of principal.