Good morning.

It’s not Dr. Evil’s Time Machine. The world’s most valuable company, $4.8 trillion Nvidia, has committed to investing up to $100 billion in OpenAI, $5 billion in Intel, $665 million in cloud provider Nscale and $500 million in autonomous driving startup Wayve. On Tuesday, it revealed its latest stake: a $1 billion position in Nokia.

For nostalgic millennials, that name may trigger memories of the Finnish company’s clunky early mobile phones in the 2000s. Or the melodic phrase by composer Francisco Tárrega that doubles as the famous Nokia ringtone. Naturally, Nvidia is not investing in the past: Nokia, which rose 26% Tuesday, is now one of the world’s largest network equipment manufacturers. The two companies plan to co-develop next-generation 6G cellular and AI network technologies. Plus, to our knowledge, no one is pining to compose text messages using a numeric analog keypad.

Microsoft, OpenAI (Finally) Finalize Terms of Not-Quite Divorce

Microsoft and OpenAI are staying together for the kids. Sort of.

After lengthy deliberations en route to its transformation from a non-profit entity into a for-profit company, OpenAI finally came to terms Tuesday with its Big Tech incubator, Microsoft. It won’t exactly be a clean split.

Now Without Azure-ances

To recap, OpenAI was founded as a non-profit entity in 2015, with some $13 billion in backing from Microsoft and a stated goal of developing “safe and beneficial” artificial general intelligence (AGI), a level matching or topping that of humans. The problem, company leaders have argued in recent years, is that the road to AGI is long, arduous, and, most importantly, expensive. So expensive, in fact, it requires significant investment that only a for-profit entity could attract. Long standing in the way of OpenAI’s for-profit transformation has been Microsoft, which wanted to retain, or at least be duly compensated for, its slice of the world’s most valuable private company.

Under the terms of the deal, Microsoft will retain a 27% stake in OpenAI; that’s a slight decrease from its previous ownership of 32.5% but still worth some $135 billion. The news stirred enough investor enthusiasm to propel the Windows-maker into the ultra-exclusive $4 trillion market cap club. Another 26% of the for-profit OpenAI will be owned by the OpenAI Foundation, which will have exclusive control over hiring and firing board members and intends to keep the company true to its “safe and beneficial” mission statement. The remaining 47% will be owned by employees and other investors (one $30 billion SoftBank investment, notably, has been contingent on the company successfully transforming into a for-profit entity).

The upshot for Microsoft, which reports third-quarter earnings today, is that executives have struck a deal to offload much of the financial risk involved in funding OpenAI while securing assurances that it will benefit from whatever reward may lie in the company’s future:

- According to sources who spoke with Bloomberg, Microsoft will still be entitled to 20% of all OpenAI revenue (though OpenAI will now have a little more flexibility regarding how and when it pays). OpenAI also agreed to buy $250 billion worth of computing power from Microsoft’s Azure cloud computing unit.

- Additionally, Microsoft secured the intellectual property rights to OpenAI’s models and products, including data center hardware (but not consumer hardware) through 2032; that’s a change from the prior agreement, in which Microsoft had IP rights secured until OpenAI achieved AGI.

The AGI Endgame: The ongoing relationship comes with other possible expiration dates, too. Sources told Bloomberg that the revenue-sharing agreement will end if or when OpenAI achieves AGI. Microsoft will also own the IP rights to any research OpenAI conducts until 2030 or AGI, whichever comes first. And whether OpenAI achieves AGI will now be determined by an independent panel rather than OpenAI’s own board. After that happens, who knows? Though everyone involved seems to think it will be a really, really big deal.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find straightforward advice on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

UPS Eliminates 48,000 Jobs While Working Toward $3.5 Billion Cost-Cutting Target

Santa will have a much smaller logistics network at his disposal this Christmas. United Parcel Service said Tuesday that it cut 48,000 jobs in the first nine months of the year.

UPS made the disclosure and expounded on its ongoing turnaround as it reported third-quarter earnings of $1.3 billion and revenue of $21.4 billion, both of which represented declines but topped Wall Street’s expectations.

High Yields Come in All Packages

UPS has been led by Carol Tomé, the Atlanta-based multinational shipping giant’s first outsider CEO, since 2020. As you can imagine, that was the most roller-coaster possible year to take over a courier company. Early in her tenure, UPS shares were turbocharged by the surge in package shipping during the pandemic. However, they’ve been in an extended slump since the spring of 2022, including a 23.6% loss since January, as volumes have sunk with the waning of the pandemic.

This year, of course, delivered a one-two punch: President Donald Trump’s tariffs have eroded UPS’ business. Packages sent to the US from China fell 30% year over year in the third quarter, reflecting the closure of a loophole that had allowed duty-free shipments below $800. To right the ship(ment), Tomé has pursued a $3.5 billion cost-reduction plan. That includes not only eliminating jobs, but also trimming money-losing businesses. One of the latter, Tomé says, is delivering packages for Amazon. UPS plans to cut its Amazon shipping volumes 50% by the second half of 2026. In the third quarter, it achieved a 21% reduction in Amazon parcel deliveries compared with last year (nevertheless, Amazon generated nearly 12% of revenue in 2024). Meanwhile, management has been resolute in conveying to markets its willingness to accelerate turnaround efforts:

- In April, UPS said it was planning to cut 20,000 jobs, which made Tuesday’s 48,000 figure especially eye-popping. Management highlighted how automation is improving its operations, and said it is hiring fewer seasonal workers for the holiday period.

- UPS said it has already realized $2.2 billion worth of year-over-year cost savings as of September 30. The company plans to meet its $3.5 billion year-over-year target by the end of the year.

Means to a Dividend: UPS stock’s very high dividend yield of 7.4%, more than three times the S&P 500 average of 2.3%, has raised concerns that payouts to shareholders are eating up too much profit and might therefore be lowered. Executives have signaled that their plans don’t include a dividend cut, however, and UPS rose 8% yesterday as investors shuffled in with dreams of a little passive income.

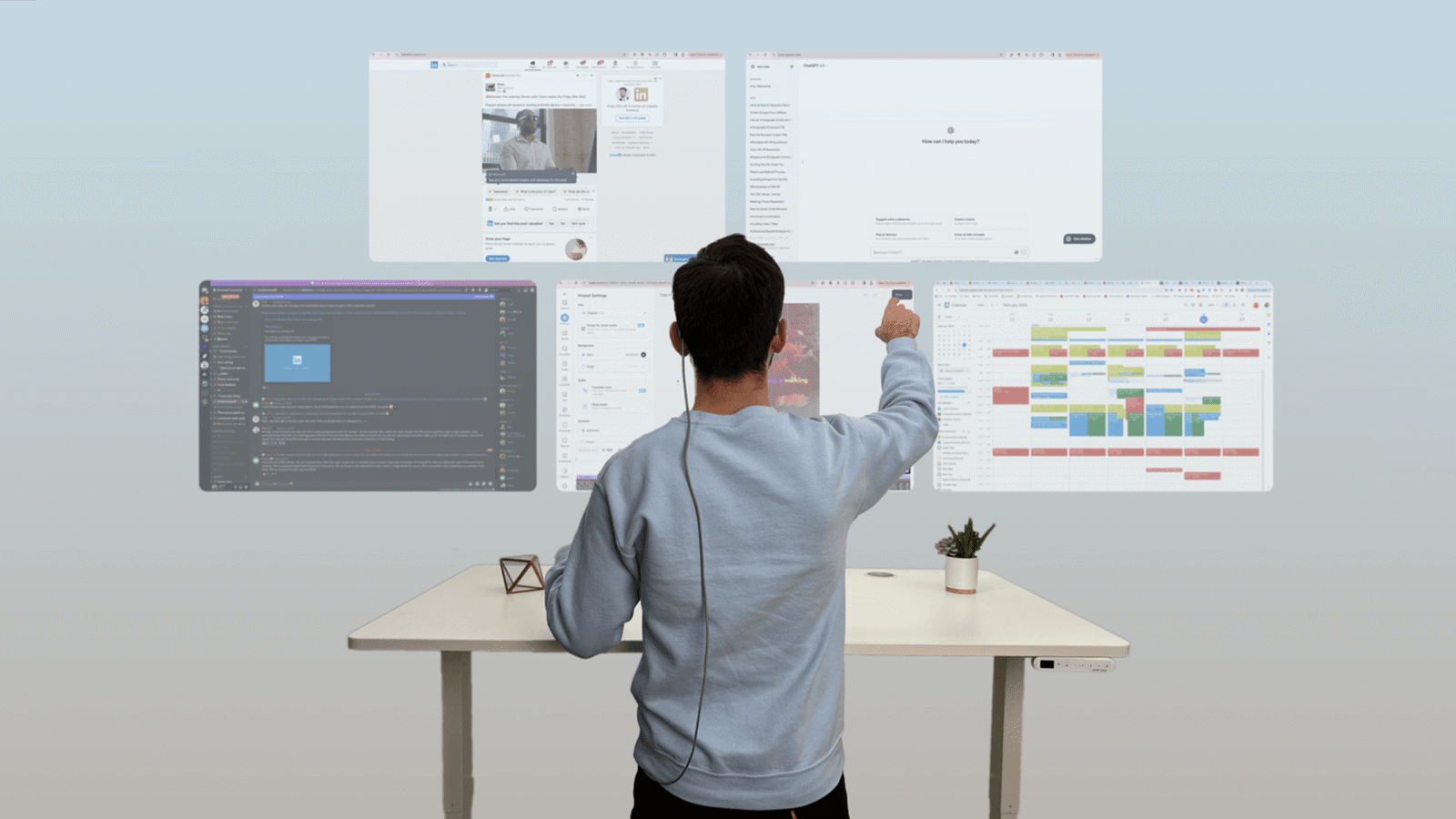

Ending Thursday: Pre-IPO Stock Up 4,000%. They just reserved the Nasdaq ticker $IMRS, but 6,000+ people already became pre-IPO investors in Immersed. It’s not hard to see why 1.5M people use their breakthrough productivity app, including Fortune 500 teams. They’ve got partnerships with Google and Samsung. Founders and execs behind Facebook and Reddit invested. Claim your pre-IPO stake before Thursday night’s deadline.*

Banking on a Fed Rate Cut Today, Investors Look for Hints of What’s Next

No one will be surprised if (when?) the Federal Reserve announces an interest-rate cut today. Traders put the odds of a 0.25% reduction at 99.9%, according to CME Group’s FedWatch tool. It’s the most straightforward call the central bank will make all year.

The next one won’t be so easy, so all eyes will be on any hint to the Fed’s plans for December, when the monetary policy committee holds its next meeting.

A Fed Divided

These are challenging times for monetary policy wonks. The government shutdown, now entering its fifth week, means that the Federal Reserve’s Open Market Committee doesn’t have the data it usually relies on to make its decision. Members are also battling still-high inflation while contending with weakness in the labor market.

The market may be expecting a Christmas rate cut, but that doesn’t mean that the Fed will acquiesce:

- In September, Fed Chair Jerome Powell said at a press conference that nine of the Fed’s 19 policymakers favored no more than one additional rate cut this year.

- “They are at a moment in the policy cycle where there’s genuine disagreement between people who are thinking we will probably cut rates but I’m not ready to cut again just yet, and people who think even though there’s risks, it’s time to do more now,” the Fed’s former director of monetary affairs, Bill English, told CNBC. “There’s dissent between people who want to cut now, and people who want to wait and see a bit more.”

Tipping Point: What would sway the Fed one way or another? “Labor market weakness is the Fed’s primary concern right now,” says JoAnne Bianco, partner and senior investment strategist at BondBloxx. “Private sector data indicates job losses in recent months, plus Chairman Powell has acknowledged further downside risks to employment.”

And of course, inflation matters. While inflation is right around 3%, still higher than 2% the Fed is comfortable with, Bianco points out that it doesn’t appear to be accelerating. Traders currently set the odds of an additional quarter-point rate cut in December at 90.8%, per Fedwatch. But for now, we’ll have to wait and see.

Extra Upside

- Political Fallout: Yale University researchers estimate that Tesla CEO Elon Musk’s political activity since acquiring X, formerly Twitter, cost the electric carmaker 1 million vehicle sales.

- Green Gamble: Bill Gates called on humanity to direct more of its “limited resources” to addressing poverty and disease, and potentially away from climate change, in an essay he said could lead to him being labeled a “hypocrite.” He’s still in favor of net zero, by the way.

- Robinhood Legend Just Rewrote the Trading Playbook. This advanced platform lets you trade directly from charts with real-time data. Build custom layouts in seconds, link widgets across multiple screens, and execute trades instantly as you spot opportunities. All the power tools active traders need. Start trading now.**

** Partner

Just For Fun

Disclaimers

*This is a paid advertisement for Immersed’s Regulation CF offering. Please read the offering circular at https://invest.immersed.com/.

1. https://www.marketresearchfuture.com/reports/ai-productivity-tools-market-23074.

2. https://www.grandviewresearch.com/industry-analysis/ai-productivity-tools-market-report.

3. https://www.giiresearch.com/report/grvi1512062-ai-productivity-tools-market-size-share-trends.html.

**All investing involves risk.

Brokerage services are offered through Robinhood Financial LLC, (“RHF”) a registered broker dealer (member SIPC), and clearing services through Robinhood Securities, LLC, (“RHS”) a registered broker dealer (member SIPC). While there is no additional cost to use Robinhood Legend, there are other fees associated with your brokerage account. Review the fee schedule for more information.

Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount.