Good morning.

For all the head-scratching over exactly what was agreed upon, the trade deal “framework” that US and Chinese officials touted ahead of Thursday’s trade talks had a huge impact on the markets on Monday. Treasury Secretary Scott Bessent noted that it would avert additional 100% tariffs being placed on Chinese imports to the US. The S&P 500, of note, rose 1.2% to hit a new record.

The potentially calmer geopolitical waters that a trade deal framework suggests also pushed gold lower. A safe-haven asset, gold has surged this year amid trade uncertainty, reaching an all-time high of $4,380.89 per ounce on October 20 before plunging below $4,000. Capital Analysts lowered their gold price forecast for the end of 2026 to $3,500, suggesting it has another 12% to fall. On the other hand, a certain Federal Reserve policy committee is gathering in Washington, D.C., for a two-day meeting beginning today, and interest rate cuts, after all, are traditionally good for gold. If officials cut rates, as expected, those gold foil-wrapped chocolate coins you get on Halloween might be worth something.

Qualcomm Makes a Play for AI Chip Market Dominated by Nvidia, AMD

Qualcomm wants everyone to know that it’s not chopped liver in the AI economy.

On Monday, the San Diego-based veteran in the semiconductors-for-smartphones game climbed aboard the AI hype train, with a pair of accelerator chips for massive data centers set to hit the market in 2026 and 2027, respectively. The move adds yet another late-breaking entrant into the race dominated by Nvidia and AMD.

Qual(comm)ity Concerns

Shares of Qualcomm climbed as high as 22% on Monday, ultimately closing up 11%. And the pop is hardly a surprise. After all, who wouldn’t want to invest in a new picks-and-shovels company in the midst of the tech industry’s multi-trillion dollar gold rush/AI capex spending spree? And better yet, the picks and shovels (in this case, chips) need constant replacing; by most estimates, AI chips will have an average lifespan of just two to three years. That means Qualcomm could snap up some beefy contracts when AI’s most prominent players replace their Nvidia and AMD hardware.

In the meantime, Qualcomm said Monday it already has one major client lined up: Humain, the start-up backed by Saudi Arabia’s Public Investment Fund and launched earlier this year that seeks to build an AI-powered alternative to Windows and macOS operating systems. Humain plans to have about 200 megawatts of data centers powered by Qualcomm chips online by the end of next year.

Still, experts have already flagged the chips’ potential tradeoffs:

- Qualcomm touts its new chips, specifically designed for AI inference (running actual models) rather than AI training, as offering a “generational leap in efficiency and performance,” with each chip housing as many as 768 gigabytes of low-power dynamic random access memory.

- That may sound like a lot, and memory has proven a key constraint for AI chips, but not everyone is so sure it’s the right type of memory solution. Bank of America analysts were skeptical of Qualcomm’s announcement, CNBC’s Kristina Partsinevelos reported Monday, calling them “lower-end chips” and flagging their lack of critical high-bandwidth memory capacity.

The Chips Are Coming from Inside the House: Be that as it may, Bank of America’s analysts project the new chip line could open up as much as $2 billion in annual revenue for Qualcomm. It’s sorely needed, with longtime smartphone client Apple increasingly adopting its in-house-designed chips to achieve independence from third-party contractors by 2027. Apple was responsible for roughly 20% of Qualcomm’s $39 billion in revenue in 2024. Unfortunately for Qualcomm (and Nvidia and AMD), Big Tech is already starting to get the same idea for AI chips.

The Help You Need Managing Your Hard-Won Success

A job promotion should feel like progress, not a tax headache. Stock options, RSUs and board income can create real wealth — and real complexity. Exercise at the wrong time, and taxes take the win. Miss a planning window, and opportunity slips away.

Join Aspiriant’s Helen Dietz and Nick Ruzette on November 11 for a webinar on executive-compensation planning. You’ll learn:

- How to make confident decisions about complex pay packages.

- When to exercise options and manage concentrated stock.

- How to layer equity strategies to maximize after-tax returns.

Whether you’re facing your first major grant or balancing multiple income streams, learn how to turn liquidity events into long-term wealth.

Nelson Peltz Says $7B Take-Private Bid Would Let Janus Henderson ‘De-Risk’

It’s what Paul McCartney might call “hands across the water,” the capitalist chapter, anyway. One of Wall Street’s most famous hedge fund captains has his sights set on one of London’s biggest asset managers.

Nelson Peltz’s Trian Fund Management and venture capital firm General Catalyst offered to acquire the UK’s Janus Henderson at a roughly $7.2 billion valuation on Monday. Trian, which already owns 20.4% of the asset manager, said it would be better off as a private company. Janus Henderson, which oversees $457 billion of assets, plans to appoint a committee to consider the offer.

Global Sensitivities

In the press, Peltz is often referred to as “corporate raider” or “activist,” terms he expressly dislikes. The New York Times last year went with “longtime corporate agitator,” and there were certainly agitations when he called for strategic changes at Unilever and Disney. Peltz also helped oust Janus Henderson’s former CEO in 2022, but his new bid for the company goes further, calling for a reset as a private company. The case for this lies in Janus Henderson’s record. The product of a transatlantic marriage between Denver-based Janus Capital and London’s Henderson Group in 2017, the firm has been marked by uneven performance across the years, leading to the loss of clients. Moreover, in April, Janus Henderson shares lost more than a third of their value after the US government announced a slate of global tariffs, though they’ve since recovered. Trian and General Catalyst said their plan would “de-risk an investment that we believe is highly sensitive to capital market and geopolitical dynamics.” They also suggested accepting their offer would mean taking advantage of the year’s equity rally:

- Janus Henderson’s New York-listed shares rose 11.3% on Monday to a record $46.35, or 35 cents more than Peltz’s per-share offer. Before Monday’s surge, they were down roughly 2.5% on the year.

- Trian and General Catalyst wrote in a letter that, “free from the constraints of operating as a public company,” Janus Henderson would be able to make long-term investments in its products and technology more effectively.

Private Matters: If the deal were approved, it would align with the trend of more companies opting to stay private or go private in recent years. Morningstar found that the median age of a company going public was 10.7 years in 2024, up from 6.9 years in 2014. Meanwhile, gaming giant Electronic Arts agreed to an unprecedented $55 billion take-private deal last month.

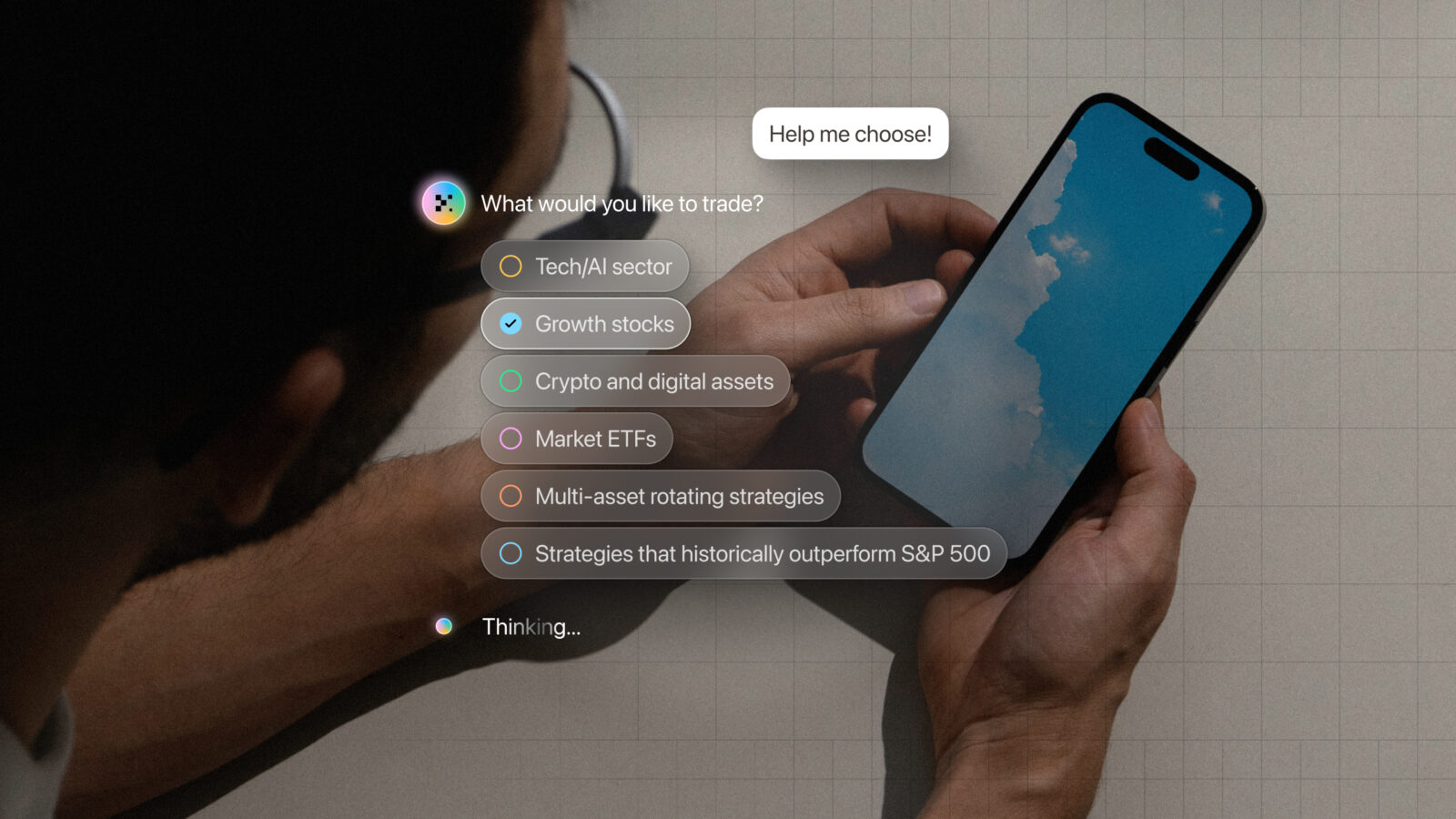

Your End-To-End AI Trading Partner. Remember those hours researching, testing and manually placing trades? Never again. Describe your strategy ideas in plain English, and Composer will build, backtest and execute them at your command — no coding, no spreadsheets, no costly overhead. Use code UPSIDE for 88% off. Trade with AI.

Keurig Dr Pepper’s Shares Fizz Amid Private Equity Cash Infusion

Dr Pepper’s getting a 24th flavor: leveraged buyout with notes of debt restructuring. Parent company Keurig Dr Pepper (KDP for short) scored $7 billion from KKR, Apollo Global Management and Goldman Sachs. The investment will be divvied up, with $4 billion going toward making new K-Cup pods and $3 billion put into preferred convertible stock.

The beverage conglomerate also lifted its annual sales forecast, and shares of the company (which owns brands including Canada Dry, Snapple and Hawaiian Punch) fizzed up about 8% as of yesterday’s market close.

Feeling Hot and Cold

Dr Pepper became America’s second-most popular soda behind Coke last year, surpassing Pepsi’s market share. KDP’s net sales climbed 11% in the most recent quarter, reported yesterday, led by a 14% boost in beverage sales. The company’s coffee division, however, hasn’t been as steamy:

- The sector’s sales ticked up less than 2% last quarter. Keurig warned investors earlier this year that its coffee biz could go cold as the company faces droughts and tariffs in the top coffee bean-producing countries of Brazil and Vietnam. At the same time, the coffee industry has struggled with budget-conscious consumers skipping out on little treats.

- KDP in August announced it was doubling down on PSLs anyway with an $18 billion acquisition of JDE Peet’s and a plan to split its coffee biz off from its soda-focused side. Investors weren’t buzzy about the news, and KDP’s stock plummeted 20%. Enter: Activist investor Starboard, which has built up a stake in the company, presumably with plans to push for changes from the inside.

Shaken Up: The recent investment from private equity firms could help protect KDP from activist investors like Starboard, sources told the Financial Times. PepsiCo, meanwhile, is coping with similar pressures: Activist investor Elliott Management snapped up a $4 billion stake in PepsiCo as investors grew concerned about its beverages losing market share to rivals, including Dr Pepper. Elliott suggested that PepsiCo should break up its biz and spin out its bottling arm, a move critics say would be too costly. Throughout the food and beverage industry, companies including Kraft Heinz and Kellogg’s have been splitting up their businesses to bolster profits.

Extra Upside

- Out of the Jungle: Amazon plans to cut up to 30,000 corporate jobs beginning today to offset overhiring during the pandemic.

- Spooky Police: Airbnb says it will deploy “advanced anti-party technology” to block properties from being reserved for large, “unauthorized” Halloween celebrations.

- 300 Finance Leaders Share Their Priorities. Citizens’ survey shows payment trends include a focus on speed & security, using B2C payment alternatives & other strategies. Learn more.*

* Partner